Shipping Corporation of India (SCI) reported its first quarter results for fiscal year 2026, presenting a mixed financial picture with operational revenue declining year-over-year while net profit surged significantly due to substantial other income. The state-owned shipping giant’s performance reflects the complex dynamics facing India’s maritime sector amid evolving global trade patterns.

SCI Q1 FY26 financial performance showing revenue decline but profit growth driven by other income

Financial Performance Overview

Revenue Challenges

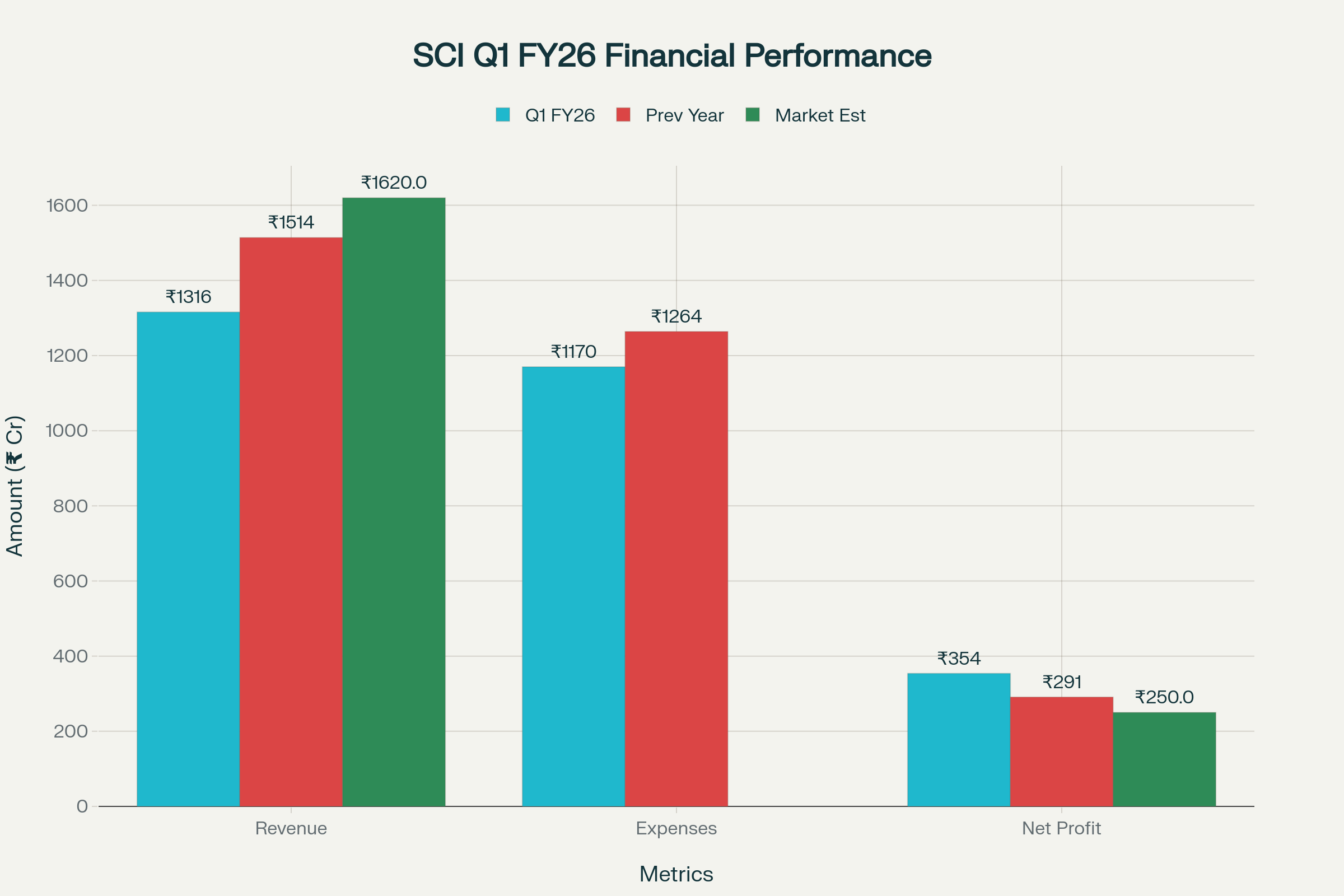

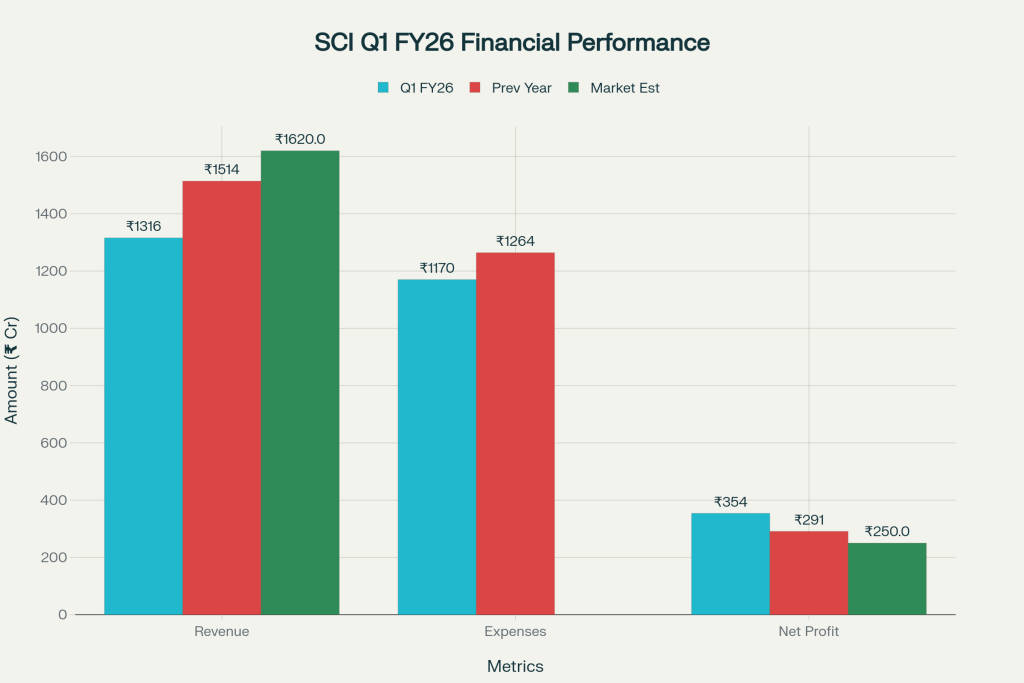

SCI’s operational revenue for Q1 FY26 declined 13.1% year-over-year to ₹1,316 crore compared to ₹1,514 crore in the corresponding quarter of the previous year. This decline was more pronounced when compared to market expectations, with the company falling short of analyst estimates of ₹1,620 crore by 18.8%. The revenue downturn was primarily attributed to challenging market conditions in the shipping sector, reflecting broader headwinds affecting global maritime trade.

On a sequential basis, revenue showed a marginal decline of 0.7% from the previous quarter’s ₹1,325 crore. This consistent downward trend in operational revenue underscores the persistent challenges facing SCI’s core shipping operations amid volatile freight rates and changing trade patterns.

Profitability Surge

Despite revenue headwinds, SCI delivered robust profit growth, with net profit increasing 21.6% year-over-year to ₹354 crore from ₹291 crore in Q1 FY25. This performance significantly exceeded market expectations of ₹250 crore, representing a 41.6% outperformance against analyst estimates. The quarter-over-quarter improvement was even more dramatic, with net profit surging 91.4% from the previous quarter’s ₹185 crore.

Earnings per share (EPS) reflected this strong profit performance, rising 21.4% year-over-year to ₹7.60 from ₹6.26 in the same quarter last year. The EPS growth demonstrates improved per-share returns for investors despite the challenging operational environment.

SCI’s quarterly financial trends showing declining revenue but improving profitability driven by other income

Margin Expansion

