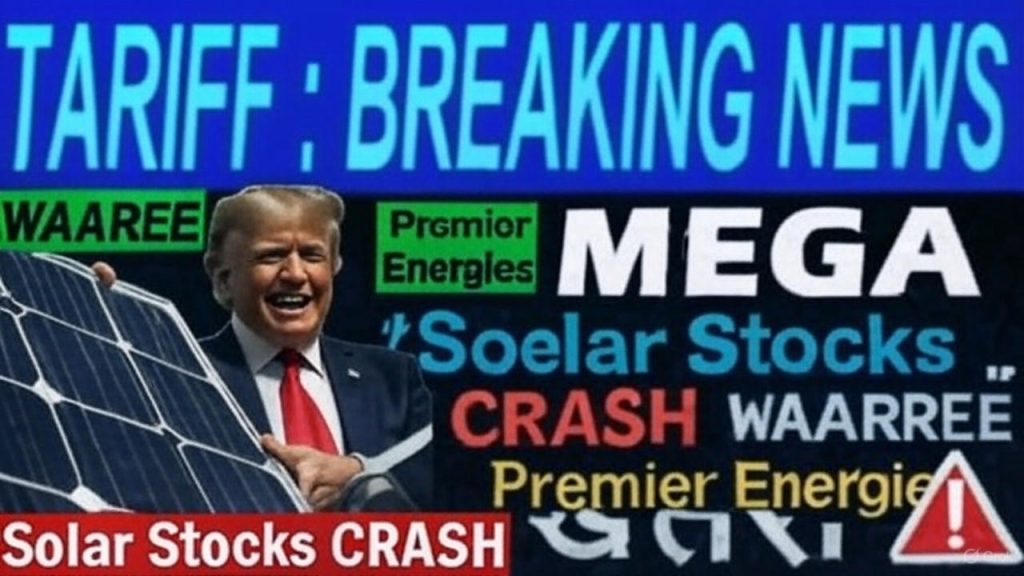

The solar energy sector, a cornerstone of the global push for sustainable energy, has recently faced significant turbulence. On July 18, 2025, major Indian solar companies like Waaree Energies, Premier Energies, and Sterling & Wilson Solar experienced sharp declines in their stock prices, with drops of approximately 4% across the board. This sudden downturn sent shockwaves through the market, leaving investors and industry analysts scrambling to understand the underlying causes. The primary trigger? A looming threat from the United States in the form of proposed tariffs and anti-dumping duties on solar modules imported from India and other Asian countries. This article delves into the reasons behind the solar stock crash, the role of U.S. trade policies, and the broader implications for the global solar industry. With a comprehensive analysis spanning 3,400 to 4,900 words, we aim to provide actionable insights for investors, industry stakeholders, and renewable energy enthusiasts.

The Solar Stock Crash: A Market in Turmoil

The Indian stock market witnessed a sea of red on July 18, 2025, with the solar sector bearing the brunt of the downturn. Companies like Waaree Energies, Premier Energies, and Sterling & Wilson Solar, which have been pivotal in India’s renewable energy growth, saw their stock prices plummet. This wasn’t an isolated event confined to a single company but a sector-wide phenomenon that demands a closer look. The solar industry, particularly firms involved in manufacturing solar modules and panels, faced intense pressure due to external factors originating from the United States. Understanding the catalysts behind this crash requires examining the interplay of global trade policies, market dynamics, and competitive pressures.

Why Did Solar Stocks Crash?

The sharp decline in solar stocks stems from a U.S.-based initiative to impose tariffs and anti-dumping duties on solar modules imported from India and other Asian nations, including Indonesia. U.S. solar manufacturers, feeling the heat from low-cost imports, have petitioned their government to implement protective measures. These firms argue that Indian and Asian solar companies benefit from unfair subsidies, allowing them to sell products below production costs—a practice known as dumping. This alleged dumping undermines the competitiveness of U.S. manufacturers, prompting calls for higher tariffs to level the playing field.

The petition, filed by a coalition of U.S. solar firms, accuses Indian and Asian manufacturers of flooding the American market with cheap solar modules. The proposed tariffs, if approved, could significantly increase the cost of Indian solar products in the U.S., a critical market for Indian exporters. This news triggered immediate panic among investors, leading to the observed sell-off in stocks like Waaree Energies, Premier Energies, and Sterling & Wilson Solar. The fear of reduced market access and shrinking profit margins drove the market’s bearish sentiment.

