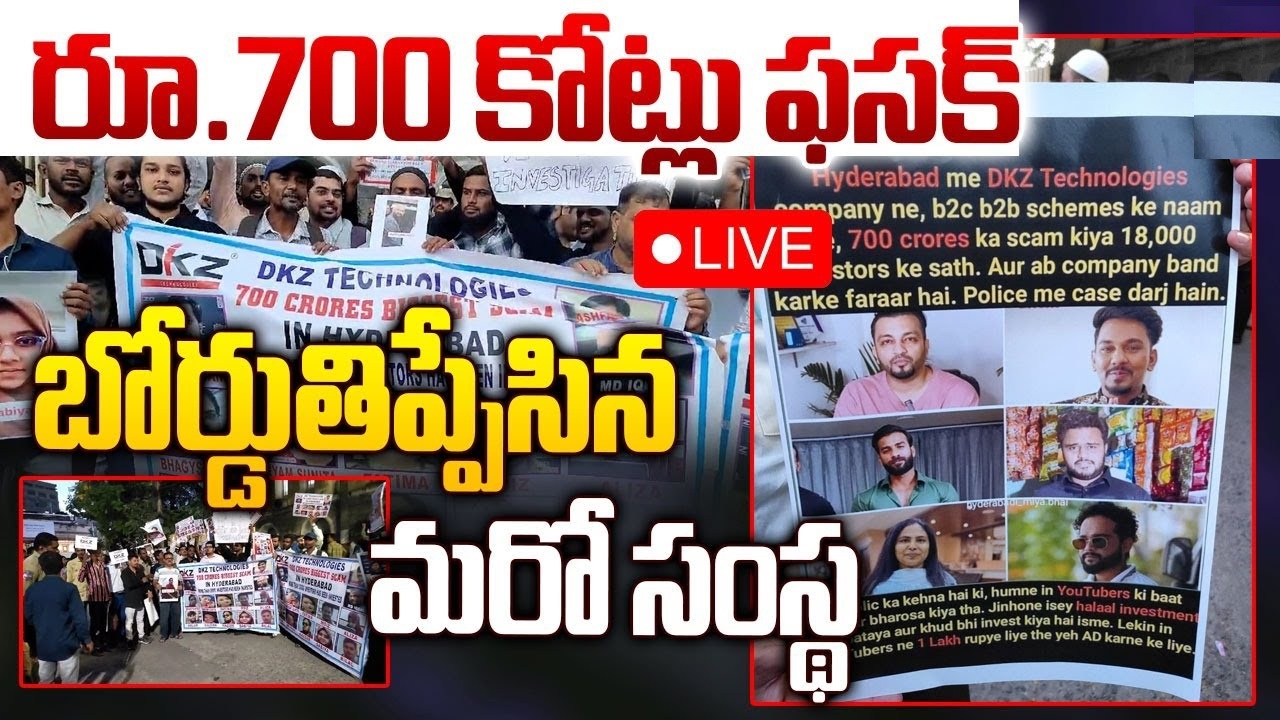

The DKZ Technologies scam has recently come to light, uncovering a massive fraud operation that swindled over 30,000 investors out of Rs 700 crore. The company, based in Madhapur, cleverly lured victims through flashy marketing strategies, including hiring popular YouTubers and social media influencers to promote their fraudulent schemes. Many unsuspecting investors, drawn by promises of high returns, invested substantial sums, only to be left empty-handed.

In this article, we will examine the details of this shocking scam, the experiences of some of its victims, and the growing calls for a deeper investigation into the matter.

The Scope of the DKZ Technologies Scam

The DKZ Technologies scam has had a widespread impact, spanning three states and affecting both Indian residents and Non-Resident Indians (NRIs). With over 30,000 victims, the total fraud amount is estimated at Rs 700 crore. The company’s false promises of high monthly interest rates, ranging from 8% to 12%, attracted investors from various walks of life, all hoping to gain quick financial returns.

The scam’s large scale and the involvement of influencers have raised questions about the role of government authorities and regulators. Many are now calling for the Telangana State government to transfer the case to the Central Bureau of Investigation (CBI) to ensure a thorough and impartial investigation.