The company’s profitability improvement was reflected in expanded margins across key metrics. EBITDA margin widened to 37.2% in Q1 FY26 compared to 33.6% in the year-ago period. This margin expansion occurred despite a 3.8% decline in absolute EBITDA to ₹489.6 crore from ₹509 crore year-over-year. The improved margins indicate better operational efficiency and cost management despite lower revenue volumes.

Other Income Analysis

Significant Other Income Contribution

A critical factor driving SCI’s profit growth was the substantial increase in other income, which surged 232% year-over-year to ₹146 crore from ₹44 crore in Q1 FY25. This represented a 94.7% increase from the previous quarter’s ₹75 crore. The other income component accounted for 41.2% of total net profit, highlighting its significant contribution to the company’s bottom line performance.

sci_q1_2026_results_summary.csv

Generated File

Core Operations Performance

When adjusting for the extraordinary other income, SCI’s core operational profitability presents a different picture. Normalizing for other income levels, the core operations profit would have been approximately ₹252 crore, suggesting that while operational performance improved, the headline profit growth was substantially boosted by non-operational income sources.

Market Reaction and Stock Performance

Share Price Movement

Following the results announcement, SCI shares ended trading at ₹201.95 on the BSE, down 2.42% or ₹5 from the previous session. This decline suggests that despite the strong profit numbers, investors remained cautious about the underlying revenue trends and the sustainability of other income contributions.

The stock has faced broader headwinds over the past year, declining 21.89% over the 12-month period. However, it has shown resilience with a 5-year return of 231.32%, reflecting the cyclical nature of the shipping industry and SCI’s ability to navigate through different market cycles.

Valuation Metrics

SCI currently trades at a price-to-earnings ratio of 11.13, which is considered average for the stock based on historical trends. The company’s market capitalization stood at ₹9,391 crore, with the stock trading significantly below its 52-week high of ₹288.75 and above its 52-week low of ₹138.26.

