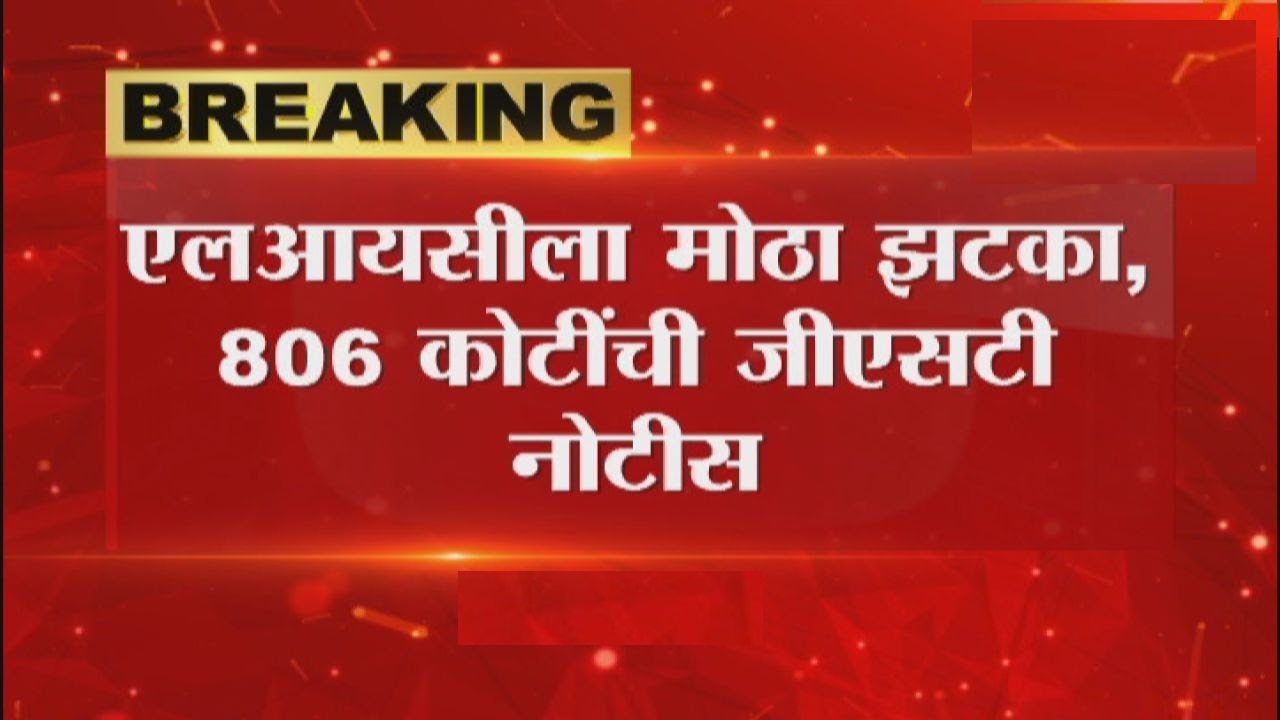

LIC receives a ₹806 crore GST notice from Maharashtra, including a ₹404 crore penalty for various tax-related non-compliances.

Key Takeaways

- LIC faces a GST penalty of ₹404 crore for non-compliance in FY2017-2018.

- The total demand, including GST dues, interest, and penalty, amounts to ₹806 crore.

- LIC plans to appeal against the order.

- The company assures no impact on operations due to the notice.

LIC Receives ₹806 Crore GST Notice from Maharashtra

Life Insurance Corporation of India (LIC) has received a hefty GST notice from the Maharashtra Deputy Commissioner of State Tax, imposing a penalty of ₹404 crore for various shortcomings in tax-related compliances in FY2017-2018.

The notice breaks down the total demand as follows:

- ₹365.02 crore of GST dues

- ₹404.7 crore of penalty

- ₹36.5 crore of interest

Alleged Non-Compliances

The notice cites the following alleged non-compliances by LIC:

- Non-reversal of input tax credit: LIC failed to reverse input tax credit as per CGST rules 37 and 38.

- Reinsurance input tax credit: LIC did not reverse input tax credit availed from reinsurance.

- Delayed payment and RCM liability: LIC faces interest and dues on delayed GSTR-3B payments and disclosed less reverse charge mechanism (RCM) liability than its suppliers.

LIC’s Response

LIC plans to file an appeal against the order before the Commissioner in Maharashtra. The company also assures that the GST notice will not impact its operations or activities.

GST Notices from Other States

This isn’t the first GST notice LIC has received recently. The insurance giant has faced similar notices from other states:

- Bihar: ₹290 crore notice with a penalty of ₹16.67 crore

- Jammu and Kashmir: Demand order for GST, interest, and penalty

- Telangana: ₹183 crore notice, including interest and penalty

Frequently Asked Questions

Q: What is GST?

GST stands for Goods and Services Tax, a comprehensive indirect tax levied on the supply of goods and services in India.

Q: What are the reasons for LIC’s GST penalty?

The penalty is due to alleged non-compliance with GST rules, such as not reversing input tax credit and delayed payments.

Q: Will this impact LIC’s operations?

According to the company, the GST notice will not impact its operations or activities.