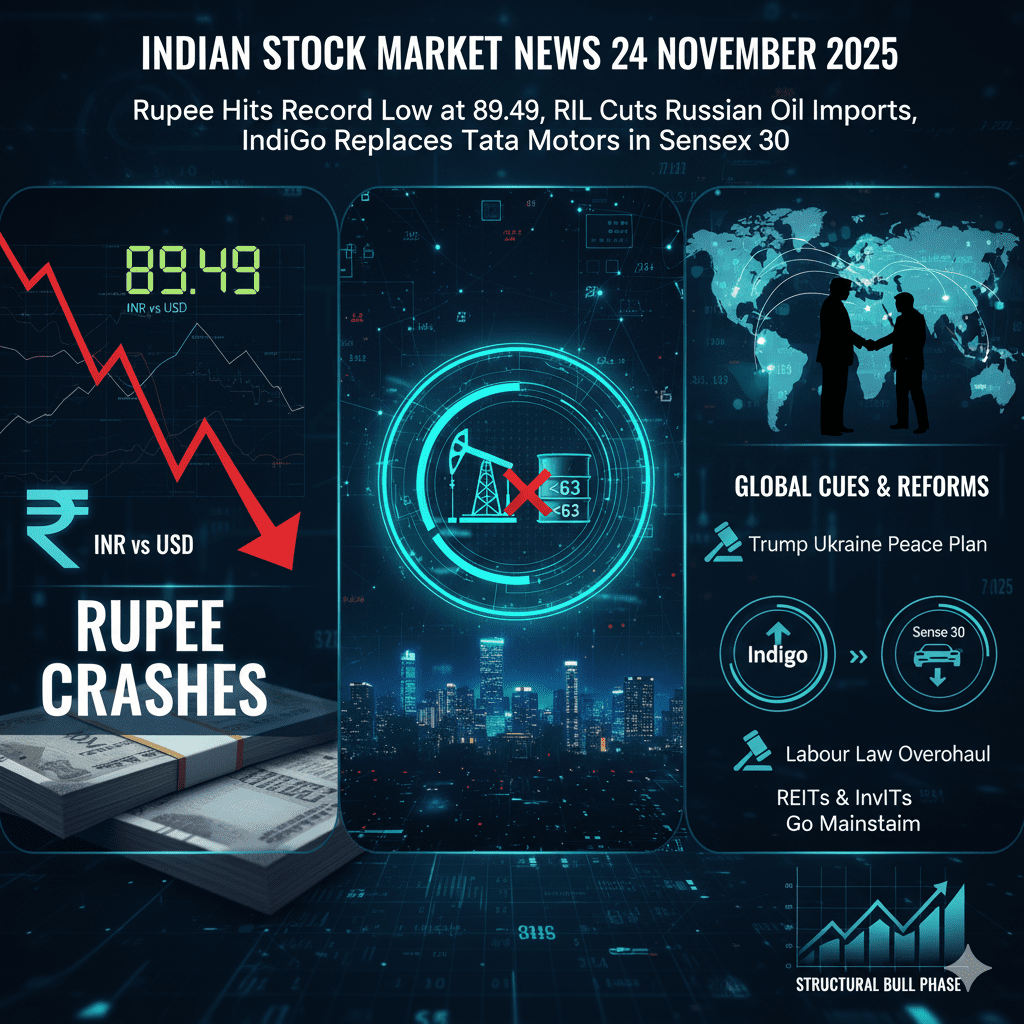

The Indian rupee plunged to an all-time low of 89.49 against the US dollar on 24 November 2025, while global oil prices eased on hopes of a Russia-Ukraine peace deal. Domestic indices opened flat-to-negative amid heavy FII outflows, fresh US tariff uncertainty, and a weakening currency. Here’s your comprehensive, SEO-optimized roundup of everything that moved markets today.

Indian Rupee Crashes to Historic Low of 89.49 – What It Means for Investors

The rupee depreciated nearly 0.9% in a single session to touch 89.49 – its weakest level ever. Year-to-date, the currency has fallen over 4.5% in 2025, making it one of Asia’s worst-performing major currencies.

Key Triggers Behind Rupee’s Free Fall

- Massive FII selling: Foreign institutions have pulled out ≈$16 billion from Indian equities so far in 2025.

- Uncertainty over India-US trade deal under the incoming Trump administration.

- Surprisingly muted RBI intervention – the central bank appears to have stepped back from aggressive dollar buying near psychological 89-90 levels.

- Persistent trade deficits and elevated crude import bills (despite lower prices).

A weaker rupee makes imports costlier, fuels imported inflation, and erodes returns for foreign investors when converted back to dollars. However, it provides a natural boost to IT, pharmaceuticals, and export-oriented sectors.

