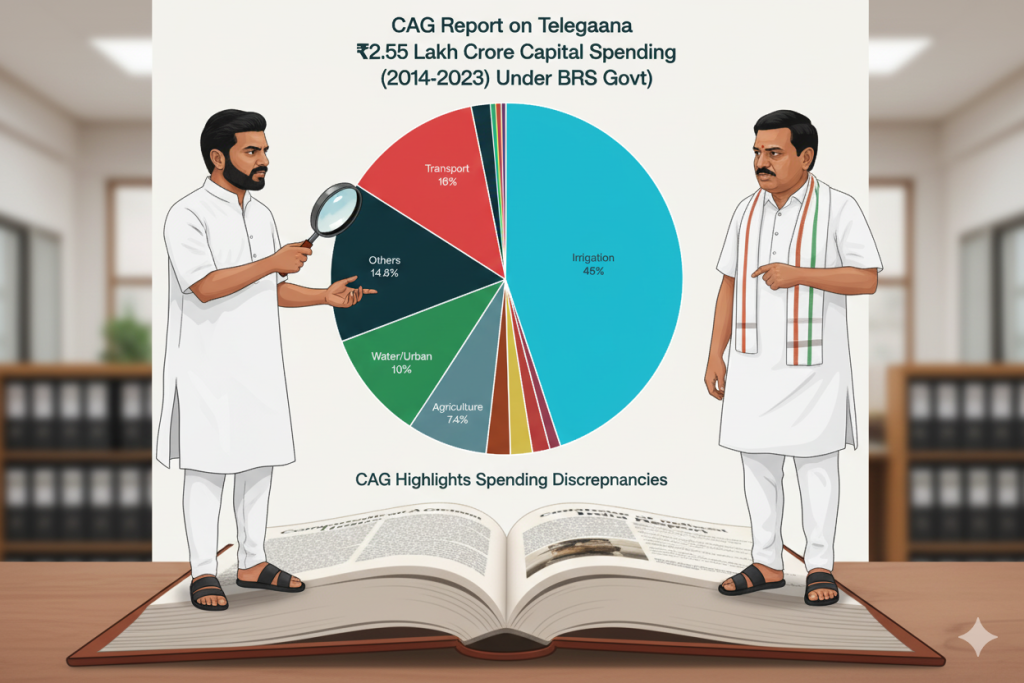

The recently released Comptroller and Auditor General (CAG) report on Telangana’s fiscal management during the Bharat Rashtra Samithi (BRS) regime from 2014 to 2023 has unveiled a startling pattern of development spending that prioritized irrigation infrastructure over critical social sectors. The comprehensive analysis reveals how 45% of every ₹100 spent on capital projects went to irrigation (primarily the controversial Kaleshwaram project), while schools received merely ₹1 and hospitals got only ₹2 per ₹100 of development expenditure.

Capital expenditure allocation per ₹100 in Telangana (2014-2023) showing irrigation received ₹45 while education got only ₹1

The Stark Reality of Development Fund Allocation

Capital Expenditure Breakdown: A Tale of Skewed Priorities

Over nine years of BRS governance, Telangana spent a massive ₹2.55 lakh crore on capital projects, with the allocation pattern revealing concerning priorities that favored large-scale infrastructure projects over essential social services. The CAG data shows that irrigation and flood control received ₹1.15 lakh crore (45%) of the total capital expenditure, predominantly channeled into the Kaleshwaram Lift Irrigation Project.

This allocation pattern becomes even more troubling when compared to social sector spending. Education infrastructure received a meager ₹2,550 crore (1%), while health infrastructure was allocated ₹5,500 crore (2%). Transport and roads, the second-largest recipient, received ₹16 per ₹100, highlighting the government’s emphasis on physical infrastructure over human development.

