Google’s parent company, Alphabet Inc., has demonstrated remarkable market performance through October 2025, with its stock price surging over 52% in the past year and maintaining strong momentum amid the artificial intelligence revolution. As of October 24, 2025, Alphabet Class A shares (GOOGL) trade at approximately $250.46, while Class C shares (GOOG) stand at $253.73, representing a significant recovery from 52-week lows and positioning the technology giant among the world’s most valuable companies with a market capitalization exceeding $3 trillion. This comprehensive analysis examines Google’s share price dynamics, financial performance, revenue drivers, analyst perspectives, and investment considerations for stakeholders navigating the evolving digital landscape.

Google (Alphabet) stock price performance from January 2024 to October 2025, showing significant growth trajectory with notable volatility in early 2025

Understanding Alphabet’s Stock Structure and Current Valuation

Alphabet operates through a dual-class share structure that provides investors with different options for participating in the company’s growth trajectory. Class A shares (GOOGL) carry voting rights, while Class C shares (GOOG) do not, though both track the company’s underlying business performance closely. The current price differential between these share classes remains minimal, typically within a few dollars, allowing investors flexibility based on their governance preferences.

The company’s valuation metrics reveal a stock trading at approximately 25.7 to 27.14 times trailing twelve-month earnings, with earnings per share of $9.39 as of the most recent reporting period. This price-to-earnings ratio positions Google more favorably than several technology peers, trading below Microsoft’s 39x multiple while maintaining comparable growth prospects. The stock’s forward P/E ratio of approximately 20.37 to 25.35 suggests market confidence in continued earnings expansion driven by artificial intelligence integration and cloud computing acceleration.

Alphabet’s market capitalization of $3.06 trillion as of October 2025 ranks it as the fourth most valuable publicly traded company globally, trailing only Microsoft, Apple, and Nvidia in total market value. This valuation reflects not merely the company’s current profitability but also investor expectations regarding its competitive positioning in transformative technologies including generative AI, cloud infrastructure, autonomous vehicles through Waymo, and quantum computing initiatives.

Stock Price Performance: Historical Trends and Recent Momentum

Google’s share price has exhibited substantial volatility and impressive long-term appreciation since its 2004 initial public offering. The stock reached an all-time high of $257.87 on October 16, 2025, before experiencing modest consolidation to current levels. This represents a dramatic recovery from the 52-week low of $140.53 recorded in early 2024, demonstrating the stock’s capacity for significant price swings based on market sentiment, regulatory developments, and financial performance.

The year-to-date performance for 2025 shows Alphabet shares gaining approximately 31.19%, substantially outperforming the broader S&P 500 index. This strong performance accelerated particularly in the second half of 2025, with the stock advancing from approximately $180 in early spring to surpass $255 by September, driven by robust second-quarter earnings that exceeded analyst expectations across search advertising, YouTube revenue, and cloud computing segments.

Historical analysis reveals that Alphabet stock has delivered cumulative returns exceeding 206% over the past five years, though annual performance has varied considerably. The stock gained 57.11% in 2023, followed by 36.95% appreciation in 2024, establishing a pattern of strong recovery following the challenging 2022 period when shares declined 38.84% amid broader technology sector weakness and concerns about advertising market softness.

Technical analysis indicators as of October 2025 paint a bullish picture for the stock’s near-term trajectory. The 50-day moving average of $246.30 trading above the 200-day moving average of $195.60 creates a “golden cross” pattern typically associated with continued upward momentum. The Relative Strength Index (RSI) reading of approximately 57-58 indicates neutral conditions, suggesting the stock is neither overbought nor oversold at current levels. Key resistance levels appear at $255-257, corresponding to recent highs, while support zones exist around $245-247 and more significantly at $235.

Financial Performance: Revenue Growth and Profitability Expansion

Alphabet’s financial performance in 2024 and continuing into 2025 demonstrates the company’s ability to generate substantial revenue growth while expanding profit margins across key business segments. For fiscal year 2024, Alphabet reported total revenues of $350.02 billion, representing 13.87% year-over-year growth from the previous year’s $307.39 billion. This revenue expansion was accompanied by net income of $100.12 billion, marking a 35.67% increase in profitability and solidifying Alphabet’s position among the world’s most profitable corporations.

