Telangana’s Micro, Small, and Medium Enterprises (MSME) sector has been a driving force behind the state’s economic growth. With around 26 lakh MSMEs operating as of the 2015 National Sample Survey, the state’s commitment to fostering this sector is evident. Since 2020, over 8.6 lakh MSMEs have received UDYAM registration, and since 2014, 22,000 new MSMEs have been approved under the TGiPASS regulation. The resilience and development of Telangana’s MSMEs reflect their ability to adapt to the changing business landscape.

The Impressive Growth of MSMEs in Telangana

The MSME sector in Telangana has shown significant growth over the years, with annual registrations on the TGiPASS portal increasing by 11-15% since 2014. One notable achievement is the rise in average investment, which grew from Rs 1 crore in 2018 to Rs 2.15 crore in 2022. This increase underscores the sector’s growing importance in the state’s economy. Additionally, Telangana boasts strong social and gender diversity among its MSME owners, setting it apart from other states.

Despite these advancements, the sector faces several challenges. The formalization of MSMEs remains an issue, as an estimated 65.7% of MSMEs in Telangana are yet to be formalized. Moreover, medium-sized enterprises are still limited, representing only 2.9% of all manufacturing MSMEs and 3.5% of service MSMEs registered between 2016 and 2023.

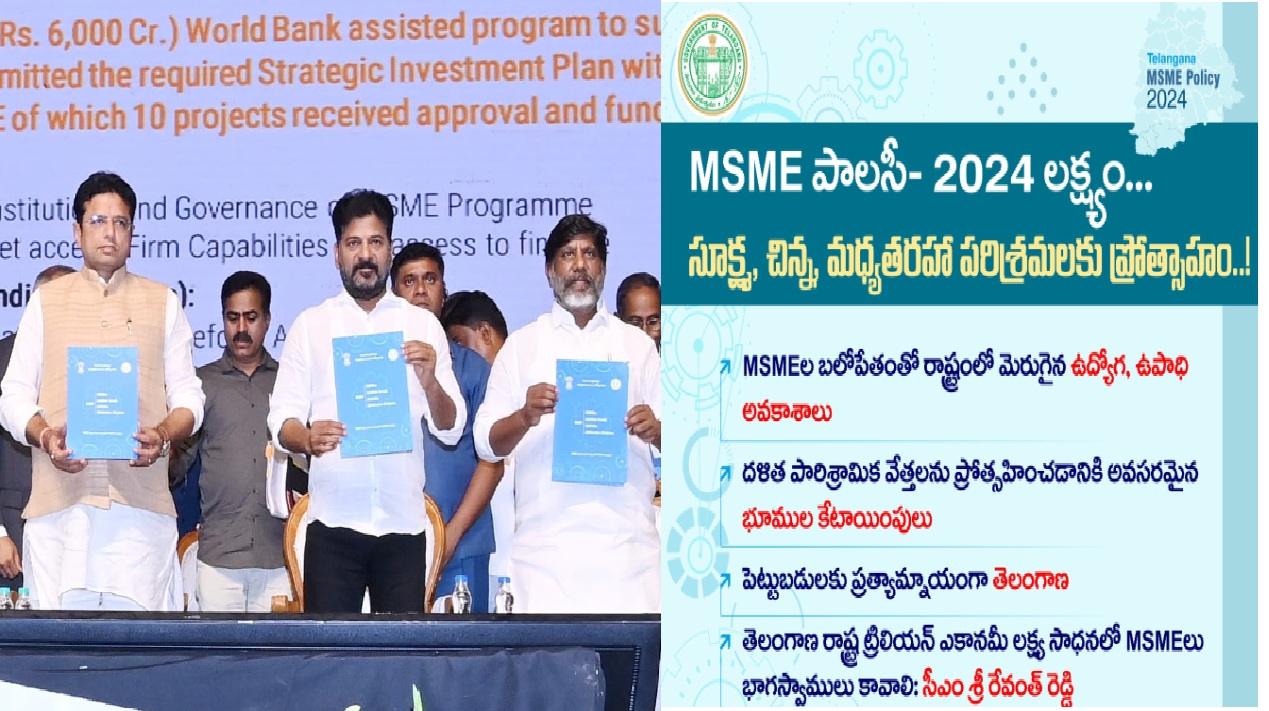

Objectives of Telangana’s MSME Policy

The newly developed MSME policy for Telangana aims to overcome the existing challenges while fostering further growth in the sector. Created through a consultative process involving government, industry representatives, and research organizations, this policy seeks to boost the state’s MSME contribution to the Gross State Domestic Product (GSDP) by 10%. It also aims for a 15% year-on-year increase in MSME registrations through TGiPASS.

Key Policy Outcomes:

- Inclusive Employment: The policy aims to create jobs, with 30% of these going to SC/ST and women workers.

- Equitable Growth: The policy will ensure that MSMEs grow across the state, with a particular focus on districts that currently house less than 10% of total MSMEs.

- Technology Modernization: This will help MSMEs adopt the latest advancements to enhance productivity and competitiveness.

- Improved Productivity: A 10% increase in GVA contribution from MSMEs is expected, along with a goal of 10% of MSMEs graduating to the next category in terms of size and operations.

Major Challenges Faced by Telangana’s MSME Sector

Despite the promising growth trajectory, MSMEs in Telangana face several persistent challenges. These include:

- Land Availability: The high cost and limited supply of industrial plots restrict MSMEs from expanding their operations.

- Access to Finance: MSMEs struggle with working capital stress and securing collateral for loans. The demand for credit remains unmet.

- Raw Material Supply: MSMEs often face issues with raw material availability, storage facilities, and access to testing centers.

- Labour Issues: Access to skilled labor, retaining migrant workers, and increasing female workforce participation remain significant hurdles.

- Technology Adoption: The high cost of technology and low adoption rates limit MSMEs’ ability to modernize and scale operations.

- Market Access: Low awareness of export requirements and a lack of quality certifications further hamper MSMEs’ growth.

Proposed Solutions in the New MSME Policy

To address these challenges, Telangana’s MSME policy offers several strategic solutions.

1. Improving Land Availability

The government plans to develop 10 industrial parks specifically for MSMEs, with dedicated parks for women-owned businesses and innovative startups. Additionally, the government will reserve 5% of plots for women entrepreneurs and 15% for SC/ST entrepreneurs.

- Land cost rebates will be increased for SC/ST entrepreneurs from 33% with a Rs 30 lakh cap to 50% with a Rs 50 lakh cap.

- Industrial plots will also be made available through long-term leases to reduce upfront financial burdens.

2. Enhancing Access to Finance

To ease the financial strain on MSMEs, the policy proposes:

- A subsidy collateralization scheme where MSMEs can use government benefits as collateral for loans.

- Increased capital investment subsidies, especially for SC/ST and women entrepreneurs.

- Pilot programs for credit access based on future sales and account aggregation practices.

3. Streamlining Raw Material Supply

The government aims to create 10 common facility centers in various MSME clusters and establish warehouse facilities with 100% stamp duty discounts. The construction of new warehouses and the allocation of raw materials by government departments in a timely manner are also priorities.

