Wipro Ltd, an Indian IT services company, reported that its stocks seemed to collapse by almost half on a few apps for stock exchange. This gap is due to reconstructing pertaining to some corporate action: a bonus share issue in the ratio of 1:1. There would be some confusion with the adjustment, but the action is consistent with Wipro’s plan to improve liquidity and shareholder value. We will consider the other side of the picture and find out why this price drop is not what it looks like.

Bonus Shares and Its Issues and How it Is Useful for the Company

Bonus shares increase the number of equity shares in issue by providing additional shares to the current shareholders. It should be noted that although the number of shares increases the price of each share decreases in a proportionate manner so that the value of the company does not change. In effect of the bonus share issue, Wipro’s shareholders were paid one bonus share for each share held, thus doubling the number of shares issued.

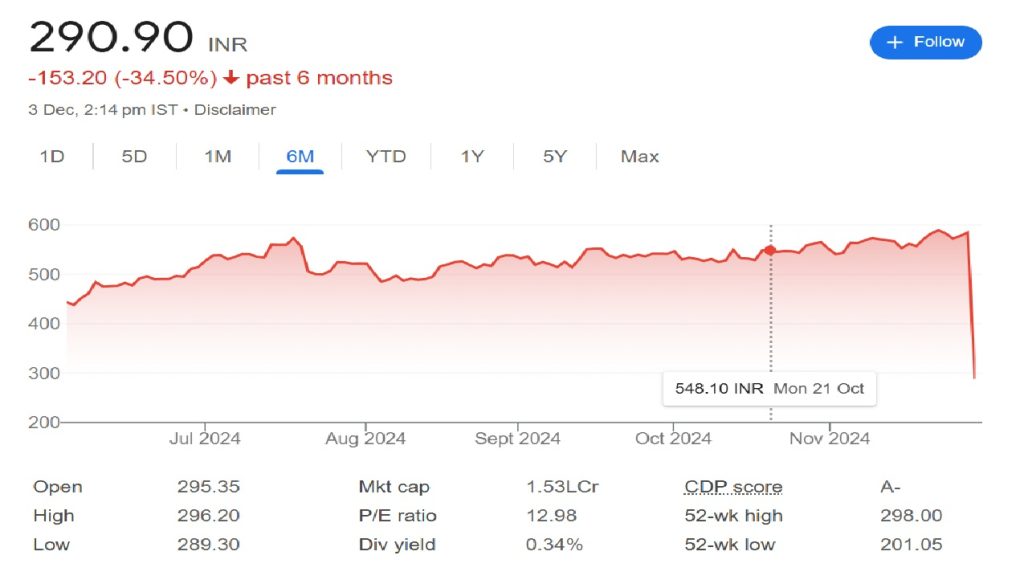

Adjustment for Prices: On the day that Wipro bonus shares were issued its share price on the Bombay Stock Exchange (BSE) opened at ₹295.50 after adjusting for the price split, donned at 1.09%. But in comparison to the unadjusted price of ₹584.55 issued the previous day, the price would appear to have dropped by fifty-nine point forty five percent. This error appears to have occurred due to the fact certain trading applications were using the unadjusted price for comparison purposes.

Liquidity and Shareholder’s Value: The rationale behind the issuance of bonus shares is to enhance liquidity and for the stock to be less expensive for retail investors. Employing free reserves and surplus cash introduce to shareholders throughout the company in the case of Wipro bonus shares without changing the market value of the company.

The Following are Relevant Features of Wipro Share Bonus

The shareholders were made happy wiht this last round of bonus issue by Wipro. Here is a comprehensive list of those bonus details:

Bonus Ratio: Issued in the proportion of 1:1, meaning one bonus share was issued for every existing share.

Free Reserves: As at 30 September Wipro had free reserves of ₹56,808 crore which comprised among others its securities premium account and capital redemption.

Paid Up Capital after the payment of Bonus: After the payment, Wipro’s paid up equity share capital shall increase and stand at an estimated figure of around ₹20,926 crore made up of approximately 10.46 billion equity shares at a nominal value of ₹2 each.

This bonus issue is noteworthy in that it is Wipro’s first bonus issue in 2019 and, therefore, recalls its beginnings as a part of India’s IT landscape.

The bonus share issues by Wipro: 1995, 1997, 2005, 2007, 2010, 2017 and 2019: A History

The company’s profits have never been built without trust and so Wipro has always been quite known to maintain alignment between its bonus shares and profits with the expectation of shareholder trust:

2019: A bonus issue of 1:3 (i.e. one bonus share for every three shares held).

2017: solicited another bonus issue of 1:1.

2010: Two thirds time including the bonus issuance period were also issued bonus shares in the ratio of 2:3.

2005, 2004: The bonus shares were issued in the ratios of 1:1 and 2:1 respectively.

1997 and 1995: In addition to the 1:1 and 2:1 ratios for 1992, there were also a number of other bonus.

2:1 was allocated multiple times. The two were issued in the bonds themselves.

Wipro’s history of bonus issues dates back as far as 1992 and traces the firm’s path to the present as well as forecasts a consistent growth rate to derive shareholder value over the decades.

The Iliad of 50% loss

The harsh correction, which in fact the term 50% decline does not do justice to it and Wipro stock price saw for no thirty thousand reasons was indeed well expected. An adjustment in the later years has begun as onset but because the closing price preceding the adjustment sustained trade inequitably throughout caused some grievous confusion among traders. Hence It has to be truly devoid of bias.

For the sake of clarity:

Record date — the date for commencement of the registered shareholders of the bonus shares.

Ex-Bonus date – is the date from which the share dealing began without the entitlement of bonus shares.

Wipro’s Current Outlook and Market Performance

That said, when applied to the wipro share price, it does matter. As this IT giant does have specific client problems, cross sector trends are relatively weak. On the positive side, there seems to be some pick up in the BFSI (Banking, Financial Services and Insurance) sector performance which augurs well for going ahead quarters.

On the other side, Wipro’s share price has been suffering within the context of broader market corrections which ruled over the last few months. In the context, it is worth mentioning that Wipro has a new CEO Srini Pallia, besides being competitively valued. Analysts are of the view that this makes for good risk reward situation for investors.

Conclusion

There is nothing to be worried about when one observes Wipro pay some of its dividends which has been a case for them before. Indeed, it does reflect the state of bonus shares rather than the company value diving. This situation emphasizes once again Wipro’s intrest towards increase of the shareholders wealth in the company especially in liquidity terms.

For investors, there would be imperative to understand the intricacies of bonus issues and other corporate actions during and after completion of the takeover bid. Considering Wipro bonus share issue in the context of Continuing operations and Opportunities of Wipro going forward, it indicates the strength of Wipro with regards to its finances and Nifty India perspective.