In the bustling world of Indian edtech, few names shine as brightly as PhysicsWallah. Founded by the charismatic Alakh Pandey, this powerhouse has transformed from a humble YouTube channel into a unicorn valued at billions, captivating millions of students chasing dreams in competitive exams like JEE and NEET. As the PhysicsWallah IPO gears up for its debut from November 11 to 13, 2025, investors face a pivotal decision: Does this edtech giant promise explosive growth, or does it hide pitfalls beneath its viral success?

This comprehensive guide dives deep into the heart of the PhysicsWallah IPO, drawing from the company’s Red Herring Prospectus (RHP) and broader market dynamics. We unpack five critical questions that could make or break your investment choice, while exploring the innovative business model, staggering growth metrics, financial realities, and lurking risks. Whether you’re a seasoned stock market enthusiast or a newcomer eyeing edtech stocks, this analysis equips you with actionable insights to navigate the hype. By the end, you’ll grasp why PhysicsWallah stands as a beacon of India’s digital education revolution—and whether its shares at ₹103-₹109 deserve a spot in your portfolio.

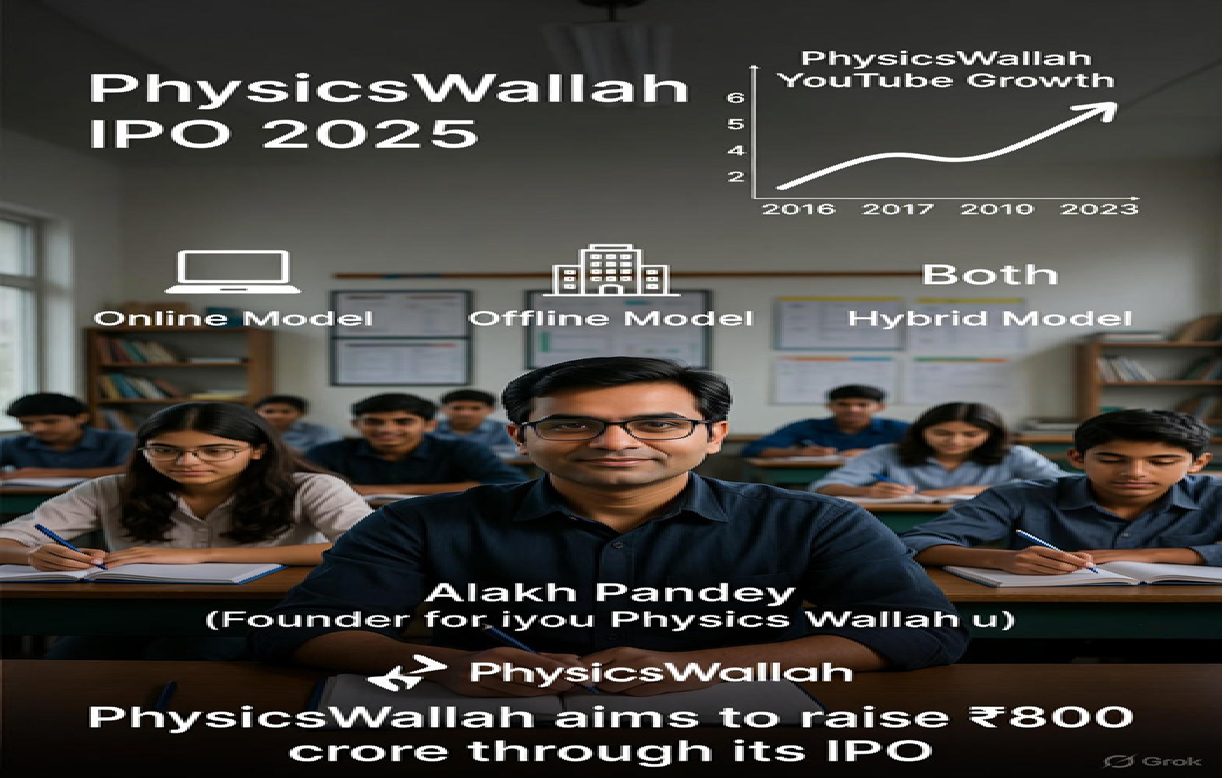

Unraveling PhysicsWallah’s Business Model: Online, Offline, and Hybrid Mastery in EdTech