4. Increasing Access to Skilled Labour

The government will set up skilling infrastructure to provide training in advanced manufacturing techniques and integrate internship and apprenticeship programs. MSME-focused courses will be incorporated at TG Young India Skills University to enhance the pool of skilled workers.

5. Promoting Technology Adoption

The policy proposes the creation of a Rs 100 crore Yantram Fund to encourage technology adoption by MSMEs. Bulk purchases of digital technology at discounted rates will also be facilitated for MSME clusters and industrial parks.

6. Boosting Market Access

To enhance market access, the government plans to support co-location of ancillary MSMEs with large-scale industries. The state will also reserve 20% of public procurement for MSMEs, with specific sub-reserves for SC/ST and women-owned businesses.

Executive Summary: Telangana Government for MSMEs growth…………. 8

MSMEs in Telangana : An overview……………………………………………… 9

Committed support Targets – consolidation………………………………… 14

MSME policy targets:…………………………………………………………………. 15

Telangana’s MSME Sector: The Challenges…………………………………. 16

Access to Land……………………………………………………………………….. 16

Access to Funds……………………………………………………………………… 16

Access to Raw Material……………………………………………………………. 17

Access to Labour……………………………………………………………………. 18

Access to Technology………………………………………………………………. 19

Access to Markets…………………………………………………………………… 19

Telangana’s roadmap for MSMEs……………………………………………….. 20

Increasing the availability of accessible and affordable land…………… 20

Greater access to Finance………………………………………………………… 21

Ensuring easy access to raw materials………………………………………… 23

Improving flexibility in Labour markets………………………………………. 24

Encouraging adoption of Technology…………………………………………. 26

Improving access to Markets……………………………………………………. 27

From ideation to action: Institutional support assured………………. 29

Governance structures to monitor delivery…………………………… 30

CONCLUSION…………………………………………………………………………….. 31

Executive Summary: Telangana Government for MSMEs growth

MSME sector in Telangana is highly resilient & has shown significant growth:

Since 2014, MSMEs in Telangana have shown a positive trend of formalisation as annual registrations on the TG-iPASS portal have increased by 11-15% annually. MSMEs have seen a rise in average investment from Rs 1 Crore in 2018 to Rs 2.15 Crore in 2022. An highly encouraging social and gender diversity among MSME owners is visible in Telangana compared to other states.

The Government is committed to engendering inclusive and sustainable growth for the MSMEs in Telangana:

The MSME policy is designed to achieve: inclusive and diverse employment, equitable growth, scale-based graduation, technology upgradation and improved productivity. Through this policy the Government has set out to achieve specific outcomes, along with outlining indicators to measure progress. The Government hopes to develop inclusive businesses that create opportunities for all regardless of identity, integrate technology to usher in the era of ‘Industry 4.0’ and unlock growth for the MSME ecosystem in the state.

Six thrust areas for improvement:

To accelerate the growth of MSMEs, the Government has identified six thrust areas for improvement- Improving availability, accessibility and affordability of land; Facilitating access to finance; Ensuring easy access to raw materials; Improving flexibility in labour markets; Encouraging adoption of technology and Enhancing access to markets.

End-to- end support from the Startup to Sales :

The policy envisages 40 measures to offer end-to-end support from the startup to sales phase.It is proposed to enhance state infrastructure through dedicated MSME parks and private flatted factories, offer fiscal support especially to SC/ST and women-owned MSMEs by increasing the incentives offered under other industrial policies, improve access to traditional and alternative sources of credit, develop best-in-class testing centres and warehousing facilities in the state, expand the pool of skilled workforce, earmark a special fund for technology transfer and modernisation in the MSME sector, enhance market access by incentivising local procurement and increased e-commerce participation and improve Ease of Doing Business in the state.

Effective Implementation and Monitoring Mechanism:

To ensure effective and efficient implementation of the policy, the Government has developed implementation and monitoring mechanisms. The Government proposes to establish an MSME wing to provide 24*7 dedicated support to MSMEs in the state. A highlevel steering committee will be established under the state leadership to monitor delivery on commitments and set policy direction. The Government has earmarked Rs 600 crores over the next five years to support these initiatives for MSMEs.

MSMEs in Telangana : An overview

Number of MSMEs operating and registered in Telangana

| Survey | Nature of Enterprises | Micro | Small | Medium | Total | |

| National Sample Survey | Manufacturing, services, retail, wholesale | 25,94,000 | 10,000 | 1,000 | 26,05,000 | |

| Udyam Registration | Manufacturing, services, retail, wholesale | 8,64,202 | 26,560 | 3,028 | 8,93,790 | |

| GoTG, 2023 | Manufacturing, services | 34,953 | 18,394 | 1,411 | 54,758 | |

| TG-iPASS registration | Manufacturing, services | 15,434 | 6,106 | 666 22,206 | ||

In 2015, the National Sample Survey estimated 26 lakh MSMEs to be operational in Telangana. About 8.9 lakh MSMEs have received Udyam registration since 2020. Around 22,000 approvals for new MSMEs have been issued under the TG-iPASS regulation since 2014.

Telangana has registered nearly 9 lakh MSMEs on the Udyam portal. 0.33% of these registered industries are medium enterprises.

Annual registration of new MSME units on the TG-iPASS portal has risen by 11-15% annually from FY 2014 to FY 2023.

Number of MSMEs registered in each financial year 1

MSMEs on the TG-iPASS received an average investment of Rs 1 crore in 2018. This investment rose to an average of Rs 2.15 crores in 2022.

Investment received by industries in Telangana2

1

TG-iPass, Government of Telangana. 2024. ‘Approvals Issued under TG-iPASS’. Telangana Industrial Project Approval and SelfCertification System. https://ipass.telangana.gov.in/.

2

TG-iPass, Government of Telangana. 2024. ‘Approvals Issued under TG-iPASS’. Telangana Industrial Project Approval and SelfCertification System. https://ipass.telangana.gov.in/.

| The concentration of MSMEs around state capitals[1] | ||||

| State | %Share of MSMEs in select Total MSMEs in Capital and adjoining districts MSMEs in select districts the state districts | |||

| Telangana | Hyderabad Rangareddy Medchal- Malkajgiri | 3,58,563 | 8,93,790 | 40 |

- According to data from Udyam registrations, 40% of MSMEs in Telangana are situated in and around the capital district.

- A 2023 survey by the Government of Telangana showed that ~25,000 manufacturing and services-based MSMEs operated out of Medchal-Malkajgiri, Sangareddy and Rangareddy districts.

| Major contributors of employment in Telangana state[2] | |||

| Number of workers Sector | |||

Micro Small Medium

Total

industries industries industries

| Services | 29,34,242 | 2,39,793 | 93,330 | 32,67,365 |

| Food Processing | 9,23,611 | 62,271 | 24,211 | 10,10,093 |

| Mineral based and wood-based Industries | 4,08,110 | 26,837 | 9,379 | 4,44,326 |

| Engineering and Capital Goods | 3,67,952 | 67,558 | 37,763 | 4,73,273 |

| FMCG and Domestic appliances | 3,60,892 | 33,411 | 14,489 | 4,08,792 |

| Textiles Industry | 2,76,601 | 10,860 | 9,348 | 2,96,809 |

| Services | 29,34,242 | 2,39,793 | 93,330 | 32,67,365 |

| Food Processing | 9,23,611 | 62,271 | 24,211 | 10,10,093 |

| Auto and Components | 2,46,534 | 8,292 | 9,427 | 2,64,253 |

| Health & Life Sciences | 1,42,209 | 38,605 | 34,385 | 2,15,199 |

| Plastic and Polymers | 82,314 | 21,958 | 14,077 | 1,18,349 |

| Electronics & IT Hardware | 72,574 | 7,172 | 8,122 | 87,868 |

| Gems and Jewellery | 59,750 | 8,984 | 3,398 | 72,132 |

According to an internal survey, services in Telangana account for nearly 33 lakh jobs, surpassing the employment generated by the next six highest sectors combined.

