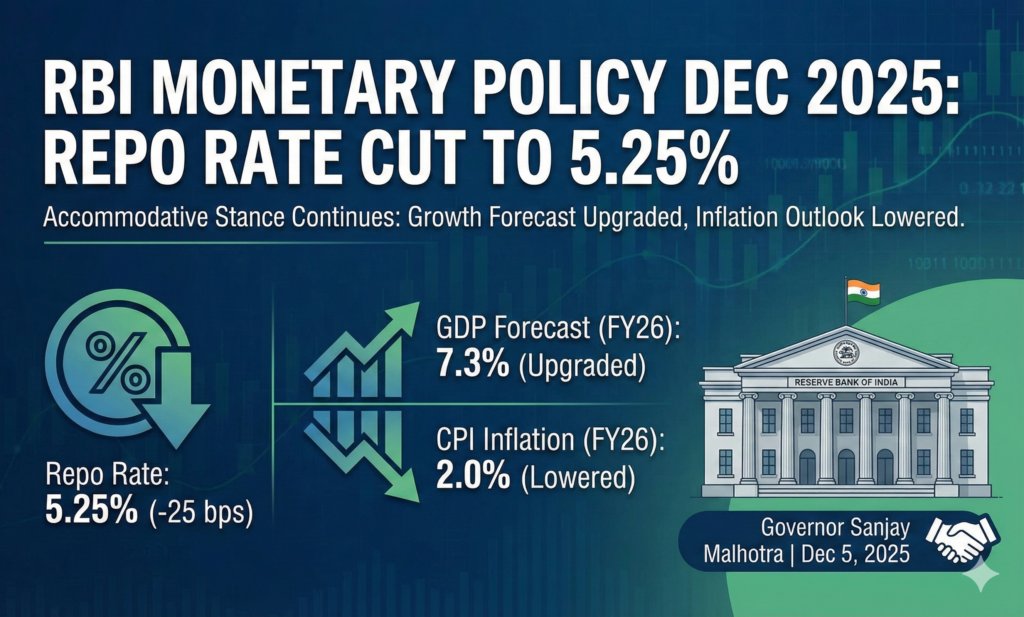

In a widely anticipated move, the Reserve Bank of India’s Monetary Policy Committee (MPC), headed by Governor Sanjay Malhotra, announced a 25 basis points repo rate cut on December 5, 2025, bringing the key policy rate down to 5.25%. The unanimous decision marks the continuation of an accommodative cycle that began earlier in the year and reflects India’s rare “Goldilocks” moment – robust economic growth coupled with historically low inflation.

This comprehensive review breaks down everything you need to know about the December 2025 RBI monetary policy, including the new repo rate impact, revised GDP and inflation forecasts, liquidity measures, transmission updates, and what it means for borrowers, investors, and the broader Indian economy.

Why RBI Cut Repo Rate to 5.25% in December 2025

The MPC cited 25 bps cut comes against the backdrop of headline CPI inflation plunging to an all-time low of just 0.3% in October 2025 and averaging only 1.7% in Q2 – well below the lower tolerance band of the 2–6% target. Food prices, which carry nearly 46% weight in the CPI basket, have been the primary driver behind this sharp disinflation.

At the same time, real GDP growth accelerated to 8.2% in Q2 FY2025-26 – the fastest in six quarters – powered by strong festive spending, GST rate rationalization, lower crude oil prices, and front-loaded government capex. This perfect combination of high growth and ultra-low inflation gave the RBI comfortable policy space to remain growth-supportive without reigniting price pressures.

Key rationale behind the 25 bps repo rate cut:

- Headline inflation significantly softer than earlier projections

- Core inflation (ex-food & fuel) easing and expected to stay anchored below 4%

- Benign food price outlook due to record kharif output and healthy rabi sowing

- Need to sustain growth momentum amid global uncertainties

New RBI GDP Growth Forecast 2025–26: Upgraded to 7.3%

The Reserve Bank sharply raised its real GDP growth projection for FY2025-26 from the earlier estimate to 7.3% – an upgrade of 50 basis points. The revision reflects stronger-than-expected H1 performance and continued domestic demand resilience.

Quarter-wise GDP projections:

- Q3 FY2025-26 → 7.0%

- Q4 FY2025-26 → 6.5%

- Q1 FY2026-27 → 6.7%

- Q2 FY2026-27 → 6.8%

Governor Malhotra highlighted that rural demand remains robust, urban consumption is recovering steadily, and private corporate investment is picking up on the back of healthy balance sheets and nearly 75% capacity utilization.

