The financial markets in 2025 are buzzing with activity, driven by global economic shifts, geopolitical developments, and sector-specific opportunities. From crude oil price fluctuations to renewable energy advancements, the landscape offers both challenges and opportunities for investors. This comprehensive guide explores critical market trends, stock movements, and economic forecasts to help you navigate the dynamic world of finance with confidence.

Understanding Global Market Dynamics

U.S. Market Performance and Its Ripple Effect

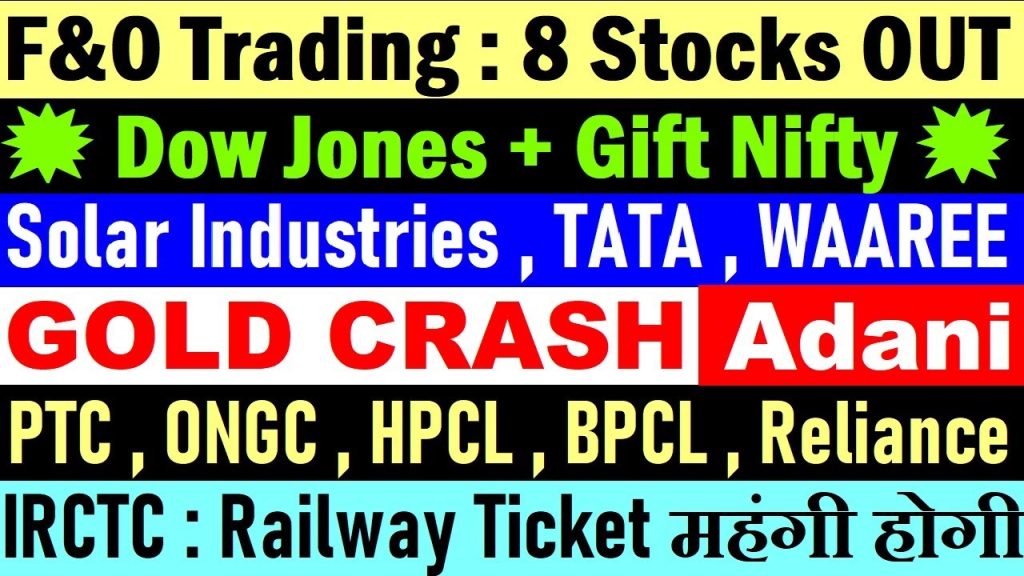

The U.S. stock market sets the tone for global financial sentiment. In early 2025, indices like the Dow Jones Industrial Average are showing resilience, climbing approximately 0.25% in recent sessions. This upward momentum signals investor optimism, driven by stabilizing macroeconomic indicators and positive corporate earnings. For Indian investors, monitoring U.S. market trends is crucial, as they often influence domestic indices like the Nifty 50 and Sensex.

Crude Oil Prices: A Game-Changer for Economies

Crude oil prices have taken center stage, with Brent crude hovering around $67 per barrel and WTI dipping below $65. A significant 5% drop in crude prices, attributed to ceasefire agreements in key geopolitical regions, has sparked a positive outlook for oil-importing nations like India. Lower crude prices reduce input costs for industries, boost corporate profitability, and ease inflationary pressures, creating a favorable environment for economic growth.

Impact on Indian Markets

India, a net importer of crude oil, benefits immensely from declining oil prices. Sectors such as aviation, paints, rubber, cement, and specialty chemicals see reduced raw material costs, enhancing their margins. Companies like BPCL, HPCL, Indian Oil, and Reliance Industries stand to gain, as cheaper crude directly improves their operational efficiency. Conversely, upstream oil companies like Oil India and ONGC may face short-term challenges due to lower realizations.

Gift Nifty: A Leading Indicator

The Gift Nifty, a key indicator of Indian market sentiment, is trading above 25,000, with a 100-point gain signaling bullish momentum. This positive movement reflects confidence in India’s economic trajectory and suggests potential strength in the opening of domestic markets. Investors should track Gift Nifty alongside global cues like the Nikkei and U.S. indices for a holistic view of market direction.