Social distribution of MSME ownership across Telangana5

| State | SC (%) | ST (%) | OBC (%) | General (%) |

| Telangana | 14.94 | 8.75 | 27.69 | 48.62 |

In Telangana, owners of 14.94% of MSMEs belong to Scheduled Castes (SC), 8.75% to Scheduled Tribes (ST), 27.69% to Other Backward Classes (OBC) and the remaining to the General category.

5

Ministry of Micro, Small and Medium Enterprises. (2023). Annual Report 2022-23. https://msme.gov.in/sites/default/files/MSMEANNUALREPORT2022-23ENGLISH.pdf.

| Number of units set up by Women in Telangana6 | |||

| State | Female entrepreneurs | Female population | Female entrepreneurship / 1,000 women |

| Telangana | 58,644 | 1,88,42,000 | 3.1 |

In Telangana, there are 3.1 female entrepreneurs registered on the Udyam portal for every 1,000 women in the state.

| Closure of Udyam-registered MSME units (2020-23)7 | |

| State | No. of units shut down |

| Telangana | 231 |

| Gujarat | 1,626 |

| Haryana | 558 |

| Karnataka | 804 |

| Maharashtra | 5,082 |

| Tamil Nadu | 2,456 |

Telangana has the lowest number of MSME closures on the Udyam portal among the studied states. The Telangana Industrial Health Clinic (TIHCL) was set up in 2018. Upto March 2024, the Clinic has extended support to 1,340 MSEs and revived 115 units.

6

Ministry of Micro, Small and Medium Enterprises. 2023. ‘Annual Report 2022-23’. https://msme.gov.in/sites/default/files/MSMEANNUALREPORT2022-23ENGLISH.pdf.

7

Minister of Micro, Small and Medium Enterprises. 2023. ‘Closure of Small Industries’. Rajya Sabha Unstarred Question No. 3622. https://sansad.in/getFile/annex/259/AU3622.pdf?source=pqars.

Committed support -Targets consolidation

MSMEs in Telangana have shown great promise in the last ten years. MSMEs in the state have steadily formalised, with registrations on the TG-iPASS portal increasing by 11–15% each year from FY 2014 to FY 2023. MSMEs on the TG-iPASS portal have also increased their average investments by 115% between 2018 and 2023.8 The MSMEs in the state are willing to formalise their operations and grow in size.

Despite their impressive performance, MSMEs in Telangana continue to face challenges with formalising and graduating in size over time. As per estimates by NSSO, 65.7% of all MSMEs in the state are yet to be formalised.9 Further, TG-iPASS data shows that Telangana continues to have a limited number of medium-sized enterprises. Between 2016 to 2023, medium-sized enterprises constituted only 2.9% of all manufacturing MSMEs and 3.5% of all service MSMEs registered on the TG-iPASS portal.

Formalisation continues to be costly and challenging for Telangana’s MSMEs. To illustrate, Small firms experience a 35% increase in unit labour costs as soon as they formalise. Similarly, manufacturing MSMEs must forgo use of 40–50% of their plot if they wish to comply with building regulations. Other regulations impose similar costs on MSMEs, often forcing them to stay informal to maintain cost-efficiency.

MSMEs in Telangana also struggle to grow in size. MSMEs need adequate resources and remunerative opportunities to grow in size. However, enterprises face difficulties in accessing land, finance and other factors of production at affordable rates. Enterprises also have difficulties identifying skilled workers and struggle to access global markets. The present MSME policy has been designed to systematically address these pain points, thereby allowing MSMEs to grow in size over time.

The Government of Telangana has already implemented process reforms, including the introduction of TG-iPASS portal, to reduce entry and operational costs for enterprises in the state. The Government of Telangana has also conducted two state-wide surveys of all MSMEs as well as numerous surveys of sector-specific MSMEs to understand key challenges for MSMEs in the state. With this policy, the Government of Telangana seeks to address other challenges discouraging MSMEs from formalising their operations and growing in size.

The present MSME policy is also geared to help MSMEs become model businesses for the 21st century. The policy proposes measures to help MSMEs become ‘inclusive businesses’— businesses that cater to the needs of those at the base of the economic pyramid by including them in the value chain of the businesses’ ecosystem. The policy also proposes measures to help MSMEs integrate technology to transform all aspects of business operations. The Government will support small businesses in the state to usher in ‘Industry

8

TG-iPass, Government of Telangana. 2024. ‘Approvals Issued under TG-iPASS’. Telangana Industrial Project Approval and SelfCertification System. https://ipass.telangana.gov.in/.

9

National Sample Survey Office. 2016. ‘National Sample Survey 73rd Round’. Ministry of Statistics and Programme Implementation, Government of India. https://www.mofpi.gov.in/sites/default/files/2015_16_nsso_73rd_round.pdf.

4.0’, by upgrading their machinery, processes and incorporating digital tools in supplementary operations.

MSME policy targets:

Impact, outcomes and indicators for the success of this policy

Through this policy, the Government of Telangana has identified six constraints to MSME growth and proposed measures to ease each constraint. The policy proposes the following measures:

- Increasing the availability, accessibility and affordability of land

- Facilitating access to finance

- Ensuring easy access to raw materials

- Improving flexibility in labour markets

- Encouraging adoption of technology

- Enhancing access to markets.

Telangana’s MSME Sector: The Challenges

Access to Land

- Land allotted by Telangana Industrial Infrastructure Corporation (TGIIC) is priced at Rs 31,360 per sqm in Siddipet, Rs 21,280 per sqm in Patancheru (Sangareddy) and Rs 10,000 per sqm in Karimnagar.10 In contrast, the Maharashtra Industrial Development Corporation prices the land at Rs 3,024 per sqm in Khandala Phase 2 (Pune) and at Rs 4,187 per sqm in Badlapur (Thane).11 For Gujarat Industrial Development Corporation, the price of land is Rs 3,650 per sqm in Sanand MSME park (Ahmedabad) Rs 6,505 per sqm in the apparel park (Ahmedabad) and Rs 6,505 per sqm in Nandesari (Vadodara).12

- A survey by Telangana Food Processing Society(TGFPS) reported that MSMEs need access to land for production around the Capital. Consider the vacant plots of Telangana Industrial Infrastructure Corporation (TGIIC), about 13 of the 33 vacant plots are available in districts two or more hours away from Hyderabad.[3] The distance of these plots from the capital increases the cost of business operations, transportation and logistics.

