Introduction to PhysicsWallah’s Meteoric Rise in Edtech

PhysicsWallah (PWL), the edtech powerhouse founded by Alakh Pandey, continues to redefine affordable education in India. Since its blockbuster IPO in November 2025, investors and students alike have watched this unicorn closely. The company’s recent Q2 FY26 results, announced today on December 8, 2025, paint a picture of robust recovery and strategic expansion.

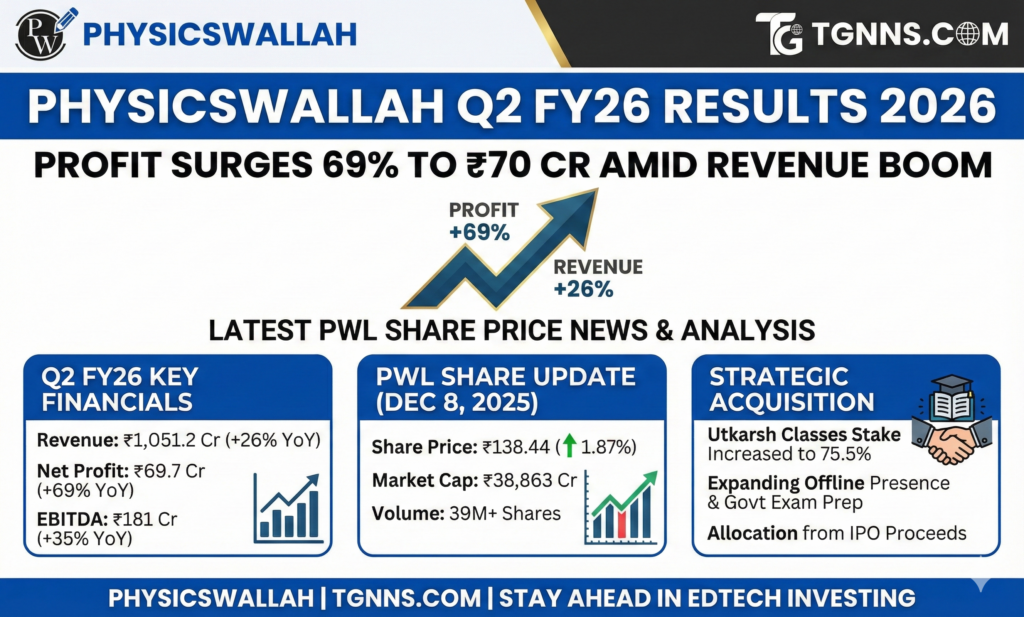

With net profit jumping 69% year-over-year (YoY) to ₹69.7 crore and revenue from operations climbing 26% to ₹1,051.2 crore, PhysicsWallah demonstrates resilience in a competitive landscape. This article dives deep into the PhysicsWallah Q2 results 2026, explores the latest PWL share news, and analyzes what these figures mean for shareholders and the broader edtech sector. Whether you’re tracking PWL share price today or eyeing long-term investments, these insights will equip you with the knowledge to stay ahead.

Founded in 2016 as a humble YouTube channel for physics tutorials, PhysicsWallah has evolved into a hybrid learning giant. It now serves over 13.7 million YouTube subscribers and boasts 4.5 million paid users across JEE, NEET, UPSC, and upskilling courses. The company’s blend of free content, affordable paid batches, and tech-enabled offline centers sets it apart from rivals like Byju’s and Unacademy. As PWL share latest news floods headlines post-results, one thing is clear: this edtech disruptor is not just surviving—it’s thriving.

PhysicsWallah IPO Recap: A Strong Debut Fuels Investor Optimism

PhysicsWallah’s journey to the stock market began with a much-anticipated IPO that opened on November 11, 2025, and closed on November 13. Priced at a band of ₹103 to ₹109 per share, the ₹3,480 crore issue comprised a fresh issuance of ₹3,100 crore and an offer for sale (OFS) of ₹380 crore. Despite initial skepticism in the edtech space—plagued by high-profile failures—the IPO garnered a subscription rate of 1.81 times overall. Qualified institutional buyers (QIBs) led the charge with 2.70 times oversubscription, while retail investors chipped in at 1.06 times.

The listing on November 18, 2025, proved spectacular. Shares debuted at a 33% premium on the BSE and NSE, opening at ₹143.10 against the upper price band of ₹109. This translated to a market capitalization of over ₹44,000 crore on day one, surpassing unlisted peers like upGrad and Unacademy. Early trading saw the stock touch a high of ₹162.05, rewarding long-term believers. However, volatility ensued; by late November, PWL shares dipped 15% from peaks, erasing ₹12,000 crore in market value amid broader market jitters.

