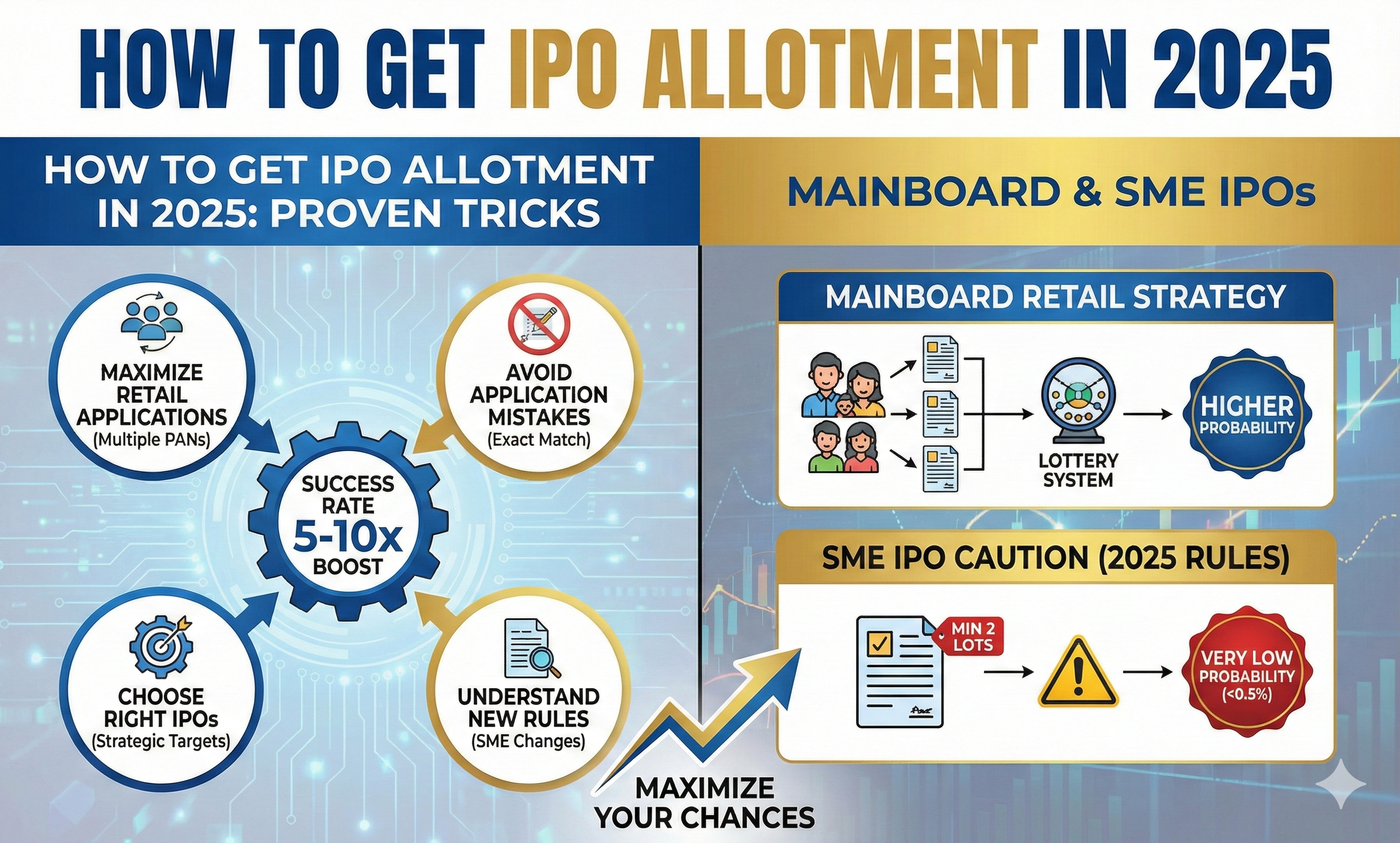

How to Get IPO Allotment in 2025: Proven Tricks to Maximize Your Chances of Success in Mainboard & SME IPOs

Getting an IPO allotment in India’s hyper-competitive market feels impossible for most retail investors. Oversubscription rates frequently cross 50x–200x, yet thousands still walk away empty-handed every week. The truth? Allotment isn’t purely luck. Smart investors who understand SEBI’s latest rules, avoid fatal application mistakes, and deploy simple yet powerful strategies consistently boost their success rate by 5–10x compared to the average applicant.

This 3500-word ultimate guide reveals exactly how IPO allotment works in 2025, the new SME IPO rules, deadly mistakes that get applications rejected, and field-tested tricks used by seasoned investors to secure allotments repeatedly — even in the hottest issues.

Understanding IPO Allotment Categories: Retail vs HNI Explained

Every mainboard IPO in India divides investors into three primary categories:

- Retail Individual Investor (RII) – Up to ₹2 lakh per application

- Non-Institutional Investor (NII) – Split into sNII (₹2–10 lakh) and bNII (above ₹10 lakh)

- Qualified Institutional Buyers (QIB) – Banks, mutual funds, etc.