Industry Context and Competitive Position

Shipping Sector Dynamics

The shipping industry globally has been experiencing mixed conditions, with tanker rates witnessing volatility across segments. The tanker shipping market, which is SCI’s primary segment, is expected to grow at a CAGR of 2.9% from 2024 to 2031, reaching USD 273.9 billion by 2031. However, short-term volatility remains a concern due to geopolitical tensions, changing trade routes, and supply-demand imbalances.

India’s maritime sector is undergoing significant transformation, with the government’s Maritime India Vision 2030 and Sagarmala Programme targeting substantial infrastructure investments. The sector handles approximately 95% of India’s foreign trade by volume and 70% by value, making it critical to the country’s economic growth.

Fleet and Operations

SCI operates India’s largest shipping fleet with 59 vessels comprising 32 tankers, 15 bulk carriers, 2 liners, and 10 offshore supply vessels, with a combined capacity of 5,311,210 DWT. The company serves major clients including Reliance Industries, ONGC, Shell, and Petronas. The tanker segment remains the most significant contributor, accounting for 64% of revenue and 79% of profits in FY25.

Strategic Initiatives and Growth Prospects

Fleet Expansion Plans

SCI has signed a Memorandum of Agreement to acquire two Very Large Gas Carriers (VLGCs) with a capacity of 82,000 cubic meters each, expected to be inducted in FY 2025-26. This strategic expansion aims to strengthen SCI’s presence in the gas transportation sector, particularly for LPG and ammonia markets, enhancing operational flexibility and competitiveness in international gas shipping markets.

Government Support and Policy Environment

The Indian government’s recent Budget 2025 announcements include a ₹25,000 crore Maritime Development Fund and infrastructure status for vessels. The Ministry of Ports, Shipping and Waterways has set ambitious targets, including completing 150 projects worth ₹2 trillion by September 2025. These initiatives are expected to benefit SCI through improved infrastructure, reduced operational costs, and enhanced competitiveness.

Financial Health and Management Efficiency

Debt Management

SCI has been actively reducing its debt levels, improving financial flexibility for future growth. The company’s debt-to-equity ratio stands at 23.3%, indicating a relatively conservative capital structure. This debt management strategy provides SCI with financial headroom to pursue growth opportunities and weather market volatility.

Dividend Policy

The company has demonstrated strong commitment to shareholder returns, with dividend payout surging from 3% to 36% in the previous fiscal year. For FY25, the board recommended a dividend of ₹6.59 per equity share, translating to an outgo of ₹306.96 crore, the highest in two decades. The current dividend yield stands at 3.27%.

Challenges and Risk Factors

Revenue Sustainability Concerns

The consistent decline in operational revenue raises questions about the sustainability of SCI’s core business performance. The 13% year-over-year revenue decline and the shortfall against market estimates suggest that the company faces structural challenges in its traditional shipping operations.

Dependence on Other Income

The significant contribution of other income (41.2% of net profit) to overall profitability raises concerns about the sustainability of earnings growth. While other income can provide temporary boosts, long-term value creation depends on core operational performance, which showed mixed results in Q1 FY26.

Market Volatility

The shipping industry remains susceptible to various external factors including geopolitical tensions, trade policy changes, commodity price fluctuations, and environmental regulations. These factors can significantly impact freight rates, vessel utilization, and overall profitability.

Future Outlook and Industry Trends

Growth Drivers

India’s growing economy, increasing trade volumes, and government-supported infrastructure development provide positive long-term drivers for the shipping sector. The country’s strategic location on major shipping routes, combined with initiatives like the Sagarmala Programme, positions SCI to benefit from increased maritime trade.

Technology and Sustainability

The industry is transitioning toward cleaner, more efficient vessels to comply with International Maritime Organization (IMO) regulations. SCI’s investment in modern, fuel-efficient vessels and exploration of green shipping initiatives align with global sustainability trends and regulatory requirements.

Market Expansion Opportunities

The planned acquisition of VLGCs and focus on gas transportation markets present opportunities for SCI to diversify its revenue streams and capture growth in emerging energy sectors. The global tanker orderbook has rebounded from historic lows, indicating renewed confidence in the sector.

Conclusion

SCI’s Q1 FY26 results present a complex picture of a company navigating challenging market conditions while demonstrating operational resilience. While the 13% decline in revenue raises concerns about core business performance, the company’s ability to generate strong profit growth through improved margins and other income demonstrates management’s adaptability.

The significant contribution of other income to profitability, while providing near-term support, highlights the need for sustainable revenue growth from core operations. SCI’s strategic initiatives, including fleet expansion and focus on emerging markets, coupled with strong government support for India’s maritime sector, provide a foundation for future growth.

However, investors should carefully monitor the sustainability of other income contributions and the company’s ability to reverse the declining revenue trend. The stock’s recent performance and valuation metrics suggest that market participants are taking a cautious approach, weighing strong profit numbers against underlying operational challenges.

As India continues to develop its maritime infrastructure and SCI positions itself to capitalize on these opportunities, the company’s ability to balance short-term profitability with long-term sustainable growth will be critical to its success in the evolving global shipping landscape.