- Moreover, zoning regulations Map of Regional Ring Road (RRR) and Outer Ring Road restrict the supply of industrial (ORR) in Hyd

land in the state. The proposed manufacturing zone between the Outer Ring Road, that covers Hyderabad city and the Regional Ring Road, a 340 km expressway encircling Hyderabad, allows only a limited proportion of land for industrial and commercial use compared to the other zonal demarcations.

Access to Funds

● As per an internal survey, MSMEs in Telangana experience the following challenges with respect to accessing finance:

○ MSMEs find it difficult to meet collateral requirements set by banks for loans. In some cases, banks ask MSMEs for collateral of upto 200% of the loan value.

○ MSMEs need more credit than the banks have been able to provide. As per a 2024 SIDBI report, demand for credit in India grew by 29% in the period between July-September of 2022 and 2023. In the same period, credit supply

10

Telangana Industrial Infrastructure Corporation Limited. 2023. ‘Statement of Revised Land Rates’. Government of Telangana.

11

Maharashtra Industrial Development Corporation. 2024. ‘Online Land Allotment System’. MIDC.

12

Gujarat Industrial Development Corporation. 2024. ‘Allotment Price for Land’. GIDC.

grew in volume by only 20%.14 Much of this growth in credit supply was a result of the banks giving out more ‘micro-loans’ i.e. loans of a value below 1 crore. While loans lower than Rs. 1 crore grew by 7% in value, loans between Rs. 1 to 10 crores grew by only 3%. Loans for over Rs. 10 crores have decreased by 9% by value.15 A 2023 report confirms that Telangana follows this national trend in the growth of credit.16 Telangana had the third-largest growth in credit supply between Q4 of FY2022 and FY2023 (4%). In this period, loans lower than Rs. 1 crore grew by 23% in value, loans between Rs. 1 to 10 crores grew by only 1% and loans for over Rs. 10 crores decreased by 19%.

○ MSMEs struggle to meet the information requirements to access loans.

○ MSMEs, particularly micro and small enterprises, find it challenging to access credit for their working capital needs. About 81% of micro enterprises and 50% of small and medium enterprises reported a time period of more than 90 days to receive payments, thereby creating a working capital challenge.17 MSMEs have limited assets to be made available as collateral to lending institutions, given that most of their assets are already collateralised to finance capital needs.

Access to Raw Material

- MSMEs in Telangana need quality raw materials at competitive rates. However, the prices of raw materials have increased across India in the last two years. For instance, the price of wood, the primary material used by many manufacturing MSMEs, increased from Rs 408 in January 2023 to Rs 472 in July 2024.18 Increasing raw material costs affect 65% of micro and medium enterprises and 97% of small enterprises in Telangana and exacerbate the access to finance challenge.19

- MSMEs struggle to access raw materials on time. In their Annual Report, the Department of Industries and Commerce reported that 25% of MSMEs in Telangana experienced delays in the delivery of raw materials.

- MSMEs in the state need more testing facilities. Of India’s 92 Common Facility Centres (CFC), only 1 is in Telangana under the Micro and Small Enterprises-Cluster

Development Programme (MSE-CDP) scheme.20 Access to such testing facilities is

14

Small Industries Development Bank of India. February 2024. ‘MSME Pulse’.

https://www.sidbi.in/head/uploads/msmepluse_documents/MSME%20Report%208%20X%208_Feb%202024_Revised%2028th%20Feb.pd f

15

Small Industries Development Bank of India. February 2024. ‘MSME Pulse’.

https://www.sidbi.in/head/uploads/msmepluse_documents/MSME%20Report%208%20X%208_Feb%202024_Revised%2028th%20Feb.pd f

- Small Industries Development Bank of India. August 2023. ‘MSME Pulse’.

- KPMG. (2023). Strategic Investment Plan (SIP) under RAMP, Telangana.

18

Ministry of Agriculture and Farmers Welfare, Government of India. (2024). State wise Wholesale Prices Monthly Analysis. Retrieved 22 July 2024, from https://agmarknet.gov.in/PriceTrends/SA_Pri_Month.aspx.

19

KPMG. (2023). Strategic Investment Plan (SIP) under RAMP, Telangana.

20

Press Information Bureau. (2023). Micro and Small Enterprises Cluster Development Programme. Government of India. https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=1907500.

important for MSMEs to indicate the quality of raw materials used in production and integrate with the export value chain. Proximity to such centres will reduce the cost of initiating new channels of supply for MSMEs.

● Surveys conducted by the Telangana State Food Processing Society indicate that MSMEs struggle to access warehousing and cold storage facilities. MSMEs would benefit from more and better quality business infrastructure facilities since focus sectors like food processing heavily rely on warehousing facilities for timely delivery and storage of raw materials and managing the supply of finished products. Telangana has 161 registered warehouses (~5 per district), while Tamil Nadu has 848 (~22 per district).21

Access to Labour

- As per an internal survey, MSMEs need access to skilled workers. As per the survey, workers in the state rate highly on technical skills, but need support in building shop floor skills like scheduling, production planning, process planning and inventory management. This is substantiated by a 2024 India Skills Report which shows that Telangana has the highest availability of talent proficient in technical areas like numerical skills (76.7%).[4] However, only 37.7% of talent in Telangana is proficient in critical thinking skills. It appears that certification from formal institutions like ITIs is not a reasonable certification of shop floor competence. Therefore, skilling from formal institutions needs to be supplemented by on-the-job training. Workers in the state recognise this, with 96.7% of young talent in Telangana looking for internship opportunities.[5]

- As per the Government’s internal survey, MSMEs have to regularly deal with the issue of migrant labour travelling back to their home state. As per Government estimates, 5 to 6 lakh workers in Telangana are migrant workers.[6] Migrant workers tend to travel back to their home to avail Government assistance during periods of distress. Migrant workers may also travel back if they perceive the quality of life in their state of work to be suboptimal.

- The state’s unemployment rate stands at 7.6%. This indicates that the state has a large pool of labour that can avail of employment. The 2024 India Skills Report supports this view, observing that the state has the greatest concentration of employable talent in the 18–21 age category (85.45%).[7] The unemployment rate for urban females in Telangana is higher than any other group in the state. This suggests that urban females are an underutilised group for MSMEs looking for workers.

21

Department of Food and Public Distribution, Government of India. (2024, July 23). List of registered warehouses. Warehousing Development and Regulatory Authority. https://wdra.gov.in/web/wdra/registered-warehouses.

Access to Technology

- MSMEs in the state can improve their productivity, efficiency and occupational safety by adopting technological tools in the production process. As per a sample survey, 25% of MSMEs in Telangana were aware of options for automation of industrial processes and 10% were aware of the Internet of Things. Of all relevant technology, MSMEs were least aware of Robotics and Blockchains. Only 38% of the MSMEs surveyed knew about the Credit Linked Capital Subsidy & Technology Upgradation Scheme introduced by GoI.

- In stakeholder consultations with enterprises, MSMEs reported the following challenges as significant barriers to technology adoption:

- High cost of technological tools and equipment;

- Steep learning curve to integrate the tool into the production process; and ● Lack of skilled manpower that can develop skills to use the tool efficiently.

