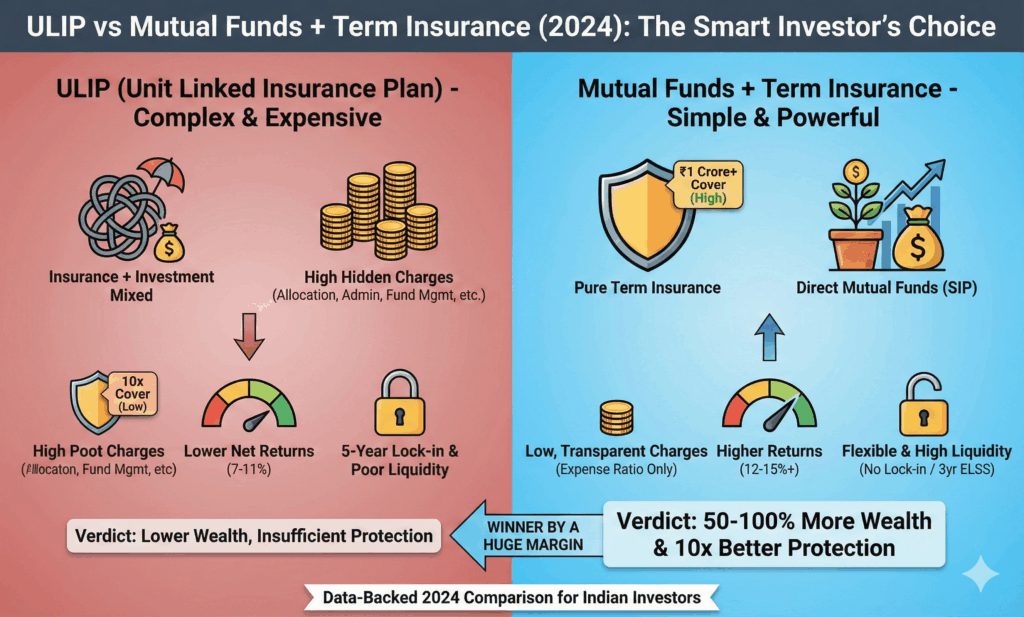

In 2026, thousands of Indian investors are still being sold Unit Linked Insurance Plans (ULIPs) as the “perfect” combination of life insurance and wealth creation. Banks, relationship managers, and cold callers push ULIPs aggressively because of high commissions. But when you run the actual numbers, the truth is shocking: ULIPs deliver lower returns, pathetic insurance cover, sky-high hidden charges, and poor liquidity compared to the simple strategy of buying pure mutual funds + a separate term insurance plan.

This in-depth 2026 comparison reveals exactly why separating insurance and investment is the smartest financial move for most Indians today – backed by real calculations, latest tax rules, and performance data.

What Exactly is a ULIP (Unit Linked Insurance Plan)?

A ULIP is a hybrid financial product that tries to give you two things in one policy:

- Life insurance cover

- Market-linked investment (equity, debt, or hybrid funds)

You pay a fixed premium every year (or month). A portion goes toward insurance, another portion pays multiple charges, and only the leftover amount gets invested in funds of your choice.

On paper, it sounds convenient. In reality, you end up with neither good insurance nor good investment growth.

Mutual Funds + Term Insurance: The Clean and Powerful Alternative

Instead of mixing the two goals, smart investors today:

- Buy a pure term life insurance policy for high coverage at rock-bottom premiums.

- Invest the remaining money systematically through SIP in equity mutual funds (especially ELSS for tax saving).

This separation gives you:

- 10–50 times higher life cover

- Higher net returns

- Complete flexibility and transparency

- Far lower charges

Key Differences: ULIP vs Mutual Funds + Term Plan (2026 Updated)

| Feature | ULIP | Mutual Funds + Term Insurance |

|---|---|---|

| Lock-in Period | 5 years minimum | 3 years only for ELSS; others no lock-in |

| Liquidity | Very poor – heavy surrender charges | High – exit load max 1% in first year |

| Life Cover | Usually just 10x annual premium | Easily 1–2 crore at the same total cost |

| Charges | 7–9 different charges (can eat 30–40% early) | Only expense ratio 0.5–1.5% + GST |

| Returns (10-yr avg) | 7–11% net after charges | 12–15%+ in good equity funds |

| Transparency | Very low – hidden charges | 100% transparent portfolio & daily NAV |

| Tax on Maturity | Tax-free if annual premium ≤ ₹2.5 lakh | LTCG 12.5% above ₹1.25 lakh (equity funds) |

| Flexibility | Cannot pause premiums | Can pause, increase, or stop SIP anytime |

Hidden Charges in ULIPs That Destroy Your Wealth

Most people never realize how many charges ULIPs deduct before your money even reaches the market:

- Premium Allocation Charge – 5–20% in early years

- Policy Administration Charge – Up to ₹500–600/month

- Fund Management Charge – Up to 1.35% per year

- Mortality Charge – For the tiny insurance cover

- Surrender/Discontinuance Charge – Up to ₹6,000 if you exit early

- Switching Charge – For changing funds

- GST @18% on all the above charges

Because of these charges, it can take 6–8 years just to break even in a ULIP.

