JIO Financial Services has emerged as one of India’s most promising financial services companies since its demerger from Reliance Industries in August 2023. With strategic partnerships, robust fundamentals, and exposure to India’s rapidly growing digital financial ecosystem, JIOFIN presents compelling investment opportunities for both retail and institutional investors. Currently trading at ₹323.85, the stock has delivered impressive 30.11% returns since listing, outpacing broader market indices while establishing itself as a key player in India’s evolving financial landscape.

Current Market Position and Financial Performance

JIO Financial Services has demonstrated strong operational momentum in its short public trading history. The company’s market capitalization of ₹2,05,751 crore positions it among India’s significant financial services entities, while maintaining a healthy promoter holding of 47.12% that reflects strong management confidence.

The stock’s recent performance metrics paint an encouraging picture for long-term investors. With a 52-week high of ₹363.00 and current levels representing a strategic buying opportunity near technical support zones, JIOFIN trades with 12.47% annualized volatility – indicating manageable risk levels for equity investors. The company’s dividend yield of 0.15% suggests management’s focus on growth reinvestment rather than immediate income distribution.

From a technical analysis perspective, JIOFIN currently trades above its 50-day moving average of ₹317.78 and 200-day moving average of ₹282.56, indicating a bullish trend structure. This positioning suggests institutional accumulation and growing investor confidence in the company’s long-term prospects.

Operational Excellence and Business Diversification

The company’s operational performance has been particularly impressive across multiple business verticals. JIO Financial’s consolidated revenue grew 46.58% year-over-year to ₹612 crore in Q1 FY26, while net profit increased 16.95% to ₹325 crore. This growth trajectory reflects successful execution of the company’s diversified financial services strategy.

The lending arm, Jio Credit Limited (JCL), has shown exceptional growth with Assets Under Management (AUM) skyrocketing to ₹11,665 crore from just ₹217 crore a year earlier. This 5,276% growth in lending portfolio demonstrates the company’s ability to capture market share in India’s expanding credit market. JCL maintains a strong capital adequacy ratio of 38.2% and conservative debt-to-equity ratio of 1.7x, ensuring sustainable growth while maintaining prudent risk management.

Strategic Partnership with BlackRock: Game-Changing Alliance

The Jio-BlackRock joint venture represents one of the most significant developments in India’s asset management industry. This 50:50 partnership combines BlackRock’s global investment expertise with JIO’s extensive digital infrastructure and local market knowledge.

Jio BlackRock Asset Management has received final approval from SEBI to launch mutual fund operations, marking a transformative moment for India’s investment landscape. The joint venture has already achieved remarkable success with its New Fund Offers (NFOs) raising over ₹17,800 crore, making it one of India’s largest debt NFOs.

The partnership leverages BlackRock’s Aladdin platform, a leading investment management and risk analytics system that manages over $20 trillion globally. This technological advantage positions Jio BlackRock to deliver sophisticated investment solutions while maintaining cost efficiency through digital-first approaches.

Market Impact and Competitive Positioning

The Jio BlackRock venture enters India’s mutual fund market at an opportune time. With industry AUM of ₹72.2 lakh crore as of May 2025 and projected growth to ₹130 lakh crore by 2030, the partnership is well-positioned to capture significant market share. India’s mutual fund penetration remains at only 15% of GDP compared to the global average of 74%, indicating substantial growth potential.

The joint venture’s digital-first approach targets India’s young, tech-savvy population, particularly in B30 cities that now contribute 18% of total mutual fund AUM. This geographic diversification strategy aligns with India’s financial inclusion initiatives and expanding middle-class wealth.

Joint Jio and BlackRock branding highlighting their partnership in financial services and investments

Industry Growth Drivers and Market Opportunities

India’s financial services sector is experiencing unprecedented transformation, driven by multiple structural growth factors that directly benefit JIO Financial Services. The country’s GDP is projected to reach $7 trillion by 2030, creating substantial opportunities for financial intermediation and wealth management services.