Access to Markets

- An internal survey shows that MSMEs in Telangana struggle to understand complex product testing certifications and export standards set by large national and international buyers. MSMEs reported a paucity of financial resources, technology, infrastructure and dampening their ability to be competitive in the global market.

- Compliance with standards and certifications can help MSMEs access formal markets, including Government tenders and international trade. For example, the ZED Certification promotes the culture of Zero Defect Zero Effect (ZED) practices among MSMEs. As of 2023, 64 firms in Telangana were accorded the ZED registration compared to 8,868 firms in Andhra Pradesh—the state with the maximum number of ZED registered firms.

- MSMEs need to enhance market access by leveraging e-commerce platforms. Ecommerce platforms allow MSMEs to extend their access beyond local markets. According to an internal survey, 13% of MSMEs in the state use e-commerce platforms to access markets.

- In a survey conducted by the Government of Telangana, medium-sized enterprises in the state reported difficulty in understanding export-related compliances and standards. The lack of clarity limits their ability to adapt their processes and products to meet export requirements.

Telangana’s roadmap for MSMEs

Increasing the availability of accessible and affordable land

The Government of Telangana is committed to developing centres of MSME growth across the state. To this end, the Government will facilitate access to land via construction of dedicated industrial infrastructure for MSMEs and making land available at affordable prices. In addition, the Government proposes to augment the optimal utilisation of land to help MSMEs make productive use of their capital invested.

- Creating Industrial parks for MSMEs: For each Industrial Park that the Government plans to build, 20% of plots will be reserved for MSMEs. The Government of Telangana proposes to develop 1 Industrial Park in each district in the next 5 years. In addition, the Government will construct 10 Industrial Parks between the Outer Ring Road and the Regional Ring Road. Out of these 10 Industrial Parks, 5 will be MSME parks. In each MSME park, 5% of plots will be reserved for women entrepreneurs and 15% of plots will be reserved for SC/ST entrepreneurs. Out of the 5 MSME parks between ORR-RRR, 1 park will be built exclusively for women-owned MSMEs and 1 park will be built exclusively for innovative startups. These parks will have in-built facilities like hostels, creches, toilets, testing centres and research & development centres.

- Increasing the areas zoned for industrial use: The Government of Telangana will increase the areas classified as industrial, commercial and mixed land use zones in Master Plans of areas between the Outer Ring Road and the Regional Ring Road. In addition, the Government will allow more green and orange MSMEs to conduct operations in peri-urban areas around the capital region.

- Providing subsidies on purchase of land: MSMEs run by SC/ST entrepreneurs are currently given a 33.33% rebate with a cap of Rs 30 lakhs on land cost under T-PRIDE. The Government will increase the cap to 50% limited to Rs 50 lakhs for SC/ST entrepreneurs. For other MSMEs, the Government will introduce a new formula to make land available as close to cost price as feasible without reducing the rebate benefits currently offered under T-IDEA. MSMEs are currently given 100% reimbursement on stamp duty payable on the purchase and lease of land for industrial use under T-PRIDE and T-IDEA policies.26 The Government of Telangana will continue to do so.

- Impetus for development of flatted factories: To allow MSMEs to access compact production venues around the capital city, The Government of Telangana will encourage the development of private flatted factory complexes that earmark at least 20% of units for MSMEs. The Government will offer 100% reimbursement on stamp duty applicable on the purchase and lease of land by flatted factory complex developers. Rebates on land cost offered to standalone units under this policy will be offered to private flatted factory developers as well. The Government will also

26

Telangana State Industrial Development and Entrepreneur Advancement Incentive Scheme, 2014 (2014). https://industries.telangana.gov.in/Library/2014INDS_MS28.pdf

Telangana State Program for Rapid Incubation of Dalit Entrepreneurs (2014).

consider relaxing building standards like parking, setbacks and height restrictions. In addition, the Government will aim to develop PPP models for the construction of flatted factories.

- Constituency -centric focussed development-Priority for women:

○ To support women-owned MSMEs, the Government of Telangana will develop one small-scale flatted factory in each of the state’s 119 constituencies. In constituencies with concentration of self help groups (SHGs), the Government will encourage female members of SHGs to set up small businesses in these flatted factories. These flatted factories will provide the following facilities: In-built facilities like hostels, creches, toilets and testing centres; Access to international consultants to lend support on business, product and market strategy development; Access to hassle-free credit under the StreeNidhi Scheme; Co-branding support with the ‘Government of Telangana’ tag; National and export market linkage support.

○ Between the ORR and RRR, one flatted factory will be built exclusively for innovative startups and MSMEs.

- Encouraging pooling of facilities to optimise land utilisation: The Government will allow MSMEs situated in flatted factories, flatted factory complexes, industrial parks and MSME clusters to pool facilities like creches, canteen facilities, medical rooms etc provided for under labour regulations.

- Allowing leasing of Industrial land: Within 6 months of the launch of this policy, the Government will release a scheme to allow Telangana Industrial Infrastructure Corporation (TGIIC) to allot plots/sheds on lease basis for a period of 30 years on recovery of upfront lease premium at rates fixed from time to time. The lease period may be extended for some MSMEs based on mutual agreement and return on investment.

Greater access to Finance

The Government of Telangana recognises the central role that easy access to finance plays in the health of MSMEs. The Government is proposing measures to improve access to finance from traditional as well as alternative sources. In addition, the Government is committed to improve transparency and efficiency in the disbursal of fiscal benefits to MSMEs to alleviate working capital challenges.

- Improving access to traditional sources of finance: The Government of Telangana will help MSMEs access traditional sources of credit, including Government benefits.

○ Additional Incentives: The Government will increase benefits under the capital investment subsidy for Micro and Small Enterprises. Under the T-IDEA scheme, eligible Micro and Small Enterprises currently receive a 15% capital investment subsidy up to a limit of Rs 20 lakhs. The Government will now provide a subsidy of 25% up to a limit of Rs 30 lakhs. Women-owned Micro and Small Enterprises currently receive additional subsidy of 10% upto a limit of Rs.10 Lakhs under T-IDEA. This additional subsidy will be increased to 20% upto a limit of Rs.20 Lakhs.

- Boost to SC/ST Entrepreneurs: Under the T-PRIDE scheme, SC/ST owned Micro and Small manufacturing enterprises currently receive a capital investment subsidy of 35% up to a limit of Rs 75 lakhs. This subsidy will be increased to 50% up to a limit of Rs 1 crore for all SC/ST owned Micro and Small Manufacturing Units. Women-owned Micro and Small Enterprises currently receive additional subsidy of 10% upto a limit of Rs.10 Lakhs under T-PRIDE. This additional subsidy will be increased to 20% upto a limit of Rs.20 Lakhs for all SC/ST owned Micro and Small Manufacturing Units.

○ Owners of MSMEs may also approach the DIC in cases where a banking institution fails to comply with any special scheme for MSMEs notified by the Reserve Bank of India. For such complaints, a representative at the DIC will relay the complaint to the relevant authority of the banking institution for resolution. DICs will collate information for all instances of failures to resolve the complaints within a period of 90 days for discussion in the periodic meetings of the SLBC.