India’s Economic Outlook: GDP Forecasts and Growth Drivers

S&P’s Optimistic GDP Projection

S&P Global has raised India’s GDP growth forecast for FY26 to 6.5%, a robust figure despite global economic headwinds. This projection underscores India’s resilience, driven by strong domestic consumption, infrastructure investments, and a burgeoning digital economy. However, to achieve a transformative growth rate of 7% or higher, sustained policy reforms and private sector investment are essential.

Path to 7% Growth

Achieving a consistent 7% GDP growth requires structural improvements in manufacturing, exports, and job creation. While 6.5% growth is commendable, India must leverage its demographic dividend and accelerate reforms in sectors like agriculture and education to unlock its full potential. The government’s focus on infrastructure and renewable energy could pave the way for sustained economic expansion.

Sector-Specific Insights: Opportunities and Challenges

Energy Sector: Renewable Energy Takes the Lead

The global shift toward sustainability is reshaping the energy landscape. Adani Group, a key player in India’s renewable energy sector, announced ambitious plans at its Annual General Meeting (AGM) to invest $15–20 billion over the next five years. The group aims to achieve 100 gigawatts of power capacity by 2030, aligning with India’s renewable energy target of 500 gigawatts. This mega-plan positions Adani as a frontrunner in the green energy revolution.

Waaree Renewable Technologies: Expanding Horizons

Waaree Renewable Technologies has signed a Memorandum of Understanding (MoU) to bolster its renewable energy projects. Such strategic partnerships enhance revenue visibility and strengthen the company’s position in the solar energy market. As India accelerates its clean energy adoption, companies like Waaree are well-poised to capitalize on growing demand.

Defense Sector: Solar Industries Shines

Solar Industries, a leader in explosives manufacturing, secured a ₹158 crore order from the Ministry of Defence. This contract underscores the company’s critical role in India’s defense ecosystem. As defense spending rises, Solar Industries is likely to see improved topline and bottom-line growth, making it an attractive pick for long-term investors.

Railways: IRCTC Faces Mixed Prospects

IRCTC, the ticketing and tourism arm of Indian Railways, is set to benefit from a proposed fare hike starting July 1, 2025. While this increase may marginally impact passenger affordability, it is expected to boost IRCTC’s revenue. Given the railways’ cost-effectiveness for long-distance travel, demand is likely to remain robust, supporting the company’s financial performance.

Aviation: PTC Industries Soars

PTC Industries has signed an MoU with Safran Aircraft Engines, signaling strong business prospects in the aerospace sector. This partnership enhances PTC’s credibility and opens doors to global opportunities. As India’s aviation industry grows, driven by rising air travel demand, companies like PTC are well-positioned for growth.

Starbucks in India: Navigating Market Dynamics

Clarifying Exit Rumors

Recent speculation about Starbucks exiting China was debunked, with the company confirming ongoing operations while exploring stake sales. In India, Starbucks operates through a joint venture with Tata Consumer Products, holding a 50% stake. Listed on the Indian stock exchanges, Tata Consumer Products benefits from its diverse portfolio, including beverages like Tata Tea and packaged water. As a Nifty 50 constituent, the company remains a stable investment option.

Growth Potential in India

Starbucks’ expansion in India aligns with the country’s growing coffee culture. With rising disposable incomes and urbanization, the company is well-positioned to capture market share. Investors should monitor Tata Consumer Products for its diversified revenue streams and strong brand equity.

Gold and Bitcoin: Safe Havens in Flux

Gold Prices Slide

Gold prices have dipped below ₹1 lakh, influenced by falling crude oil prices and ceasefire developments. While this decline impacts gold-related companies, it reflects a broader market sentiment shift. Investors in gold stocks should exercise caution, as short-term volatility may persist.