The third quarter of 2024 proved particularly strong, with consolidated revenues reaching $88.3 billion, up 15% year-over-year in reported currency and 16% in constant currency terms. Operating income surged 34% to $28.5 billion during this period, while operating margin expanded by 4.5 percentage points to 32%, demonstrating improved operational efficiency alongside revenue growth. Diluted earnings per share increased 37% to $2.12, substantially exceeding the consensus analyst estimate of $1.85 and highlighting the company’s earnings momentum.

Performance continued strongly into 2025, with first-quarter revenues of approximately $90.5 billion growing 12% year-over-year, and second-quarter revenues of $96.4 billion expanding 14% compared to the prior-year period. The company achieved record quarterly net income of $34.54 billion in Q1 2025, followed by $28.19 billion in Q2 2025, both reflecting substantial profitability despite increased capital expenditures for artificial intelligence infrastructure.

Alphabet’s cash generation capabilities remain exceptional, with the company producing approximately $73 billion in free cash flow during 2024 and projected to generate $80 billion in 2025. This robust cash flow supports the company’s capital allocation strategy encompassing dividend payments, share repurchases totaling $70 billion authorized in 2024, and aggressive investments in AI and cloud infrastructure exceeding $85 billion annually.

Revenue Breakdown: Diversified Business Segments Driving Growth

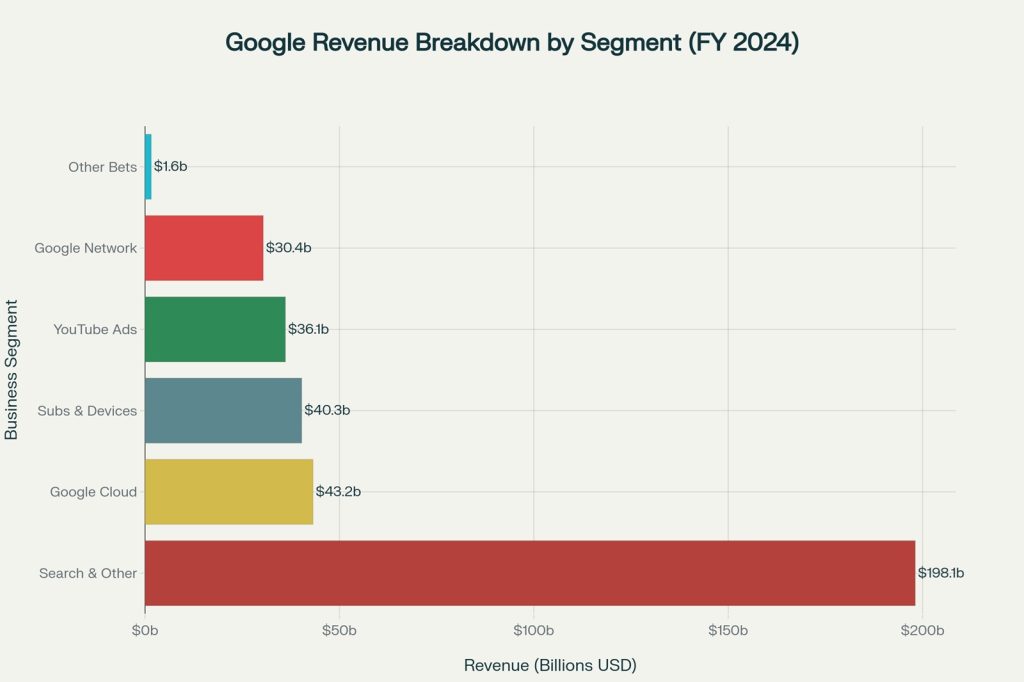

Alphabet’s revenue distribution across major business segments in 2024, with Google Search & Other generating the largest share at $198.1 billion

Google’s revenue streams exhibit substantial diversification across multiple high-growth segments, providing resilience against market fluctuations in any single business area. Google Search & Other remains the dominant revenue generator, contributing $198.1 billion in 2024, representing 56.6% of total revenues despite increasing competition from AI-powered search alternatives. This segment grew 13% year-over-year, demonstrating the enduring value of Google’s search advertising platform even as the company integrates generative AI features that transform how users interact with search results.

