Several users nationwide encountered connectivity issues with UPI on Tuesday. NPCI confirmed the disruptions, attributing them to technical problems encountered by certain banks.

NPCI’s Statement on UPI Connectivity Disruption

Addressing the concerns, NPCI expressed regret for the inconvenience caused by UPI connectivity issues, clarifying that a few banks were grappling with internal technical challenges. NPCI reassured users that its systems were operational and that they were collaborating with the affected banks to expedite resolution.

Social Media Outcry: Users Vent Frustrations over Failed Transactions

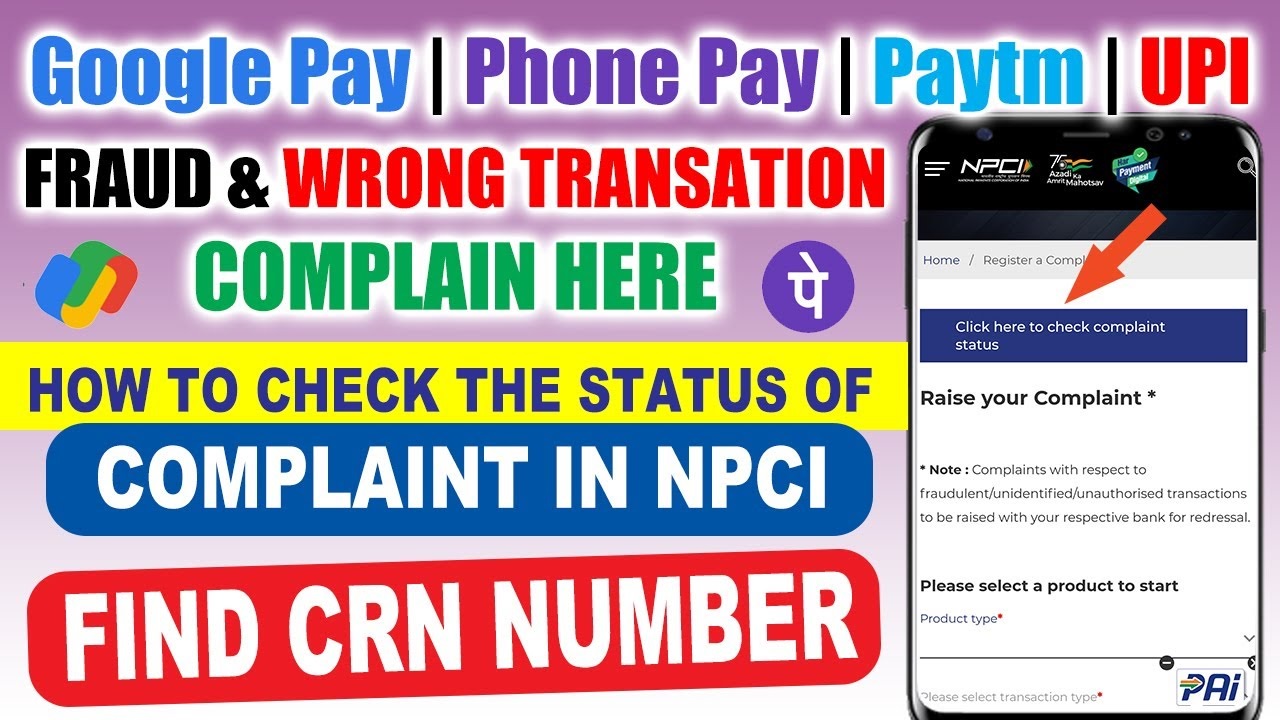

Numerous UPI users in India vented their frustrations on social media platforms as their payment transactions failed to process. Complaints flooded in from users of popular UPI apps like PhonePe, Google Pay, and Bhim.

Bank-Specific Challenges: HDFC Bank Among Affected Institutions

Reports surfaced of customers encountering transaction failures, with HDFC Bank notably experiencing high failure rates across various UPI apps. Similar issues were reported by customers of SBI, Kotak Bank, and Bank of Baroda.

Disassociation with Paytm Woes: Clarification from the Banking Sector

Despite speculation linking the UPI disruption to ongoing issues faced by Paytm, banking officials clarified that the downtime was unrelated to Paytm’s regulatory challenges.

HDFC Bank’s Confirmation and Resolution Efforts

Acknowledging the impact on its customers, HDFC Bank acknowledged facing challenges on UPI, which it attributed to broader ecosystem issues. However, the bank assured customers of its swift return to normal operations.

Record UPI Transactions in January 2024

Despite the recent setbacks, UPI transactions soared to unprecedented levels in January 2024. NPCI data revealed a staggering Rs 18.41 trillion in UPI transactions, marking a historic milestone. The announcement was also echoed by the PMO account on social media.