Today, as Q2 results hit the wires, PWL share price today reflects renewed vigor. Trading around ₹138-140 on NSE as of midday December 8, 2025, the stock has rebounded 2.8% intraday, with a 52-week range of ₹121.22 to ₹162.05. Volume surged to over 30 million shares, signaling strong interest.

For investors searching “PWL share latest news,” this post-results pop underscores the company’s ability to deliver on growth promises. Analysts at Mehta Equities maintain a “Subscribe for Long-Term” rating, citing PhysicsWallah’s 10.4x FY25 sales multiple as aggressively priced yet justified by its 30 crore addressable student base—of which only 1.5% is monetized so far.

Unpacking PhysicsWallah Q2 FY26 Results: Key Financial Highlights

The Board of Directors’ meeting concluded just after 8:50 AM IST today, unveiling consolidated figures that exceeded expectations. PhysicsWallah’s Q2 FY26 (July-September 2025) performance marks a pivotal turnaround, especially against a Q1 loss of ₹127 crore. Let’s break down the numbers in detail.

Revenue from operations soared 26% YoY to ₹1,051.2 crore from ₹832.2 crore in Q2 FY25. Quarter-on-quarter (QoQ), it grew 24% from ₹847.1 crore in Q1 FY26. Including other income of ₹47.2 crore, total income reached ₹1,098.4 crore—a 27% YoY jump from ₹862 crore. This growth stems from expanded online subscriptions, hybrid center enrollments, and upskilling verticals like data science and finance courses.

Expenses rose in tandem, reflecting aggressive investments. Total expenses climbed to ₹999 crore in Q2 FY26 from ₹800 crore YoY, driven by marketing (up 35%) and offline expansions. Yet, EBITDA improved sharply, rising 35.1% to ₹181 crore with margins expanding to 17.2% from 16.1%. This efficiency highlights PhysicsWallah’s maturing cost controls amid scaling.

The crown jewel: net profit exploded 69% YoY to ₹69.7 crore from ₹41.1 crore. QoQ, it flipped from a ₹127 crore loss to profitability, a staggering recovery. Earnings per share (EPS) followed suit, improving from 18 paise to 28 paise YoY and swinging from -46 paise QoQ. For the half-year (H1 FY26), however, cumulative profit stands at ₹57 crore against a ₹30 crore loss in H1 FY25—dragged by Q1’s setback but poised for acceleration.

These PhysicsWallah Q2 results 2026 figures aren’t isolated wins. They align with FY25’s revenue of ₹2,887 crore (up 48.7% YoY) and narrowing losses to ₹243 crore. As PWL results today dominate searches, experts like those at Deven Choksey Research applaud the 7.5x TTM P/Revenue valuation, emphasizing the brand’s community-driven model.

| Key Metric | Q2 FY26 | Q2 FY25 | YoY Growth | Q1 FY26 | QoQ Growth | H1 FY26 | H1 FY25 |

|---|---|---|---|---|---|---|---|

| Revenue from Ops (₹ Cr) | 1,051.2 | 832.2 | +26.3% | 847.1 | +24.1% | 1,898.3 | 1,500 |

| Total Income (₹ Cr) | 1,098.4 | 862 | +27.4% | 902 | +21.8% | 2,000.4 | 1,500 |

| Total Expenses (₹ Cr) | 999 | 800 | +24.9% | 1,054 | -5.2% | 2,053 | 1,470 |

| EBITDA (₹ Cr) | 181 | 134 | +35.1% | 150 | +20.7% | 331 | 250 |

| Net Profit (₹ Cr) | 69.7 | 41.1 | +69.6% | -127 | N/A | 57 | -30 |

| EPS (₹) | 0.28 | 0.18 | +55.6% | -0.46 | N/A | 0.23 | -0.12 |

This table captures the essence of PWL results today, showcasing balanced growth across metrics.

Strategic Moves: Acquisition Approval Boosts Offline Ambitions

Beyond the numbers, today’s board meeting greenlit a game-changing investment: the third tranche of stake in Utkarsh Classes & Edutech Private Limited. PhysicsWallah now holds 75.5% equity, up from 63.25%, with plans to reach 100% in multiple phases. This builds on the 2023 joint venture, where PW infused tech and content into Utkarsh’s offline strongholds in Rajasthan and beyond.

