The financial world is bracing for a pivotal week for HDFC Bank, India’s largest private sector lender, RBI’s Recent Penalty on HDFC Bank and Shriram Finance: Key Takeaways, and prepares to announce its Q1 FY26 results. These developments are poised to trigger significant market volatility, impacting not only HDFC Bank’s stock but also the broader Nifty Bank and Nifty 50 indices. With allegations of ethical lapses against its CEO, Sashidhar Jagdishan, and the bank’s substantial influence on India’s financial landscape, all eyes are on how these events will unfold. This article delves into the court case, its implications for corporate governance, the anticipated Q1 results, and their potential to reshape market sentiment.

RBI Penalties on HDFC Bank and Shriram Finance: Navigating Regulatory Compliance in 2025

The Reserve Bank of India (RBI) plays a pivotal role in maintaining the integrity of India’s financial ecosystem. In July 2025, the RBI imposed monetary penalties on two major financial institutions, HDFC Bank and Shriram Finance, for failing to adhere to specific regulatory guidelines. HDFC Bank faced a penalty of Rs 4.88 lakh for violating foreign investment norms, while Shriram Finance was fined Rs 2.70 lakh for non-compliance with digital lending regulations. These actions underscore the RBI’s commitment to enforcing strict compliance standards to protect consumers and ensure financial stability.

This comprehensive article explores the details of these penalties, their implications for the financial sector, and the broader context of regulatory compliance in India. By delving into the specifics of the violations, the RBI’s enforcement process, and actionable insights for businesses, this piece aims to provide a thorough understanding of the evolving regulatory landscape in 2025.

HDFC Bank’s Penalty: A Closer Look at Foreign Investment Violations

HDFC Bank, India’s largest private sector lender, faced a penalty of Rs 4.88 lakh for breaching norms related to foreign investment while granting a term loan. The violation occurred under the RBI’s “Master Direction – Foreign Investment in India,” which outlines strict guidelines for authorized dealer banks handling foreign investments.

Details of the Violation

The RBI identified that HDFC Bank contravened specific provisions while processing a term loan for a client. Although the exact nature of the violation was not detailed in public statements, it likely involved improper handling of foreign investment transactions, such as inadequate due diligence or failure to report transactions accurately. The RBI issued a show-cause notice to HDFC Bank, prompting the bank to submit a written response and participate in oral submissions.

After a thorough review of the case, the RBI concluded that the violations warranted a monetary penalty. The fine, while relatively modest compared to the bank’s scale, underscores the importance of meticulous compliance with foreign investment regulations.

Implications for HDFC Bank

The penalty serves as a reminder that even minor lapses can attract regulatory action. For HDFC Bank, the financial impact of the Rs 4.88 lakh fine is negligible, but the reputational implications are significant. As a leading financial institution, HDFC Bank must maintain a spotless record to preserve investor and customer trust. The penalty may prompt the bank to strengthen its internal controls and compliance mechanisms to prevent future violations.

Broader Impact on the Banking Sector

The RBI’s action against HDFC Bank signals heightened scrutiny of foreign investment transactions across the banking sector. With India attracting significant foreign capital, banks must ensure strict adherence to RBI guidelines to avoid penalties and maintain the country’s reputation as a reliable investment destination.

Shriram Finance’s Penalty: Non-Compliance with Digital Lending Norms

Shriram Finance Limited, a prominent non-banking financial company (NBFC), was fined Rs 2.70 lakh for failing to comply with the RBI’s “Digital Lending Directions, 2025.” The violation centered on the company’s practice of routing loan repayments through third-party accounts instead of directly from borrowers.

The Digital Lending Violation

The RBI’s digital lending guidelines, introduced to regulate the rapidly growing digital lending ecosystem, mandate transparency and directness in loan transactions. Shriram Finance’s practice of using third-party accounts for loan repayments violated these guidelines, potentially compromising transparency and increasing the risk of fraud or mismanagement.