PhysicsWallah thrives by blending accessibility with premium learning experiences, catering to India’s relentless pursuit of academic excellence. At its core, the company empowers over 48 lakh users—primarily students aged 15-25—to conquer exams like JEE, NEET, UPSC, GATE, and even skill-based certifications in commerce and MBA prep. Founders Alakh Pandey, a physics whiz with an innate knack for simplifying complex concepts, and Prateek Maheshwari, the tech-savvy co-founder who scaled the digital backbone, launched this venture in 2016. What started as free YouTube videos exploded into a multifaceted empire, now spanning 13 course categories.

The magic lies in PhysicsWallah’s tripartite delivery system, each tailored to diverse learner needs and budgets. First, the online model dominates with its low-barrier entry. Students access bite-sized lectures, live sessions, and doubt-clearing forums via the PhysicsWallah app, website, or YouTube—pure digital democracy. This approach scales effortlessly, reaching remote corners of India where traditional coaching remains a luxury.

Complementing this, the offline model, branded as Vidyapeeth, revives the classic classroom vibe. Here, learners flock to physical centers in high-demand cities like Kota and Delhi for immersive, face-to-face interactions. Teachers deliver real-time feedback, fostering discipline and camaraderie that’s hard to replicate online. Vidyapeeth isn’t just about rote learning; it builds communities where students grind through mock tests and group studies, mimicking the high-stakes intensity of exam halls.

Enter the hybrid model, dubbed Pathshala, which ingeniously fuses both worlds. Imagine a bustling center where a star educator broadcasts live from a studio, projected onto giant screens for dozens of students. Yet, a local facilitator hovers nearby, smashing doubts on the spot. This setup slashes costs while amplifying engagement—online scalability meets offline personalization. Pathshala has surged in popularity post-pandemic, as parents seek structured environments without the full offline premium.

YouTube serves as the ultimate acquisition engine, acting as the “top of the funnel.” Aspiring students sample Alakh Pandey’s electrifying explanations—think quantum mechanics demystified with everyday analogies—before committing to paid courses. This freemium strategy converts curiosity into cash, with viral clips racking up billions of views. In essence, PhysicsWallah doesn’t just teach physics; it engineers a seamless learner journey, blending tech innovation with human touch to dominate the ₹50,000 crore Indian test-prep market.

Explosive YouTube Growth: How PhysicsWallah Built a 98.8 Million Subscriber Juggernaut

Question one on every investor’s mind: How rapidly has PhysicsWallah’s YouTube ecosystem expanded? The numbers stun. As of June 2025, the flagship PhysicsWallah channel boasts 13.7 million subscribers, but aggregate across all channels—covering JEE, NEET, UPSC, and niche topics—skyrockets to 98.8 million. That’s not mere vanity metrics; it’s a growth engine propelling real revenue.

From fiscal 2023 to 2025, subscribers surged at a blistering 41.8% compound annual growth rate (CAGR). Picture this: In a nation where 25 million students annually battle for 1 lakh engineering seats via JEE, PhysicsWallah’s content has become the go-to primer. Alakh Pandey’s unscripted style—raw energy, zero fluff—resonates with Gen Z, turning passive viewers into loyal paying customers. Videos like “NEET 2025 Strategy: Crack It in 6 Months” garner millions of views overnight, funneling traffic to app downloads and enrollments.

This digital prowess extends beyond views. Engagement metrics reveal sticky audiences: Average watch time hovers at 70% per video, far outpacing competitors like Unacademy or BYJU’S. PhysicsWallah leverages data analytics to tailor content—spotting trending topics via AI and deploying quick-response series. The result? A subscriber base that rivals Bollywood stars, converting 10-15% into transacting users annually.