Utkarsh, with its 20+ years in government exam prep, adds firepower to PW’s hybrid model. The acquisition allocates ₹26.5 crore from IPO proceeds for further integration, plus ₹33.7 crore for lease payments at Utkarsh centers. Expect co-branded products in state jobs and private placements, tapping into untapped Tier-2/3 markets. As per Inc42 reports, Utkarsh contributed ₹150 crore to FY24 revenue, validating this synergy.

This move aligns with PW’s broader inorganic strategy: ₹941 crore earmarked for acquisitions, including a 50% stake in Xylem Learning for South India penetration. With 303 offline centers (112 Vidyapeeths, 78 Pathshalas) as of June 2025, PhysicsWallah eyes 500+ by FY27. Such expansions fuel PWL share news, as investors bet on offline’s 40% higher retention rates versus pure online.

PWL Share Price Today: Post-Results Rally and Market Sentiment

As of 3:00 PM IST on December 8, 2025, PWL shares trade at ₹138.44, up 1.87% from yesterday’s ₹135.90 close. Intraday highs hit ₹141.33, with volumes exceeding 39 million—double the average. Market cap stands at ₹38,863 crore, trading at 10.15x book value.

Post-IPO volatility tested nerves: a 42% debut surge gave way to a 21% weekly drop by November 25, per Mint analysis. Yet, today’s Q2 beat has sparked a rebound, with technicals showing support at ₹134 and resistance at ₹142. Brokerages like Business Today flag RSI at 55 (neutral) and a 50-day moving average crossover as bullish signals.

What drives this? Edtech sentiment revives amid macro tailwinds—rising disposable incomes and 30 crore aspirational students. PWL’s 6,267 faculty and 8.6 million-question bank differentiate it. Risks linger: high marketing spends (₹710 crore planned) and competition. Still, for “PhysicsWallah share news” seekers, the verdict is hold for growth; target ₹160 in 6 months per Trendlyne.

Growth Drivers: Why PhysicsWallah Excels in Edtech

PhysicsWallah’s secret sauce? A community-led funnel converting free YouTube views (1.5 billion annually) to paid batches at ₹2,000-5,000—far below rivals’ ₹20,000+. AI-powered personalization and multilingual content (7 languages) boost engagement. Offline hybrid centers, now 40% of revenue, offer live doubt-solving, driving 2x conversions.

Upskilling verticals shine: PW Skills added 500,000 users in H1 FY26, targeting analytics and software jobs. Partnerships like CRPF educational support amplify social impact. FY26 guidance: 40% revenue growth to ₹4,000 crore, with EBITDA margins at 18%. As edtech rebounds from Byju’s shadows, PW’s 161% CAGR since FY22 positions it as a sector bellwether.

Challenges Ahead: Navigating Edtech Headwinds

No success story lacks hurdles. PhysicsWallah grapples with FY25’s ₹243 crore loss, fueled by capex. Q1 FY26’s ₹127 crore hit stemmed from offline ramps and acquisitions. Regulatory scrutiny on edtech advertising and data privacy looms, while Unacademy’s layoffs highlight talent wars.

Competition intensifies: Allen and FIITJEE encroach online, but PW’s affordability (1.5% monetization of base) provides moat. Macro risks like election-year spending dips could pressure enrollments. Mitigation? Prudent capex: ₹460 crore for new centers, ₹200 crore for cloud infra. Investors monitoring PWL results today should watch H2 for sustained profitability.

Future Outlook: Projections for PWL Share and Edtech Dominance

Looking to FY26 end, analysts forecast ₹4,200 crore revenue and ₹300 crore profit, implying 25% margins. EPS could hit ₹1.20, valuing PWL at 20x forward earnings—premium but earned via 50% subscriber growth. Inorganic bets like Utkarsh full acquisition could add ₹200 crore revenue by FY27.

Long-term, PhysicsWallah eyes global forays and AI tutors. With India’s edtech market hitting $10.4 billion by 2025 (per Redseer), PW captures 5% share. For shareholders, “PWL share latest news” spells opportunity: buy dips below ₹130, sell rallies above ₹150. As Alakh Pandey tweets, “Education democratized—profits follow.”

Investor Takeaways: Should You Buy PWL Shares Now?

PhysicsWallah Q2 FY26 results affirm its trajectory from YouTube sensation to IPO star. Profit surges, revenue booms, and strategic acquisitions signal momentum. Yet, volatility demands caution—diversify and focus on fundamentals.

Download the results PDF via official filings or Telegram channels for DIY analysis. Comment below: Did you subscribe to the IPO? What’s your PWL target? Stay tuned for more PhysicsWallah share news as this edtech titan accelerates.