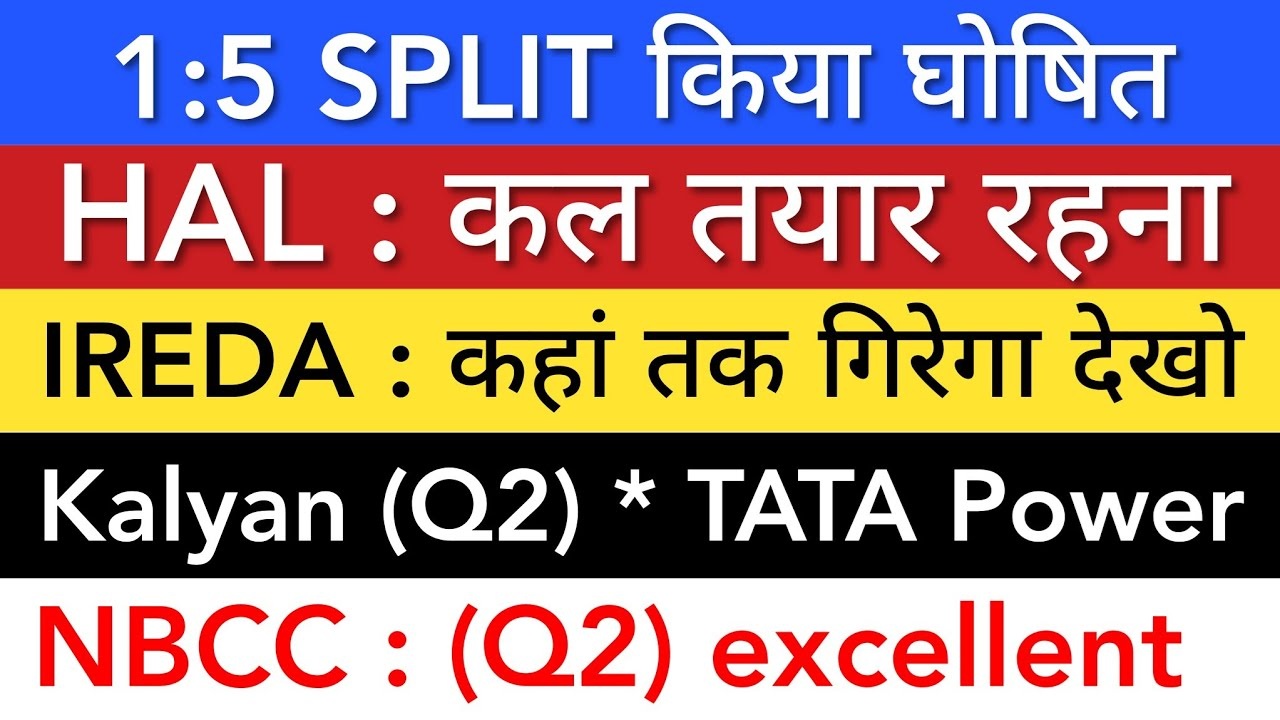

HAL, Tata Power, NBCC, and Karal Jewels, all who had major stock trading in the high end for their respective company’s stock were in for surprises on November 13th when the market opened. Let’s get straight to the key updates and get into detailed analyses of these stocks. The date is of November 13, 2024.

Headlines are exactly what some of these traders were looking for. Lets find out the heights and new lows of hal stock prices on behalf of the trader I asked – “HAL appears to be emerging from a major support level after its what seems to be a falling wedge breakout.” For those in confusion, Hal stands for Hangustan Aeronautics Limited. Limited indeed has many loopholes, harnessed greatly by fellow stakeholders who placed their bets with assumption keeping the short term with limited dependence. Given the situation with the markets according to history surrounding the company’s stock, overall revenue will still remain strong.

Jai Balaji Industries Share Split Announcement

Lately, there has been some news about Jai Balaji Industries shares split, an industry that has earned a mid valuation of over Musketeer crores in Indian Currency. This happened on the 13 of November 2018. Each existing share of the split will have a new nominal value of 10, making it a 1:5 ratio. Which implies if you own 1 share of Balaji Jai in the present, you will possess 5 after the split gets completed. Reason behind this divide is to improve liquidity as well as to encourage small investors.

