Suzlon Energy has emerged as a focal point for investors, showcasing remarkable resilience in a volatile market. On June 9, 2025, the stock demonstrated significant upward momentum despite a broader market downturn. This article delves into the dynamics behind Suzlon Energy’s recent performance, the implications of a massive block deal, and the promising future of India’s wind energy sector. With a robust order book, strategic promoter decisions, and increasing government support for renewable energy, Suzlon is well-positioned for growth. Let’s explore why Suzlon Energy is capturing the attention of global and domestic investors and what it means for the renewable energy landscape.

Understanding Suzlon Energy’s Stock Performance

Suzlon Energy’s stock has been a standout performer in the renewable energy sector, particularly in the wind energy space. On June 9, 2025, the stock closed at ₹68.23, reflecting a 1.64% gain despite a marginal market decline. Intraday trading saw the stock reach a high of ₹69.50 and a low of ₹66, indicating volatility but also strong buying interest. This performance is noteworthy, given the BSE Sensex closed at 82,391, down 53 points or 0.065%, after an initial surge of nearly 200 points was eroded by profit booking.

The Nifty Energy Index, a key benchmark for energy stocks, also showed resilience, closing at 36,515 with a 0.45% gain. Suzlon’s ability to outperform in a consolidating market highlights its strong fundamentals and investor confidence. But what fueled this surge, especially in the face of a massive block deal by promoters? Let’s dive deeper.

The Block Deal That Shook the Market

On June 9, 2025, Suzlon Energy witnessed a significant block deal involving the sale of 19.8 crore shares by its promoters, valued at over ₹1,300 crore. The shares were sold at an average price of ₹66.05, with key promoter entities, including Tanti Holdings, Ranchhodbhai Tanti, Vinod Tanti, and Rambhabha, offloading substantial stakes. Specifically:

- Tanti Holdings sold 6.69 crore shares.

- Ranchhodbhai Tanti sold 5.08 crore shares.

- Vinod Tanti sold 5.28 crore shares.

- Rambhabha sold 2.75 crore shares.

Typically, large-scale promoter sales trigger a decline in stock prices due to perceived lack of confidence. However, Suzlon’s stock defied this trend, maintaining stability and even gaining ground. The reason? Major domestic and global institutional investors swooped in to absorb the shares, signaling strong faith in Suzlon’s growth trajectory.

Who Bought Suzlon’s Shares?

The block deal attracted a host of heavyweight investors, both from India and abroad, who saw the promoter sale as an opportunity to increase their stakes in Suzlon Energy. Some of the prominent buyers included:

- Aditya Birla Sun Life Mutual Fund: Acquired 3.03 crore shares.

- Motilal Oswal Mutual Fund: Purchased 4.54 crore shares.

- Goldman Sachs (Singapore) Pte: Bought 15.14 lakh shares.

- Goldman Sachs Asian Equity Portfolio: Secured 5.83 crore shares.

- ICICI Prudential Life Insurance: Acquired 1.69 crore shares.

- Invesco Mutual Fund: Purchased 48.45 lakh shares.

- Bajaj Allianz Life Insurance: Bought 30.28 lakh shares.

- Sundaram Mutual Fund: Acquired 75.7 lakh shares.

- ASK Absolute Return Fund: Purchased 15.14 lakh shares.

This diverse group of investors, including mutual funds, insurance companies, and global financial giants, underscores the widespread confidence in Suzlon’s future. The involvement of marquee names like Goldman Sachs and Motilal Oswal highlights the stock’s appeal as a long-term investment in the renewable energy sector.

Why Didn’t the Stock Price Crash?

The absence of a price decline post-block deal is a testament to the robust demand for Suzlon Energy’s shares. Typically, large block deals lead to oversupply, driving prices down. However, in this case, institutional investors quickly absorbed the shares, preventing a price drop. This aggressive buying reflects several key factors:

- Strong Order Book: Suzlon’s order pipeline is robust, with significant projects in the wind energy sector. The company’s focus on executing these projects without increasing debt likely prompted promoters to sell shares to raise capital.

- Strategic Promoter Decision: The promoter sale was a calculated move to fund ongoing projects while maintaining financial discipline. By avoiding debt, Suzlon strengthens its balance sheet, positioning itself for sustainable growth.

- Investor Confidence: The participation of global and domestic funds signals strong belief in Suzlon’s ability to capitalize on India’s renewable energy boom. Investors view the promoter sale as an opportunity to enter or increase their stakes at an attractive price.