Pie chart showing 45% of Telangana’s capital expenditure went to irrigation (Kaleshwaram) while health got only 2%

Revenue Expenditure: Committed Costs Dominated Spending

The revenue expenditure pattern further illustrates the fiscal challenges faced during the BRS regime. For every ₹100 of revenue expenditure, ₹30 went to salaries, pensions, and interest payments – representing committed expenditure that left limited fiscal space for discretionary spending. Education operations, primarily teacher salaries, consumed ₹20 per ₹100, while health operations received only ₹7 per ₹100 of revenue expenditure.

The heavy burden of committed expenditure severely constrained the government’s ability to invest in quality improvements and infrastructure development in critical sectors like health and education.

Kaleshwaram Project: A Financial Albatross

Project Cost Escalation and Economic Viability Crisis

The Kaleshwaram Lift Irrigation Project, touted as the world’s largest multi-stage lift irrigation scheme, has become synonymous with fiscal mismanagement and cost overruns. Originally estimated at ₹38,500 crore under the previous PCSS project, the cost escalated to ₹81,911 crore when re-engineered as Kaleshwaram, and the CAG now projects the final cost could exceed ₹1.47 lakh crore.

The CAG report delivers a damning verdict on the project’s economic viability, calculating a Benefit-Cost Ratio (BCR) of just 0.52, meaning every rupee spent yields only 52 paise in returns. This falls far below the minimum BCR of 1.0 required for project viability, indicating the project was “ab-initio, economically unviable”.

Massive Operational Cost Burden

Beyond the capital cost crisis, Kaleshwaram saddles the state with enormous operational expenses. The project requires 8,459.10 MW of power – representing 46.82% of Telangana’s total installed capacity – resulting in an annual electricity bill of approximately ₹10,000 crore. The total annual operational cost, including maintenance and debt servicing, could reach ₹25,000 crore per year.

Delivery Failure: Promises vs Reality

Despite the massive expenditure, Kaleshwaram’s delivery has been abysmal. The CAG found that by March 2022, only 40,888 acres of new command area had been created against the targeted 18.26 lakh acres. This represents a stunning failure rate of over 97%, with the cost per acre of irrigation coming to ₹11.45 lakh compared to ₹93,000 achieved by previous governments.

Social Sector Neglect: Health and Education Underfunding

Healthcare Infrastructure Crisis

The BRS government’s neglect of healthcare infrastructure is evident in both absolute numbers and comparative analysis. Health expenditure as a percentage of total spending declined from 4.67% in 2018-19 to 4.57% in 2022-23, falling far short of the National Health Policy 2017 target of 8% of the state budget. The CAG audit covering 2016-2022 found that health sector expenditure ranged between 2.53% to 3.47% – less than 50% of the specified norm.

Capital expenditure on health showed a declining trend, dropping from 17.6% of total expenditure in 2018-19 to 9.3% in 2022-23. This underinvestment has left Telangana’s healthcare system struggling to meet growing demands, particularly evident during the COVID-19 pandemic when health’s share of capital expenditure barely touched 3%.

Education Infrastructure Stagnation

Educational infrastructure received equally inadequate attention, with only 1% of capital expenditure allocated to schools and educational facilities. While the government spent ₹20 per ₹100 of revenue expenditure on education, this primarily covered teacher salaries rather than infrastructure development. The stark contrast between operational expenses and capital investment has resulted in a deteriorating educational infrastructure that fails to support quality learning environments.

Off-Budget Borrowing: The Hidden Debt Crisis

Concealed Financial Obligations

One of the most alarming findings of the CAG report relates to off-budget borrowings (OBB) totaling ₹1,18,629 crore that were concealed from legislative oversight. These borrowings, primarily through Special Purpose Vehicles like the Kaleshwaram Irrigation Project Corporation Limited (KIPCL), allowed the government to circumvent fiscal responsibility limits while hiding the true extent of the state’s debt burden.