Revised CPI Inflation Projections: Down to 2.0% for FY2025-26

In one of the most aggressive downward revisions in recent memory, the RBI slashed its average CPI inflation forecast for the current financial year by 60 basis points to just 2.0%.

Updated quarter-wise inflation outlook:

- Q3 FY2025-26 → 0.6%

- Q4 FY2025-26 → 2.9%

- Q1 FY2026-27 → 3.9%

- Q2 FY2026-27 → 4.0%

The central bank stressed that underlying inflationary pressures are even lower, as rising precious metal prices added roughly 50 bps to headline numbers. Excluding this statistical effect, true inflation momentum is comfortably below the 4% target.

Impact of Repo Rate Cut on Home Loans, Car Loans & EMIs

With the repo rate now at 5.25%, banks have already started passing on the benefit. Since the beginning of the easing cycle (cumulative 100 bps cut), weighted average lending rates on fresh rupee loans have fallen by 69–78 bps, while outstanding loan rates declined by 63 bps.

What borrowers can expect now:

- Home loan interest rates likely to dip below 8% for many borrowers

- Car loans and personal loans to become cheaper in coming weeks

- Faster transmission expected because of surplus liquidity and competitive pressure

RBI’s Major Liquidity Injection Plans – ₹1 Lakh Crore OMO + $5 Billion Forex Swap

To ensure durable liquidity and strengthen monetary transmission, the Reserve Bank announced two big-bang measures:

- Open Market Operations (OMO) purchase of government securities worth ₹1 lakh crore in December 2025

- A 3-year dollar-rupee buy/sell swap of $5 billion this month

Governor Malhotra clarified that OMOs are meant for long-term (durable) liquidity, while regular repo/reverse repo operations under LAF manage day-to-day (transient) fluctuations. Both can happen simultaneously without contradiction.

System liquidity has remained in surplus mode (average ₹1.5 lakh crore) since the October policy, keeping money market rates closely aligned with the repo rate.

External Sector Resilience: Forex Reserves Cross $686 Billion

India’s external sector continues to display remarkable strength:

- Current account deficit narrowed to 1.3% of GDP in Q2

- Forex reserves at $686 billion (as of Nov 28, 2025) – providing over 11 months of import cover

- Robust services exports and record remittance inflows

- Gross FDI remains strong; net FDI rose sharply because of lower repatriation

Despite a wider merchandise trade deficit in October, the overall external position remains comfortable and resilient.

Banking Sector Health & Credit Growth Momentum

Scheduled commercial banks and NBFCs continue to exhibit strong fundamentals – high capital buffers, improving asset quality, and healthy profitability.

Key highlights:

- Total financial resource flow to commercial sector in FY26 so far: ₹20.1 lakh crore (vs ₹16.5 lakh crore last year)

- Combined bank + non-bank credit growth: 13% YoY

- Non-food bank credit growth accelerated to 11.4%

- Strong retail, services, MSME, and large industry lending

RBI’s New Year Push: Two-Month Drive to Clear Pending Customer Grievances

In a customer-centric initiative, the Reserve Bank announced a special two-month campaign starting January 1, 2026, to resolve all complaints pending with RBI Ombudsman schemes for over 30 days. Governor Malhotra urged all regulated entities to put customers at the core of their operations and reduce grievance redressal time.

What the December 2025 Repo Rate Cut Means for You

For homebuyers and borrowers → Expect lower EMIs and cheaper loans in the coming months For investors → Equity markets likely to cheer continued liquidity and growth support For depositors → Deposit rates may remain soft in the near term For the economy → Sustained 7%+ growth trajectory with inflation under control

Final Verdict: RBI Remains Growth-Supportive While Watching Global Risks

Despite an uncertain global environment – geopolitical tensions, divergent central bank policies, and high equity valuations – India’s domestic story remains exceptionally strong. The RBI has smartly used the inflation headroom created by bumper harvests and low crude prices to keep the pedal pressed on growth.

With the repo rate now at 5.25%, a neutral stance, and aggressive liquidity measures lined up, the central bank has clearly signaled that it will continue to nurture India’s economic momentum proactively while preserving macroeconomic and financial stability.

Stay tuned for the detailed RBI Monetary Policy Statement and the Governor’s press conference reactions as markets absorb India’s latest growth-supportive, low-inflation regime.