YouTube advertising revenues reached $36.1 billion in 2024, growing 14.7% and comprising 10.3% of total revenues. YouTube’s combined advertising and subscription revenues surpassed $50 billion over the trailing four quarters for the first time, highlighting the platform’s evolution into a critical component of Alphabet’s business model. The integration of AI-driven content recommendations and the expansion of YouTube Premium and YouTube TV subscriptions contribute to accelerating growth in this segment.

Google Cloud emerged as one of Alphabet’s fastest-growing segments, generating $43.2 billion in revenue during 2024, representing 30.7% year-over-year growth. The third quarter of 2024 proved particularly robust, with cloud revenues jumping 35% to $11.4 billion, marking the fastest growth rate in eight quarters. Operating income for Google Cloud surged 632% year-over-year to $1.9 billion in Q3 2024, with operating margins expanding to 17%, demonstrating the segment’s improving profitability as it achieves greater scale.

The Google Subscriptions, Platforms, and Devices segment contributed $40.3 billion in 2024, growing 16.3% and representing 11.5% of total revenues. This category encompasses YouTube Premium and YouTube TV subscriptions, Google One cloud storage, Pixel smartphones, Nest smart home devices, and other hardware products. The diversity within this segment provides multiple avenues for revenue expansion as consumers increasingly adopt subscription-based services and Google-branded hardware.

Google Network advertising revenues totaled $30.4 billion in 2024, declining 3.0% as the company continues strategic adjustments to its third-party advertising network business. Despite this modest contraction, the segment remains a substantial revenue contributor representing 8.7% of total revenues. Finally, the Other Bets segment, including autonomous vehicle company Waymo and various experimental ventures, generated $1.6 billion in revenue with 7.9% growth, though it continues operating at significant losses as these nascent businesses develop.

Artificial Intelligence: The Catalyst Transforming Google’s Business Model

Artificial intelligence has emerged as the defining strategic priority for Alphabet, with CEO Sundar Pichai characterizing 2025 as a pivotal year requiring accelerated AI innovation to address real-world challenges and maintain competitive positioning. The company’s Gemini AI models have achieved leadership status according to independent benchmarks, outperforming competitors including ChatGPT across various performance metrics. This technological advantage translates into practical business applications across search, advertising, cloud services, and consumer products.

In search, Google has deployed AI Overviews and enhanced search capabilities that fundamentally change how users interact with information. These AI-powered features expand what people can search for and how they search, creating new opportunities for advertising integration while potentially disrupting traditional search result formats. Early adoption metrics suggest strong user engagement, though concerns persist about potential impacts on paid search click-through rates and advertising revenue dynamics.

Google Cloud Platform’s AI infrastructure and solutions have become primary growth drivers, with the integration of custom AI chips, the Vertex AI development platform, and generative AI solutions attracting enterprise customers and driving deeper product adoption. The company announced plans to invest approximately $85 billion in capital expenditures during 2025, substantially higher than the $52 billion invested in 2024, with the majority directed toward AI infrastructure including data centers, servers, and networking equipment.

Strategic partnerships amplify Alphabet’s AI reach, including expanded collaboration with Salesforce integrating Gemini models into the Agentforce 360 Platform, and strengthened relationships with Nvidia for advanced GPU infrastructure supporting next-generation AI workloads. The recent announcement of a $15 billion investment to build an AI data hub in Visakhapatnam, India, represents Google’s largest AI infrastructure investment outside the United States, positioning the company to capitalize on India’s growing technology ecosystem.

Cloud Computing: Accelerating Growth in Enterprise Services

Google Cloud Platform has transitioned from a capital-intensive, margin-challenged business into a high-growth, increasingly profitable segment that analysts view as critical to Alphabet’s long-term valuation expansion. The segment’s 35% revenue growth in Q3 2024 represented the strongest quarterly performance in two years, driven by accelerated adoption of AI Infrastructure, Generative AI Solutions, and core GCP products.

