Bharat Electronics Limited (BEL), India’s leading state-owned defense electronics enterprise, recently released its Q2 FY25 financial results, revealing an impressive 34% rise in net profit, totaling ₹1,091 crore. The company’s revenue also increased by 15% year-over-year (YoY), demonstrating BEL’s ongoing financial strength in the competitive defense sector. Additionally, the order book stood robust at ₹74,595 crore as of October 1, 2024, indicating continued demand and future revenue growth.

BEL Achieves Strong Revenue and Profit Growth in Q2 FY25

In Q2 FY25, Bharat Electronics reported a net profit increase of 34.4% year-over-year, reaching ₹1,091.27 crore compared to ₹812.34 crore in Q2 FY24. This growth underlines BEL’s focus on expanding operations and optimizing resources across its defense and aerospace projects. Revenue for the quarter rose by 14.8% to ₹4,583.41 crore, compared to ₹3,993.32 crore in the same period last year, showcasing the company’s ability to drive consistent top-line growth.

Order Book Strengthened to ₹74,595 Crore

BEL’s order book position reached an impressive ₹74,595 crore as of October 1, 2024, further solidifying its industry leadership. This growth in order backlog is a testament to Bharat Electronics’ reputation as a reliable defense technology provider for both domestic and international clients. The expanded order book provides a steady revenue pipeline for upcoming quarters, ensuring sustained operational and financial momentum.

Improved EBITDA and Margins for Q2 FY25

At the operational level, BEL’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) grew 38.3% in Q2 FY25, reaching ₹1,388.5 crore compared to ₹1,004 crore in Q2 FY24. Notably, the EBITDA margin expanded by over 500 basis points, improving from 25.2% to 30.3%. This surge in EBITDA margin highlights Bharat Electronics’ ability to control costs and enhance operational efficiency despite a challenging market.

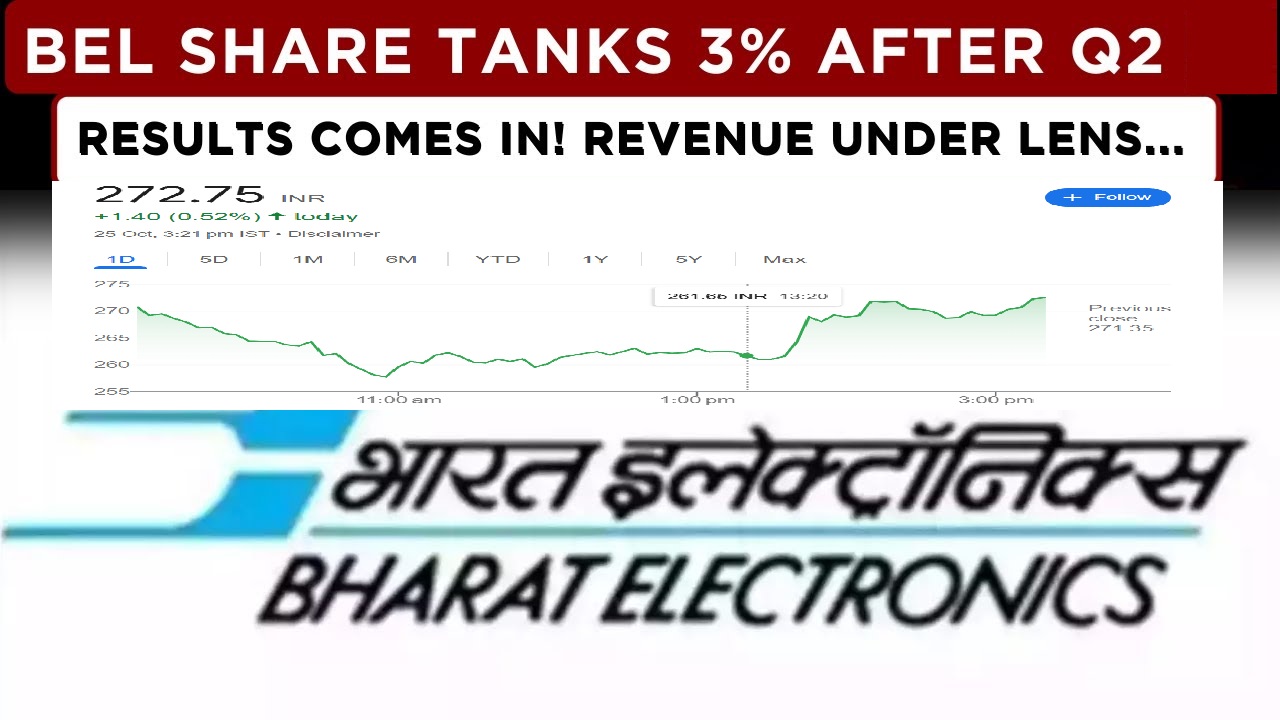

BEL Stock Performance and Market Sentiment

Despite the stellar financial performance, BEL’s stock has experienced mixed reactions in recent months. The stock has seen a minor decline of 10% over the past three months. However, on a year-to-date (YTD) basis, BEL’s share price has surged by 47%, yielding robust returns for investors. Over a longer term, the company has delivered substantial returns, achieving over 107% growth in the past year and a remarkable 305% over the past three years. At 2:10 PM on the day of the announcement, BEL’s stock was trading at ₹271.75 on the Bombay Stock Exchange (BSE), marking a 0.13% increase.

Key Highlights from BEL’s Q2 Earnings Call

During the earnings call, Bharat Electronics’ management emphasized the company’s strong financial position and strategic focus. The consolidated revenue for Q2 came in at ₹4,605 crore, slightly lower than market expectations of ₹5,159 crore. However, consolidated profit after tax (PAT) exceeded estimates, reaching ₹1,192.5 crore against a market consensus of ₹843 crore, signaling a robust bottom-line performance.

BEL’s order book position as of October 1 further underscored its growth potential, while EBITDA reached approximately ₹1,400 crore, outperforming expectations. The EBITDA margin also beat forecasts, arriving at 30.4% compared to the expected 20.8%. Despite these positive results, the stock saw a temporary dip of over 3% following the announcement, suggesting a mixed reaction from investors who anticipated slightly higher revenue figures.

Conclusion: Bharat Electronics on Track for Long-Term Growth

In summary, Bharat Electronics has delivered strong financial results in Q2 FY25, marked by significant profit growth, an expanding order book, and improved operational margins. Although the company’s stock faced a brief decline following the announcement, BEL remains a prominent player in India’s defense technology sector, with its robust financial performance and impressive order backlog suggesting sustained growth in the quarters to come.