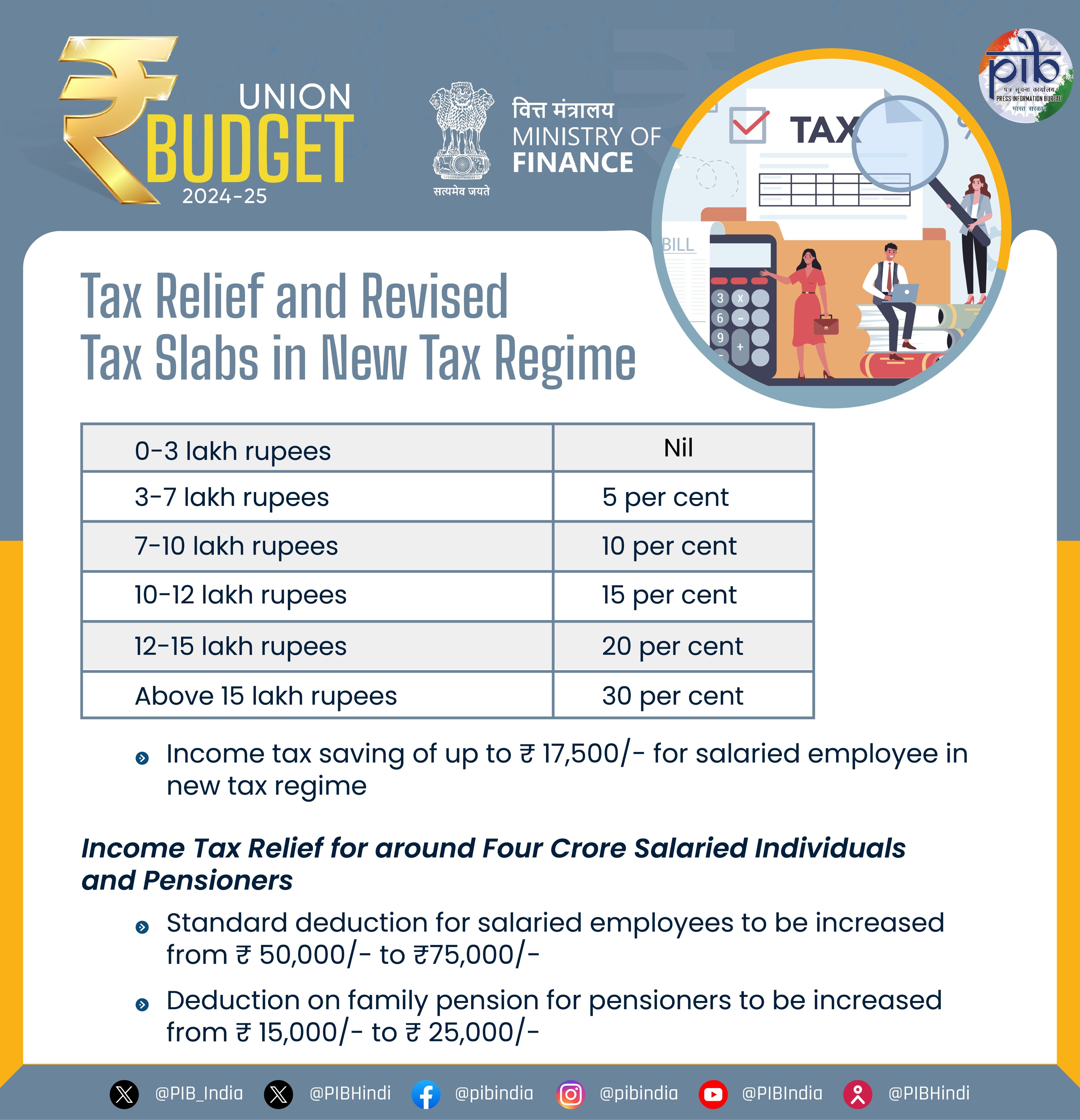

Tax Relief and Revised Tax Slabs: A Deep Dive into the New Tax Regime

The Indian government has recently announced significant changes to the income tax regime, providing substantial relief to salaried individuals and pensioners. With the revised tax slabs and increased standard deductions, many taxpayers are set to benefit from significant savings. In this article, we’ll explore the details of these changes and what they mean for you.

