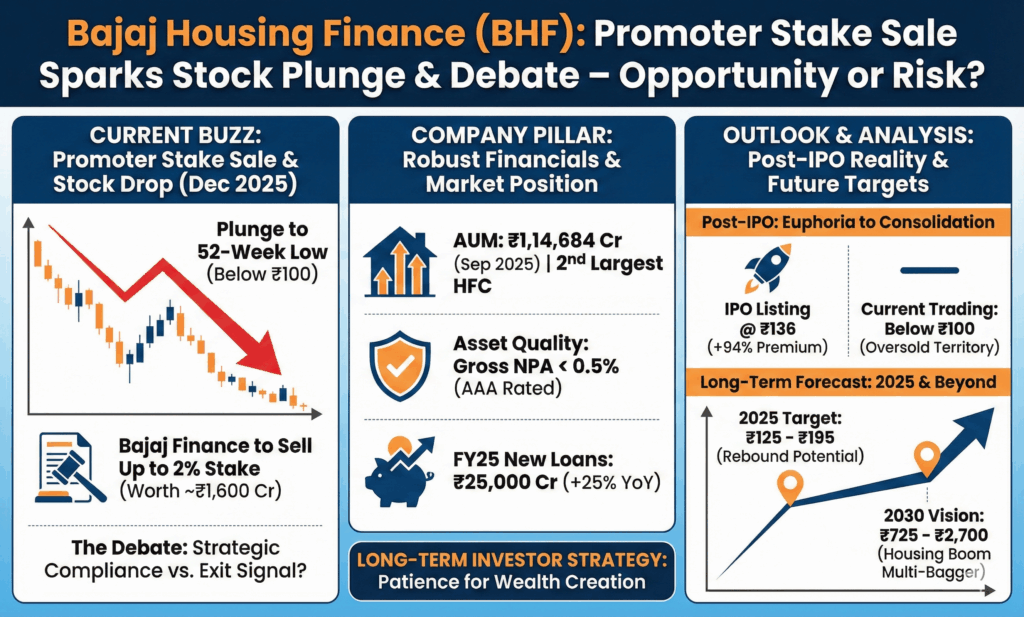

Bajaj Housing Finance (BHF), the powerhouse subsidiary of Bajaj Finance, finds itself at the center of such buzz as of December 2025. With its promoter announcing plans to offload up to 2% of its equity stake—potentially worth over ₹1,600 crore—the stock has plunged to a 52-week low, sparking debates on whether this signals an exit or a strategic compliance move.

Investors grapple with BHF share price targets for 2025, wondering if the current consolidation phase masks a golden long-term opportunity or hides deeper risks. This comprehensive analysis dives deep into the Bajaj Housing Finance promoter stake sale latest news, unpacks the company’s robust financials, evaluates BHF share performance post-IPO, and forecasts potential price trajectories through 2030. Drawing from real-time market data and expert insights, we explore why patient investors might still eye BHF as a cornerstone in housing finance stocks for long-term wealth creation.

Bajaj Housing Finance Company Overview: A Pillar in India’s Housing Finance Sector

Bajaj Housing Finance Limited stands tall as one of India’s premier non-deposit-taking housing finance companies (HFCs), carving a niche since its inception in 2008 as a wholly-owned subsidiary of Bajaj Finance Limited. Registered with the National Housing Bank (NHB) in 2015, the company kicked off mortgage lending operations in 2018 and has since skyrocketed to become the second-largest HFC by assets under management (AUM) within just seven years. As of September 2025, Bajaj Housing Finance boasts an AUM exceeding ₹1,14,684 crore, serving over 308,693 active customers across 215 branches in 174 locations spanning 20 states and three union territories.

What sets Bajaj Housing Finance apart in the crowded housing finance market? Its product suite shines with diversity and depth. Home loans dominate at 81.7% of the portfolio, targeting prime salaried and self-employed borrowers with competitive rates and swift approvals.