This dynamic has created a positive feedback loop, where institutional buying has bolstered retail investor confidence, further supporting the stock’s stability.

Suzlon Energy’s Market Position and Historical Performance

Suzlon Energy has long been a leader in India’s wind energy sector, known for its expertise in manufacturing wind turbines and providing end-to-end renewable energy solutions. However, the company has faced challenges in the past. On September 12, 2024, Suzlon’s stock hit a one-year high of ₹86.04. However, over the subsequent seven months, it experienced a 46.54% correction, dropping to ₹46 by April 7, 2025—the lowest level in the year.

Since then, the stock has shown signs of recovery, driven by renewed investor interest and favorable sector developments. As of March 2025, the shareholding pattern revealed:

- Domestic Mutual Funds: Held a 4.17% stake, with no single fund owning more than 1%.

- Foreign Portfolio Investors (FPIs): Accounted for 23.03% of the shareholding, with Vanguard’s Total International Stock Index Fund (1.23%) and Emerging Market Stock Index Fund (1.11%) being notable investors.

- Retail Investors: Approximately 561,976 small investors held stakes worth up to ₹2 lakh, while 496 high-net-worth individuals held 25.12% of shares valued above ₹2 lakh.

- Promoter Holding: Stood at 13.25% before the block deal, now reduced due to the sale.

This diverse investor base, combined with Suzlon’s recovery from its April 2025 low, highlights its potential as a multibagger stock for long-term investors.

The Wind Energy Sector: A Bright Future

India’s wind energy sector is at a pivotal juncture, driven by government initiatives and global demand for clean energy. Suzlon Energy, as a market leader, stands to benefit significantly from these trends. Here are the key developments shaping the sector:

Government Support for Renewable Energy

The Indian government is prioritizing renewable energy to meet its ambitious climate goals, including achieving 500 GW of non-fossil fuel capacity by 2030. Wind energy is a critical component of this strategy, with policies aimed at enhancing domestic manufacturing and reducing reliance on foreign equipment. The “Make in India” initiative encourages companies like Suzlon to produce wind turbines and components locally, boosting self-reliance and job creation.

Addressing Cybersecurity Concerns

Recent reports of alleged cyberattacks on India’s power infrastructure, particularly from neighboring countries, have raised concerns about the security of critical energy systems. While claims of a 70% hack on India’s electricity grid were debunked, they underscored the need for robust cybersecurity measures. The government is now mandating that all wind turbine systems and operational data be hosted in India to prevent foreign interference. This policy aligns perfectly with Suzlon’s capabilities, as the company manufactures its equipment domestically, ensuring full control over its systems.

Suzlon’s Competitive Edge

Suzlon’s vertically integrated business model—encompassing design, manufacturing, installation, and maintenance of wind turbines—gives it a competitive advantage. The company’s ability to deliver end-to-end solutions positions it as a preferred partner for wind energy projects. Additionally, Suzlon’s strong order book and ongoing project executions signal robust revenue growth in the coming years.

Why Suzlon Energy Is a Multibagger Opportunity

Suzlon Energy’s recent performance and strategic moves make it a compelling investment opportunity. Here’s why:

- Robust Financial Strategy: By selling promoter shares instead of taking on debt, Suzlon is funding its growth sustainably. Once current projects are completed, the company is likely to generate significant cash flows, potentially allowing promoters to increase their stakes again.

- Institutional Backing: The participation of global giants like Goldman Sachs and domestic leaders like Motilal Oswal in the block deal reflects strong institutional confidence. This backing often signals long-term growth potential to retail investors.

- Sector Tailwinds: India’s push for renewable energy, coupled with policies favoring domestic manufacturing, creates a favorable environment for Suzlon. The company’s alignment with national priorities, such as “Make in India” and cybersecurity, enhances its growth prospects.

- Stock Recovery: After a significant correction from its September 2024 high, Suzlon’s stock has shown resilience, recovering from its April 2025 low. This rebound, supported by strong fundamentals, suggests the stock may be undervalued, offering room for growth.

Investment Considerations and Risks

While Suzlon Energy presents a compelling case, investors should exercise caution and conduct thorough research before investing. Key considerations include:

- Market Volatility: The broader market’s consolidation phase, with the BSE Sensex fluctuating between 81,000 and 82,000, could impact Suzlon’s stock in the short term. Profit booking, as seen on June 9, 2025, may lead to temporary dips.