The RBI conducted a statutory inspection of Shriram Finance’s financial position as of March 31, 2024, which revealed the non-compliance. Following a show-cause notice, the company submitted written and oral responses. However, the RBI determined that the violation warranted a penalty, emphasizing the importance of direct borrower-lender transactions in digital lending.

Consequences for Shriram Finance

The Rs 2.70 lakh penalty, while modest, highlights the need for NBFCs to align their operations with RBI’s digital lending framework. Shriram Finance may need to overhaul its repayment processes to ensure direct transactions, which could involve updating its digital infrastructure and training staff on compliance requirements.

The Growing Importance of Digital Lending Compliance

The digital lending sector has seen exponential growth in India, driven by technological advancements and increased smartphone penetration. However, this growth has also raised concerns about predatory lending practices, data privacy, and transparency. The RBI’s digital lending guidelines aim to address these issues by setting clear standards for loan disbursal, repayment, and borrower protection. The penalty on Shriram Finance underscores the regulator’s commitment to enforcing these standards, ensuring a fair and secure lending environment.

The Court Case: Allegations Against HDFC Bank’s CEO

Background of the Lilavati Trust Dispute

HDFC Bank’s CEO and Managing Director, Sashidhar Jagdishan, faces serious allegations from the Lilavati Kirtilal Mehta Medical Trust, which operates Mumbai’s renowned Lilavati Hospital. The trust accuses Jagdishan of accepting ₹2.05 crore in kickbacks to provide financial advice that allegedly helped former trustees maintain illegal control over the trust. The accusations, detailed in a First Information Report (FIR) filed at Bandra police station, have sparked a legal battle that has reached the Bombay High Court.

The trust further claims that Jagdishan was appointed as a financial advisor through a concealed letter dated February 2, 2022, without the knowledge or consent of permanent trustees Kishor Mehta and Charu Kishor Mehta. This alleged lack of transparency raises significant regulatory and ethical concerns, particularly given Jagdishan’s role as the head of a major private sector bank. The trust has also called for a Central Bureau of Investigation (CBI) probe, intensifying the scrutiny on HDFC Bank’s leadership.

Supreme Court and Bombay High Court Developments

On July 4, 2025, the Supreme Court declined to intervene in Jagdishan’s plea to quash the FIR, directing the matter to the Bombay High Court, where it was scheduled for a hearing on July 14, 2025. However, the case has faced repeated delays, with four Bombay High Court judges recusing themselves, the most recent being Justice Gautam Ankhad on July 8, 2025. These recusals have fueled uncertainty, as the case remains unresolved, casting a shadow over HDFC Bank’s corporate governance standards.

Jagdishan’s legal team, led by senior advocate Mukul Rohatgi, argues that the FIR is “malafide” and a pressure tactic related to outstanding dues of approximately ₹65.22 crore as of May 31, 2025. Rohatgi has emphasized that there is no immediate threat of arrest for Jagdishan, but the prolonged legal battle continues to damage the bank’s reputation and could affect investor confidence.

RBI’s Recent Penalty on HDFC Bank

The allegations against Jagdishan strike at the heart of corporate governance, a critical factor for investor trust in a bank of HDFC’s stature. As the CEO of India’s largest private sector lender, Jagdishan’s actions are under intense scrutiny. The claim that he accepted payments to influence trust decisions raises questions about fiduciary integrity and compliance with banking regulations. Posts on X reflect growing public concern, with some users suggesting that these allegations could render Jagdishan’s position as CEO untenable, especially if further evidence emerges.

The case also highlights broader issues of ethics in banking. HDFC Bank’s prominence in the Indian financial sector amplifies the impact of such controversies. A prolonged legal battle could erode stakeholder confidence, potentially affecting the bank’s stock performance and its influence on key indices like the Nifty Bank, where it holds a 29.42% weight, and the Nifty 50, where it accounts for 13%.

