The Telangana government has rolled out the Rajiv Yuva Vikasam Scheme 2025, a flagship initiative designed to foster self-employment and economic empowerment among the state’s youth. Targeting SC, ST, BC, and Minority communities, this scheme provides concessional loans of up to ₹3 lakh, coupled with substantial subsidies, to help young entrepreneurs establish their own businesses. With a massive budget allocation of ₹6,000 crore, the program is set to transform the lives of 5 lakh unemployed youth in its inaugural year by providing the financial backing needed to launch sustainable ventures.

Announced by Deputy Chief Minister Mallu Bhatti Vikramarka, the scheme underscores Telangana’s commitment to reducing unemployment and promoting inclusive economic growth. By offering financial aid, subsidies, and streamlined application processes, the Rajiv Yuva Vikasam Scheme 2025 paves the way for aspiring entrepreneurs to achieve financial stability and contribute to the state’s economy. This article delves into the scheme’s key features, eligibility criteria, loan categories, application process, and more to guide you through this game-changing opportunity.

What is the Rajiv Yuva Vikasam Scheme 2025?

The Rajiv Yuva Vikasam Scheme 2025 is a strategic initiative by the Telangana government to combat unemployment and promote entrepreneurship among marginalized communities. By providing financial assistance in the form of subsidized loans, the scheme enables youth from SC, ST, BC, and Minority groups to start their own businesses, ranging from small-scale enterprises to larger ventures. With a target to support 5 lakh beneficiaries in its first year, the program is backed by a robust ₹6,000 crore investment, ensuring widespread impact across the state.

The scheme’s implementation includes a meticulous selection process, with applications open from March 15 to April 4, 2025, and loan sanctions scheduled for June 2, 2025, during Telangana Formation Day celebrations. District-level committees are actively screening applications to ensure transparency and fairness, while advanced technology is being utilized to filter out ineligible candidates. This initiative not only provides financial support but also fosters a culture of self-reliance and innovation among Telangana’s youth.

Key Objectives of the Rajiv Yuva Vikasam Scheme

The Rajiv Yuva Vikasam Scheme 2025 is driven by several core objectives aimed at transforming the socio-economic landscape of Telangana:

- Promote Self-Employment: The scheme encourages unemployed youth to establish their own businesses, reducing dependency on traditional job markets.

- Empower Marginalized Communities: By targeting SC, ST, BC, and Minority youth, the program ensures inclusive economic growth.

- Reduce Unemployment: With financial aid and subsidies, the scheme aims to create sustainable employment opportunities for 5 lakh youth in its first year.

- Foster Entrepreneurship: The initiative provides the resources and support needed to nurture entrepreneurial talent and innovation.

- Drive Economic Growth: By enabling small and medium-scale enterprises, the scheme contributes to Telangana’s economic development.

These objectives align with the state’s vision of creating a vibrant, self-reliant economy where youth from all backgrounds have the opportunity to thrive.

Eligibility Criteria for Rajiv Yuva Vikasam Scheme 2025

To ensure that the benefits of the Rajiv Yuva Vikasam Scheme reach the right candidates, the Telangana government has outlined specific eligibility criteria. Applicants must meet the following requirements to qualify for financial assistance:

- Domicile: Candidates must be permanent residents of Telangana, ensuring that the scheme benefits local youth.

- Community: Applicants must belong to Scheduled Castes (SC), Scheduled Tribes (ST), Backward Classes (BC), or Minority communities.

- Age: The scheme is open to youth aged between 18 and 35 years, targeting the most dynamic and entrepreneurial demographic.

- Income: Applicants must fall under the Below Poverty Line (BPL) category, ensuring that financial aid reaches those in need.

- Business Intent: Candidates must seek financial assistance for self-employment ventures, such as small businesses, retail, or service-based enterprises.

Additionally, the scheme restricts eligibility to one beneficiary per family to ensure equitable distribution of resources. Applicants who have previously availed benefits under similar welfare schemes are ineligible for five years, preventing duplication of aid.

Loan Categories and Subsidies Under the Scheme

The Rajiv Yuva Vikasam Scheme 2025 offers a tiered loan structure with generous subsidies to cater to diverse entrepreneurial needs. The loans are divided into three categories, each with a specific subsidy percentage:

- Category 1: Loans up to ₹1 Lakh

- Subsidy: 80%

- Beneficiary Contribution: The remaining 20% can be covered by the applicant or arranged through bank linkage.

- Purpose: Ideal for micro-enterprises, such as small retail shops, food stalls, or home-based businesses.

- Category 2: Loans from ₹1 Lakh to ₹2 Lakh

- Subsidy: 70%

- Beneficiary Contribution: The remaining 30% is to be arranged by the applicant or through bank financing.

- Purpose: Suitable for medium-scale ventures, such as tailoring units, small manufacturing businesses, or service-based enterprises.

- Category 3: Loans up to ₹3 Lakh

- Subsidy: 60%

- Beneficiary Contribution: The remaining 40% is to be covered by the applicant or bank loans.