Digital Financial Services Revolution

India’s digital payments ecosystem is expected to surpass $1 trillion by 2030, driven by increasing smartphone adoption and digital literacy. The fintech market is projected to grow from $435 billion in 2021 to $1.3 trillion by 2025, representing a 31% CAGR.

India’s fintech market is projected to grow to $1.3 trillion by 2025 with strong growth across payments, lending, and investment tech sectors

This rapid digitization creates multiple revenue streams for JIO Financial through payment solutions, digital lending, and fintech partnerships.

The NBFC sector, where JIO Financial operates, has demonstrated superior growth compared to traditional banking. NBFCs achieved 20% year-over-year credit growth in FY25, significantly outpacing commercial banks’ 12% growth. Digital lending adoption among NBFCs reached 60.53% compared to just 5.53% for traditional banks, highlighting JIO Financial’s competitive advantage in digital-first financial services.

Mutual Fund Industry Expansion

India’s mutual fund industry presents exceptional growth opportunities for the Jio-BlackRock partnership. Industry AUM has grown from ₹25 lakh crore to ₹72.2 lakh crore in recent years, with projections suggesting ₹100-130 lakh crore by 2030. This represents a compound annual growth rate (CAGR) of 14-18.6%, driven by increasing financial literacy and retail participation.

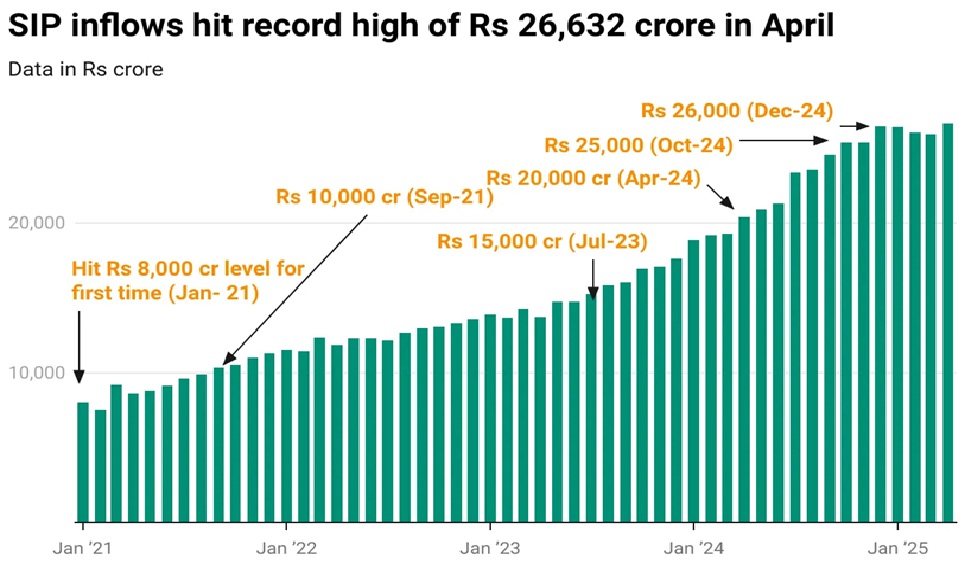

Systematic Investment Plans (SIPs) have emerged as a key growth driver, with monthly inflows reaching a record ₹26,688 crore in May 2025.

Chart showing consistent growth of SIP inflows in India from Rs 8,000 crore in Jan 2021 to a record Rs 26,632 crore in April 2025, indicating growing mutual fund investment trends

The 9.06 crore SIP accounts and growing penetration in smaller cities indicate sustained long-term growth potential. JIO Financial’s partnership with BlackRock positions the company to capture significant market share in this rapidly expanding segment.

Share Price Target Analysis for 2030

Based on comprehensive fundamental analysis, industry growth projections, and strategic positioning, JIO Financial Services presents multiple valuation scenarios for 2030. Current analyst consensus and technical analysis provide the foundation for realistic price target expectations.

Near-term Price Targets (2025)

Analyst consensus for 2025 shows convergence around ₹325-343 range, indicating 0.36% to 5.91% upside potential from current levels. Deven Choksey maintains a hold rating with ₹325 target, while MarketScreener consensus suggests ₹343 representing the higher end of near-term expectations.

