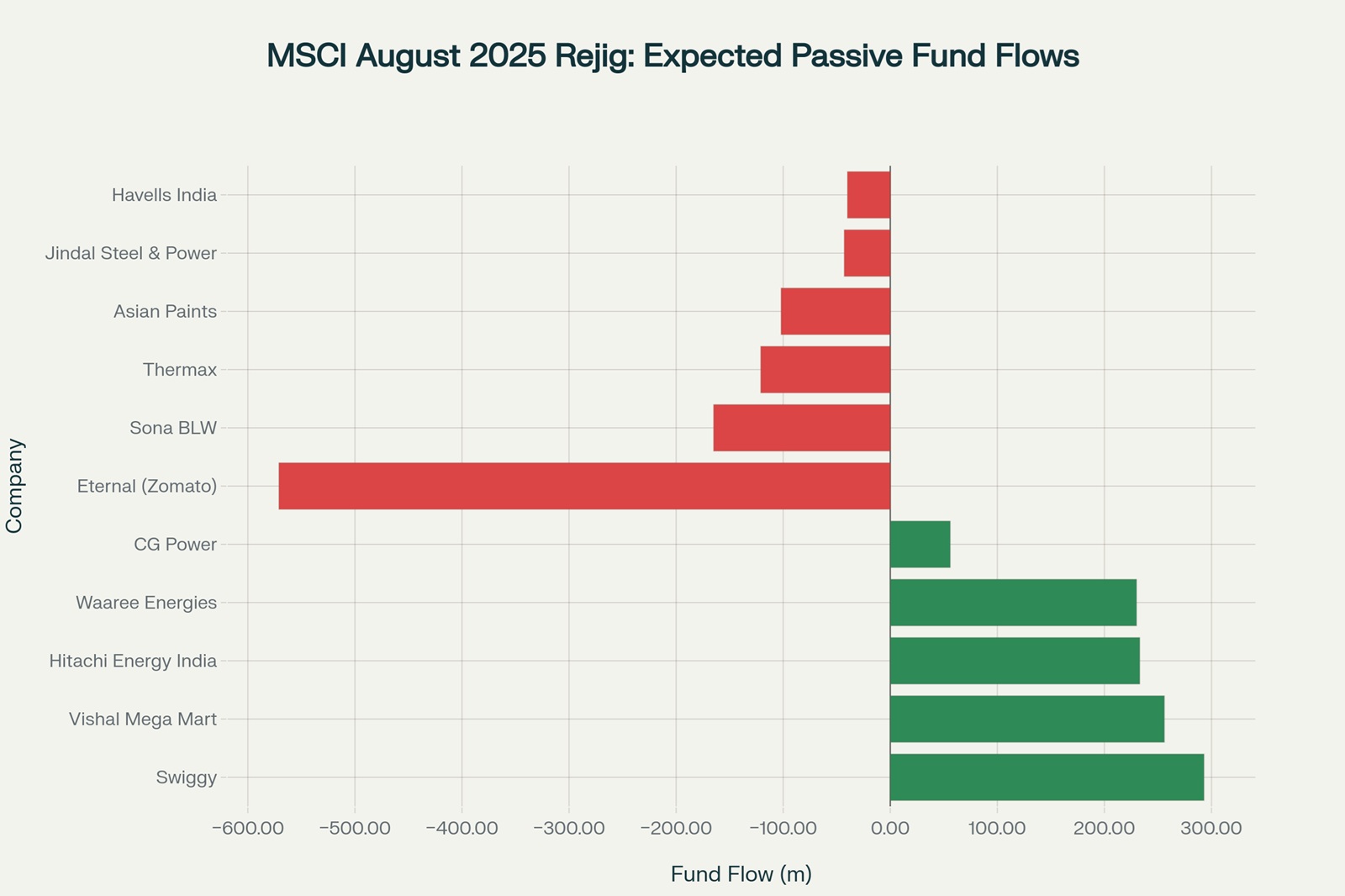

MSCI’s August 2025 review adds Swiggy, Vishal Mega Mart, Waaree Energies and Hitachi Energy to the MSCI India Standard Index while dropping Sona BLW and Thermax. Net flows are broadly neutral—big inflows into the four additions are almost offset by heavy outflows from weight cuts in Eternal (Zomato) and Asian Paints. Passive‐fund–tracking activity will peak around the effective date (after market close 26 Aug 2025).

2. Why MSCI Rejigs Matter

- $16.9 trn in assets benchmarked to MSCI indexes; passive and closet-tracking active funds must replicate every add/delete.

- Flow pressure is front-loaded: 70-80% of required trades historically execute in the four sessions before the rebalance.

- Short-term alpha: adds typically rally 3-12% into the event; deletes underperform 7-15% over the same window.

3. Impacted Stocks in Detail

A. Beneficiaries (Inclusions & Weight Gain)

- Swiggy – First-time entry to a global benchmark; sizeable free float and consumer-tech appeal underpin the $293 m figure.