Q1 FY26 Results: A Critical Market Catalyst

Scheduled Announcement and Market Expectations

HDFC Bank is set to release its Q1 FY26 financial results on July 19, 2025, during a board meeting to review unaudited standalone and consolidated financials for the quarter ending June 30, 2025. The announcement, expected around 3 PM IST based on past trends, will likely include management commentary and a press conference, providing insights into the bank’s performance and strategic direction.

The bank’s Q1 update, released on July 4, 2025, offers a glimpse into its performance. Gross advances grew 6.7% year-on-year to ₹26.53 lakh crore, with average advances under management rising 8.3% to ₹27.42 lakh crore. Deposits increased by 16% year-on-year, reflecting steady but measured growth. However, sequential growth remained modest at 0.4%, indicating cautious credit expansion in a competitive market.

Financial Performance Trends

HDFC Bank’s Q4 FY25 results provide context for what investors might expect. The bank reported a standalone net profit of ₹17,616.14 crore, up 6.7% from ₹16,511.85 crore in Q4 FY24. The gross non-performing assets (GNPA) ratio improved to 1.33% from 1.42% in the previous quarter, signaling better asset quality. The bank also recommended a dividend of ₹22 per share, the highest since its stock split, with a record date of June 27, 2025.

For Q1 FY26, analysts anticipate continued growth in net interest income, driven by a 24% year-on-year increase in interest income, as seen in HDB Financial Services’ FY25 results. However, rising expenses, which climbed 23% to ₹13,372.48 crore in FY25 for the subsidiary, could pressure margins. Investors will closely watch the net interest margin (NIM) and provisions for potential asset quality issues, especially given the ongoing economic uncertainties.

Management Commentary and Press Conference

The upcoming press conference following the Q1 results announcement will be a focal point for investors and analysts. Management is expected to address the court case, providing clarity on how the bank plans to navigate the ethical and legal challenges surrounding its CEO. Questions about corporate governance, risk management, and the bank’s response to the Lilavati Trust allegations are likely to dominate discussions.

Additionally, management commentary will shed light on HDFC Bank’s strategic priorities, including digital banking initiatives, credit card portfolio changes, and efforts to maintain asset quality. Recent changes to credit card terms, effective July 1, 2025, such as new charges for gaming, wallet loads, and utility payments, may also be discussed, as they could impact customer sentiment and transaction volumes.

Market Impact and Volatility Forecast

Stock Performance and Market Sentiment

HDFC Bank’s stock has experienced volatility in recent weeks, reflecting uncertainty around the court case and broader market dynamics. As of July 11, 2025, the stock traded at ₹1,989.70, down 0.83% for the day, with a market capitalization of ₹15,26,221.53 crore. Over the past six months, the stock has risen 8.34%, and over the past year, it has gained 16.49%, outperforming the Nifty Financial Services index’s 14.65% growth.

However, posts on X indicate mixed sentiment. Some users highlight technical support levels at ₹1,650 and resistance at ₹1,700, suggesting potential for short-term fluctuations. Others express concern about the CEO’s legal troubles, with one post noting that allegations of mis-selling Credit Suisse bonds to NRIs could further complicate Jagdishan’s position.

Impact on Nifty Bank and Nifty 50

HDFC Bank’s significant weight in the Nifty Bank (29.42%) and Nifty 50 (13%) means its performance directly influences these indices. A negative outcome in the court case or disappointing Q1 results could trigger a sell-off, potentially dragging down the Nifty Bank index by 1,000 points or more, as seen in past instances of adverse news. Conversely, a favorable court ruling or strong financial performance could propel the stock and indices to new highs, as suggested by some analysts on X.

The broader market is also watching for cues from the July 14 hearing. If the case is delayed again due to another judge’s recusal, it could prolong uncertainty, leading to flat or negative stock performance in the short term. However, a resolution—whether positive or negative—could provide clarity, allowing investors to refocus on the bank’s fundamentals.

