JPMorgan Chase & Co. (JPM), the world’s largest financial institution, has initiated mass layoffs despite reporting record-breaking profits in 2024. The bank has already let go of approximately 1,000 employees in February, with more cuts anticipated throughout 2025. This move, part of JPMorgan’s strategic workforce realignment, raises questions about the bank’s long-term vision and operational efficiency.

Ongoing Workforce Reductions: What’s Happening?

JPMorgan’s layoff wave is expected to continue, with additional job cuts scheduled in March, May, June, August, and September. While the bank has not disclosed the total number of planned reductions, it employed around 317,000 workers globally at the end of 2024.

According to a company spokesperson, these job cuts align with JPMorgan’s standard business practices. The bank regularly reviews its workforce, creating new roles as needed and eliminating positions when necessary. Despite the layoffs, JPMorgan continues to advertise around 14,000 open positions across various departments.

Record-Breaking Profits Amid Job Cuts

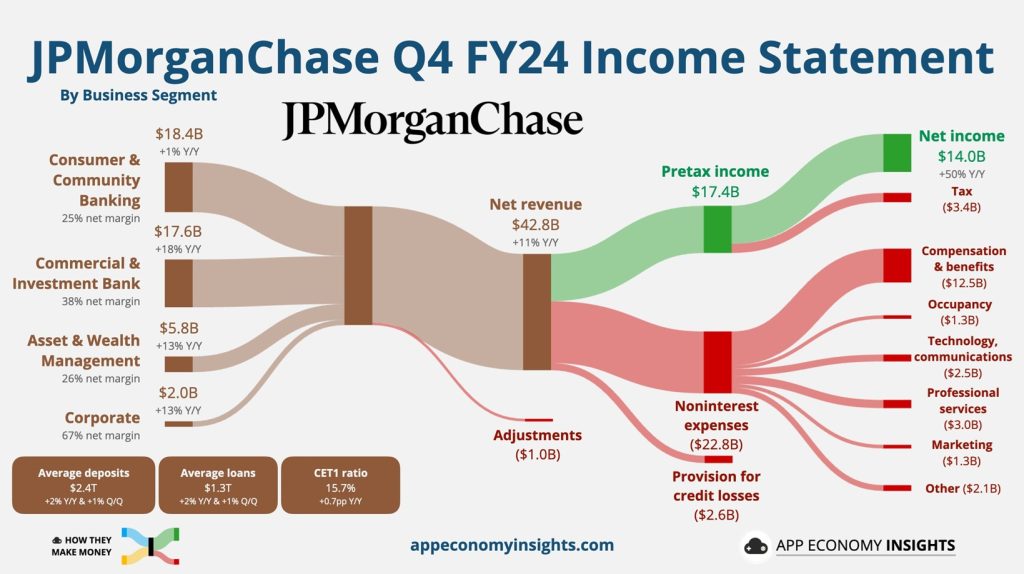

The timing of these layoffs is striking, given JPMorgan’s exceptional financial performance. The bank reported its highest-ever annual profit in 2024, fueled by a strong stock market, booming mergers and acquisitions (M&A), and an increase in initial public offerings (IPOs).

- Investment banking revenue surged by 46% year-over-year in Q4 2024, reaching $2.6 billion.

- JPMorgan’s stock price soared by 62% over the past 12 months, hitting near-record highs.

- Net income jumped by 50% year-over-year, totaling $14 billion in the final quarter of 2024.

Despite this financial success, JPMorgan’s leadership remains focused on optimizing efficiency, leading many to speculate about the motives behind the workforce reductions.

Employee Unionization and Return-to-Office Policy

JPMorgan’s layoffs coincide with a broader shift in its workplace policies. The bank recently announced that all employees must return to the office five days a week starting in March. This reversal from its hybrid work model has sparked frustration among employees, particularly those affected by the job cuts.

Furthermore, JPMorgan workers in multiple U.S. locations have been attempting to unionize. The layoffs, coupled with the return-to-office mandate, have led to speculation that these moves may be designed to suppress unionization efforts and encourage voluntary resignations.

A Pattern of Workforce Restructuring at JPMorgan

JPMorgan’s workforce reductions follow a familiar trend. In early 2023, the bank laid off hundreds of mortgage employees, despite expanding in other areas. Over the years, JPMorgan has strategically restructured its workforce through performance-based layoffs, job relocations to lower-cost states, and offshoring certain operations.

Analysts suggest that recent job cuts may be part of a larger strategy rather than a simple restructuring. Some industry observers believe that the return-to-office mandate serves as a means to reduce headcount without implementing mass terminations outright.

Additionally, there are growing concerns about employee morale. Reports indicate that JPMorgan has adjusted salary raises and bonuses, with many employees feeling dissatisfied with their compensation. However, many workers fear retaliation if they voice their concerns.

Is JPMorgan’s Stock Still a Strong Investment?

Despite the layoffs, analysts remain largely bullish on JPM stock. Currently, JPMorgan Chase holds a Moderate Buy rating from Wall Street analysts:

- 12 analysts recommend a Buy

- 7 analysts suggest holding

- Average price target: $275.60, reflecting minimal upside potential

Given the bank’s strong financial standing and continued expansion in key areas, many investors still see JPMorgan as a stable long-term investment.

Strategic Layoffs Despite Financial Strength

Layoffs are not uncommon in the banking sector, where firms regularly eliminate redundant positions, streamline operations, and leverage automation. However, JPMorgan’s latest job cuts stand out because they come at a time of historic financial success.

Bank executives maintain that these layoffs are part of routine business management, but market analysts suspect a deeper corporate strategy at play. While the company continues hiring in various departments, the selective job cuts indicate a move towards increased efficiency rather than financial distress.

JPMorgan’s Future Workforce Outlook

JPMorgan’s workforce strategy reflects a balancing act between growth and cost control. Unlike past economic downturns that triggered widespread job losses, today’s layoffs appear more calculated, targeting specific areas rather than broad cuts.

However, as the economic landscape shifts, JPMorgan is likely to continue reshuffling its workforce. Employees, investors, and industry observers will be closely watching to see how these strategic adjustments impact the bank’s future performance and workforce stability.

Key Takeaways

- JPMorgan Chase has laid off approximately 1,000 employees in February, with more cuts expected throughout 2025.

- Despite record profits, the bank is prioritizing operational efficiency, raising questions about its long-term workforce strategy.

- Unionization efforts and return-to-office mandates coincide with job cuts, leading to speculation about their true intent.

- JPM stock remains a strong investment, with a Moderate Buy rating from analysts.

- More workforce adjustments are likely as JPMorgan navigates evolving market conditions.

JPMorgan’s layoffs, despite financial success, highlight the bank’s focus on maintaining efficiency in an increasingly competitive landscape. Whether these job cuts are simply a part of regular workforce optimization or a deeper corporate strategy remains to be seen. However, one thing is clear—job security in the banking sector remains uncertain, even in times of record profitability.