India is finally waking up to the global semiconductor race. With the government approving projects worth over ₹1.6 lakh crore across six states and Prime Minister Narendra Modi promising lightning-fast approvals, the “Make in India” semiconductor dream is turning into reality. The country that missed the first three waves of chip-making is now determined to capture a slice of the $1 trillion global market by 2030.

This is not just another “emerging sector” story — it is a national mission. From Gujarat to Assam, massive fabrication (fab) units, OSAT (Outsourced Semiconductor Assembly and Test) facilities, and design centres are coming up. And for investors, this means one thing: a new crop of Indian semiconductor stocks is ready to explode.

In this 3,500-word ultimate guide, we reveal the top listed semiconductor companies in India for 2025, break down their exact role in the chip ecosystem (design, OSAT, testing, fab), share latest shareholding patterns, growth triggers, and the real risks you must know before investing.

Why India’s Semiconductor Push Is Different This Time

For decades, India remained a consumer, not a producer, of chips. Today, everything has changed:

- ₹76,000+ crore PLI scheme dedicated to semiconductors

- 100% FDI allowed with fast-track approvals

- 10 major projects already cleared worth ₹1.6 lakh crore

- Partnerships with global giants: Micron, Tata-PSMC, CG Power-Renesas

- Target: $300 billion electronics production by 2026, with semiconductors leading the charge

This is India’s biggest industrial policy bet since liberalization — and the stock market is taking notice.

Understanding the Semiconductor Value Chain in India

Not every “semiconductor stock” makes actual chips. The ecosystem has four main pillars:

- Design & IP – Creating the blueprint of chips

- Fabrication (Fabs) – Manufacturing the silicon wafer

- OSAT (Assembly, Testing, Marking & Packaging) – The “back-end” where chips become usable

- ATMP (Assembly, Testing, Marking, Packaging) – Similar to OSAT, often used interchangeably

India is focusing heavily on OSAT and ATMP first (lower capital, faster returns), then moving upstream into fabs.

Now let’s meet the real players.

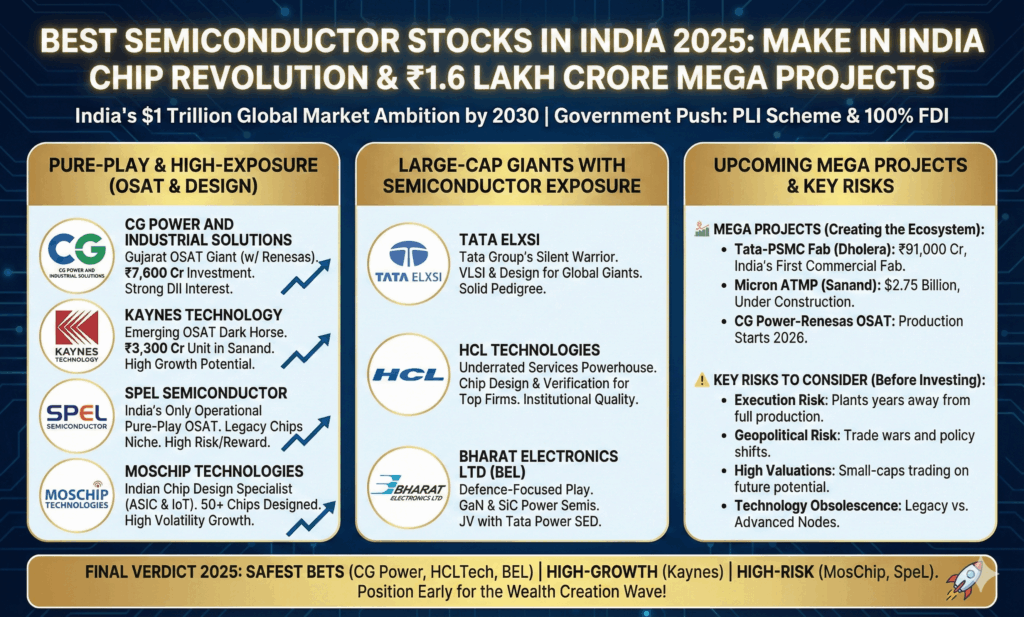

Top Pure-Play & High-Exposure Semiconductor Stocks in India 2025

1. CG Power and Industrial Solutions – The Gujarat OSAT Giant

CG Power (Murugappa Group) is building India’s largest OSAT facility in Sanand, Gujarat in partnership with Renesas (Japan) and Stars Microelectronics (Thailand). Investment: ₹7,600 crore. This plant will produce chips for consumer, industrial, automotive, and medical devices.

