Investors across India eagerly await the ICICI Prudential AMC IPO, a landmark event in the asset management sector. As one of the nation’s leading mutual fund houses, ICICI Prudential Asset Management Company (ICICI Prudential AMC) prepares to launch its public offering, drawing attention from retail enthusiasts, high-net-worth individuals (HNIs), and institutional players alike. This comprehensive guide delves deep into the ICICI Prudential AMC IPO details, spotlighting the much-talked-about shareholder quota for ICICI Bank holders, subscription timelines, price band insights, and smart strategies to maximize allotment chances. Whether you qualify for the shareholder reservation or plan to apply under retail or non-institutional investor (NII) categories, this article equips you with actionable knowledge to navigate the ICICI Prudential AMC IPO 2025 confidently.

The buzz around the ICICI Prudential AMC IPO stems from the company’s robust growth trajectory. With a quarterly average assets under management (AUM) exceeding ₹10.87 lakh crore as of September 30, 2025, ICICI Prudential AMC commands a 13.2% market share in India’s competitive asset management landscape. Analysts predict strong subscription levels, fueled by the IPO’s pure offer-for-sale (OFS) structure and the exclusive shareholder quota. In this piece, we explore every facet—from eligibility criteria for the ICICI Prudential AMC shareholder quota to grey market premium (GMP) trends and post-listing expectations. Stay tuned as we break down how this IPO could reshape your investment portfolio.

Understanding the ICICI Prudential AMC IPO: A Game-Changer in India’s Mutual Fund Sector

ICICI Prudential AMC, a joint venture between ICICI Bank (51% stake) and Prudential Corporation Holdings (49%), has solidified its position as India’s second-largest asset manager by quarterly average AUM. Established in 1993, the company manages 143 mutual fund schemes—the highest among peers—and serves over 1.55 crore investors through a vast network of 272 offices and 1,10,719 distributors. The ICICI Prudential AMC IPO represents a pivotal step toward greater market transparency and liquidity, allowing Prudential to offload up to 9.91% of its stake via a 100% OFS.

What sets this IPO apart? Unlike many recent offerings that faced size reductions, the ICICI Prudential AMC IPO maintains its anticipated scale of ₹10,602.65 crore, aligning perfectly with market expectations of around ₹10,000 crore. This stability boosts investor confidence, especially amid a booming mutual fund industry where systematic investment plans (SIPs) hit record highs of ₹3,910 crore in March 2025. The IPO’s structure ensures no fresh capital flows to the company, but it unlocks value for existing shareholders while providing retail investors access to a proven wealth creator.

The ICICI Prudential AMC IPO arrives at an opportune moment. India’s asset management sector has witnessed a 32.7% CAGR in QAAUM from FY23 to FY25, outpacing the industry’s 29.0% growth. ICICI Prudential AMC leads in equity-oriented schemes with a 13.4% market share and boasts the largest individual investor franchise, with ₹6,61,030 crore in monthly average AUM from retail clients. For investors eyeing long-term growth, this IPO offers exposure to diversified products like the flagship Large Cap Fund and Balanced Advantage Fund, both category leaders. As subscription kicks off, experts forecast oversubscription by 10-15x in the retail segment alone, underscoring the IPO’s appeal.