These conservative near-term targets reflect market caution regarding valuation multiples, with the stock trading at a P/E ratio of 126.5 and P/B ratio of 8.21. However, this premium valuation is justified by exceptional growth rates and strategic positioning in high-growth markets.

Long-term Projections for 2030

Conservative Scenario (₹583 – 12.47% CAGR): This scenario assumes steady growth aligned with India’s GDP expansion and modest market share gains. The 80% total return over five years reflects sustainable business expansion without extraordinary valuation re-rating.

| Source | Price Target (INR) | Target Type | Upside Potential (%) |

| Deven Choksey | 325 | 2025 | 0.36 |

| MarketScreener Consensus | 343 | 2025 | 5.91 |

| TradingView | 325 | 2025 | 0.36 |

| Conservative Estimate | 582 | 2030 | 80 |

| Moderate Estimate | 809 | 2030 | 150 |

| Aggressive Estimate | 1295 | 2030 | 300 |

Moderate Scenario (₹810 – 20.11% CAGR): This projection incorporates successful execution of the BlackRock partnership, significant market share capture in mutual funds, and accelerated digital financial services adoption. The 150% total return reflects strong operational performance and industry leadership.

Aggressive Scenario (₹1,295 – 31.95% CAGR): This scenario assumes exceptional growth through market disruption, substantial AUM growth in asset management, and successful expansion across multiple financial services verticals. The 300% total return represents transformational value creation.

Valuation Framework and Assumptions

The price target analysis incorporates several key assumptions about JIO Financial’s business evolution:

Asset Management Growth: The Jio-BlackRock venture is projected to capture 5-10% market share of India’s mutual fund industry by 2030, translating to ₹5-13 lakh crore AUM. With industry-standard management fees, this represents ₹2,500-6,500 crore annual revenue from asset management alone.

Lending Business Expansion: JCL’s current ₹11,665 crore AUM is expected to grow at 25-35% CAGR, reaching ₹35,000-60,000 crore by 2030. This expansion, combined with improving net interest margins, could contribute ₹3,000-5,000 crore annual revenue.

Digital Financial Services: Revenue from payment solutions, insurance brokerage, and fintech partnerships is projected to reach ₹1,500-3,000 crore annually by 2030, driven by India’s digital transformation and JIO’s ecosystem advantages.

Geographic and Demographic Advantages

JIO Financial Services benefits from India’s favorable demographic trends and geographic expansion opportunities. The country is expected to add 75 million middle-income and 25 million affluent households by 2030, with these segments accounting for 56% of the population. This demographic shift creates substantial demand for sophisticated financial services.

Urban and Rural Market Penetration

The company’s strategy of targeting B30 cities (beyond top 30 cities) aligns with India’s urbanization trends and financial inclusion initiatives. These markets currently represent 18% of mutual fund AUM but offer significantly higher growth potential due to lower penetration rates. JIO’s extensive digital infrastructure provides competitive advantages in reaching underserved markets cost-effectively.

Tier-2 and Tier-3 cities show particularly strong adoption of digital financial services, with SIP growth rates exceeding metropolitan areas. States like Telangana, Haryana, and Uttar Pradesh have shown 30%+ annual AUM growth, indicating substantial geographic expansion opportunities.

Financial Inclusion and Government Support

The Indian government’s focus on financial inclusion through initiatives like Digital India and Jan Dhan Yojana creates supportive regulatory environment for JIO Financial’s expansion. The Unified Payments Interface (UPI) ecosystem and India Stack digital infrastructure provide technological foundations for rapid scaling.

Agricultural credit disbursements have increased from ₹8.45 lakh crore to ₹24.30 lakh crore between FY15 and FY24, indicating substantial rural financial services opportunities. JIO Financial’s digital-first approach positions the company to capture share in this expanding market segment

Risk Assessment and Investment Considerations

While JIO Financial Services presents compelling growth opportunities, investors should consider several risk factors that could impact the 2030 price targets. Understanding these risks enables more informed investment decisions and appropriate portfolio allocation.