- Purpose: Designed for larger ventures, such as retail franchises, agricultural businesses, or technology-driven startups.

This tiered approach ensures that youth with varying financial needs and business aspirations can access the support they require. The subsidies significantly reduce the financial burden on beneficiaries, making entrepreneurship more accessible.

Application Process for Rajiv Yuva Vikasam Scheme 2025

Applying for the Rajiv Yuva Vikasam Scheme 2025 is a straightforward process, conducted entirely online to ensure accessibility and transparency. Follow these steps to submit your application:

- Visit the Official Portal: Navigate to the official website, tgobmms.cgg.gov.in, where the application process is hosted.

- Register on the Portal: Click on the “Apply Now” button and create an account by providing basic details such as name, contact information, and email address.

- Log In: Use your registered credentials to access the application form.

- Complete the Application Form: Fill in all required fields, including personal details, community information, income status, and details of the proposed business venture.

- Upload Documents: Submit scanned copies of necessary documents, including:

- Proof of identity (Aadhaar card, voter ID, etc.)

- Community certificate (SC/ST/BC/Minority)

- Income certificate (BPL certification)

- Proof of residence (domicile certificate)

- Bank account details linked to Aadhaar

- Review and Submit: Double-check the application for accuracy, then click the “Submit” button to complete the process.

After submission, applicants receive a confirmation and can track their application status on the portal. The government has streamlined the process to minimize errors and ensure a smooth experience for all candidates.

Key Dates for Rajiv Yuva Vikasam Scheme 2025

Staying informed about the scheme’s timeline is crucial for applicants. Below are the important dates for the Rajiv Yuva Vikasam Scheme 2025:

- Registration Start Date: March 15, 2025

- Application Deadline: April 4, 2025

- Application Scrutiny Period: April 6 to May 31, 2025

- Loan Sanction and Distribution: June 2, 2025 (Telangana Formation Day)

These dates ensure that applicants have ample time to prepare and submit their applications while allowing the government to conduct thorough evaluations before disbursing funds.

Selection Process: How Beneficiaries Are Chosen

The selection process for the Rajiv Yuva Vikasam Scheme 2025 is designed to be transparent and merit-based. Here’s how it works:

- Application Submission: Candidates submit their applications through the official portal by the April 4, 2025, deadline.

- Document Verification: District-level committees verify submitted documents, including identity, community, income, and bank account details, cross-referencing them with Aadhaar and welfare corporation databases.

- Field-Level Scrutiny: Field committees conduct on-ground assessments to evaluate the feasibility of proposed business ventures and ensure compliance with eligibility criteria.

- Counseling and Final Selection: Shortlisted candidates undergo counseling to refine their business plans. By May 31, 2025, the final list of beneficiaries is prepared with the approval of district ministers.

- Loan Sanction: Approved candidates receive sanction letters on June 2, 2025, marking the official allocation of funds.

To ensure fairness, the government employs advanced technology to filter out ineligible applicants, such as those who have previously benefited from similar schemes or provided inaccurate information. The selection process also considers population demographics across mandals, districts, and municipalities to allocate units equitably.

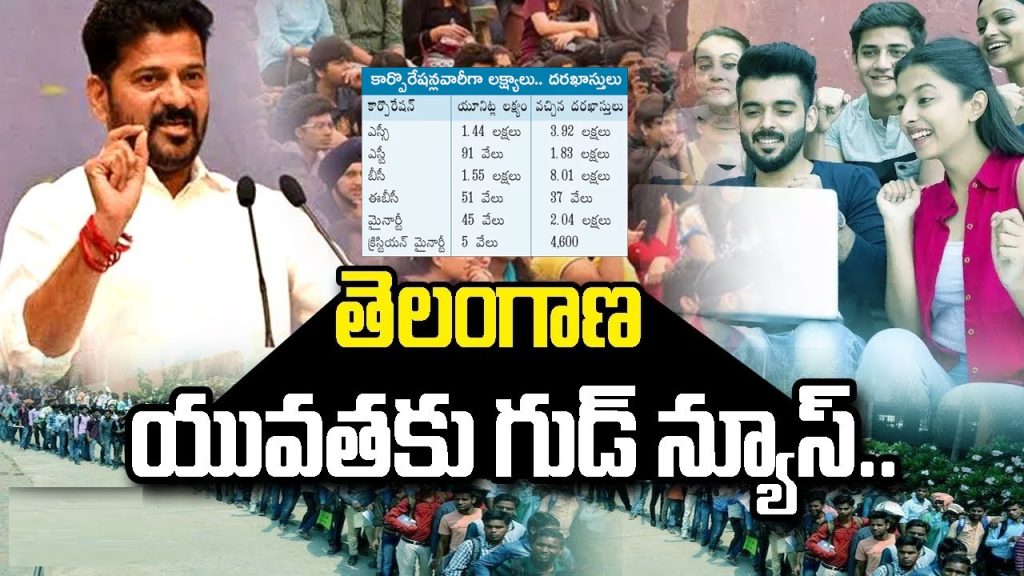

Application Statistics: A Snapshot of Demand

The Rajiv Yuva Vikasam Scheme 2025 has garnered overwhelming interest, with approximately 16.2 lakh applications received statewide. The government aims to select 5 lakh beneficiaries, offering units worth up to ₹4 lakh in some cases. Here’s a breakdown of the application trends by loan category and community:

- Loans up to ₹1 Lakh: Fewer applications than expected, indicating lower demand for micro-loans.