At an annual run rate basis, Google Cloud generates approximately $49.2 billion, positioning it as the world’s third-largest cloud services provider behind Amazon Web Services (32% market share) and Microsoft Azure (22% market share). Despite Google Cloud’s smaller market share of approximately 11%, the business exhibits faster revenue growth rates than mature competitors, suggesting market share gains and successful competitive positioning.

The cloud segment’s improving economics represent a significant inflection point for Alphabet’s overall profitability profile. Operating margins expanded from negligible levels in prior years to 17% in Q3 2024, with the business generating $1.9 billion in operating income. This margin expansion reflects economies of scale, improved capacity utilization, and the premium pricing power associated with AI-optimized infrastructure and platform services.

Google Cloud’s competitive differentiation stems from several factors including deep integration with Google’s AI capabilities through the Vertex AI platform, superior data analytics tools leveraging Google’s expertise in large-scale data processing, and increasingly competitive pricing with initiatives such as Cloud WAN offering up to 40% lower latency and reduced networking costs. The platform’s strength in open-source technologies and developer-friendly tools positions it advantageously as enterprises increasingly adopt flexible, multi-cloud strategies.

Looking forward, Google Cloud revenue is expected to maintain robust growth, potentially exceeding 30% annually as more capacity comes online and AI adoption accelerates among enterprise customers. Management has indicated that capacity constraints limited growth in some recent quarters, suggesting significant pent-up demand that newer data center infrastructure will address.

Analyst Perspectives: Price Targets and Investment Recommendations

Wall Street analysts maintain overwhelmingly bullish sentiment toward Alphabet stock, with consensus ratings of “Strong Buy” based on evaluations from 43-48 covering analysts. This positive outlook reflects confidence in the company’s competitive positioning, growth trajectory, and ability to monetize artificial intelligence investments across its business portfolio.

Average twelve-month price targets range from $250.40 to $261.53 depending on the analyst survey consulted, suggesting modest upside of approximately 3% from current levels at the consensus estimate. However, this average obscures considerable variation in individual analyst projections, with the highest price targets reaching $300-340 and the lowest at $190, reflecting different assumptions about AI adoption rates, regulatory outcomes, and competitive dynamics.

Evercore ISI represents the most bullish major firm, raising its price target to $300 while maintaining an “Outperform” rating based on survey data showing Google’s continued dominance in commercial-intent search, accelerating YouTube revenue growth, steady Google Cloud progress, and the expanding value of Waymo’s robotaxi service. This $300 target implies approximately 25% upside from October 2025 price levels

Bank of America increased its price target to $280 from $252 ahead of third-quarter earnings, citing checks indicating advertising spending exceeding expectations supported by improving macroeconomic conditions, increased data utilization, and higher advertising budgets sufficient to offset organic search traffic declines. BofA projects robust search performance with consistent growth in paid clicks, potentially mitigating risks associated with AI disruptions while supporting valuation expansion.

Bernstein analyst Mark Shmulik, ranked among the top 430 analysts tracked by TipRanks with a 74% success rate, highlighted eased regulatory concerns and faster AI development as key drivers for maintaining a bullish stance. Shmulik emphasized Gemini’s rise to top app store rankings and strong Google Cloud Platform growth fueled by higher Anthropic usage and major AI customer wins, though he cautioned that competition remains intense with OpenAI holding strong competitive positions.

Of the analysts covering Alphabet, approximately 77-85% issue “Strong Buy” or “Buy” ratings, while 15-20% recommend “Hold,” and virtually no analysts rate the stock a “Sell”. This distribution reflects broad confidence in the company’s fundamental business strength while acknowledging near-term uncertainties related to regulation, competitive dynamics, and the substantial capital expenditures required to maintain AI leadership.

Dividend Policy and Shareholder Returns

Alphabet initiated its first-ever regular quarterly dividend in April 2024, marking a significant evolution in capital allocation strategy for a company historically focused exclusively on share repurchases and growth investments. The company declared an initial dividend of $0.20 per share, subsequently increased to $0.21 per share in April 2025, representing a 5% dividend growth rate.