- Increasing financing options for public contracts: The Government of Telangana will allow all suppliers for public contracts to opt in for reverse factoring. Under a reverse factoring arrangement, a financial institution would make upfront payments to suppliers on behalf of a MSME owner. In return, the owner would pay the financial institution at a later date. In this way, reverse factoring allows MSMEs to participate in public contracts without depleting their working capital.

- Improving access to alternative sources of finance: The Government of Telangana will also take measures to promote alternative sources of credit for MSMEs in Telangana.

- The Government of Telangana will run a pilot program for revenue-based financing for MSMEs. As per the model, MSMEs can access credit based on future sales, reducing upfront burdens and making funding more accessible, especially for women-led ventures. The pilot project will help the Government assess if MSMEs in the state are interested in such routes for finance. The pilot will also help the Government identify interventions that the Government can make to encourage more revenue-based financing.

○ The Government of Telangana will work with recognised third parties for the promotion of the infrastructure for and adoption of, Account Aggregators in the state. Account Aggregators are platforms which allow establishments to consolidate disaggregated financial data, seamlessly supply it to financial institutions and control how such data is used by others.

○ The Government of Telangana will institute programs for blended financing, involving a collaborative role between the state Government and lending institutions to give loans specifically to MSMEs.

- Building capacity for MSMEs to access finance: The Government of Telangana will provide technical support and advice to help MSMEs improve financial planning and follow standard book-keeping practices. For this purpose, the Government of Telangana will empanel third-parties to ensure that technical advice and support is practically accessible to MSMEs across the state. The Government of Telangana will also commission the production of videos in Telugu to help train MSMEs in basic book-keeping practices. This training will help MSMEs improve their planning for working capital needs and with accessing formal credit.

Ensuring easy access to raw materials

The Government of Telangana is dedicated to removing impediments to the steady and high-quality supply of raw materials to MSMEs in the state. To this end, the Government aims to develop best-in-class testing centres and warehousing facilities in the state, streamline supply chains where Government agencies are the key suppliers and guide MSMEs towards better price discovery, quality control and certification standards.

- Establishing common testing centres: The Government of Telangana will establish 10 new Common Facility Centres (CFCs) in the 10 districts with the highest incidence of MSMEs, with a view to ultimately providing one Common Facility Centre in every district. Access to CFCs will be provided to MSMEs at a discounted rate. CFCs can provide MSMEs with affordable access to facilities for the testing of the quality of raw materials. The location of the CFCs will be decided with the intention of ensuring equitable access. The Government of Telangana will additionally establish Cluster Based Testing Facilities (CBTFs) through a PPP model. CBTFs will be established for plastic products, bulk drug manufacture and garment processing clusters. The Government of Telangana will also incentivise large and mega industries with BIS certified in-house testing facilities that allow MSMEs to access these services.

- Strengthening warehouse and storage ecosystem in the state: The Government of Telangana will pursue reforms to encourage optimal use of land by warehouses in the state. The Government will offer 100% discount on stamp duty applicable on the purchase and lease of land by warehouse developers. Rebates on land cost offered to standalone units under this policy will be offered to warehouse developers as well. The Government will also consider relaxing building standards like parking, setbacks and height restrictions. In particular, the Government of Telangana will pursue reforms to facilitate the construction of warehouses near the Outer Ring Road and the upcoming Regional Ring Road. In the 5 MSME parks to be constructed between ORR-RRR, the Government will encourage the construction of one warehouse in each park and wherever feasible through a PPP model. Capital and Interest subsidies provided under the Telangana State Logistics Guidelines will be extended to these warehouses.

- These reforms would help MSMEs harness the full potential of the existing and upcoming road infrastructure, in the form of lower costs of transportation of raw materials and products.

- Supporting Import duty drawback: The Government of Telangana proposes to reimburse the duty incurred on import of raw material at the time of import. Currently, exporting MSMEs can only claim import duty drawback after the final product is exported. This system increases working capital constraints for MSMEs in the period between the import of raw material and the export of the final product. To help with working capital constraints, the Government of Telangana will develop a system in consultation with the Government of India to reimburse the import duty to MSMEs at the time of import.

- Government as a supplier of raw material: The Government of Telangana will ensure that the allotment of raw material by different departments to MSMEs is conducted in a timely and efficient manner.

- Creation of raw materials directory: The Government of Telangana proposes to create a directory of raw materials required across industries and bona fide suppliers who meet quality-control standards.

| Raw materials to be included in the directory | |

| Industry Raw materials | |

| Food processing | Nuts, seeds |

Textile Cotton, silk, jute

Plastics Vegetable fats and oils

FMCG products Paper packaging, milk

Waste management Plastic

Wood-based products Particle board, softwood

Transportation Rubber, glass

- Increasing presence of MSMEs on online B2B platforms: The Government of Telangana will facilitate the onboarding of MSMEs on online platforms that facilitate B2B transactions. The Government of Telangana will onboard Business Facilitators under the RAMP scheme to help MSMEs find other suppliers and buyers on B2B and B2C platforms. The facilitators will strive towards increasing MSME representation and activity on portals like the Open Network for Digital Commerce (ONDC) and private platforms like Power2SME, Tradohub and IndiaMart. Such technical assistance will particularly benefit owners of micro and small enterprises who may not possess the necessary knowledge and skills to effectively establish their business profiles on online platforms and solicit new business relationships.

- Streamline applications for quality certification: The Government aims to simplify and streamline the process through which MSMEs can obtain quality certifications. The Government of Telangana will collaborate with reputed certification bodies to ensure that raw material suppliers may access certification such as ISO, IMS.

Improving flexibility in Labour markets

The Government of Telangana is committed to enabling the MSME sector’s access to a pool of skilled workforce. Under this policy, the Government will set up the infrastructure to enable mass skilling and create opportunities for the state’s youth to avail on-the-job training. The state will also take proactive measures to rationalise restrictions on women’s labour force participation, simplify labour-related compliances, propose steps to retain workers and improve productivity.

- Setting up of The Telangana Skilling University: The Government of Telangana is setting up of a Telangana Skilling University in the state. The Government will ensure that courses relevant to the MSME sector—particularly focusing on manufacturing and industry knowledge—are offered to ensure the upskilling of the young talent in Telangana. Relevant courses will include Advanced Manufacturing Techniques, Industrial Management and Operations, Technical Skills and Trades , Information Technology and Digital Skills which will be tailored to cater to the needs of Telangana’s thrust sectors such as pharmaceuticals and food processing wherever necessary. Such MSME-friendly training will boost job creation in the state and ensure the robust growth of its MSME sector.

- Inclusion of apprenticeship opportunities in the ‘Digital Employment Exchange of Telangana’ (DEET): The Government of Telangana has created DEET, a dedicated platform to simplify talent discovery in the state. DEET does this by connecting skilled jobseekers in the state to private sector companies that are actively recruiting. The Telangana Government shall ensure that DEET integrates apprenticeships under the platform. Through this integration with DEET, the Government shall reduce the search costs of labour for MSMEs.

