India is a nation with diverse cultures, traditions, and preferences when it comes to food and drink. Alcohol consumption in India is a reflection of this diversity, with significant differences from other countries around the world. The consumption patterns and preferences for various alcoholic beverages—spirits, beer, and wine—reveal insights into cultural trends, social habits, and economic factors that shape how Indians “get high.” Let’s take a deeper look into these trends and compare India’s alcohol consumption to other major countries.

India’s Preference for Spirits

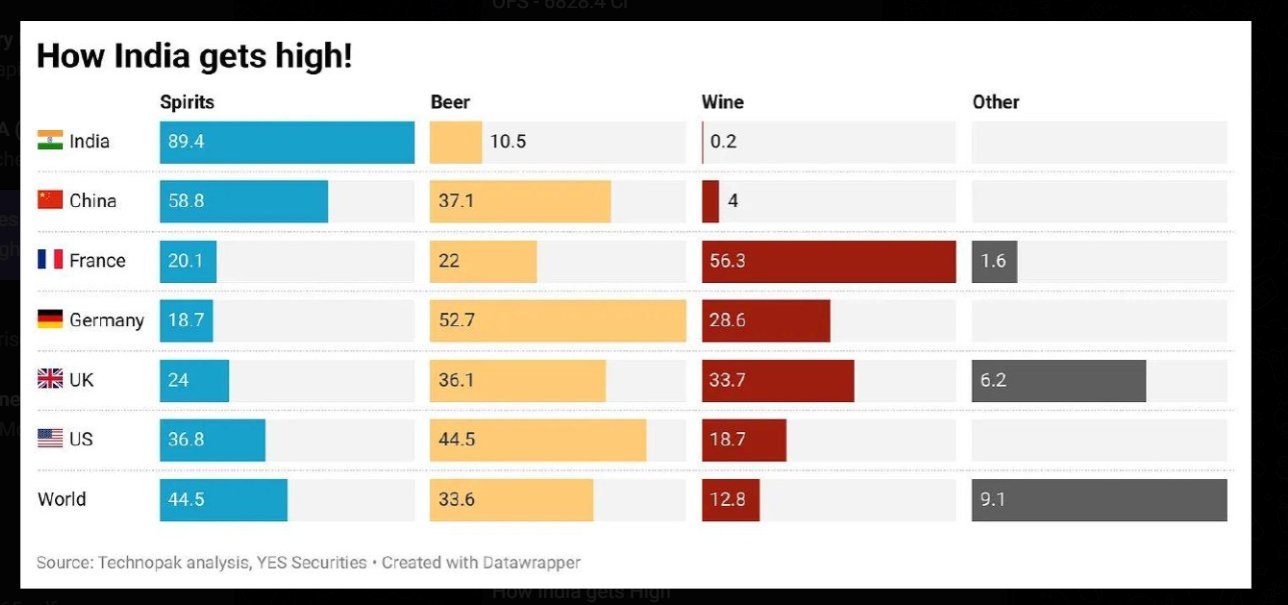

India’s preference for spirits is unmistakable. According to data provided in the image, an overwhelming 89.4% of alcohol consumption in India consists of spirits. This rate far exceeds global averages and contrasts sharply with other countries like France, Germany, and the United States. Spirits are the clear favorite among Indian consumers, and this high percentage underscores a unique cultural inclination toward stronger alcoholic beverages.

Several factors contribute to this inclination toward spirits:

- Affordability and Accessibility: Spirits, especially locally produced options such as Indian-made foreign liquor (IMFL) and traditional drinks like arrack and toddy, are often more affordable and accessible than imported beers or wines.

- Cultural Acceptance: In many parts of India, spirits are more socially acceptable compared to other forms of alcohol, especially beer and wine. The stronger potency of spirits also aligns with social gatherings where smaller quantities are consumed for a quicker effect.

- Economic Considerations: Beer and wine are relatively more expensive due to taxes and import duties. Spirits, particularly those produced locally, remain a more budget-friendly option, catering to a wide population.

The Low Popularity of Beer in India

While beer is immensely popular in many countries, particularly in Germany and the United States, it only accounts for 10.5% of alcohol consumption in India. This statistic is strikingly low, especially when compared to Germany’s 52.7% or the United States’ 44.5%. The limited consumption of beer in India can be attributed to several key factors:

- Higher Taxes on Beer: Beer is subject to high taxation in India, making it pricier relative to spirits. For many Indian consumers, this price disparity dissuades them from choosing beer over more affordable spirits.