In direct mutual funds, you only pay a low expense ratio (0.5–1.5%) and nothing else.

Real-Life Example: ₹1.2 Lakh Annual Investment (2026 Numbers)

Let’s take a 35-year-old non-smoker male investing ₹10,000 per month (₹1.2 lakh per year) for 15 years.

Option A: HDFC Life Click 2 Wealth ULIP (100% Equity Fund)

- Annual Premium: ₹1,20,000

- Life Cover Received: ₹12–15 lakh only (10x rule)

- Total Charges in first 5 years: ~₹2.5–3 lakh

- Expected Gross Return: 12%

- Net Return to Investor after all charges: ~8.5–9.5%

- Maturity Value after 15 years (pre-tax): ~₹38–42 lakh

- Effective Life Cover: Laughably low for the premium paid

Option B: Pure Term Plan + Direct Equity Mutual Fund SIP

- Pure Term Insurance (1 Crore cover, 30-year term): ₹11,000–13,000 per year

- Remaining Amount for SIP: ₹1,07,000–1,09,000 per year

- Invested in a good Flexi-cap/ELSS direct fund @13–14% long-term average

- Expense Ratio: 0.8–1%

- Maturity Value after 15 years: ₹58–68 lakh (post-tax)

- Life Cover: ₹1 Crore (8–10 times higher than ULIP)

Winner by a landslide: Mutual Fund + Term Insurance gives you 50–60% higher corpus and 8–10 times higher protection for the same yearly outflow.

Latest Tax Rules 2025–26: How They Affect ULIPs vs Mutual Funds

- ULIPs issued after 1 Feb 2021: If annual premium > ₹2.5 lakh → maturity proceeds taxable as capital gains.

- ULIPs issued before 1 Feb 2021: Still tax-free (grandfathered).

- Equity Mutual Funds: LTCG tax is now 12.5% on gains above ₹1.25 lakh per year (Budget 2026 change).

- ELSS Mutual Funds: Still eligible for ₹1.5 lakh deduction under Section 80C + only 3-year lock-in.

Even after the new 12.5% LTCG tax, pure mutual funds + term plan beat ULIPs by 3–6% net annual return.

Why Do Banks and Agents Still Push ULIPs Aggressively in 2026?

Simple: Commissions.

Agents and banks earn 15–40% commission in Year 1 and 5–7% every renewal year on ULIPs. Mutual funds (especially direct plans) give almost zero commission.

That’s why you’ll never hear “buy term + mutual fund” inside a bank branch.

When (If Ever) Should You Consider a ULIP in 2026?

Very rarely. Possible scenarios:

- You already crossed ₹2.5 lakh 80C limit and still want tax-free maturity (old ULIPs only).

- You are extremely undisciplined and need a forced 5-year lock-in.

- You want minor tax-free debt allocation inside insurance wrapper.

For 99% of salaried and business individuals in India, ULIPs make zero financial sense in 2026.

The Winning Strategy for 2026 and Beyond

- Calculate your exact life insurance need (10–20x annual income).

- Buy a pure online term plan (₹1–2 crore cover costs just ₹800–1,500/month).

- Start SIPs in 3–5 diversified equity funds (Flexi-cap, Mid-cap, Large & Mid, International).

- Use ELSS funds if you need Section 80C benefit (3-year lock-in only).

- Review and increase cover + SIP every 3 years.

This simple, transparent strategy has helped thousands of Indian investors build 3–5 crore portfolios while staying fully protected.

Final Verdict: ULIP vs Mutual Funds in 2026 India

- If you want high life cover → ULIPs fail miserably.

- If you want high returns → ULIPs underperform by 3–6% every year.

- If you want flexibility & transparency → ULIPs score zero.

The math is crystal clear in 2026: Separate your insurance and investment. Buy a pure term plan and invest the rest in direct mutual funds through SIP. Your family gets real protection, and your wealth grows 50–100% more over 15–20 years.

Stop falling for glossy ULIP brochures and high-pressure sales pitches. Choose financial freedom instead.

Start today – calculate your term insurance premium and open your first direct mutual fund SIP. Your future self (and your family) will thank you.