ICICI Prudential AMC IPO Timeline: Key Dates You Can’t Miss

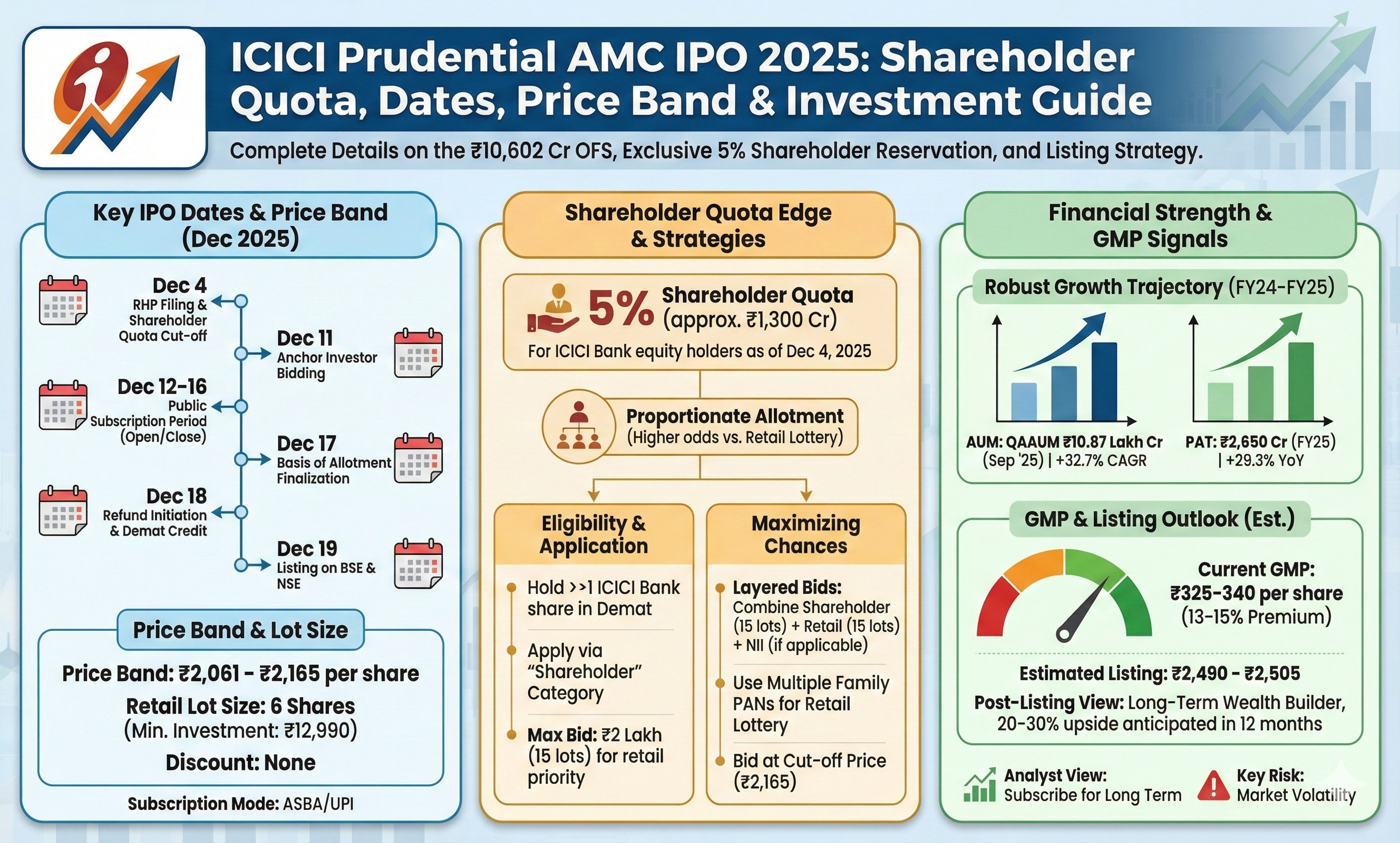

Timing is everything in IPO investments, and the ICICI Prudential AMC IPO timeline delivers clarity for proactive bidders. The Red Herring Prospectus (RHP), filed on December 5, 2025, with SEBI and stock exchanges, confirms the offer opens for anchor investors on December 11, 2025. Public subscription follows from December 12 to December 16, 2025, giving ample window for applications via ASBA or UPI-linked accounts.

Allotment finalizes on December 17, 2025, with refunds processed and shares credited by December 18. The much-anticipated listing on BSE and NSE occurs on December 19, 2025—mere days after closure, minimizing holding periods for eager investors. This swift schedule reflects SEBI’s T+1 settlement efficiency and positions the ICICI Prudential AMC IPO for a seamless debut.