- Storage and Availability: Beer requires refrigeration and has a shorter shelf life compared to spirits, making it less convenient for retailers in remote or rural areas where infrastructure may be limited.

- Taste and Preference: The Indian palate may also play a role in the low preference for beer. Many Indians prefer the strong and immediate effects of spirits, which beer generally doesn’t provide as quickly due to its lower alcohol content.

Wine: A Growing Yet Small Market in India

Wine occupies a very small share in India’s alcohol consumption, accounting for only 0.2%. In contrast, countries like France and the UK have a deep-rooted wine culture, with wine comprising 56.3% and 33.7% of alcohol consumption, respectively. The minimal wine consumption in India can be attributed to several reasons:

- High Prices and Limited Production: Wine is relatively expensive in India due to import tariffs and the limited local production of quality wines. Premium wines are often out of reach for the average consumer, making wine a niche product for more affluent segments of society.

- Lack of Wine Culture: Unlike European countries where wine is deeply ingrained in the culture, India lacks a historical wine tradition. This limits wine’s appeal, and many Indians remain unfamiliar with wine varieties, flavors, and the practice of pairing wine with meals.

- Perception as a Luxury Product: Wine is still considered a luxury item in India, rather than a casual or everyday drink. The majority of consumers see wine as a special occasion drink rather than something for regular consumption.

Comparison with Alcohol Consumption in Other Countries

India’s alcohol consumption patterns are unique and differ significantly from those in other countries. Let’s compare some notable trends:

- China: China has a strong inclination toward spirits (58.8%) similar to India but shows a more balanced consumption of beer (37.1%) and a moderate share for wine (4%).

- France: France is well-known for its wine culture, with wine making up a whopping 56.3% of its alcohol consumption. Spirits and beer have a smaller presence, with spirits at 20.1% and beer at 22%.

- Germany: Germany’s alcohol consumption is dominated by beer, which accounts for 52.7%, showing the country’s rich beer tradition. Spirits and wine are less popular, at 18.7% and 28.6%, respectively.

- UK and US: Both the UK and US have more balanced consumption patterns across beer, wine, and spirits. In the UK, beer is at 36.1%, spirits at 24%, and wine at 33.7%. In the US, beer leads at 44.5%, followed by spirits at 36.8%, and wine at 18.7%.

These comparisons highlight that India stands out for its exceptionally high preference for spirits, while other nations demonstrate a more balanced approach across all types of alcohol.

Possible Future Trends in India’s Alcohol Market

As India continues to grow economically and culturally, the alcohol consumption landscape may evolve. Here are some anticipated trends:

- Growth of Beer and Wine Markets: With increasing globalization and changing social dynamics, beer and wine may see a gradual rise in popularity. The growth of craft breweries and local wine production in India, particularly in states like Maharashtra and Karnataka, could make these options more accessible and affordable.

- Changing Demographics: The younger generation in India is more exposed to global trends and may develop a preference for beer and wine as these drinks become more widely available. Many young Indians are increasingly inclined toward lighter and socially versatile beverages, which could diversify India’s alcohol market in the coming years.

- Government Policies and Taxation: Reforms in alcohol taxation and regulation could also influence consumption patterns. If beer and wine become more affordable due to reduced taxation or increased local production, they may gain a larger share of the market.

- Increasing Health Awareness: As awareness of health and wellness grows in India, some consumers may shift toward lower-alcohol options such as wine or lighter beer varieties. This trend is already evident in other parts of the world and may gradually take hold in India as well.

Conclusion: India’s Distinct Alcohol Preferences

India’s alcohol consumption patterns reveal a strong preference for spirits, with beer and wine occupying much smaller shares of the market. Cultural, economic, and social factors heavily influence these trends, making India’s alcohol market unique when compared to global consumption habits. However, as globalization and changing lifestyles bring new drinking habits into Indian society, the consumption of beer and wine may gradually increase, leading to a more diversified alcohol market in the years to come.

India’s current focus on spirits as the preferred alcoholic beverage is a testament to the country’s unique drinking culture. Understanding these patterns helps in grasping the broader social landscape of alcohol in India and offers insight into potential shifts in consumer preferences.