The Indian share market witnessed significant fluctuations on November 28, 2024, with Nifty 50 closing below the 24,000 mark. This marks a steep drop of 2914 points, or 1.49%. With Friday being the last trading day of the week, investors are eager to understand what lies ahead. Let’s delve into market analysis, global influences, and key updates to anticipate tomorrow’s trends.

Market Sentiments and Nifty 50 Analysis

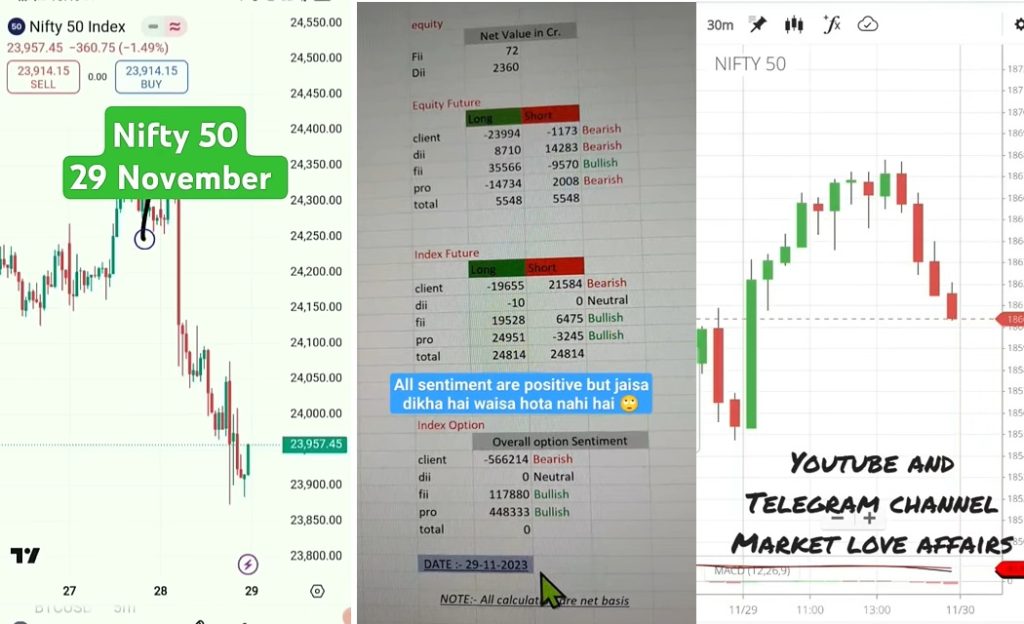

The Nifty 50 index showed weak momentum, breaking the crucial support level of 24,000, with resistance forming around 24,300. Over the past four trading days, the index encountered persistent resistance, signaling challenges in sustaining higher levels.

Analysts from LKP Securities highlight critical support levels. If the index breaks below 23,870, the next potential target could be 23,500. On the upside, a recovery might push Nifty 50 toward 24,200, provided it overcomes immediate resistance.

Insights from Technical Analysts

Experts from Moneycontrol shared a technical viewpoint, emphasizing that Nifty could breach its 200-day Exponential Moving Average (EMA) near 23,600. A breakdown at this level could lead to further consolidation or market corrections. However, positive cues from global and domestic fronts could stabilize market movements.

Global Market Impact on Indian Stocks

Key updates from the global market significantly influenced investor sentiment:

- US Markets Closed: Thanksgiving holiday in the US led to limited trading activity. However, Dow Jones futures showed a positive trend, gaining 0.24%, while Nasdaq futures rose by 0.34%.

- Crude Oil Prices: A slight drop in Brent crude prices was observed, while the Indian rupee depreciated against the US dollar.

- Gift Nifty Trends: As of 10:31 PM IST, Gift Nifty exhibited a gain of around 230 points, indicating potential bullish momentum for the Indian market.

SEBI’s New Trading Policy Announcement

An important update emerged from SEBI, announcing a significant shift for NSE and BSE. Effective April 1, 2025, these stock exchanges will function as alternate trading venues for one another. While the exact implementation process remains unclear, this initiative aims to enhance market efficiency and investor confidence.

Domestic Influences on Market Performance

Quarterly GDP Data

India’s Q2 GDP data for FY2024-25 is set to be released on November 29 at 5:30 PM. Analysts predict a potential drop in growth rates, with the Reserve Bank of India (RBI) forecasting around 6.5%. This data will play a crucial role in shaping market direction.

Monetary Policy Update

Reports from poll predictions suggest a possible rate cut during the February Monetary Policy Committee (MPC) meeting. However, confidence in this move remains lower than previous estimates, as economic challenges persist.

Sectoral Insights

- PSU Stocks: Analysts like Deepan Mehta recommend cautious investments in PSU stocks, emphasizing potential breakouts in select small and mid-cap stocks.

- Banking and IT Sectors: While Bank Nifty displayed resilience, IT stocks faced notable declines, reflecting mixed sectoral trends.

Geopolitical Developments

Middle East Ceasefire

Positive news emerged from the Israel-Hezbollah ceasefire agreement, which was officially signed, reducing tensions in the region. Speculation suggests that a similar agreement between Israel and Hamas could follow, further stabilizing global markets.

Russia-Ukraine Conflict

Market watchers anticipate potential peace talks between Russia and Ukraine, which could significantly impact global economic sentiment and trade flows.

Tomorrow’s Key Market Predictions

Resistance Levels for Nifty 50

- 24,060 – First resistance based on the 4-hour chart pattern.

- 24,250 – Second major resistance.

- 24,450 – Critical for sustained upward momentum.

Support Levels

- 23,910 – Intraday low observed on November 28.

- 23,800 – Aligns with the 20-day EMA on the 4-hour chart.

Bank Nifty Outlook

Unlike Nifty, Bank Nifty maintained its support level, closing stable near 51,800. Resistance lies between 52,500 and 52,750, with significant upward potential if global cues remain positive.

Conclusion

As we approach the end of the trading week, investors should monitor global and domestic cues, including Gift Nifty trends, GDP data, and geopolitical developments. While the market currently shows signs of weakness, resilience in certain sectors and positive global indicators could foster a recovery.

Stay updated with real-time insights, and don’t forget to track critical support and resistance levels for informed trading decisions. Let’s hope for a bullish closing to the week!