The Role of U.S. Tariffs in the Solar Industry

Tariffs have long been a contentious issue in global trade, and the solar industry is no stranger to their impact. The United States, under various administrations, has employed tariffs to protect domestic industries from foreign competition. In the context of solar energy, tariffs aim to shield U.S. manufacturers from the influx of low-cost imports, particularly from Asia. The recent petition targeting Indian solar modules is part of a broader pattern of trade protectionism that has significant implications for global solar markets.

What Are Anti-Dumping Duties?

Anti-dumping duties are taxes imposed on imported goods sold at prices lower than their domestic market value or production cost. These duties aim to prevent foreign companies from undercutting local manufacturers by “dumping” products at artificially low prices. In the case of solar modules, U.S. firms claim that Indian and Asian manufacturers benefit from government subsidies, enabling them to sell products at prices that U.S. companies cannot match. By imposing anti-dumping duties, the U.S. seeks to raise the cost of imported solar modules, making domestic products more competitive.

Historical Context: Tariffs on Solar Imports

The U.S. has a history of imposing tariffs on solar imports, particularly from Asian countries. In April 2022, the U.S. shocked the global solar industry by levying tariffs as high as 3,521% on solar panels imported from Southeast Asian countries like Cambodia, Thailand, Malaysia, and Vietnam. These tariffs targeted alleged circumvention of trade rules, with accusations that Chinese manufacturers were routing products through these countries to evade existing duties. The lowest tariffs imposed during this period were around 41%, still a significant barrier to market access.

The 2022 tariffs set a precedent for aggressive trade measures in the solar sector, and the current petition against Indian solar modules follows a similar playbook. The fear of such high tariffs being applied to Indian exports has rattled investors, as it could severely restrict market access and erode profit margins for companies like Waaree Energies and Premier Energies.

The Impact on Indian Solar Companies

Indian solar companies have emerged as key players in the global renewable energy market, with the U.S. serving as a major export destination. Companies like Waaree Energies, Premier Energies, and Sterling & Wilson Solar rely heavily on the U.S. market for revenue, much like India’s IT sector depends on American clients. The proposed tariffs threaten to disrupt this lucrative market, posing significant challenges for these firms.

Waaree Energies: A Leader Under Pressure

Waaree Energies, one of India’s largest solar module manufacturers, has built a strong presence in the U.S. market. Its ability to offer high-quality solar modules at competitive prices has made it a preferred supplier for American solar projects. However, the proposed tariffs could increase the cost of Waaree’s products in the U.S., potentially reducing demand and squeezing profit margins. The company’s stock price dropped by approximately 4% on July 18, 2025, reflecting investor concerns about its exposure to the U.S. market.

Premier Energies: Navigating Market Challenges

Premier Energies, another prominent player in India’s solar industry, specializes in solar cell and module manufacturing. Like Waaree, it has benefited from strong demand in the U.S., driven by the country’s ambitious renewable energy goals. The threat of tariffs, however, could force Premier Energies to rethink its export strategy. A potential increase in costs could make its products less competitive, prompting buyers to seek alternatives from domestic U.S. suppliers or other countries not subject to the tariffs.

Sterling & Wilson Solar: A Global Giant at Risk

Sterling & Wilson Solar, known for its expertise in solar EPC (engineering, procurement, and construction) services, also felt the impact of the market downturn. While the company operates globally, its reliance on the U.S. market for solar module exports makes it vulnerable to trade barriers. The proposed tariffs could disrupt its supply chain and project timelines, leading to financial strain and reduced investor confidence.

Why Are U.S. Firms Pushing for Tariffs?

The push for tariffs by U.S. solar manufacturers stems from their struggle to compete with low-cost imports from Asia. Asian countries, including India, have dominated the global solar market due to their ability to produce high-quality solar modules at significantly lower costs. This cost advantage is attributed to several factors, including economies of scale, advanced manufacturing capabilities, and, as alleged by U.S. firms, government subsidies.

The Allegation of Unfair Subsidies

U.S. manufacturers accuse Indian and Asian solar companies of receiving unfair government subsidies that allow them to sell products below production costs. These subsidies, they argue, enable foreign firms to flood the U.S. market with cheap solar modules, undermining domestic producers. While subsidies are common in the renewable energy sector to promote clean energy adoption, their use in international trade can spark disputes, as seen in this case.

Protecting the U.S. Solar Market

The U.S. solar market is heavily reliant on imports, with overseas companies capturing a significant share of the market. Domestic manufacturers argue that without protective measures like tariffs and anti-dumping duties, they cannot compete effectively. The petition against Indian solar modules reflects a broader effort to safeguard the U.S. solar industry, which has struggled to scale production to match Asian competitors.