- Vishal Mega Mart – India’s value-retail leader; passive demand $256 m, adding liquidity to an otherwise tightly held stock.

- Hitachi Energy India & Waaree Energies – Play on grid modernisation and solar supply chain; each pulls ≈ $230 m.

- CG Power – Float rise lifts weight; incremental $56 m bid.

B. Casualties (Exclusions & Weight Cuts)

- Sona BLW & Thermax – Exit the standard index; migrate to small-cap universe where they recoup $40 m/$30 m but still net negative.

- Eternal (Zomato) – Foreign-ownership cap slashes float; a massive $571 m selling wave looms.

- Asian Paints, Jindal Steel & Power, Havells India – Smaller float downgrades trigger $40-102 m each in outflows.

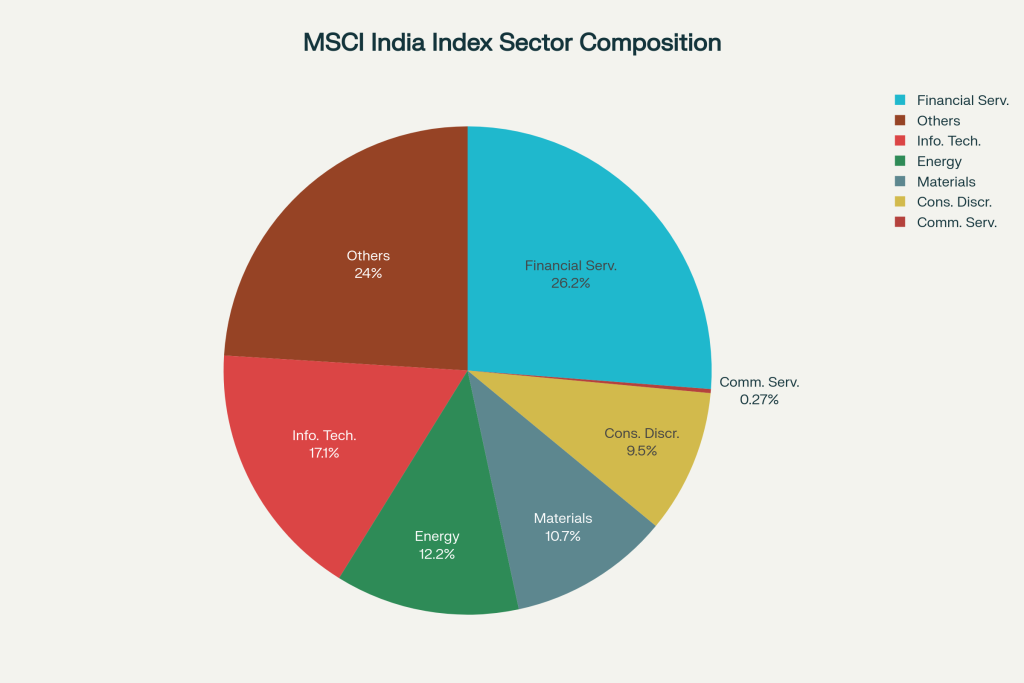

4. MSCI India Index in Context

The index captures ~85% of India’s free-float market cap. Sector mix remains finance-heavy

| Sector | Weight % |

|---|---|

| Financial Services | 26.2 |

| Information Technology | 17.1 |

| Energy | 12.2 |

| Materials | 10.7 |

| Consumer Discretionary | 9.5 |

| Others | 24.3 |

Frequent quarterly reviews (Feb/May/Aug/Nov) keep the basket investable and liquid.

5. Trading & Portfolio Considerations

- Front-run or fade?

- Momentum desks often buy inclusions early August and unwind just before the effective close.

- Value hunters eye deletes post-event once forced-selling subsides.

- ETF mechanics: US-listed INDA, UK-listed IWDA and domestic MSCI-linked ETFs will rebalance after close 26 Aug.

- Hedging flows: Options liquidity spikes in inclusion names; spreads widen in deletes—use cautious limit orders around Aug 22-26.

- Small-cap rejig: 15 additions (e.g., Nexus Select Trust) bring $4-40 m each; 6 removals (Bharat Dynamics, Easy Trip) face $2-31 m exits.

6. Outlook Beyond August

- India’s MSCI EM weight has risen to ~18% from 8% in 2020, reflecting sustained FII preference.

- Regulatory caps (e.g., FDI limits) can flip weights abruptly—as seen with Zomato and earlier Nykaa.

- Next scheduled announcement: 5 Nov 2025; effective 25 Nov 2025.

Visuals

MSCI August 2025 Rejig: Expected Passive Fund Flows (USD m)

MSCI India Index Sector Composition

Bottom line: Swiggy and Vishal Mega Mart headline MSCI’s August shuffle, unlocking sizable foreign inflows. Yet heavy float-driven cuts in Eternal and Asian Paints neutralise much of the benefit, leaving India’s overall passive flow roughly flat. Traders should position early, watch liquidity into 26 August and reassess fundamentals once index dust settles.