For those tracking the ICICI Prudential AMC IPO dates, bookmark these milestones: Anchor bidding sets the tone on the 11th, retail frenzy peaks mid-week, and basis of allotment announcements on the 17th often spark GMP surges. Historical data from peers like HDFC AMC shows listings within 7-10 days post-closure yield 15-20% premiums on strong debuts. With the ICICI Prudential AMC IPO subscription period spanning five days, strategize early—apply on Day 1 to avoid last-minute glitches and potential subscription spikes that dilute allotment odds.

ICICI Prudential AMC IPO Issue Size and Structure: Breaking Down the ₹10,602 Crore Opportunity

The ICICI Prudential AMC IPO issue size clocks in at ₹10,602.65 crore, comprising an OFS of 4,89,72,994 equity shares (face value ₹1 each) sold by Prudential Corporation Holdings. At the upper price band, this values the stake sale at approximately ₹10,603 crore, targeting a pre-IPO market cap of ₹1.07 lakh crore. No fresh issue means proceeds flow directly to the promoter, yet the structure benefits investors through enhanced liquidity and governance standards post-listing.

Delve deeper into the ICICI Prudential AMC IPO structure: It’s a book-built issue with reservations ensuring broad participation. Qualified Institutional Buyers (QIBs) snag up to 50% (not more than), reflecting anchor interest from global funds. Retail Individual Investors (RIIs) secure at least 35%, translating to a massive ₹3,710 crore pool—ideal for small-ticket applicants. Non-Institutional Investors (NIIs), including HNIs, claim 15%, split into small NII (up to ₹2 lakh) and big NII (above ₹2 lakh).

A standout feature? The 5% shareholder quota reserves up to 24.48 lakh shares exclusively for eligible ICICI Bank shareholders, carving out ₹1,300 crore in value. This reservation, detailed in the RHP, deducts from the QIB portion, keeping retail and NII intact. Compared to recent IPOs like Tata Capital’s trimmed ₹17,000 crore expectation, the ICICI Prudential AMC IPO’s unaltered size signals promoter commitment, potentially driving 20-25x overall subscription.

Financially, the issue underscores ICICI Prudential AMC’s strength: FY25 revenue surged 32.4% to ₹4,977.3 crore, with PAT climbing 29.3% to ₹2,650.7 crore. H1 FY26 profitability hit ₹1,618 crore on ₹2,949.4 crore revenue, boasting an 86.8% return on net worth. For the ICICI Prudential AMC IPO issue size, this translates to a P/E multiple of around 40x—premium yet justified by 32% CAGR in operating profits over three years.

ICICI Prudential AMC IPO Price Band: ₹2,061 to ₹2,165 – Is It a Buy?

The ICICI Prudential AMC IPO price band spans ₹2,061 (floor) to ₹2,165 (cap) per share, fixing the minimum lot investment at ₹12,990 for retail bidders (6 shares per lot). This pricing, announced via RHP, values each share at a 5% premium over the floor, balancing accessibility with valuation discipline. At the cap, the full OFS fetches ₹10,603 crore, implying a post-issue market cap of ₹1.07 lakh crore—aligning with peers like HDFC AMC’s ₹90,000 crore valuation.

Why does this ICICI Prudential AMC IPO price band excite analysts? It reflects a forward P/E of 38-40x on FY26 estimates, competitive against UTI AMC (45x) and Nippon Life India AMC (35x). The band’s narrow 5% spread encourages cut-off bidding at ₹2,165, simplifying decisions for retail investors. Lot multiples of 6 shares keep entry barriers low: Retail maxes at ₹2 lakh (15 lots), small NII at ₹10 lakh (77 lots), and big NII uncapped.