Global Implications of the Solar Stock Crash

The proposed tariffs on Indian solar modules have far-reaching implications for the global solar industry. As countries strive to meet climate goals and transition to renewable energy, trade barriers could disrupt supply chains, increase costs, and slow the adoption of solar power. This section explores the broader consequences of the current crisis.

Disruption of Global Supply Chains

The global solar industry relies on a complex network of manufacturers, suppliers, and distributors. Tariffs on Indian solar modules could disrupt this supply chain, forcing U.S. buyers to seek alternative suppliers or absorb higher costs. This could lead to delays in solar project deployments and increased prices for consumers, undermining the affordability of renewable energy.

Impact on Renewable Energy Goals

The U.S. has set ambitious targets for renewable energy adoption, with solar power playing a central role. However, reliance on imported solar modules means that trade barriers could hinder progress toward these goals. Higher costs for solar modules could make solar projects less economically viable, slowing the transition to clean energy and affecting climate commitments.

Opportunities for Other Markets

While the proposed tariffs pose challenges for Indian solar companies, they could create opportunities for manufacturers in other regions. Countries not targeted by the tariffs, such as those in Europe or Latin America, may see increased demand for their solar products. Additionally, U.S. manufacturers could benefit from reduced competition, provided they can scale production to meet demand.

Strategies for Indian Solar Companies to Mitigate Risks

In the face of potential tariffs, Indian solar companies must adopt proactive strategies to protect their market share and maintain profitability. Here are some actionable steps they can take:

Diversifying Export Markets

To reduce reliance on the U.S. market, Indian solar companies should explore opportunities in other regions, such as Europe, Africa, and the Middle East. These markets have growing demand for renewable energy and may offer more stable trade environments.

Enhancing Domestic Production

Investing in domestic manufacturing capabilities can help Indian companies reduce costs and improve competitiveness. By leveraging economies of scale and adopting advanced technologies, firms like Waaree Energies and Premier Energies can maintain their edge in global markets.

Strengthening Advocacy Efforts

Indian solar companies, in collaboration with industry associations, should engage in advocacy to counter the allegations of unfair subsidies and dumping. By presenting a unified front, they can negotiate with U.S. authorities to minimize the impact of proposed tariffs.

Innovating Product Offerings

Innovation in product design and efficiency can help Indian companies differentiate themselves from competitors. Developing high-efficiency solar modules or integrating smart technologies could attract buyers even in the face of higher costs due to tariffs.

What Lies Ahead for the Solar Industry?

The outcome of the U.S. petition against Indian solar modules remains uncertain, creating a climate of volatility for investors and industry stakeholders. If the U.S. government accepts the petition, Indian solar companies could face significant challenges, including reduced market access and compressed margins. Conversely, if the petition is rejected, the sector could experience a robust recovery, with stocks like Waaree Energies and Premier Energies rebounding strongly.

The Role of Policy Decisions

The decision on tariffs will ultimately rest with U.S. policymakers, with the administration playing a pivotal role. Given the history of trade protectionism in the U.S., particularly under certain administrations, the likelihood of tariffs being imposed cannot be dismissed. However, diplomatic efforts and trade negotiations could lead to a more balanced outcome that preserves market access for Indian companies.

Investor Strategies in a Volatile Market

For investors, the solar stock crash presents both risks and opportunities. Staying informed about policy developments and market trends is critical for making sound investment decisions. Diversifying portfolios to include solar companies with strong fundamentals and exposure to multiple markets can mitigate risks associated with U.S. tariffs.

Conclusion: Navigating the Solar Storm

The solar stock crash of July 18, 2025, underscores the vulnerability of the global solar industry to trade policies and market dynamics. The proposed U.S. tariffs on Indian solar modules have sent shockwaves through the sector, affecting leading companies like Waaree Energies, Premier Energies, and Sterling & Wilson Solar. While the immediate impact has been a sharp decline in stock prices, the long-term implications depend on the outcome of the tariff petition and the strategic responses of Indian companies.

By diversifying markets, enhancing production capabilities, and advocating for fair trade practices, Indian solar firms can weather this storm and continue to play a vital role in the global renewable energy landscape. For investors, staying vigilant and informed will be key to capitalizing on opportunities in this dynamic sector. As the world moves toward a cleaner energy future, the resilience and adaptability of the solar industry will determine its ability to overcome challenges and thrive.