Latest Shareholding (Sep 2025):

- Promoters: 56.8%

- FIIs: 13.2%

- DIIs: 16.4%

- Public: 13.6%

Why Investors Love It: Strong parentage, zero debt, and direct beneficiary of “Make in India” incentives.

2. Kaynes Technology – The Emerging OSAT Dark Horse

Kaynes is setting up a ₹3,300+ crore OSAT unit in Sanand (again Gujarat is the hotspot!). The company already serves aerospace, automotive, and medical clients with high-reliability electronics.

Shareholding Pattern:

- Promoters: 53.46%

- FIIs: 10.71%

- DIIs: 23.66%

- Public: 12.17%

Rising DII stake shows smart money is accumulating.

3. SpeL Semiconductor – India’s Only Operational Pure-Play OSAT

SpeL is India’s oldest and currently the only functioning semiconductor packaging and testing company. Though small (< ₹300 crore revenue), it enjoys near-monopoly status for legacy chips.

Shareholding:

- Promoters: 59%

- FII + DII: almost 0%

- Public: ~41%

High risk, high reward — classic small-cap semiconductor bet.

4. MosChip Technologies – The Indian Chip Design Specialist

MosChip provides turnkey ASIC design and IoT solutions. It has designed over 50 chips till date and serves clients in aerospace, automotive, and telecom.

Market Cap: < ₹4,000 crore → pure high-volatility growth story.

Shareholding:

- Promoters: 41.65% (decreasing)

- FIIs: <1%

- Public: 57%+

Promoter stake dilution is a red flag, but order wins can send the stock flying 50–100% in weeks.

Large-Cap Giants with Growing Semiconductor Exposure

5. Tata Elxsi – Tata Group’s Silent Semiconductor Warrior

While famous for automotive design, Tata Elxsi has quietly built a strong VLSI and semiconductor design practice. Clients include top-10 global chip makers.

Shareholding:

- Promoters (Tata Sons): ~44%

- FIIs + DIIs: combined >22%

- Public: ~33%

Rock-solid pedigree with reasonable valuation.

6. HCL Technologies – The Underrated Semiconductor Services Powerhouse

Through HCLTech Engineering Services, the company provides chip design, verification, and embedded solutions to seven of the top ten global semiconductor firms.

Shareholding:

- Promoters: 60.8%

- FIIs: 16.5%

- DIIs: ~18%

- Public: <5%

Almost zero public float — the definition of institutional quality.

7. Bharat Electronics Ltd (BEL) – The Defence-Focused Semiconductor Play

BEL manufactures GaN and SiC power semiconductors, RF chips, and has a joint venture with Tata Power SED for advanced fabs.

Shareholding:

- Government of India: 51.1%

- FIIs: 18%

- DIIs: 21%

- Public: ~9%

Defence + semiconductor dual trigger makes BEL a favourite among large-cap hunters.

Upcoming Mega Projects That Will Create the Next Multibaggers

- Tata-PSMC Fab (Dholera, Gujarat) – ₹91,000 crore, India’s first commercial fab

- Micron ATMP (Sanand, Gujarat) – $2.75 billion, already under construction

- CG Power-Renesas OSAT – Production starts 2026

- Kaynes OSAT – Targeting 2026–27

- HCL-Foxconn JV (Uttar Pradesh) – ₹30,000+ crore upcoming OSAT

These projects will need hundreds of ancillary and service companies — creating a ripple effect across the entire ecosystem.

Risks You Cannot Ignore in Indian Semiconductor Stocks

- Execution Risk – Most plants are still 2–4 years away from commercial production

- Geopolitical Risk – US-China trade war benefits India, but sudden policy shifts hurt

- High Valuations – Many small-cap names trade at 100–300x P/E on “future potential”

- Technology Obsolescence – Legacy nodes vs advanced nodes battle

- Order Book Consistency – Especially brutal for small companies

Final Verdict: Who Deserves Your Money in 2025?

Safest Large-Cap Bets → CG Power, HCLTech, BEL, Tata Elxsi High-Growth Mid-Cap → Kaynes Technology High-Risk High-Reward → MosChip, SpeL Semiconductor

The Indian semiconductor story is no longer “coming soon” — it is happening right now. The government has put its weight, money, and prestige behind it.

Investors who position themselves early in the right semiconductor stocks in India stand to ride one of the biggest wealth-creation waves of this decade.

Start your research today — because by 2030, the leaders of tomorrow’s chip revolution will already be multi-baggers.

Which semiconductor stock are you betting on for 2025–2030? Drop your pick in the comments and let the discussion begin! 🚀