At current stock prices, Alphabet’s dividend yield approximates 0.33-0.46%, modest compared to mature dividend-paying stocks but comparable to technology peers Meta Platforms (approximately 0.5%) and significantly higher than non-dividend-paying Amazon and Berkshire Hathaway. The annual dividend of approximately $0.84 per share represents just 8.54% of earnings, providing substantial room for future dividend increases as management allocates additional capital toward cash returns.

The dividend initiation reflects Alphabet’s maturation from a pure growth company to a cash-generative enterprise capable of returning capital to shareholders while simultaneously funding aggressive investments in artificial intelligence and cloud infrastructure. The company’s exceptional free cash flow generation of $73-80 billion annually provides ample resources to support dividend payments totaling approximately $10 billion per year while maintaining the $70 billion share repurchase authorization announced in 2024.

Total shareholder yield, combining dividend yield with buyback yield and debt paydown, approximates 2.29% based on recent data. While this total return to shareholders remains below some technology peers, the trajectory suggests increasing capital returns as Alphabet’s core businesses mature and cash generation continues expanding.

Investment Risks: Regulatory Challenges and Competitive Threats

Despite strong financial performance and positive analyst sentiment, Alphabet faces significant risks that investors must consider when evaluating the stock. Regulatory scrutiny represents perhaps the most immediate threat, with antitrust actions progressing on multiple fronts in the United States and European Union.

In August 2024, Federal Judge Amit Mehta ruled that Alphabet unlawfully maintained a monopoly in online search services, hindering competitors from developing alternative products. The U.S. Department of Justice has proposed remedies including forcing Google to divest its Chrome web browser and potentially the Android operating system, while requiring the company to share user and advertiser data with competitors. A ruling on proposed remedies is expected in mid-2025, with potential implementation that could fundamentally alter Google’s business model and competitive positioning.

Separate antitrust litigation targets Google’s dominance in online advertising technology, with both U.S. and U.K. regulators expressing concerns about the company’s practices in digital advertising markets. The European Union has implemented the Digital Services Act and Digital Markets Act, imposing stringent regulations on data management and competitive practices that could constrain Google’s operational flexibility and profitability.

Competitive threats from artificial intelligence natives present another substantial risk factor. OpenAI’s ChatGPT, Anthropic’s Claude, and emerging AI search engines like Perplexity represent direct challenges to Google’s search dominance, particularly among younger users who may prefer conversational AI interfaces to traditional search. Samsung’s reported agreement to preload Perplexity AI as the default search engine on devices potentially beginning in 2026 could significantly erode Google’s mobile search traffic.

In cloud computing, Google faces intense competition from larger, well-established competitors Amazon Web Services and Microsoft Azure, both of which enjoy substantial market share advantages and deep enterprise relationships. While Google Cloud demonstrates faster growth rates, maintaining this momentum requires continued heavy capital investment in infrastructure at a time when some investors question the return on AI-related expenditures.

Market volatility and economic uncertainties pose additional risks, with Google’s advertising-dependent business model rendering it vulnerable to shifts in consumer behavior and economic downturns that reduce advertiser spending. The stock’s beta of approximately 1.00-1.01 indicates it tends to move in line with broader market fluctuations, providing limited downside protection during market corrections.

Investment Opportunities: Growth Drivers and Competitive Advantages

Notwithstanding these risks, Alphabet possesses multiple competitive advantages and growth opportunities that support the bullish investment thesis. The company’s dominance in search, with over 90% global market share in most regions despite recent modest declines, provides a durable competitive moat and nearly unmatched pricing power in digital advertising.

YouTube’s evolution into a comprehensive video platform encompassing short-form content, long-form entertainment, live streaming, and subscription services positions it uniquely in the creator economy and streaming media landscape. The platform’s AI-driven content recommendation engine, vast content library, and growing subscription revenue streams create multiple monetization pathways less vulnerable to advertising cycle fluctuations.

Google Cloud’s AI-first positioning, leveraging the company’s deep expertise in machine learning, natural language processing, and large-scale distributed systems, differentiates it from competitors still developing comparable AI capabilities. The integration of custom Tensor Processing Units (TPUs) optimized for AI workloads provides performance and cost advantages that strengthen Google Cloud’s value proposition for AI-intensive applications.