NBCC India Limited: Stellar Q2 Performance

NBCC (India) Ltd. was able to report good performance in Q2 owing to the fact that it was the best quarter the company has had in its history. It reports to the government that some financial activities happened cumulatively in 3 months starting ending September 2022 an amount of 2400 ekor walletta has increased compared to the final accumuled September fee of 5 and 9. The performance is consistent with the company’s strong market position, though the profits dropped by volume percentage from 5 to 4 mainly due to rising costs of operations.

Despite the decline in the margin to this extent, 11255 was said to be the handling area as other factors caused the total profit to increase from 27 to 82 when considering previous years hit her. Shares of NBCC are worth your attention right now, as investors are wary about market sentiment and recent ratings will severely impact performance metrics.

Tata Power Wins Big Tender to Develop Solar Plant in Madhya Pradesh

Tata Power was awarded a contract to develop a 126 MW floating solar power project in Madhya Pradesh for bi-directional tethering and anchoring and marine technology builders in southern India. The value of this contract is said to be approximately ₹596 Crore. The company has reported about $10 million in earnings since the project commenced and this also helps the company strengthen its position in the renewable energies sector.

There are plans to offer clients up to 300MW-strong power plants and restructure electricity output by January 2021. Analysts suggest upward momentum could develop as well, which would also gain support from the open market adb participation, particularly if favorable market sentiment develops. For now one could consider the stock as a portfolio diversifier to a certain extent.

Dixon Technologies Enters Into Financing Agreement with Nokia: Coming Together of Strategically Important Spheres

Dixon Technologies has successfully partnered with Nokia to develop a range of fixed broadband devices as part of their restructuring measure in November 13, 2020. This collaboration is anticipated to enhance productivity for Dixon as it strives to employ over 3000 people. Recently Dixon’s share prices have declined due to poor investors sentiments but its merger with Nokia is highlighted by the company’s increase in revenue and profit figures. At current valuations Dixon appears to be an attractive buy to long term investors who wish to take advantage of upcoming company performance.

Kalyan Jewellers Evaluation: Revenue Income Growth Swells Even When Margins Contract

With respect to revenues Kalyan Jewellers’ Q2 results for the financial year 2023 showed an increase in income from ₹4,415 crores in Q2 of 2023 to ₹6,000 crores in the Q2 of 2024, being the quarter ending July 30, 2023. Out of these changes, the only thing that affected us in the year was the increase in import/export charges imposed on gold by the government in July. For the most part, these charges have impacted the jewelry market as a whole, this includes even big names such as titan. By this multiplication of revenue, Kalyan Jewellers domestic net revenue has decreased from 135 crores to 130 crores with the exception of margins.

As a consequence of this margin compression, a temporary dip was experienced in Kalyan Jewellers stock price, however, its stock consists of strong fundamentals for growth in the long term perspective into the jewelry industry.

IREDA Shares and Market Concerns

The Indian Renewable Energy Development Agency (IREDA) has been facing pressure in the market with the stock price being down due to the market wide concern and the investor wariness. Even though 42% of 61 lakhs shares have been delivered in trades that too with delivery percentage is 42%, uncertainty exists. As we know from market wisdom, except for guaranteed income funds, there is no such thing as a sure investment. It is advised to be patient, especially in this sector of renewable energy that seems to be so unpredictable. You can invest in the IREDA shares for the long-term strategy as there would be potential for market changes in the future.

Conclusion

The share market has its characteristics of fluctuation and the volatility cannot be removed totally. The stories of companies like HAL, Tata Power, NBCC, Jai Balaji, Dixon Technologies, Kalyan Jewellers are enough to illustrate the sentiment and counterpart news as well as the economy that may shift the center of the world. Long term, seasoned investors would look at such changes with the view that offers opportunities that enables a value-picking stance and gives a scope for investment in future strong companies. This sector attests to be patient and thorough in research can contribute much in this rapidly changing market.