Lack of Oversight: Questions Raised About Authorities

Afroz Khan, a victim of the scam, expressed his frustration with the authorities, questioning the role of the State Intelligence Department. “What was the State Intelligence Department doing since 2018 even after two persons registered a bogus firm and looted the common man to the tune of Rs 700 crores?” Khan said.

This criticism stems from the fact that DKZ Technologies had been operating since 2018, during which time it amassed a massive sum from investors. Despite its fraudulent activities being widespread, there appears to have been a lack of intervention or action from authorities until the scam reached its peak.

Khan, along with other victims, believes that the involvement of the former home minister and certain social media personalities who promoted the company must be investigated. Moreover, there are demands to freeze the assets of DKZ Technologies and compensate the defrauded investors.

How DKZ Technologies Tricked Investors

The company’s fraudulent activities centered around false promises of monthly interest payouts ranging from 8% to 12%. These high rates of return enticed many people to invest their life savings, hoping for quick and substantial gains. However, none of these promises materialized.

Afroz Khan, one of the many victims, explained how he fell for DKZ Technologies’ false assurances. In May, he invested Rs 5 lakh with the hope of earning a steady monthly interest of 8% to 12% over six months. Initially, the company representatives assured him that the interest payments would begin in June. However, as the months passed, the company offered one excuse after another, claiming that technical upgrades to their payment system were causing delays.

Khan’s trust in the company delayed his decision to take action. By the time he finally decided to visit their office in August, he was met with an empty building and a notice stating that DKZ Technologies had shut down its operations. This is when he realized he had been scammed, along with thousands of others.

The Experiences of Other Victims

The fraudulent operations of DKZ Technologies affected countless people, including IT professionals and middle-class individuals who invested their hard-earned savings. Another victim, Mujeeb Basha, shared his devastating experience with NewsMeter. Basha, an IT employee, invested Rs 7 lakh with DKZ Technologies in two phases during August, drawn by the promise of high returns over a one-year plan.

As per his agreement with the company, Basha was supposed to receive monthly interest payments of Rs 60,000 on his Rs 5 lakh investment and Rs 22,000 on his Rs 2 lakh investment after 45 days. However, like many others, he was met with silence when the company abruptly shut down in August, leaving him scrambling to recover his money.

“I am very much concerned about my investment now. I am running from pillar to post to find the owners of the firm and get back my investment,” Basha said. He also revealed that when he approached the police, he discovered that thousands of other investors had been duped in a similar fashion.

Calls for a Full Investigation and Justice

The DKZ Technologies scam has shaken investor confidence and exposed gaps in regulatory oversight. Victims and their families are now urging the authorities to take swift action. Many believe that the scope of the scam requires an investigation by a central agency such as the CBI. There are growing concerns that the involvement of high-profile individuals, including influencers and politicians, may have helped shield the scam from scrutiny for years.

Additionally, the victims demand that the assets of DKZ Technologies be seized and sold to compensate the investors who lost their savings. Many are calling for stricter regulations to prevent similar scams from occurring in the future, especially those involving misleading promotions by influencers and public figures.

Lessons to Learn from the DKZ Technologies Scam

The DKZ Technologies fraud serves as a sobering reminder of the risks associated with investing in schemes that promise unrealistically high returns. Investors should always be cautious and thoroughly research any company or investment opportunity before committing their money. The involvement of social media influencers and YouTubers in promoting such scams also highlights the need for stricter advertising regulations in the digital age.

Furthermore, authorities need to be more proactive in identifying and shutting down fraudulent companies before they can cause widespread harm. The lack of action from regulatory bodies in this case has raised serious questions about their ability to protect the public from financial scams.

Conclusion

The DKZ Technologies scam has devastated the lives of over 30,000 investors, robbing them of their savings and exposing the vulnerabilities of the financial system. As calls for a deeper investigation grow louder, victims and their families continue to seek justice and compensation. This fraud serves as a cautionary tale for future investors and underscores the need for stronger regulatory measures to prevent similar incidents from occurring in the future.

Ultimately, the lessons learned from this case should push authorities to act swiftly and decisively to protect the public from falling victim to scams like DKZ Technologies.