The CAG noted that 64.3% of Kaleshwaram project expenditure (₹55,807.86 crore out of ₹86,788.06 crore) was financed through off-budget borrowings. This practice violates the principle of legislative control over public finances and creates hidden liabilities that future generations must service.

Debt Sustainability Crisis

When off-budget borrowings are included, Telangana’s debt-to-GSDP ratio jumps to 35.64%, significantly exceeding the 25% limit prescribed under the state’s Fiscal Responsibility and Budget Management Act and the 29.70% ceiling recommended by the 15th Finance Commission. The total outstanding debt increased from ₹95,598 crore in 2014-15 to ₹5,07,807 crore by 2022-23 – a staggering 500% increase.

Interest Payment Burden: Crippling Future Finances

Exponential Growth in Debt Servicing

The BRS government’s borrowing spree has created a crushing debt servicing burden that severely constrains fiscal flexibility. Interest payments grew from ₹5,227 crore in 2014-15 to ₹21,821 crore in 2022-23 – a 317% increase that reflects the unsustainable debt accumulation. By 2023-24, interest payments had ballooned to 28.2% of the state’s own revenue when off-budget borrowings are included.

This exponential growth in debt servicing costs has created a vicious cycle where borrowing becomes necessary to service existing debt, further deteriorating the state’s fiscal position. The CAG warned that the state government will have to repay ₹2,67,018 crore as principal and interest on market borrowings over the next 10 years (by 2032-33).

Impact on Development Spending

The rising debt servicing burden has crowded out development spending, creating a situation where nearly 45% of revenue receipts in 2023-24 were consumed by salaries, pensions, and interest payments alone. This leaves minimal fiscal space for essential public services, infrastructure maintenance, and new development initiatives.

Constitutional and Legal Violations

Excess Expenditure Without Legislative Approval

Perhaps the most serious finding of the CAG report relates to excess expenditure of ₹2,88,811 crore between 2014-15 and 2021-22 without proper legislative authorization. This massive unauthorized spending violates constitutional principles of legislative control over public finances and represents a fundamental breach of democratic governance norms.

The CAG noted that this excess expenditure “vitiated the system of budgetary and financial control and encouraged financial indiscipline in the management of public resources”. Despite multiple meetings of the Public Accounts Committee, none of these unauthorized expenditures were regularized through proper legislative processes.

Administrative Irregularities

The Kaleshwaram project exemplifies the administrative chaos that characterized BRS financial management. Instead of seeking single comprehensive approval for the project, the government issued 73 separate administrative approvals totaling ₹1.10 lakh crore. This piecemeal approach prevented proper oversight and enabled cost escalations without adequate scrutiny.

Economic Impact and Development Outcomes

Irrigation Efficiency Comparison

The BRS government’s irrigation spending, despite its massive scale, delivered poor value for money. The cost per acre of new irrigation was ₹11.45 lakh compared to ₹93,000 achieved by previous administrations – representing a 1,130% increase in unit costs. This dramatic deterioration in efficiency highlights fundamental flaws in project planning and execution.

The previous governments had created 58 lakh acres of irrigated area by spending much less per acre, while the BRS government managed to create only 15.8 lakh acres despite spending ₹1.81 lakh crore over 10 years.

Social Development Deficit

The skewed spending priorities have created significant deficits in social development outcomes. With health spending far below national targets and education infrastructure receiving minimal investment, Telangana lagged in building the human capital necessary for sustained economic growth. The state’s per capita health budget, while claimed to be among the highest, failed to translate into proportionate infrastructure development.