Market and Competitive Risks

The Indian financial services sector faces increasing competition from both traditional players and new-age fintech companies. Digital lending platforms and established mutual fund houses may limit JIO Financial’s market share expansion, particularly if competitive advantages erode over time.

Regulatory changes in the financial services sector could impact business models and profitability. The RBI’s digital lending guidelines and evolving SEBI regulations for mutual funds require continuous compliance investments and may restrict certain business practices.

Valuation and Market Sentiment Risks

The stock’s current premium valuation with P/E ratio of 126.5 leaves limited margin for execution disappointments. If the company fails to achieve projected growth rates, significant valuation compression could occur, impacting share price performance.

Market sentiment toward financial services stocks can be volatile, particularly during economic downturns or credit cycles. JIO Financial’s relatively short public trading history means limited historical data for stress-testing performance during adverse market conditions.

Execution and Partnership Risks

The success of Jio-BlackRock partnership depends on effective integration of different corporate cultures and business approaches. Delays in product launches, technology integration challenges, or strategic disagreements could impact growth projections.

Scaling challenges in credit business require sophisticated risk management and adequate capital allocation. Rapid AUM growth without corresponding risk controls could lead to asset quality deterioration and financial losses.

Investment Strategy and Portfolio Allocation

For investors considering JIO Financial Services as part of their long-term portfolio strategy, several allocation approaches merit consideration based on risk tolerance and investment objectives.

Growth-Oriented Investment Approach

Aggressive investors seeking maximum capital appreciation may allocate 3-5% of equity portfolio to JIO Financial, targeting the ₹1,295 aggressive scenario by 2030. This approach requires tolerance for volatility and confidence in management’s execution capabilities.

The systematic investment plan (SIP) approach allows gradual position building while averaging purchase costs over time. Monthly investments of ₹10,000-25,000 over 2-3 years can build substantial positions while managing timing risk.

Balanced Portfolio Integration

Moderate risk investors may consider 1-2% allocation targeting the ₹810 moderate scenario, combining JIO Financial with other financial services stocks for sector diversification. This approach balances growth potential with portfolio stability.

Defensive investors focused on capital preservation might wait for technical corrections below ₹300 levels before initiating positions, targeting the ₹583 conservative scenario with emphasis on downside protection.

Geographic and Sectoral Diversification

International investors seeking Indian market exposure can consider JIO Financial as part of broader emerging market allocations. The stock provides exposure to multiple growth themes including digitization, financial inclusion, and demographic dividend.

Sector rotation strategies may involve increasing JIO Financial allocation during favorable regulatory environments or market cycles supporting financial services outperformance.

Conclusion: Long-term Value Creation Opportunity

JIO Financial Services represents a compelling long-term investment opportunity positioned at the intersection of India’s digital transformation and financial services modernization. The company’s strategic partnership with BlackRock, diversified business model, and exposure to high-growth market segments create multiple pathways for sustained value creation through 2030.

The ₹583-1,295 price target range reflects varying degrees of execution success, with the moderate scenario of ₹810 representing a balanced assessment of growth opportunities and associated risks. This 20.11% CAGR expectation aligns with India’s economic growth trajectory and the company’s competitive positioning in expanding financial services markets.

Key investment catalysts include successful scaling of the mutual fund business, credit portfolio expansion, and digital financial services adoption. The company’s strong balance sheet, experienced management team, and strategic partnerships provide solid foundations for achieving these growth objectives

For investors with 5-7 year investment horizons and tolerance for emerging market volatility, JIO Financial Services offers attractive risk-adjusted return potential. The combination of structural growth drivers, demographic advantages, and technological innovation positions the company to benefit from India’s continued economic development and financial sector evolution.

Regular monitoring of quarterly results, regulatory developments, and competitive dynamics remains essential for optimizing investment outcomes. As India progresses toward its $7 trillion GDP target by 2030, JIO Financial Services appears well-positioned to capture significant value from this transformational economic growth.