Waymo, Alphabet’s autonomous vehicle subsidiary, has achieved operational robotaxi service averaging 150,000 paid rides weekly as of late 2024, far ahead of most competitors in the autonomous driving space. Analysts estimate Waymo’s standalone valuation could eventually reach $5 trillion if the technology achieves broad commercial deployment, though this remains speculative and faces significant regulatory and technological hurdles.

The company’s balance sheet strength, with approximately $96 billion in cash and short-term investments as of December 2024, provides financial flexibility to weather economic uncertainty, make strategic acquisitions as demonstrated by the $32 billion Wiz cybersecurity purchase, and maintain aggressive investments in emerging technologies.

Technical Analysis: Support, Resistance, and Trading Considerations

From a technical perspective, Alphabet stock exhibits bullish momentum characteristics as of October 2025, though showing some signs of consolidation after reaching all-time highs. The stock trades above all major moving averages, with the 8-day SMA at $251.14, 20-day SMA at $247.65, 50-day SMA at $235.01, and 200-day SMA at $191.37, creating a series of upward-sloping support levels.

Key resistance appears in the $255-258 range, corresponding to the all-time high of $257.87 reached on October 16, 2025, and recent trading highs. A breakout above this resistance zone with substantial volume could signal continuation toward analyst price targets in the $260-280 range. More optimistic technical projections suggest potential resistance levels extending to $300 should bullish momentum accelerate.

Support levels are well-defined at multiple price points providing downside protection. Immediate support exists at $245-247, corresponding to recent consolidation lows. Stronger support appears at $235, aligning with the 50-day moving average and representing approximately 7% below current prices. Major support establishing the base for the current rally sits at $199-200, corresponding to early 2025 levels and the 200-day moving average zone.

Technical indicators present a mixed but generally constructive picture. The Relative Strength Index at 57-58 indicates neutral momentum, suggesting room for further appreciation before reaching overbought territory typically associated with RSI readings above 70. The MACD (Moving Average Convergence Divergence) line trading above its signal line generates a bullish momentum signal. Bollinger Bands analysis suggests the stock is trading near the upper band, indicating strong upward momentum though potentially vulnerable to short-term consolidation.

Volume patterns show trading activity generally in line with historical averages, with the 10-day average volume approximating 32-36 million shares. Significant volume spikes typically accompany major price movements and earnings announcements, with volume expansion on up days reinforcing bullish conviction.

Comparative Analysis: Google Versus Technology Peers

Evaluating Alphabet’s investment merits requires comparison with technology sector peers, particularly Amazon and Microsoft, which compete directly in cloud computing while pursuing parallel AI strategies. Alphabet’s valuation appears relatively attractive, trading at approximately 22 times forward earnings compared to Amazon’s 42 times and Microsoft’s 39 times forward earnings multiples.

This valuation discount reflects several factors including greater regulatory risk facing Google’s search monopoly, slower historical cloud revenue growth compared to AWS and Azure, and market skepticism about Google’s ability to monetize AI innovations without cannibalizing high-margin search advertising. However, the discount also suggests potential upside if Google successfully navigates regulatory challenges and demonstrates sustainable AI monetization.

Revenue growth rates favor Google in recent quarters, with the company’s 15% year-over-year growth in Q3 2024 comparing favorably to peers. Alphabet exhibits superior profit margins, with operating margins of 32% substantially exceeding Amazon’s overall operating margin profile, though trailing Amazon Web Services’ segment-specific 37% operating margin. Microsoft’s overall operating efficiency remains strong, though specific segment comparisons vary based on business mix.

In cloud computing specifically, AWS maintains clear leadership with 32% market share and approximately $105 billion annual run rate, followed by Microsoft Azure at 22% market share, and Google Cloud at 11% market share with $49 billion annual run rate. However, Google Cloud’s 35% growth rate exceeds both AWS (19%) and Azure’s recent growth rates, suggesting market share gains despite starting from a smaller base.

