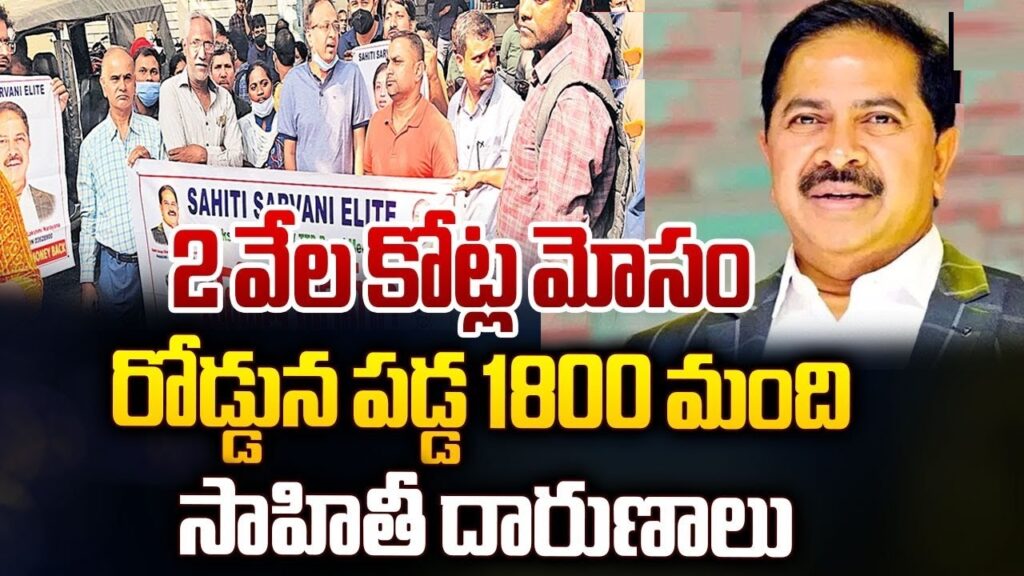

The Sahiti Infra scam has sent shockwaves through India’s real estate industry, revealing a well-orchestrated fraud that swindled unsuspecting investors out of a staggering Rs. 1800 crore. The scam, spearheaded by Sahiti Infra, lured potential buyers with promises of lucrative pre-launch offers on various projects, only to misuse the funds for personal gain. Here, we dive into the details of this colossal fraud that has left many victims in its wake.

The Beginnings of the Sahiti Infra Scam

In 2019, Sahiti Infra laid the foundation for what would later become one of the biggest real estate frauds in recent history. Under the guise of pre-launch offers, the company claimed it would build 32 floors in 10 towers on 23 acres of land located in Ameenpur. This ambitious project drew the attention of 1,752 buyers, who collectively invested Rs. 504 crore into the venture. However, as time passed and construction failed to begin, investors grew suspicious.

By August 2022, frustrated victims took action and filed complaints with the Hyderabad CCS Police against Sahiti Infra and its Managing Director, Budati Lakshminarayana. The investigation that followed uncovered shocking truths about the scam.

The Scope of the Scam: Nine Projects in Focus

Sahiti Infra’s fraudulent activities extended beyond just one project. The company orchestrated pre-launches for nine different projects, collecting massive sums from investors without any intention of delivering on their promises. Among the most notable projects were:

- Sahiti Swadha Commercial Project in Nanakramguda: Rs. 65 crore collected from 69 investors.

- Sishta Abode in Kompally: Rs. 79 crore taken from 248 people.

- Sahiti Green in Kompally: Rs. 40 crore scammed from 153 buyers.

- Sahiti Sitara Commercial in Gachibowli Rolling Hills: Rs. 269 crore extracted from 135 investors.

- Sahiti Mahita Centro in Banjara Hills: Rs. 22 crore from 44 people.

- Anand Fortune in Nizampet: Rs. 46 crore from 120 investors.

- Sahiti Kruti Blossom in Gachibowli: Rs. 16 crore stolen from 25 buyers.

- Sahiti Sudeeksha in Mokila: Rs. 22 crore from 30 investors.

- Ruby Constructions in Bachupally: Rs. 69 crore taken from 43 people.

Unveiling the Truth: Police Investigations and Arrests

As the Hyderabad CCS Police dug deeper into Sahiti Infra’s activities, they discovered that the company’s directors had collected Rs. 1164 crore across various projects. Worse, the firm had secured little to no legal permissions for the promised constructions. Of the 23 acres in Ameenpur, only 10 acres were actually purchased. The rest of the land was tied up in dubious sales agreements, with some even being unregistered.

The investigation also revealed that the funds collected from one project were used to finance other schemes. This Ponzi-style operation ultimately collapsed, leaving hundreds of investors high and dry. By the time law enforcement got involved, more than 50 cases had been registered against Sahiti Infra across multiple districts, including Cyberabad, Hyderabad, and Medak.

Enforcement Directorate’s Involvement: Property Seizures Begin

The Enforcement Directorate (ED) soon stepped in, launching its own investigation into Sahiti Infra under the Prevention of Money Laundering Act (PMLA). On Thursday, the ED issued orders to attach properties worth Rs. 161 crore, belonging to Sahiti Infra and its key figures, including Managing Director B. Lakshminarayana and former director S. Purnachandra Rao.

The ED’s investigation revealed that Sahiti Infra had defrauded around 655 buyers of Rs. 248 crore, promising to deliver flats and villas that never materialized. The company collected over Rs. 250 crore for its ‘Sarvani Elite’ project in Ameenpur village, but no construction was initiated, despite the project being launched three years prior.

Omics International: A Key Player in the Fraud

The ED also uncovered Sahiti Infra’s financial dealings with Omics International Limited. In 2020, Sahiti Infra entered an agreement with Omics International to develop nine acres of land in Ameenpur Village. While Sahiti paid Rs. 32 crore for the deal, Omics International only transferred two acres, valued at Rs. 3 crore. The remaining Rs. 29 crore was never returned to Sahiti Infra, prompting the ED to consider Omics International a participant in the crime.

Misappropriation of Funds: The Role of S. Purnachandra Rao

The ED’s probe further revealed the role of former Sahiti Infra director, S. Purnachandra Rao, in misappropriating customer funds. Rao, who headed the sales and marketing team, siphoned off Rs. 126 crore, including Rs. 50 crore collected in cash between 2018 and August 2020. After resigning from Sahiti Infra, Rao acquired numerous immovable properties in his name and the names of his family members, laundering the proceeds of the crime.

Conclusion: A Cautionary Tale for Real Estate Investors

The Sahiti Infra scam serves as a stark reminder of the dangers that lurk in the real estate market. Investors must exercise extreme caution when entering pre-launch deals and thoroughly vet the companies behind such projects. For the victims of Sahiti Infra, the path to justice is long, but with law enforcement agencies like the CCS and ED on the case, there is hope that the fraudsters will be held accountable.

This Rs. 1800 crore scam is a wake-up call for all stakeholders in the real estate industry to demand greater transparency, stricter regulations, and more rigorous enforcement to prevent such large-scale fraud from happening in the future.