- Promoter Stake Reduction: Although the block deal was absorbed by institutional investors, a reduced promoter holding could raise concerns among retail investors. However, the strategic intent behind the sale mitigates this risk.

- Sector-Specific Risks: The wind energy sector faces challenges such as regulatory changes, project execution delays, and competition from other renewable energy sources like solar. Investors should monitor these factors closely.

Before investing, consult a financial advisor to assess whether Suzlon aligns with your risk tolerance and investment goals. Conduct your own research to validate the company’s fundamentals and market conditions.

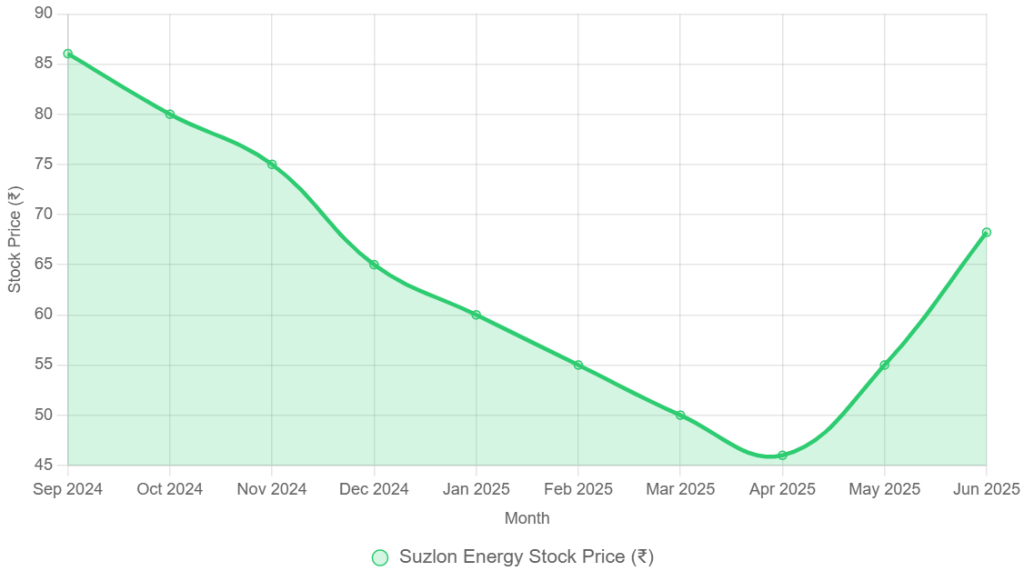

Charting Suzlon’s Stock Performance

To visualize Suzlon Energy’s recent performance, here’s a chart tracking its stock price over the past year:

This chart illustrates Suzlon’s peak at ₹86.04 in September 2024, its decline to ₹46 in April 2025, and its recovery to ₹68.23 by June 2025. The upward trend since April suggests growing investor confidence.

The Broader Market Context

The BSE Sensex’s performance on June 9, 2025, reflects a consolidating market. After an initial 200-point surge, profit booking led to a marginal decline, closing at 82,391. This consolidation phase, with the index oscillating between 81,000 and 82,000, indicates a period of stabilization following a rapid 9,000-point rally from 73,000. The Nifty Energy Index’s 0.45% gain highlights the energy sector’s relative strength, with Suzlon leading the charge.

Investors should note that markets often consolidate after sharp rallies, allowing stocks like Suzlon to shine based on company-specific developments. The absence of a breach below 81,000 suggests a strong support level, providing a stable backdrop for Suzlon’s growth.

Conclusion: Suzlon Energy’s Path Forward

Suzlon Energy’s recent stock surge, driven by a massive block deal and strong institutional buying, underscores its position as a leader in India’s wind energy sector. The company’s strategic decision to fund projects through promoter sales rather than debt, combined with government support for domestic manufacturing and cybersecurity, positions Suzlon for long-term success. With a robust order book and a recovering stock price, Suzlon offers a compelling opportunity for investors seeking exposure to renewable energy.

However, as with any investment, due diligence is critical. Consult a financial advisor, analyze market trends, and assess your risk appetite before making decisions. Suzlon Energy’s story is one of resilience, strategic foresight, and alignment with India’s renewable energy ambitions. As the wind energy sector gains momentum, Suzlon is poised to ride the wave to new heights.