Free cash flow generation capabilities favor Alphabet, with the company producing $73-80 billion annually compared to Amazon’s substantial but lower free cash flow after accounting for retail segment capital requirements. This cash generation advantage provides Alphabet greater financial flexibility for shareholder returns, strategic acquisitions, and AI infrastructure investments without excessive balance sheet strain.

Future Outlook: Growth Projections and Strategic Initiatives

Analysts project Alphabet’s revenues will reach approximately $512.6 billion by 2028, representing compound annual growth of approximately 11.3%, with earnings expanding to $148.4 billion from the current $115.6 billion base. These projections assume continued search advertising growth approaching 10% annually, accelerating cloud revenue growth exceeding 30% in the near term, and successful monetization of AI capabilities across the product portfolio.

The company’s strategic roadmap emphasizes several key initiatives that should drive growth through the remainder of the decade. In artificial intelligence, continued development and deployment of Gemini models across search, advertising, cloud services, and consumer applications remains the top priority. The introduction of AI-powered features including AI Overviews in search and Gemini integration in Google Workspace products aims to enhance user engagement and create new revenue opportunities.

Google Cloud Platform expansion continues with aggressive capacity buildout, the $75 billion capital expenditure program for 2025 primarily targeting data center infrastructure to support AI workloads and enterprise cloud adoption. Strategic partnerships with Salesforce, SAP, and other enterprise software vendors integrate Google’s AI capabilities into business applications, potentially accelerating cloud platform adoption.

YouTube’s evolution encompasses enhanced creator monetization tools, expanded shopping integration, and growing subscription services including YouTube Premium and YouTube TV. The platform’s short-form video product YouTube Shorts competes directly with TikTok, while live streaming and gaming content provide additional engagement and monetization vectors.

Hardware initiatives including the Pixel smartphone line, Nest smart home devices, and potential new product categories seek to create integrated ecosystems that strengthen user engagement with Google services. The recent integration of Gemini AI capabilities into Pixel devices demonstrates the strategic alignment between hardware and AI software development.

Waymo’s autonomous vehicle technology represents a longer-term opportunity with potentially transformative implications, though commercial scaling faces regulatory hurdles and requires substantial continued investment. The service’s current operation in limited markets with 150,000 weekly paid rides demonstrates technical feasibility while building the operational expertise necessary for broader deployment.

Conclusion: Investment Considerations for Google Stock

Google share price reflects a complex interplay of exceptional financial performance, transformative technology investments, significant competitive advantages, and meaningful regulatory and competitive risks. The stock’s approximately 52% appreciation over the past year demonstrates investor confidence in Alphabet’s ability to maintain advertising dominance while successfully transitioning into the AI era and scaling its cloud computing business.

For growth-oriented investors, Alphabet offers exposure to multiple high-growth secular trends including artificial intelligence, cloud computing, digital advertising evolution, and autonomous vehicles, all backed by exceptional cash generation and a management team with proven execution capabilities. The stock’s reasonable valuation relative to growth prospects and technology peers, combined with strong analyst support averaging $250-262 price targets with some reaching $300, suggests potential for continued appreciation.

Income-focused investors should note the company’s nascent but growing dividend, which despite its modest 0.33-0.46% current yield provides room for substantial growth given the low 8.54% payout ratio and robust free cash flow generation. The combination of dividends and share repurchases creates total shareholder yield approaching 2.3%, with prospects for expansion as the business matures.

Conservative investors and those with shorter time horizons should carefully consider the regulatory risks, competitive threats from AI natives, substantial capital expenditure requirements, and the stock’s demonstrated volatility. The potential for adverse antitrust rulings forcing Chrome or Android divestiture represents a material downside risk that could significantly impact the investment thesis.

Ultimately, Google stock appears well-positioned for investors who believe in the company’s ability to maintain search leadership while successfully monetizing AI innovations and scaling its cloud business, though the investment carries meaningful risks that warrant careful portfolio sizing and ongoing monitoring of regulatory developments, competitive dynamics, and AI adoption trajectories. The combination of strong fundamentals, attractive valuation relative to peers, and substantial growth opportunities supports the Wall Street consensus “Strong Buy” rating, while acknowledging that near-term volatility remains likely as these various dynamics unfold