Complementing this are loans against property (LAP), lease rental discounting for commercial real estate owners, and developer financing that fuels large-scale projects. The company’s emphasis on retail lending—over 90% of its book—ensures stability, while its geographic focus on high-growth regions like Maharashtra, Karnataka, Telangana, Gujarat, and Delhi minimizes regional risks.

Backed by the iconic Bajaj brand, synonymous with trust and innovation in consumer finance, Bajaj Housing Finance enjoys AAA ratings from CRISIL and ICRA, underscoring its low-risk profile. Gross non-performing assets (NPAs) hover below 0.5%, a testament to stringent underwriting and robust collection mechanisms. In fiscal year 2025 (FY25), the company disbursed ₹25,000 crore in new loans, a 25% year-on-year (YoY) jump, driven by India’s booming real estate sector. Urbanization, rising disposable incomes, and government initiatives like PMAY (Pradhan Mantri Awas Yojana) propel demand, positioning Bajaj Housing Finance as a key enabler of the ₹50 lakh crore annual housing finance opportunity.

Yet, challenges persist. Interest rate volatility, regulatory scrutiny on NBFCs, and competition from banks like HDFC and SBI test resilience. Despite this, Bajaj Housing Finance’s parentage provides a safety net—Bajaj Finance’s diversified ecosystem ensures seamless funding access. As India aims for 10 million new homes annually by 2030, Bajaj Housing Finance gears up with digital innovations like app-based loan applications and AI-driven credit scoring, promising sustained growth in the housing finance stocks arena.

Bajaj Housing Finance IPO Performance: From Euphoria to Extended Consolidation

The Bajaj Housing Finance IPO in September 2024 marked a blockbuster debut, raising ₹6,560 crore through a fresh issue of ₹3,560 crore and an offer-for-sale (OFS) of ₹3,000 crore. Priced at ₹70 per share, the issue saw overwhelming subscription—67.43 times overall, with retail at 7.4 times and QIBs at 64 times. Grey market premium (GMP) soared to ₹70, fueling expectations of listing gains. On September 16, 2024, shares listed at ₹136 on NSE, a 94% premium over the IPO price, skyrocketing to a post-listing high of ₹190 within weeks. This euphoria reflected investor faith in the Bajaj pedigree and the housing sector’s tailwinds.

However, reality soon tempered the hype. Post-IPO, BHF share price entered a prolonged consolidation phase, shedding over 50% from peaks to trade below ₹100 by December 2025. Analysts attribute this to several factors. First, the IPO’s massive oversubscription trapped retail investors chasing quick flips, leading to profit-booking. Second, broader market corrections in NBFC stocks, triggered by RBI’s liquidity tightening, amplified the downturn. Third, the stock’s rich valuation at debut—trading at 30x FY24 earnings—invited scrutiny as growth normalized.

Data paints a clear picture: From ₹190 in October 2024, BHF consolidated between ₹100-₹140 for 18 months, forming a multi-month base. As of December 2, 2025, it hit a record low of ₹95 after a 9% plunge, with trading volume exploding to 30.7 crore shares—over 10 times average. Technical indicators scream oversold: Money Flow Index (MFI) at 23, below 50-day and 200-day moving averages (₹109 and ₹116), and RSI under 30. This mirrors classic IPO traps where hype outpaces fundamentals, ensnaring non-learned investors, as one expert quipped.

Yet, consolidation often precedes breakouts in quality stocks. Historical parallels abound—consider HDFC’s post-IPO phase in the early 2000s, which consolidated for two years before a multi-bagger run. For BHF, this phase tests patience but builds a stronger base. Loan growth held steady at 25% YoY in FY25, and net interest margins (NIMs) expanded to 4.5%, signaling operational strength amid the lull. Investors eyeing BHF share price targets must view this as a coiling spring, not a broken wire.