Investor sentiment hinges on the ICICI Prudential AMC IPO price band fairness. With 143 schemes driving diversified revenue—62% from equity AUM at higher fees—the pricing captures growth in SIPs (₹3,910 crore monthly) and a 13.7% individual investor market share. Risks like fee compression (industry average 1.2% TER) exist, but ICICI Prudential AMC’s 25.3% hybrid scheme dominance mitigates them. Bid at cut-off for simplicity, or floor for value—either way, the band positions this as a mid-cap gem in the IPO pipeline.

Unlocking the ICICI Prudential AMC Shareholder Quota: Your Edge in Allotment

The ICICI Prudential AMC shareholder quota emerges as the IPO’s crown jewel, reserving 5% (24.48 lakh shares) for eligible ICICI Bank equity holders. This ₹1,300 crore carve-out, confirmed in the RHP, prioritizes parent company loyalists, slashing competition in a pool where general retail often sees 50x oversubscription. Unlike draft prospects in past IPOs that omitted quotas, this 100% confirmed reservation boosts allotment odds dramatically—potentially 2-5x higher than standard retail.

How does the ICICI Prudential AMC shareholder quota work? It operates on a proportionate lottery basis: Bidders applying up to ₹2 lakh (15 lots) receive priority scaling with bid size. Oversubscription below 15x guarantees at least one lot; lower levels yield multiples. This contrasts with retail’s pure lottery, where even max bids risk zero allotment. For ICICI Bank shareholders, this quota doubles as a loyalty perk, deducting from QIB (capping at 45%) while safeguarding 35% retail and 15% NII.

The ICICI Prudential AMC IPO shareholder quota aligns with SEBI’s push for equitable access, mirroring successes in ICICI Lombard and Prudential Life listings. With 24 lakh reserved applications possible, even modest oversubscription (5-10x) ensures 10-20% success rates—far superior to the 2% in high-demand retail pools. Strategize: Pair quota bids with retail applications for dual shots, amplifying confirmed wins.

ICICI Prudential AMC IPO Shareholder Quota Eligibility: Who Qualifies and How?

Qualifying for the ICICI Prudential AMC IPO shareholder quota demands precision, tied to ICICI Bank shareholding as of the RHP filing cut-off: December 4, 2025 (pre-T+1 settlement). Hold at least one equity share in your Demat account under the same PAN by end-of-day December 4, and you unlock eligibility—regardless of post-RHP sales. This record-date mechanism, per RHP guidelines, accommodates multiple Demat accounts linked to one PAN, aggregating holdings for verification.

ICICI Prudential AMC shareholder quota eligibility criteria emphasize simplicity: No minimum share threshold beyond one ICICI Bank equity; corporate or individual holders qualify if shares reflect in the beneficiary position by cut-off. Multiple family Demats under one PAN count collectively, but applications must use the linked Demat for IPO bids. Exclusions apply to promoters, employees, or those with conflicting interests, as outlined in SEBI norms.

To confirm ICICI Prudential AMC IPO shareholder quota status, query your Depository Participant (NSDL/CDSL) for December 4 holdings. Post-qualification, apply via UPI ASBA, selecting the “Shareholder Reservation” option—your broker verifies PAN-Demat linkage automatically. This quota’s beauty lies in its inclusivity: Even recent ICICI Bank buyers (pre-December 4) qualify, rewarding proactive investors. With 24.48 lakh shares reserved, early confirmation via KFin Technologies (registrar) ensures seamless participation.

How to Apply Under ICICI Prudential AMC IPO Shareholder Quota: Step-by-Step Guide

Applying for the ICICI Prudential AMC IPO shareholder quota follows a streamlined ASBA process, blending digital ease with regulatory rigor. First, verify eligibility via your Demat statement for December 4, 2025, holdings. Log into your broker’s portal (Zerodha, Groww, or ICICI Direct) or bank app (HDFC, SBI) between December 12-16, 2025, and select the IPO application module.