- Loans from ₹1 Lakh to ₹2 Lakh: High demand, reflecting the popularity of medium-scale ventures.

- Loans from ₹2 Lakh to ₹4 Lakh: Significant interest, with 3.24 lakh applications for 20,000 SC corporation units and 6.66 lakh applications for 22,000 BC corporation units.

- EBC Category: 32,000 applications for 8,000 units, showcasing strong participation from economically backward classes.

The high volume of applications underscores the scheme’s relevance and the pressing need for financial support among Telangana’s youth.

Role of Technology in Ensuring Transparency

The Telangana government is leveraging technology to ensure a fair and efficient selection process. Key measures include:

- Database Cross-Verification: Applications are cross-checked against welfare corporation databases to identify and eliminate ineligible candidates, such as those who have previously received benefits.

- Aadhaar-Linked Bank Account Validation: Bank account details are verified using Aadhaar to prevent fraudulent submissions.

- Automated Screening: Advanced algorithms filter applications based on eligibility criteria, reducing manual errors and expediting the process.

These technological interventions enhance transparency, minimize discrepancies, and ensure that financial aid reaches deserving candidates.

District-Level Implementation: A Case Study of Peddapalli

In Peddapalli district, the Rajiv Yuva Vikasam Scheme is in its final stages of beneficiary selection. Mandal Parishad Development Offices (MPDOs) and municipal offices have meticulously reviewed applications, forwarding eligible candidates’ details to bankers for further processing. Bankers play a pivotal role in assessing the financial viability of proposed ventures, ensuring that loans are allocated to sustainable projects.

Although the district collector set a deadline of April 14, 2025, for finalizing the beneficiary list, the process has faced slight delays due to the high volume of applications. Once approved by the in-charge minister, sanction letters will be distributed to beneficiaries on June 2, 2025, aligning with the state-wide rollout.

Support and Helpline for Applicants

The Telangana government has established robust support channels to assist applicants throughout the process. For any queries or technical issues, candidates can reach out via:

- Email: helpdesk.obms@cgg.gov.in

- Telephone: 040-23120334

- Official Website: tgobmms.cgg.gov.in

These resources ensure that applicants receive timely assistance, whether they face issues with the online portal, document submission, or eligibility concerns.

Impact of the Rajiv Yuva Vikasam Scheme

The Rajiv Yuva Vikasam Scheme 2025 is poised to make a significant impact on Telangana’s socio-economic landscape. By empowering 5 lakh youth with financial aid and subsidies, the scheme will:

- Create Employment Opportunities: Enable the establishment of diverse businesses, from retail to agriculture, generating direct and indirect jobs.

- Promote Financial Inclusion: Provide marginalized communities with access to formal financial systems, fostering long-term economic stability.

- Boost Local Economies: Stimulate economic activity in rural and urban areas through the growth of small and medium enterprises.

- Encourage Innovation: Support young entrepreneurs in launching innovative ventures, contributing to Telangana’s reputation as a hub of entrepreneurship.

With a budget of ₹6,000 crore and a commitment to grounding units within three months, the scheme is a testament to Telangana’s dedication to youth empowerment and economic progress.

Tips for a Successful Application

To maximize your chances of securing financial assistance under the Rajiv Yuva Vikasam Scheme 2025, consider the following tips:

- Prepare a Clear Business Plan: Outline a feasible and sustainable business idea to strengthen your application.

- Ensure Accurate Documentation: Double-check all documents for accuracy and completeness before submission.

- Meet Deadlines: Submit your application by April 4, 2025, to avoid missing out on this opportunity.

- Seek Guidance: Contact the helpline or visit the official portal for clarification on any doubts.

- Leverage Counseling Sessions: Use the counseling process to refine your business plan and align it with the scheme’s objectives.

By following these steps, you can enhance your application’s chances of approval and take a significant step toward entrepreneurial success.

Conclusion: Seize the Opportunity with Rajiv Yuva Vikasam Scheme 2025

The Rajiv Yuva Vikasam Scheme 2025 is a transformative initiative that empowers Telangana’s youth to achieve financial independence and contribute to the state’s economic growth. With loans of up to ₹3 lakh, generous subsidies, and a transparent selection process, the scheme offers a golden opportunity for SC, ST, BC, and Minority youth to turn their entrepreneurial dreams into reality. By applying online before April 4, 2025, and preparing a strong business plan, you can unlock the financial support needed to launch your venture.

Don’t miss this chance to be part of Telangana’s entrepreneurial revolution. Visit tgobmms.cgg.gov.in today, complete your application, and take the first step toward a brighter, self-reliant future.