In the broader edtech landscape, this growth outpaces the curve. While India’s online education market crept up just 2-4% year-over-year from 2022-2025, PhysicsWallah’s user base ballooned 56.7% CAGR in the same period. Investors, take note: This isn’t fleeting virality; it’s a moat built on authentic value, positioning PhysicsWallah as the edtech equivalent of a content powerhouse like Khan Academy on steroids.

Revenue Breakdown: Online Volume vs. Offline Value in PhysicsWallah’s Dual-Engine Model

Delving into question two: What slice of PhysicsWallah’s revenue pie comes from online versus offline streams? Fiscal 2025 paints a balanced yet intriguing picture. Total operational revenue hit ₹2,800 crore, split nearly 50-50: ₹1,404 crore from online and ₹1,350 crore from offline/hybrid combined.

At first glance, this parity surprises. Online boasts 41.3 lakh unique transacting users—over 90% of the total 4.48 million—while offline lags at a mere 3.3 lakh. How does offline punch above its weight? Enter average revenue per user (ARPU), the silent equalizer.

Offline learners shell out ₹40,044 per head, reflecting premium pricing for tangible infrastructure: Air-conditioned classrooms, dedicated labs, and personalized mentoring. These centers, numbering over 100 across 50+ cities, command loyalty in coaching hubs like Kota, where parents invest fortunes in their child’s future. Conversely, online ARPU dips to ₹3,682, embracing the volume play. Affordable batches at ₹999-₹4,999 attract mass enrollments, subsidizing growth through sheer scale.

This duality showcases strategic brilliance. Online fuels acquisition and margins (low overheads mean 70%+ gross margins), while offline anchors credibility and higher lifetime value—repeat enrollments for advanced courses add 20-30% uplift. JEE and NEET, comprising 37% of users (15 lakh strong), drive 60% of revenue here, underscoring category dominance.

Compared to peers, PhysicsWallah’s hybrid revenue mix de-risks volatility. Pure-play online firms like UpGrad face ad-spend burnout, but PhysicsWallah’s offline buffer stabilized revenues during 2023’s market dip. As edtech matures, expect online ARPU to climb via premium add-ons like AI-driven adaptive learning, potentially tilting the scale toward 60-40 online by 2030.

Employee Costs Under the Microscope: Why Talent Eats 50% of PhysicsWallah’s Revenue

No edtech analysis skips question three: How hefty is PhysicsWallah’s employee cost as a percentage of revenue? Brace for impact—it’s a whopping 48.54%, or ₹1,400 crore out of ₹2,800 crore in FY25. In an industry where human capital reigns supreme, this isn’t an anomaly; it’s the price of excellence.

Star educators like Alakh Pandey command cult followings, pulling crowds that fill seats and boost enrollments. Top JEE physics tutors earn ₹5-10 lakh monthly, far eclipsing corporate salaries, because their personal brand translates to direct revenue. Offline centers amplify this: A single viral teacher can swell batch sizes by 50%, justifying poaching premiums. Non-teaching staff—counselors, admins, tech support—add another layer, with hybrid models demanding on-ground facilitators.

Yet, this burn fuels innovation. PhysicsWallah invests in upskilling: Internal academies train 5,000+ educators annually, blending pedagogy with tech tools like VR simulations for NEET biology. Retention strategies, including equity pools and performance bonuses, curb turnover below 15%—a feat in talent-hungry India.

Critics decry the bloat, but context matters. Edtech employee costs average 40-60% globally; PhysicsWallah’s aligns with leaders like Coursera. As scale kicks in, automation (chatbots for doubts, AI grading) could trim this to 40% by FY28, freeing cash for R&D. For investors, it’s a bet on human ingenuity driving India’s skilling boom, projected to add $1 trillion to GDP by 2030.

IPO Cost of Acquisition: ₹109 for You, Pennies for Promoters—Fair Play or Red Flag?