- Promotion of worker housing reforms in Industrial zones: The Government of Telangana shall encourage greater retention of workers by promoting the development of worker housing. To this end, will initiate a scheme for the construction of worker housing on a Public-Private-Partnership (PPP) model. In addition, the Government will review master plans operational in the state to permit the construction of worker housing in areas marked for industrial use. To illustrate, the Government of Telangana will review clause 2.7 of the Master Plan Report for Kakatiya Urban Development Authority(KUDA) to remove the prohibitions on the construction of worker hostels in industrial zones.

- Rationalisation of compliance requirements for labour contractors: The Government of Telangana will consider rationalising labour compliance requirements to encourage greater supply of skilled contract labour. In particular, the Government will consider introducing a single licence with long-duration validity for contractors with exemplary compliance track records.

- Increase options for working hour arrangements for MSMEs: The Government of Telangana will consider increasing flexibility in working hour regulations to encourage greater productivity in MSMEs and to enable better responsiveness to a global value chain.

- Facilitating greater participation of women in industrial processes: The Government of Telangana will systematically review and rationalise prohibitions under The Telangana Factories Rules, 1950 on the employment of women workers in sectors including biotechnology and pharmaceuticals, food processing, Information Technology and IT-Enabled services, as well as restrictions on their employment in commercial establishments in the state.

- Operationalisation of the 24×7, year round operation of Shops and Establishments: The Government of Telangana will remove impediments to the implementation of Government Order No. 4, dated 04 April, 2023 issued by the Telangana Labour Employment Training & Factories Department, which provides an exemption to the Telangana Shops and Establishments Act, 1988 and allows shops and establishments to operate 24×7 in the state of Telangana and Government Order No. 12, dated 15 May, 2023, issued by the Telangana Labour Employment Training & Factories Department, which extends the permission for all Shops & Establishments to operate on all days of the year in Telangana State, subject to certain conditions.27 28

Encouraging adoption of Technology

The Government of Telangana is committed to being a pioneer in the implementation of Industry 4.0. The Government aims to accelerate the technological and digital transformation of MSMEs in the state. To this end, the Government proposes to support MSMEs in increasing awareness, building adoption capability and augmenting purchasing power to develop next-gen production lines and digital capacity.

- Identifying technology needs of MSMEs: Within three months of the release of this policy, the Government will commission a comprehensive study to review existing technology adoption practices across MSMEs in the state. This study will publish a catalogue of processes and machinery that MSMEs can adopt to upgrade their production lines.

- Dedicated fund for technology transformation of MSMEs: The Government will constitute the Yantram Fund—a special fund for technology transfer and modernisation in the MSME Sectorto encourage the adoption of innovative and effective processes and machinery that will accelerate productivity of MSMEs in the state. The Government will allocate Rs 100 crores over the next four years to the Yantram Fund. Cognizant of the fact that the payback from technology upgrades manifests after a significant time lag, the Government will provide monetary assistance through the Yantram Fund. The Fund will be operationalised within a period of six months from the publication of this policy.

- Enhancing Digitalisation of MSMEs: In addition to upgradation of manufacturing processes, the Government will also provide support in digital transformation of MSMEs. The Government will facilitate bulk purchase of digital technologies and softwares at discounted rates for MSME clusters and Industrial parks.

- Support for IPR registration: Under T-PRIDE, the Government currently offers 100% subsidy on the expenses incurred for patent registration limited to Rs 3 lakhs for SC/ST-owned MSMEs. The Government will continue to do so. Under T-IDEA, the Government will now offer a 100% subsidy on the expenses incurred for patent registration limited to Rs 2 lakhs for all other MSMEs.

- Support Research and Development: The Research and Innovation Circle of Hyderabad (RICH)—set as a part of Hyderabad Science & Technology (S&T) Cluster, an initiative of the Office of Principal Scientific Advisor (PSA) to the Government of India—will support research and development activities within the MSME Sector.

27

Labour Employment Training & Factories (LAB-I) Department, Government of Telangana. (2023, April 4). G.O.Ms.No. 4, Guidelines for granting exemption to all Shops & Establishments for operating 24/7 in the Telangana State. Retrieved from

28

Labour Employment Training & Factories (LAB-I) Department, Government of Telangana. (2023, May 15). Government Order No. 12,

Guidelines for permitting all Shops & Establishments to keep open on all the days of the year in Telangana State – Extension for a further period of three (3) years w.e.f. 16.06.2022. Retrieved from https://www.promptpersonnel.com/wp-content/uploads/2023/05/permissionto-keep-all-establishments-open-on-all-days-of-the-year-in-telangana.pdf

- Facilitating engagement between MSMEs and technology providers: The Government of Telangana will organise workshops and technology fairs that will facilitate interaction and knowledge sharing between MSMEs and suitable technology providers or larger enterprises.

Improving access to Markets

The Government of Telangana is committed to improving access to a vibrant network of local and global customers for MSMEs. To this end, the Government proposes to develop a vibrant value chain in the state to support MSMEs and help make MSMEs ready to supply to the global markets.

- Encouraging large industries to procure locally: To support MSMEs, the Government will release a scheme listing additional benefits for all Telangana-based large and mega industries that procure from Telangana-based MSMEs.

- Ensuring spill over of benefits for MSMEs located closer to industrial clusters: The Government will support co-location of MSMEs that are a part of supply chains for large-scale multinational companies setting base in Telangana. On co-location of MSMEs next to these large-scale companies, the Government will ensure that the benefits offered to large-scale vendors are offered to the MSMEs as well.

- Organise supplier meet-ups: The Government will organise supplier meet-ups where large and mega industries can share their feedback on components produced by Telangana-based MSMEs. Subsequently, the business facilitators will support the MSMEs to incorporate the feedback in their products or production lines to make the products more attractive for large buyers.

- Reimbursement of duty on samples imported for prototyping: MSMEs have to import samples from markets abroad. These samples are important for rapid prototyping for product development. The Government of Telangana will pay for the duty on imported samples valued up to Rs 10 lakhs. For MSMEs owned by women, the Government will pay for duty on imported samples valued up to Rs 15 lakhs.

- Cost-sharing for acquiring quality certificates: The Government of Telangana currently provides incentives for quality certificates such as ISI/WHO/GMP/Hallmark Certification and other National and International certifications approved by the Quality Council of India(QCI). Under T-PRIDE, the Government of Telangana covers 100% of all charges upto a maximum amount of Rs 3 lakhs incurred towards quality certifications and patent registrations. Under T-IDEA, a 50% subsidy upto Rs 2 lakhs is provided. The Government of Telangana will continue the incentivization.

- Enterprise Development Centre platform: To make MSMEs export-ready, the Government of Telangana will develop an Enterprise Development platform that will outline details of export compliances as well as export-related regulations in India and other countries. At each District Industries Centre, the Government will engage international trade experts that help conduct global market research and provide trade counselling for MSME’s exporting needs.

- Co-branding MSME products with the Government’s stamp: The Government will select 2 products produced by MSMEs per district after scrutiny and testing. The Government will co-brand these products as a product of ‘Government of Telangana’ to support MSMEs in marketing these products.