At least 35% of the issue is reserved for retail investors, making it the most attractive category.

Key Rule: In the retail category, every applicant — whether applying for 1 lot or maximum lots — receives equal treatment in the lottery. Applying for multiple lots does NOT increase your chances. You either get 1 lot or nothing when oversubscription exceeds 1x.

In contrast, the old proportionate allotment system for Big HNI has been scrapped. Now even bNII (Big HNI) follows pure lottery — you get exactly ₹2 lakh worth (typically 1 lot for that category) regardless of whether you apply ₹10 lakh or ₹10 crore.

Winner by far: Retail category gives you the highest probability of allotment in almost every mainboard IPO.

Why Retail Category Beats sNII and bNII Hands-Down in 2025

Real data from 2024–2025 mainboard IPOs tells the story:

| Category | Typical Amount-wise Oversubscription | Effective Application-wise Oversubscription | Approx. Allotment Chance |

|---|---|---|---|

| Retail | 6–15x | 4–8x | 1 in 5–10 |

| sNII (Small HNI) | 30–80x | 28–75x | 1 in 30–75 |

| bNII (Big HNI) | 50–150x | 10–30x (after adjusting for ₹2L allotment) | 1 in 12–30 |

Bottom line: If you don’t have ₹50–100 lakh to play the big HNI game comfortably, stay 100% in retail. Your odds are dramatically better.

The #1 IPO Allotment Trick in 2025: Maximize Retail Applications Legally

The single most powerful strategy that works every single time is simple — apply from as many unique PAN + Demat combinations as possible, always in the retail category.

Every family member above 18 (spouse, parents, siblings, married daughters, etc.) can apply separately with their own bank account, demat, and UPI. Each application is treated independently in the lottery.

Example: A family of 6 adult members = 6 independent lottery tickets instead of 1.

Many seasoned investors maintain 15–30 clean demat accounts and secure allotments in 70–80% of mainboard IPOs they target.

Fatal IPO Application Mistakes That Get You Rejected Instantly

Even experienced investors lose allotments because of these preventable errors:

- Mismatched UPI/Bank Details The name on Demat, PAN, and the bank/UPI used for blocking funds must match exactly. Using your own UPI for a relative’s demat account almost guarantees technical rejection.

- Multiple Applications from Same PAN in Same Category One PAN = One application per category (unless eligible for shareholder quota). Applying retail from Groww and sNII from Zerodha using the same PAN will get both applications cancelled.

- Applying After 4:00 PM on Any Day The cutoff for submitting the IPO application (not mandate approval) is strictly before market close. Applications placed after 4 PM often get rejected even if mandate is approved later.

- Using Third-Party or Unreliable UPI Apps Mandate failures are the #1 reason for cancellation on Day 3. Stick to net-banking ASBA or proven apps like Dhan that have near-zero mandate issues.

How to Choose the Right IPO When 4 Issues Open Together

When multiple IPOs open on the same dates, follow this checklist:

- Highest retail portion (closer to 40–50% is ideal)

- Moderate-to-low grey market premium (GMP) — high GMP attracts crowds and kills allotment chances

- Decent fundamentals but not the “hottest” name everyone is chasing

Real example from 2025: While everyone chased high-GMP mega issues, underrated IPOs with 10–20% GMP and larger retail portions delivered 80–90% allotment probability plus 15–25% listing gains.

SME IPO Allotment Rules: Major Changes in 2025 You Must Know

SEBI drastically changed SME IPO allotment rules to curb manipulation:

- Three categories now: Retail (minimum ₹2–3 lakh, i.e., 2 lots compulsory), sNII, bNII

- Pure lottery system across all categories — no more proportionate advantage for big applicants

- Minimum 2 lots compulsory in “retail” — you cannot apply just 1 lot anymore

- Allotment in retail = exactly 2 lots if successful

Because SME IPOs routinely hit 150–400x oversubscription, retail allotment probability has crashed below 0.5% in most cases.

Verdict: Unless you can deploy ₹50+ lakh across dozens of demat accounts in the Big HNI category, avoid SME IPOs for allotment hunting in 2025. Focus exclusively on mainboard.

Pro Tips to Skyrocket Your IPO Allotment Success Rate

- Use ASBA via Net Banking whenever possible — zero mandate headaches.

- Apply on Day 1 or Morning of Day 2 — avoids last-minute server crashes and mandate delays.

- Keep ₹16,000–18,000 blocked idle in every linked bank account — instant mandate approval.

- Avoid shareholder quota unless you genuinely hold shares — strict verification now leads to permanent bans if caught faking.

- Track subscription in “number of applicants”, not just times subscribed — this is the real indicator of your chances.

The Ultimate Truth About IPO Allotment

At its core, retail allotment is a lottery. No one can guarantee success. But by eliminating mistakes, maximizing valid retail applications, and targeting the right issues, you move from “praying for luck” to systematically stacking probability in your favor.

Investors who treat IPO applications like a disciplined process — not a gamble — consistently walk away with allotments month after month while others complain about “bad luck.”

Start implementing these proven strategies today, and 2025 could become your most profitable IPO year ever.