Question four cuts to equity: Your entry at ₹109 per share versus promoters’ acquisition cost? The RHP reveals a stark chasm. Alakh Pandey and Prateek Maheshwari’s weighted average cost per share? Negligible—below one paisa. They bootstrapped from YouTube ad scraps and angel crumbs, pouring sweat equity into a platform now eyeing unicorn-plus status.

Selling ₹380 crore via offer for sale (OFS), each offloads ₹190 crore worth— a 100,000x return on paper. Cynics cry foul, but flip the script: These founders endured bootstrapping’s grind, forgoing salaries amid 18-hour days. Alakh’s pivot from IIT dreams to teaching birthed a movement; Prateek’s code scaled it nationwide. Such windfalls incentivize risk-taking, mirroring Zomato’s deepinder Goyal or Nykaa’s Falguni Nayar.

For retail investors, ₹109 buys into validated traction: 98% revenue CAGR from FY23-25, dwarfing the 13% test-prep market growth. Fresh issue of ₹3,000 crore (total ₹3,480 crore) funds expansion—₹710 crore for marketing blitzes, ₹550 crore for leasing 50 new centers, ₹460 crore for capex. No debt here; it’s pure growth fuel. At 4-5x FY25 sales (post-issue), valuation feels grounded versus BYJU’S frothy peaks.

The Looming Risks: Losses, Dependency, and Geographic Concentration in PhysicsWallah IPO

Finally, question five: What’s the paramount risk shadowing PhysicsWallah? The RHP doesn’t mince words—persistent losses top the list. Despite 98.3% revenue CAGR, FY25 closed with ₹225 crore net loss, up from ₹1,260 crore in FY24 on ₹1,900 crore topline. Q1 FY26? Another ₹152 crore hit. Negative net worth and EBITDA swings (273% CAGR growth, yet volatile) signal scaling pains: Marketing devoured 25% of spends, while capex ramps burn cash.

Deeper dives reveal culprits. Employee costs, as noted, gobble half the pie; offline expansions incur upfront rentals and setups. The prospectus warns: Fail to tame expenses amid revenue ramps, and losses linger, eroding financial health. Investors, prioritize profitability—PhysicsWallah aims breakeven by FY27 via ARPU hikes and cost optimizations, but execution’s key.

Dependency looms large too. JEE-NEET duo fuels 60% revenue; a syllabus tweak or entrant surge (NEET seats jumped 20% in 2025) could jolt enrollments. Diversification into UPSC (up 45% YoY) and skills (30% growth) mitigates, but inertia risks stagnation.

Geographic concentration bites harder: Six cities—Delhi, Patna, Kolkata, Lucknow, Kozhikode, Kota—snag 40% offline revenue. Kota’s plunge from 43% (₹122 crore in FY23) to 4% (₹57 crore in FY25) exemplifies volatility; coaching fatigue and competition from locals like Allen hammered it. A single regulatory snag or economic dip in these hubs ripples nationwide.

Pending litigations? Minor—₹11.5 crore in tax/criminal matters, negligible for a ₹2,800 crore entity. No listed peers for comps, and metrics like P/E or RONW scream negative. Broader threats: Edtech funding winter (down 70% in 2024) and AI disruptors automating tutoring. Yet, PhysicsWallah’s 70% repeat rate and 4.5/5 app ratings signal resilience.

PhysicsWallah’s Growth Trajectory: Outpacing India’s EdTech Boom

PhysicsWallah doesn’t just ride the edtech wave; it authors it. India’s test-prep market, valued at ₹58,000 crore in 2025, eyes 13% CAGR to 2030, with undergrad (JEE-NEET) at 10% and postgrad (GATE-UPSC) at 13%. Online slice? A modest 2-4% uptick, hampered by digital divides in rural India.

Contrast PhysicsWallah’s sprint: Unique users leaped 56.7% CAGR, revenue 98.3%. From 16.8 lakh transacting users in FY23 to 41.3 lakh in FY25, it captures 8% market share in core categories. Offline centers ballooned from 28 to 100+, hybrids from zero to 40. YouTube’s 98.8 million subscribers? A war chest for organic leads, slashing customer acquisition costs 30% below peers.