Bitcoin’s Resurgence

Bitcoin has crossed $15,000, signaling renewed investor interest in cryptocurrencies. As digital assets gain traction, Bitcoin’s performance could influence related stocks and blockchain-focused companies. However, its volatility warrants a cautious approach.

Currency Movements: Dollar-Rupee Dynamics

The Indian rupee is trading below 86 against the U.S. dollar, reflecting stability amid global uncertainties. A stronger rupee benefits import-dependent sectors, while exporters may face margin pressures. Investors should monitor currency trends to gauge their impact on specific industries.

Geopolitical Influences: Trump’s Nobel Pursuit

Trump’s Peace Initiatives

Former U.S. President Donald Trump’s efforts to broker peace in conflicts like Israel-Iran and Russia-Ukraine have sparked discussions about a Nobel Peace Prize nomination. While his role in de-escalating tensions is notable, controversies surrounding his motives persist. For investors, geopolitical stability could reduce market volatility, creating a favorable environment for risk assets.

Implications for Markets

Ceasefire agreements, particularly in oil-producing regions, have contributed to falling crude prices. This stability benefits equity markets, particularly in emerging economies like India, where lower oil prices enhance economic fundamentals.

F&O Trading: Key Changes in 2025

Eight Stocks Exit F&O Segment

Starting August 29, 2025, eight companies will be excluded from the Futures and Options (F&O) segment on the National Stock Exchange (NSE). These include:

- Aditya Birla Fashion and Retail

- Adani Total Gas

- CESC

- Granules India

- IRB Infrastructure

- Jindal Stainless

- Poonawalla Fincorp

- SJVN

This change restricts F&O trading for these stocks, potentially impacting their liquidity and investor interest. Traders should reassess their strategies and focus on cash market opportunities for these companies.

Air India Crash: Black Box Controversy

The recent Air India plane crash has raised questions about the investigation process. Initial reports suggested the black box was sent to Boeing for analysis, sparking concerns about impartiality. However, the Civil Aviation Minister clarified that the black box remains in India and is being examined by the Aircraft Accident Investigation Bureau (AAIB). This transparency reassures stakeholders, but the investigation’s outcome will be critical for the aviation sector’s reputation.

IPO Watch: HDB Finance

The Initial Public Offering (IPO) of HDB Finance is generating buzz, with the Grey Market Premium (GMP) touching 10%. This indicates strong investor interest and potential listing gains. As the IPO market remains vibrant, HDB Finance could be a compelling opportunity for retail and institutional investors.

Strategies for Investors in 2025

Diversify Across Sectors

With varied market dynamics, diversification is key. Investors should consider exposure to renewable energy, defense, and consumer goods while monitoring crude-sensitive sectors like oil and aviation. A balanced portfolio mitigates risks and capitalizes on growth opportunities.

Stay Informed on Global Cues

Global factors, including U.S. market performance, crude oil prices, and geopolitical developments, significantly impact Indian markets. Regularly tracking indices like the Dow Jones, Nikkei, and Gift Nifty provides valuable insights for decision-making.

Focus on Long-Term Growth

Companies with strong fundamentals, such as Adani Group, Solar Industries, and Tata Consumer Products, offer long-term growth potential. Investors should prioritize businesses with robust order books, strategic partnerships, and alignment with national priorities like renewable energy.

Conclusion: Navigating the Future with Confidence

The financial markets in 2025 present a dynamic landscape filled with opportunities and challenges. Falling crude oil prices, robust GDP forecasts, and strategic corporate developments create a favorable environment for Indian investors. By staying informed, diversifying investments, and focusing on high-growth sectors, you can position yourself for success in this ever-evolving market.

Stay proactive, monitor global and domestic trends, and leverage the insights provided to make informed investment decisions. The future of finance is bright, and with the right strategies, you can unlock its full potential.