Enter details: PAN, Demat account, UPI ID, and bid quantity (1-15 lots at ₹2 lakh max). Choose “Shareholder Reservation Portion” under category, bidding at cut-off (₹2,165) for simplicity. Block funds via UPI (scan QR or auto-debit), and submit—receive a mandate on your UPI app for approval within 24 hours. Track status on BSE/NSE sites or registrar KFin’s portal using PAN.

Maximize via combinations: Eligible shareholders apply separately under retail (another ₹2 lakh) or small NII (up to ₹10 lakh), tripling chances without violating one-application-per-category rules. For the ICICI Prudential AMC IPO shareholder quota application, hit 15 lots for top proportionate priority—low subscription could net 2-3 lots. Avoid errors: Ensure same Demat for quota and complementary bids; non-compliance risks rejection. Post-submission, monitor via SMS alerts; allotment on December 17 credits shares by December 18 for December 19 listing.

Maximizing Allotment in ICICI Prudential AMC IPO: Strategies for Retail, HNI, and Shareholder Bidders

Securing allotment in the ICICI Prudential AMC IPO demands strategy, given projected 15-20x oversubscription. Retail investors (35% quota, ₹3,710 crore) face lottery odds: Bid 1-15 lots (₹13,000-₹1.95 lakh), but success hovers at 5-10% in hot IPOs. Counter this by applying early (Day 1) via multiple family PANs—each independent, legally compliant up to ₹2 lakh per.

HNIs dominate NII (15%, ₹1,590 crore): Small NII (₹2-10 lakh, 24,000 reserved apps) and big NII (above ₹10 lakh, 48,000 apps) use proportionate allotment, favoring larger bids. Max at 77 small NII lots or uncapped big NII for 20-30% odds, but watch cut-offs—recent IPOs like Muthoot saw 50x HNI demand.

For shareholder quota holders, layer bids: Quota (15 lots) + retail (15 lots) + small NII (if eligible), pushing cumulative odds to 25-40%. The ICICI Prudential AMC IPO allotment strategies shine in proportionate mechanics—15-lot quota bids prioritize over singles, potentially yielding multiples if under 10x subscribed. Diversify brokers for backups; use UPI for speed. Post-allotment, hold for 1-3 months—peers averaged 25% listing gains.

| Category | Quota % | Reserved Apps | Max Bid | Est. Odds | Strategy Tip |

|---|---|---|---|---|---|

| Retail (RII) | 35% | 27 lakh | ₹2 lakh | 5-10% | Multiple family apps; early bidding |

| Small NII | 15% (part) | 24,000 | ₹10 lakh | 15-25% | Bid full 77 lots for proportion |

| Big NII | 15% (part) | 48,000 | Uncapped | 20-30% | Scale up for priority |

| Shareholder | 5% | 24.48 lakh shares | ₹2 lakh | 20-40% | Layer with retail/NII |

ICICI Prudential AMC IPO GMP Today: Grey Market Signals a 13% Listing Pop

Grey market premium (GMP) offers a pulse on the ICICI Prudential AMC IPO sentiment, with today’s rate at ₹325-340 per share (13-15% over ₹2,165 cap). This implies a listing price of ₹2,490-2,505, signaling robust unlisted trading on platforms like Sharekhan and Kochi. GMP surged from ₹280 yesterday, reflecting anchor buzz and quota hype—up 15% week-on-week.

Interpreting ICICI Prudential AMC IPO GMP trends: At 13%, it trails HDFC AMC’s 20% debut but exceeds UTI AMC’s 8%, forecasting ₹300-400 gains post-listing. Kostak rates (₹1,200-1,500 per lot) and subject-to-sauda (₹5,000-6,000) indicate flipping potential, though volatile. GMP dips on heavy subscription; monitor daily via Telegram channels or IPOCentral.

For the ICICI Prudential AMC IPO GMP today, view it as directional, not definitive—fundamentals drive long-term. With 9% equity AUM share, expect sustained premiums; sell post-15% pop or hold for 30% yearly upside.

