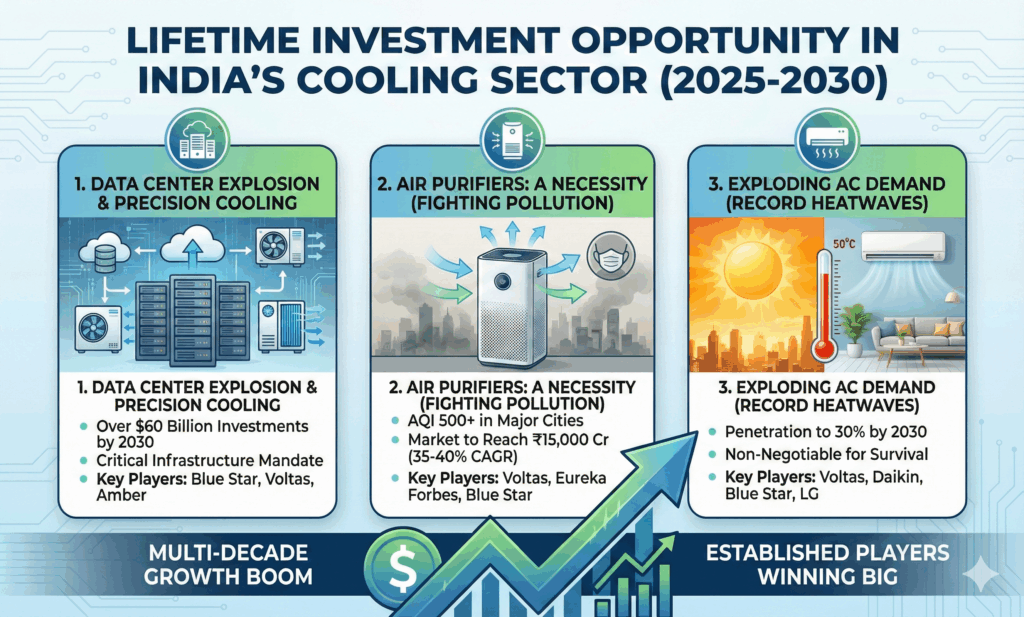

The Indian cooling industry stands at the cusp of its biggest multi-decade boom. Three unstoppable megatrends – explosive data center growth, worsening air pollution that makes air purifiers a necessity, and record-breaking heat waves that turn air conditioners from luxury to survival gear – converge to create what many analysts now call a “once-in-a-lifetime” opportunity for companies operating in precision cooling, room air conditioners (RAC), and air purification systems.

Investors who understood renewable energy a decade ago watched Tata Power multiply more than 20X from its lows. Today, the same structural tailwinds that lifted renewable stocks now favor cooling-related businesses – but with far higher certainty and faster execution visibility.

Why the Cooling Sector Deserves Your Immediate Attention

Growth separates multibagger stocks from average performers. Traditional sectors often face regulatory caps, pricing controls, or saturation. Cooling-related companies, however, enjoy three new high-growth verticals that barely existed in India five years ago:

- Data Center Cooling Solutions

- Residential & Commercial Air Purifiers

- Fast-rising Room Air Conditioner (RAC) penetration driven by unbearable summers

Each segment grows at 25-50% CAGR, and most established cooling players already participate in all three.

Megatrend #1: India’s Data Center Explosion Needs Massive Cooling Power

India’s government now mandates that critical data stay within the country. The result? Over $60 billion of data center investments announced by Reliance, Adani, Yotta, CtrlS, NTT, STT GDC, and global hyperscalers by 2030.

A single large data center consumes cooling equivalent to thousands of homes. Servers generate intense heat 24/7 – racks now hit 50-100 kW each. Without precision cooling (CRAC units, chillers, liquid cooling, rear-door heat exchangers), servers overheat and fail.

Key Beneficiaries Already Winning Contracts:

- Blue Star dominates data center cooling projects with end-to-end electro-mechanical (MEP) solutions.

- Voltas (a Tata group company) executes large MEP contracts that include chilling plants and airflow management.

- Ambthana Enterprises (Amber) supplies OEM heat exchangers and components to both Indian and global data center builders.

Goldman Sachs and Jefferies estimate India’s data center capacity will jump from ~1 GW today to 8-10 GW by 2030. Every additional gigawatt requires ₹800-1,200 crore of cooling infrastructure alone.