Brent Crude Slips Below $63 – Reliance Industries Halts Russian Oil Imports

Global oil prices continued their slide as leaked details of a potential Trump-brokered Russia-Ukraine peace plan gained traction. Brent crude now hovers around $62–63 per barrel.

Why This Matters for India

- Lower oil prices = lower fuel inflation, reduced subsidy burden, and improved current account deficit.

- Reliance Industries has sharply reduced discounted Russian crude intake at its Jamnagar refinery because of fresh company-specific US sanctions and payment complications.

- Analysts believe India may gradually shift more crude purchases toward the US and Middle East, reducing reliance on Russian supplies.

Sensex Rejig Effective 2 December 2025: IndiGo Enters, Tata Motors Exits

BSE announced the much-awaited semi-annual rebalancing:

- InterGlobe Aviation (IndiGo) will replace Tata Motors (Passenger Vehicles business post-demerger) in the benchmark Sensex 30 from 2 December.

- Max Healthcare to enter BSE Sensex 50.

- IDFC First Bank to join BSE Sensex 100.

Impact Expect passive fund inflows of $200–250 million into IndiGo stock and corresponding outflows from Tata Motors in the coming weeks.

Global Cues: Trump’s Ukraine Peace Plan, Fed Rate Cut Hopes & Treasury Yields

- Leaked US-Russia talks raise probability of an early ceasefire in Ukraine → lifting of Russian energy sanctions → higher global oil supply → bearish for energy stocks.

- Fed speakers turn slightly dovish: Dallas Fed President Lorie Logan hinted at a possible December rate cut, pushing US 10-year Treasury yields back toward 4%.

- Heavy US economic data calendar this week: Revised Q3 GDP, PCE inflation, retail sales – all delayed because of earlier government shutdown.

G20 Summit Takeaways: India Diversifies Trade Partnerships Aggressively

PM Modi held bilateral meetings with leaders from the UK, Australia, France, and others. Key themes:

- Reducing dependence on the US amid looming tariff threats.

- New India-Australia-Canada trilateral supply-chain resilience initiative.

- Fast-tracking FTAs and critical minerals partnerships.

Domestic Reforms That Could Change the Game in 2026–27

- Labour Law Overhaul Government plans to replace 29 complex labour laws with just 4 simplified labour codes – a major “Make in India 2.0” push. Formalisation of workforce expected to benefit staffing firms (Quess Corp, TeamLease), gig platforms (Zomato, Swiggy, Urban Company), and manufacturing.

- Insurance Sector Liberalisation

- 100% FDI bill listed for Winter Parliament session.

- Fresh talks to merge three public-sector general insurers (Oriental, National, United India).

- REITs & InvITs Go Mainstream SEBI chief confirms phased inclusion of REITs in Nifty/Sensex indices. Embassy Office Parks, Mindspace, Brookfield India REIT, and PowerGrid InvIT likely first beneficiaries → higher retail and institutional flows expected.

Stock-Specific Updates You Can’t Miss – 24 Nov 2025

- Kotak Mahindra Bank emerges front-runner (along with Oaktree Capital) to acquire government + LIC’s 61% stake in IDBI Bank.

- Tata Chemicals to invest ₹910 crore in Gujarat & Tamil Nadu to expand soda ash and silica capacities.

- Tata Power to invest ₹1,572 crore in 1.1 GW Bhutan hydro projects (40% stake).

- Adani Group fully exits Adani Wilmar (Fortune oil brand) after selling remaining 7% via block deals.

- TCS faces $194 million upheld damages in US trade-secret lawsuit – legal battle to continue.

- Divis Labs expects China oral-dosage plant to break even by Q4 FY26; targets 21–22% EBITDA margin in FY26.

Expert Insights from Parag Parikh Investor Meet 2025

Highlights from CIO Rajeev Thakkar’s candid session:

- “Your ₹1,000 monthly SIP won’t make you Elon Musk or Mukesh Ambani – start a business if you want that kind of wealth.”

- Index funds give free money to arbitrageurs because rebalancing dates are public.

- PPFAS to launch “Large Cap Fund” in Jan 2026 – will behave like an index but actively avoid forced rebalancing traps.

- No investments in loss-making startups despite sky-high valuations.

- “If you think ITC is expensive today, maybe you and I should migrate from India.”

Market Outlook for the Week Ahead

- Data-heavy week in the US → volatility expected.

- Rupee defence at 90 will be closely watched.

- Any positive surprise on US-India trade clarity or RBI commentary could trigger sharp short-covering.

- Sectors to watch: IT & Pharma (currency tailwind), Private Banks (M&A buzz), Staffing & Logistics (labour reforms), REITs (inclusion trigger).

Stay invested, stay informed. The Indian market remains in a structural bull phase despite near-term noise. Opportunities are emerging for long-term investors who can look beyond currency fluctuations and geopolitical headlines.