Overview of the New Tax Regime

The new tax regime aims to simplify the tax structure while offering potential savings for taxpayers. With changes in tax slabs and increased standard deductions, the regime is designed to provide relief to millions of individuals across India.

Key Highlights:

- Income Tax Saving for Salaried Employees: The new tax regime offers income tax savings of up to ₹17,500 for salaried employees.

- Relief for Salaried Individuals and Pensioners: Around four crore salaried individuals and pensioners are expected to benefit from these changes.

- Increased Standard Deduction: The standard deduction for salaried employees has been increased from ₹50,000 to ₹75,000.

Detailed Breakdown of Revised Tax Slabs

Under the new tax regime, the tax slabs have been adjusted to make the system more equitable and provide relief to lower and middle-income earners.

- Income up to ₹3 lakh: NilIndividuals earning up to ₹3 lakh annually are exempt from paying income tax. This exemption provides substantial relief to low-income earners and ensures they retain more of their income.

- Income from ₹3 lakh to ₹7 lakh: 5%For individuals earning between ₹3 lakh and ₹7 lakh, a 5% tax rate is applied. This slab is designed to minimize the tax burden on middle-income earners, helping them save more.

- Income from ₹7 lakh to ₹10 lakh: 10%The tax rate for individuals with an annual income between ₹7 lakh and ₹10 lakh is set at 10%. This represents a moderate increase, ensuring that taxpayers in this bracket benefit from reasonable savings.

- Income from ₹10 lakh to ₹12 lakh: 15%For those earning between ₹10 lakh and ₹12 lakh, the tax rate has been set at 15%. This rate is designed to provide balanced taxation while offering some relief compared to previous rates.

- Income from ₹12 lakh to ₹15 lakh: 20%The tax rate increases to 20% for individuals with incomes between ₹12 lakh and ₹15 lakh. While this represents a higher percentage, it aligns with global practices for higher income earners.

- Income above ₹15 lakh: 30%Individuals earning more than ₹15 lakh are taxed at a rate of 30%. This rate is consistent with international standards for higher income brackets.

Standard Deduction and Pensioner Benefits

In addition to revised tax slabs, the new regime also increases standard deductions and offers additional benefits for pensioners.

Increased Standard Deduction

- For Salaried Employees: The standard deduction for salaried employees has been increased from ₹50,000 to ₹75,000. This change allows employees to reduce their taxable income significantly, resulting in more take-home pay.

Enhanced Benefits for Pensioners

- Family Pension Deduction: The deduction on family pensions has been increased from ₹15,000 to ₹25,000. This enhancement provides additional financial relief to pensioners, ensuring they retain more income for their needs.

Implications for Taxpayers

The revised tax regime is designed to offer relief and savings to a broad spectrum of taxpayers. By increasing the standard deduction and adjusting tax slabs, the government aims to reduce the financial burden on individuals, particularly those in lower and middle-income brackets.

Financial Impact

- Increased Disposable Income: With lower tax rates and higher deductions, taxpayers can enjoy increased disposable income, which can be utilized for savings, investments, or consumption.

- Encouragement for Compliance: The simplified tax structure encourages compliance and reduces the complexities associated with tax filing, making it easier for individuals to meet their tax obligations.

Conclusion: Embracing the New Tax Regime

The new tax regime represents a significant shift in India’s approach to taxation. By providing substantial relief and simplifying the tax structure, the government aims to foster a more equitable system that benefits a broad range of taxpayers. Whether you are a salaried employee or a pensioner, understanding these changes can help you maximize your savings and ensure compliance with the new rules. As you plan your finances, consider the benefits of the new regime and how it can positively impact your financial future.