Financial Highlights of ICICI Prudential AMC: Why This IPO Screams Value

ICICI Prudential AMC’s financials paint a picture of resilience and expansion, justifying the IPO’s premium. FY25 revenue rocketed 32.4% to ₹4,977.3 crore from ₹3,758.2 crore, powered by 32.7% QAAUM CAGR to ₹8,79,410 crore. PAT leaped 29.3% to ₹2,650.7 crore, with H1 FY26 adding ₹1,618 crore profit on 20% revenue growth to ₹2,949.4 crore.

Key metrics for ICICI Prudential AMC IPO financials: 86.8% RONW in Sep’25, 1.2% TER yielding ₹3,240 crore pre-tax profits (32% CAGR). Equity schemes (62% AUM) generate 1.5-2% fees, outpacing debt’s 0.5%. SIP AUM hit ₹6,61,030 crore (13.7% share), ensuring sticky flows. Compared to peers, ICICI Prudential AMC’s 13.3% active MF market share dwarfs Aditya Birla Sun Life’s 5%, with ROE at 82.8% vs. industry 65%.

These ICICI Prudential AMC IPO financial highlights underscore scalability: 3,541 employees manage ₹10.87 lakh crore AUM, leveraging ICICI Bank’s 7,246 branches. Risks like market volatility (AUM sensitivity) pale against 25.3% hybrid dominance. At 40x P/E, the IPO values growth at 15-20% EPS CAGR through FY27.

Risks and Rewards: A Balanced View on ICICI Prudential AMC IPO Investment

Every IPO carries risks, and the ICICI Prudential AMC IPO is no exception. Market downturns could shave 10-15% off AUM, compressing fees amid 1.2% TER pressures from SEBI caps. Competition from 40+ AMCs and alternatives like PMS erodes 2-3% share annually, while regulatory shifts (e.g., expense ratio tweaks) threaten margins. Valuation at 40x P/E risks 10-20% correction if growth slows below 25%.

Yet, rewards abound in the ICICI Prudential AMC IPO investment outlook. Bullish equity markets (Nifty up 15% YTD) amplify AUM, with SIPs providing downside buffers. Post-listing, expect 20-30% upside in 12 months, mirroring Nippon’s 25% post-debut rally. Shareholder quota mitigates allotment risks, and diversified revenue (143 schemes) yields 18-22% ROE. For risk-averse, allocate 5-10% portfolio; aggressive investors eye 15% for compounding via dividends (2-3% yield).

Post-Listing Outlook for ICICI Prudential AMC Shares: Long-Term Wealth Builder?

Beyond the fanfare, the ICICI Prudential AMC post-listing outlook gleams with promise. Listing at 13% GMP suggests ₹2,500 debut, with 25-35% gains in six months if markets hold. Analysts project ₹3,000-3,500 targets by FY27, driven by 20% AUM CAGR and 15% EPS growth. ICICI Prudential AMC shares could rival HDFC AMC’s 50% yearly returns, bolstered by 62% retail AUM stability.

ICICI Prudential AMC post-listing performance hinges on execution: Expand digital SIPs (6.5 million users) and international advisory (₹311 billion AUM) for 25% revenue CAGR. Governance upgrades post-IPO enhance liquidity, attracting FIIs (10-15% stake). Hold 2-3 years for 50% appreciation; diversify with 20% allocation. In India’s $5 trillion MF market by 2030, ICICI Prudential AMC emerges as a cornerstone holding.

Conclusion: Seize the ICICI Prudential AMC IPO – Your Gateway to Mutual Fund Mastery

The ICICI Prudential AMC IPO 2025 stands as a beacon for savvy investors, blending quota perks, solid financials, and sector tailwinds into a compelling opportunity. From shareholder eligibility on December 4 to GMP-fueled listings on December 19, every detail equips you for success. Apply strategically, layer bids, and view this as a long-term anchor in your portfolio—ICICI Prudential AMC promises not just shares, but a stake in India’s wealth creation story. Don’t miss out; subscribe now and watch your investments flourish.