Megatrend #2: Air Pollution Turns Air Purifiers from Luxury to Necessity

Delhi’s AQI routinely crosses 500 in winter. Over 70 of the world’s 100 most polluted cities are now Indian. WHO says 7 million people die globally every year from air pollution – India accounts for over 20% of those deaths.

What was once a ₹300-400 crore niche market in 2018 has exploded into a ₹3,000+ crore industry today and analysts project ₹12,000-15,000 crore by 2030 (35-40% CAGR).

Pure-Play and Hybrid Players Capturing the Boom:

- Voltas, Blue Star, LG, Daikin, and Panasonic already sell HEPA + activated-carbon purifiers across price bands.

- Eureka Forbes (owner of Aquaguard) aggressively expands its air purification portfolio after management guided for “multi-year high-teens growth” in the segment.

- Honeywell, Philips, and Xiaomi lead unorganized sales, but listed Indian cooling giants gain share fast through wider service networks and trust.

Rising PM2.5 awareness, pediatric asthma cases, and work-from-home culture permanently shifted air purifiers into the “must-have” category.

Megatrend #3: Soaring Temperatures Make Air Conditioners Non-Negotiable

India recorded its hottest March and April ever in 2022, followed by even worse summers in 2023-2025. Rajasthan and Delhi regularly touch 48-50°C. The India Meteorological Department warns that 55°C days are no longer science fiction.

Air conditioner penetration in Indian households still lingers below 10% (versus >90% in China and >70% in urban Brazil). McKinsey projects penetration will cross 30% by 2030 and 50% by 2035 – implying 15-18% volume CAGR for the next decade.

Market Leaders Positioned to Ride the Wave:

- Voltas commands ~22-23% market share in room ACs.

- Daikin India grows 25%+ annually and targets leadership by 2027.

- Blue Star consistently gains 100-150 bps share yearly in both room and commercial ACs.

- LG India and Whirlpool maintain strong footprints with inverter and smart AC ranges.

Energy-efficiency regulations (5-star push) and replacement demand for old units add another high-margin growth layer.

Competitive Landscape: Fragmented Market = Room for Multiple Winners

Unlike mobiles or two-wheelers, India’s room AC market remains remarkably fragmented:

| Brand | Approx. Market Share (2024-25) |

|---|---|

| Voltas | 22-23% |

| Daikin | 18-19% |

| Blue Star | 14-15% |

| LG | 11-12% |

| Others | 35%+ |

Even the leader holds less than one-fourth of the market – a textbook setup for sustained above-industry growth by the top 3-4 players.

Companies You Should Research Right Now (Educational Purpose Only)

- Voltas Ltd – Market leader in room ACs, strong data center MEP execution, expanding air purifier range. Tata pedigree adds governance comfort.

- Blue Star Ltd – Pure-play cooling specialist, fastest-growing player in data center projects, consistent market-share gains.

- Amber Enterprises India Ltd – Largest RAC OEM manufacturer in India, supplies components for data center cooling, diversified into air purifiers and electronics.

- Eureka Forbes Ltd – Dominant water purifier brand pivoting aggressively into air purification with new launches and strong management commentary.

- Johnson Controls-Hitachi (not listed in India) and Daikin India (subsidiary) – foreign parents limit direct investment, but they validate the theme.

Risks You Must Consider

- Rising commodity prices (copper, aluminum, steel) can pressure margins if not passed on.

- Aggressive competition and discounting during peak summer.

- Execution delays in data center projects (government approvals, power availability).

- Potential slowdown in discretionary spending during economic downturns.

Yet every risk listed above existed for renewable energy players in 2015-2018 – and early investors still earned 10-30X returns because structural demand overwhelmed cyclical hiccups.

Final Verdict: A Rare Structural Multi-Year Opportunity

The Indian cooling ecosystem today mirrors the Indian IT services boom of the late 1990s or the renewable energy boom of 2018-2022. Demand drivers are policy-backed, non-discretionary, and multi-decadal.

Companies that grab share in data center cooling, scale air purifier distribution, and ride the inevitable AC penetration wave will likely deliver 20-30% revenue CAGR and expanding margins for the next 7-10 years – exactly the recipe that creates 5X-15X returns for patient investors.

Study the balance sheets, track quarterly commentary on each new segment, and watch order wins in data center MEP and air purifier sales. The opportunity door stands wide open right now – the only question is which players will step through and execute best.

Start your research today. The next Tata Power-style rerating in Indian equities may very well come from companies that keep India cool.