Charting the Week Ahead

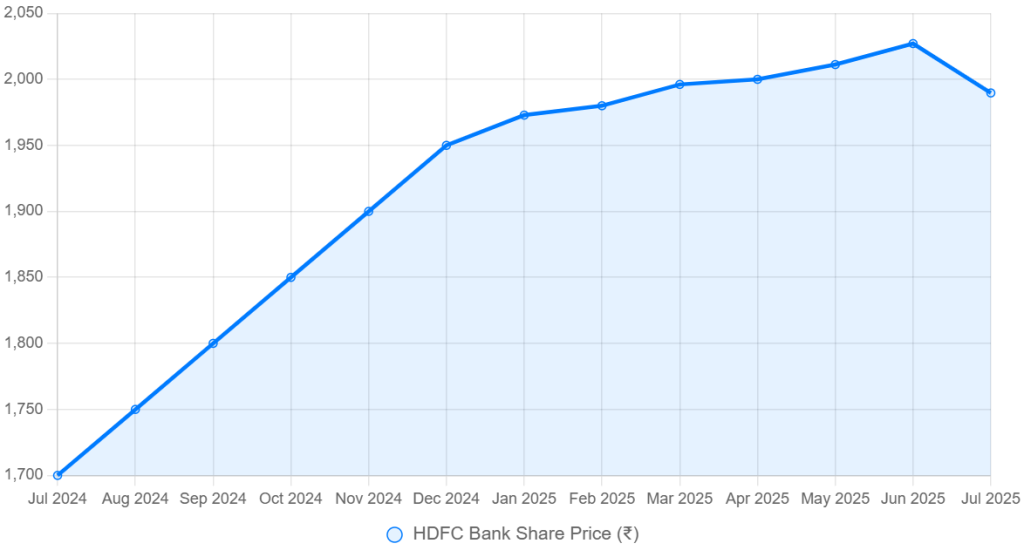

To visualize the potential impact, consider HDFC Bank’s stock performance over the past year:

This chart illustrates the stock’s upward trajectory, peaking at ₹2,027.10 in June 2025, followed by a slight decline amid recent legal uncertainties. The week of July 14–19, 2025, could see heightened volatility, with key support at ₹1,650 and resistance at ₹2,000, as suggested by market analysts.

Strategic Implications for HDFC Bank

Navigating the Ethical Crisis

HDFC Bank must address the ethical concerns head-on to restore investor and customer confidence. A transparent response during the Q1 results press conference could mitigate reputational damage. The bank may also need to strengthen its corporate governance framework, including enhanced oversight of executive actions and stricter compliance with regulatory standards.

Leveraging Financial Strength

Despite the legal challenges, HDFC Bank’s financial fundamentals remain robust. The bank’s ability to grow advances and deposits, coupled with improving asset quality, positions it well to weather short-term volatility. Strategic initiatives, such as expanding digital banking and optimizing credit card offerings, could further bolster its market position.

Preparing for Market Reactions

HDFC Bank’s leadership must prepare for various scenarios post the July 14 hearing and Q1 results. A positive court outcome could boost the stock, potentially pushing it past the ₹2,000 resistance level. However, a negative ruling or weak results could lead to a correction, with support levels at ₹1,650–₹1,700 becoming critical.

Conclusion: A Defining Moment for HDFC Bank

The week of July 14, 2025, will be a defining moment for HDFC Bank. The Bombay High Court hearing, combined with the Q1 FY26 results announcement, will shape market perceptions and influence the bank’s trajectory. Investors should monitor updates closely, as the outcomes could drive significant volatility in HDFC Bank’s stock and the broader financial indices. By addressing ethical concerns transparently and leveraging its financial strengths, HDFC Bank can navigate this challenging period and reinforce its position as a leader in India’s banking sector.