Regional Disparities and Rural Development

Urban-Rural Development Imbalance

The BRS government’s focus on mega projects like Kaleshwaram came at the expense of balanced regional development. While significant resources were allocated to large-scale irrigation infrastructure, rural development received only ₹2.2 per ₹100 of capital expenditure. This imbalance has perpetuated regional disparities and failed to address the development needs of rural communities effectively.

| Expenditure Type | Irrigation Focus | Education | Health | Key Insight |

|---|---|---|---|---|

| Capital Expenditure | ₹45 per ₹100 (Mainly Kaleshwaram) | ₹1 per ₹100 (Schools infrastructure) | ₹2 per ₹100 (Hospital infrastructure) | 45% went to irrigation projects |

| Revenue Expenditure | ₹3 per ₹100 | ₹20 per ₹100 (Teacher salaries) | ₹7 per ₹100 (Operations) | 30% went to committed expenditure |

Infrastructure Development Patterns

Transport and roads, the second-largest recipient of capital expenditure at ₹16 per ₹100, primarily benefited urban areas and major transportation corridors. Rural connectivity and basic infrastructure in remote areas received inadequate attention, contributing to persistent rural-urban development gaps.

Fiscal Governance and Transparency Issues

Budget Management Failures

The CAG report highlights systematic failures in budget management and fiscal discipline during the BRS regime. Revenue receipts consistently fell short of targets, with the government resorting to excessive borrowing to bridge fiscal gaps. In 2023-24, borrowings exceeded budget estimates by 118.94%, indicating poor financial planning and unrealistic revenue projections.

Lack of Financial Transparency

The concealment of off-budget borrowings from budget documents violated the 15th Finance Commission’s recommendations for fiscal transparency. This lack of transparency prevented proper legislative oversight and public accountability, creating conditions for fiscal mismanagement.

Long-term Consequences and Future Challenges

Intergenerational Debt Burden

The BRS government’s borrowing spree has created a significant intergenerational burden, with future administrations required to service debt equivalent to several years of state revenue. The annual debt servicing requirement of approximately ₹25,000-30,000 crore will constrain development spending for decades.

Infrastructure Maintenance Crisis

The focus on new project construction without adequate provision for maintenance has created a looming infrastructure crisis. Projects like Kaleshwaram require substantial annual maintenance expenditure, but the government failed to create sustainable financing mechanisms for long-term operational costs.

Recommendations and Way Forward

Fiscal Consolidation Priorities

Based on the CAG findings, Telangana needs urgent fiscal consolidation focusing on debt reduction, elimination of off-budget borrowings, and restoration of fiscal discipline. The current Congress government has indicated its intention to avoid off-budget borrowings and focus on sustainable financing mechanisms.

Social Sector Investment Revival

Immediate attention to health and education infrastructure is essential to address the development deficits created during the BRS regime. This requires not just increased budgetary allocations but also improved efficiency in project execution and outcomes measurement.

Project Viability Assessment

All ongoing and planned infrastructure projects need rigorous cost-benefit analysis to avoid repeating the Kaleshwaram mistakes. Projects with BCR below 1.0 should be reconsidered or redesigned to ensure optimal use of public resources.

Conclusion: Lessons from a Decade of Misplaced Priorities

The CAG report on Telangana’s finances during 2014-2023 serves as a cautionary tale about the consequences of misplaced development priorities and fiscal indiscipline. The BRS government’s obsession with mega infrastructure projects, particularly Kaleshwaram, came at the enormous cost of social sector development and fiscal sustainability.

The stark reality that ₹45 out of every ₹100 of development money went to irrigation while schools got only ₹1 and hospitals ₹2 represents a fundamental failure of development strategy. This pattern not only created massive debt burdens but also neglected the human capital investments essential for long-term economic growth and social progress.

The hidden debt crisis through off-budget borrowings, constitutional violations in expenditure management, and the creation of economically unviable projects have left Telangana with a legacy of fiscal challenges that will require years of disciplined governance to address. The experience underscores the critical importance of balanced development priorities, fiscal transparency, and rigorous project evaluation in state governance.

Moving forward, Telangana’s development trajectory will depend on the current and future governments’ ability to learn from these costly mistakes and reorient spending toward sustainable, people-centric development that truly improves lives rather than merely creating impressive infrastructure monuments