Catalysts abound. Government pushes like NEP 2020 amplify demand—₹1.5 lakh crore allocated for skilling by 2027. PhysicsWallah’s vernacular content (Hindi-English mix) penetrates Tier-2/3 cities, where 60% students reside. Partnerships with telcos for zero-rated data and AI personalization (adaptive quizzes boosting scores 25%) cement edges.

Globally, edtech unicorns like Duolingo (profitable via gamification) inspire. PhysicsWallah experiments similarly: Gamified apps with badges and leaderboards spike engagement 40%. By FY30, analysts project ₹10,000 crore revenue, assuming 20% CAGR—ambitious, but backed by 85% brand recall among 10th graders.

Financial Deep Dive: From Losses to Lucrative Horizons in PhysicsWallah’s Books

Peel back the RHP’s 669 pages, and PhysicsWallah’s financials reveal a high-octane narrative. FY25 revenue: ₹2,800 crore, up 98% YoY, with operations (courses, fees) at 95%, ancillaries (books, merch) 5%. Gross margins? 65%, buoyed by online leverage.

EBITDA flipped positive at ₹150 crore (from -₹800 crore prior), a 273% swing, thanks to scale. But PAT’s red ink persists, as capex (₹300 crore) and marketing (₹700 crore) frontload spends. Cash reserves? ₹500 crore post-IPO, ample runway.

Balance sheet strengths: Zero long-term debt, working capital efficiency (DSO at 45 days). Weaknesses? High opex—beyond employees, rentals claim 15%, content creation 10%. Path to profits: ARPU optimization (tiered pricing trials up 15%) and churn reduction (via alumni networks).

Benchmarked, PhysicsWallah outperforms. Unacademy’s 2024 losses hit ₹1,800 crore on ₹500 crore revenue; PhysicsWallah’s ratio halves that. As hybrids mature, offline margins could hit 50% (from 35%), per McKinsey edtech models.

IPO Mechanics Decoded: Subscription Strategy for PhysicsWallah Shares

The bell rings November 11-13, 2025. Price band: ₹103-₹109. Issue: 31.9 crore shares, fresh ₹3,000 crore (86%), OFS ₹480 crore (14%). Retail quota: 35%, HNIs 15%, QIBs 50%. GMP whispers ₹20 premium, hinting 18% pop.

Allotment by November 14, listing NSE/BSE November 18. Anchor raise: ₹1,000 crore from FIIs like Tiger Global. Proceeds pie: Marketing 25% (digital ads, influencer tie-ups), leases/capex 30% (100 new centers), tech upgrades 20%, balance working capital.

For bidders: Minimum lot 137 shares (₹14,933 at cap). Promoters retain 85% post-IPO, signaling skin-in-game. Valuation: ₹15,000 crore market cap, 5.3x FY26E sales—attractive versus global edtech averages (8x).

Beyond the Hype: PhysicsWallah’s Societal Impact and Investor ROI Potential

PhysicsWallah transcends stocks; it’s a social equalizer. Scholarships worth ₹100 crore annually democratize access—1 lakh underprivileged students enrolled free in 2025. Alakh’s “Yakeen” batches for dropouts boast 40% success rates, higher than national 25%.

For ROI chasers: Base case 25% CAGR yields 3x in 5 years; bull (edtech rebound) 5x. Bears? Prolonged losses cap at 1.5x. Diversify: Allocate 5-10% portfolio, pair with stable names like HDFC Bank.

Conclusion: Subscribe to the Future or Sidestep the Risks?

PhysicsWallah IPO embodies India’s edtech renaissance—raw ambition meets scalable smarts. Its YouTube rocket fuel, balanced revenue streams, and talent bet position it for dominance, but losses and dependencies demand vigilance. At ₹109, it’s a growth lottery with unicorn DNA.

As November 11 dawns, weigh your risk appetite. For believers in Alakh’s vision, this could be your ticket to edtech riches. Subscribe wisely; the exam’s just begun.