- Increasing e-commerce penetration: The Government of Telangana aims to increase e-commerce penetration in MSMEs by encouraging the participation of sellers on the Open Network for Digital Commerce portal (ONDC portal) and Government eMarketplace portal (GEM portal). The Government of Telangana will conduct awareness workshops for entrepreneurs in collaboration with industry associations and the Government of India to educate small sellers and businesses about ONDC. The Government of Telangana will conduct awareness workshops to encourage the participation of MSMEs on the GlobalLinker portal. To conduct outreach programmes, the state Government, in collaboration with GlobalLinker, will publicise stories of MSMEs that have benefited from participation on the portal.

- Preferential procurement for MSMEs: The Government of Telangana is drafting a procurement policy with preferential procurement from MSMEs, particularly from SC/ST and women owned enterprises. The Department of Industries and Commerce will, within three months of notification of the procurement policy, create a mechanism to monitor the implementation of the preferential procurement scheme.

- Incentivise green initiatives: To promote the adoption of green technologies, the Government of Telangana will provide incentives like additional 15% floor area if the MSME has a solar photovoltaic plant installed or a solid waste management plant for treatment of total generated waste or if the building has a 3-5 star rating on Green Rating for Integrated Habitat Assessment (GRIHA).

- ZED-certified clusters to ease certification: Of the five MSME parks to be constructed between ORR-RRR, at least one park will have dedicated support to facilitate MSMEs to acquire ZED bronze certification.

Please note that MSMEs can access some of the benefits listed under other policies/schemes as well. The department will run a thorough check to ensure that there are no overlaps in grant disbursement.

From ideation to action: Institutional support assured

The Government of Telangana is committed to engendering inclusive and sustainable growth for MSMEs in the state. Through this policy, the Government has set an elaborate vision, offering end-to-end support from the startup to sales phase. To ensure effective and efficient implementation of the policy, this section outlines implementation and monitoring mechanisms for the policy. In addition, this section also provides financial allocations required to materialise this policy.

Over the next five years, the Government estimates to reach ~25,000 new MSMEs to give flight to their entrepreneurial vision. In addition, this forward-looking policy aims to bolster ~15,000 SC-ST and women entrepreneurs. The Government proposes to dedicate Rs 4000 crores over the next 5 years to build inclusive businesses and usher in the era of Industry 4.0.

The overall governance of MSMEs in Telangana is under the Department of Industries and Commerce. In addition, the Government of Telangana will establish a dedicated MSME wing under the Commissioner of Industries. This MSME wing will compose of one Joint Director, two Assistant Directors and four Industrial Promotion Officers. At the District level, General Manager of DICs will be assigned an MSME co-ordinator who will focus on addressing MSME-related issues.

Dedicated officers of the Department are committed to accelerating growth and delivering on the reforms, digital interventions and grievance support systems listed under the policy. The policy will be operationalised through three streams: policy implementation, industry engagement and handholding support.

Key activities to be undertaken by the implementing agencies:

Stream 1: To aid in the effective implementation of the policy, the Commissioner of Industries and Commerce, Director, MSME & Retail, the Directors of specialised business sectors and the Directors of various Corporations such as Telangana Industrial Development Corporation(TGIDC), Telangana Industrial Health Clinic Limited (TIHCL), Telangana Trade Promotion Corporation (TGTPC), Telangana Industrial Infrastructure Corporation (TGIIC) will work for the upliftment of the sector. These departments will:

- Facilitate timely disbursal of funds and incentives to support MSMEs in their working capital needs.

- Build an implementation dashboard on an all-in-one portal using insights from different portals of departments.

- Engage third-party professionals to develop best-in-class digital solutions.

- Develop supporting infrastructure like Industrial parks, local testing centres and warehousing facilities through innovative models like PPPs.

Stream 2: To source regular industry feedback, the MSME wing will set up a digital grievance redressal system where MSMEs can report their issues directly and officers of the wing will troubleshoot frequently. The MSME wing will:

- Prepare a dashboard that will record indicators like queries received every month, issues resolved, content analysis of issues resolved and issues deferred. ● Conduct periodic industry feedback and identify systemic challenges.

Stream 3: To provide timely and effective guidance to MSMEs, the Government will engage with third-party professionals and contractors to:

- Deploy business facilitators to maintain direct engagement with MSMEs.

- Plan and organise awareness campaigns to increase scheme uptake and encourage backward classes to take up entrepreneurship.

- Provide expert guidance on business development to help MSMEs develop a better understanding of processes, technological solutions and global markets.

Governance structures to monitor delivery

Implementation of commitments under this policy will be monitored by a Steering Committee chaired by the Hon’ble Minister of Department of Industries and Commerce and attended by Principal Secretary of Department of Industries and Commerce, Commissioner of Industries, Officers of the Commissionerate of Industries, Director, MSME & Retail and representatives of some industry associations. The Steering Committee proposes to table an annual progress report against the implementation of the policy to the legislative assembly.

This committee will also function as a regulatory reform committee to review the implications of regulations affecting the acquisition, use and disposal of factors of production. This exercise will be specifically designed to encourage enterprises to grow over time. In addition, this Committee will conduct a quarterly review of Telangana’s participation and uptake of central Government schemes on MSME growth. The Committee will focus on schemes that facilitate technology upgradation and modernization such as Credit Linked Capital Subsidy Scheme (CLCSS), Technology and Quality Upgradation (TEQUP) Scheme, Lean Manufacturing Competitiveness Scheme, Design Clinic Scheme for Design Expertise, financial support to MSMEs for ZED certification, etc.

Figure: Flow-chart describing the governance structures for different functions

CONCLUSION

The MSME policy brought out by the Government of Telangana in the year 2024 promises to revolutionise the way MSME are facilitated to ideate, establish, successfully run and grow to become the best in the country. MSME Policy facilitates SHGs to transition from SHGs to MSMEs by providing end to end support structures. This policy also strengthens our place as leading exporter in the country with emphasis on import substitution.

The policy focuses on putting in place a strong institutional mechanism for effective monitoring of the policy at the highest level for periodic review and course correction for achieving the final objective of creation of quality employment for the youth in the State and creation of most vibrant MSME ecosystem in the country.

JAYESH RANJAN

SPECIAL CHIEF SECRETARY TO GOVERNMENT & CIP (FAC)

[1] Ministry of Micro, Small and Medium Enterprises. 2024. ‘District Wise Udyam Registration Details of MSMEs in the State of Telangana’.

[2] KPMG. 2023. ‘Strategic Investment Plan (SIP) under RAMP, Telangana’.

[3] Telangana Industrial Infrastructure Corporation Limited. 2024. ‘Vacant Plots Summary Zone Wise’. https://tracgis.telangana.gov.in/TIS/TISNEW/tsiic/tsiiczone/searchpage.aspx.

[4] Wheebox. 2024. ‘India Skills Report: Impact of Artificial Intelligence on skills, work and mobility’. 11th edition.

[5] Wheebox. 2024. ‘India Skills Report: Impact of Artificial Intelligence on skills, work and mobility’. 11th edition.

[7] Wheebox. 2024. ‘India Skills Report: Impact of Artificial Intelligence on skills, work and mobility’. 11th edition.

[6] Siddharth Kumar Singh. May 17, 2024. ‘The death and disappearance of migrant workers’. The Hindu. Retrieved July 23, 2024.