Bajaj Housing Finance Financials 2025: Robust Growth Amid Market Headwinds

Bajaj Housing Finance’s financial performance in 2025 underscores its resilience, delivering double-digit growth despite sector volatility. For Q2 FY26 (ended September 2025), the company reported net sales of ₹2,754.85 crore, up 14.3% YoY from ₹2,410 crore. Profit after tax (PAT) surged 17.84% to ₹642.96 crore, beating estimates of ₹545.60 crore, driven by controlled provisions and higher fee income. Net interest income (NII) climbed 20% annually to ₹1,200 crore, with NIMs stable at 4.2%.

Annually, FY25 painted an even brighter canvas. Revenue hit ₹9,576 crore, a 25.7% YoY increase from ₹7,618 crore in FY24. PAT grew 24.9% to ₹2,163 crore, reflecting a compound annual growth rate (CAGR) of 56.32% over five years. AUM expanded 26% to ₹1,14,684 crore, fueled by 25% loan book growth to ₹1,00,000 crore. Borrowings rose to ₹69,129 crore, but the company maintained a healthy debt-equity ratio of 4.5x, supported by low-cost bank lines and debentures.

Key metrics highlight efficiency: Return on assets (ROA) at 1.8%, return on equity (ROE) at 18%, and cost-to-income ratio under 20%. Asset quality remains pristine—gross NPAs at 0.4%, net NPAs at 0.1%—thanks to a 70% focus on salaried borrowers with scores above 750. Operating income CAGR stood at 34.16% from FY20-25, underscoring scalable operations.

Challenges linger: Q4 FY25 saw a 25.6% revenue jump to ₹2,500 crore, but rising funding costs from RBI hikes squeezed margins temporarily. Still, Bajaj Housing Finance’s diversified funding—40% banks, 30% debentures, 30% parent infusions—mitigates risks. Compared to peers like LIC Housing Finance (ROE 12%) or PNB Housing (NPA 2%), BHF’s metrics shine, positioning it as a top pick in housing finance stocks for 2025.

| Key Financial Metrics (FY25 vs FY24) | FY25 | FY24 | YoY Growth |

|---|---|---|---|

| Revenue (₹ Crore) | 9,576 | 7,618 | 25.7% |

| PAT (₹ Crore) | 2,163 | 1,731 | 24.9% |

| AUM (₹ Crore) | 1,14,684 | 90,700 | 26% |

| NIM (%) | 4.2 | 4.0 | 5% |

| ROE (%) | 18 | 16 | 12.5% |

| Gross NPA (%) | 0.4 | 0.5 | -20% |

This table illustrates Bajaj Housing Finance’s trajectory, emphasizing why fundamentals trump short-term noise.

Bajaj Housing Finance Promoter Stake Sale Latest News: Compliance or Caution?

The elephant in the room: Bajaj Finance’s announcement on December 1, 2025, to sell up to 2% stake (16.66 crore shares) in Bajaj Housing Finance. Valued at ₹1,740 crore at current prices, the divestment aims to meet SEBI’s minimum public shareholding (MPS) norms—capping promoter holding at 75%. Currently at 88.70%, this move complies with RBI’s upper-layer NBFC listing mandate by September 2025.

Details unfold strategically: The sale runs from December 2, 2025, to February 28, 2026, in one or multiple tranches via open-market block deals. Floor price? Reports peg it at ₹95, a 9.6% discount to the December 1 close of ₹104.50. Promoters, including Bajaj Finserv, pledge no open-market buys on sale days, per SEBI rules. A massive block deal on December 2—19.5 crore shares at ₹97—sent shares crashing 9% to ₹95, erasing ₹8,000 crore in market cap.

Is this a promoter exit? Far from it. Bajaj Finance, holding 88.70% (739 crore shares), views this as routine housekeeping. Post-IPO, public float stood at 11.3%; this boosts it to 13.3%, enhancing liquidity without diluting control. Historical precedents reassure: HDFC’s 2018 stake trim complied similarly, preceding a 200% rally. Market overreaction stems from timing—amid consolidation—but experts like ICICI Securities call it a “non-event” for long-term holders.

BHF share latest news also spotlights Q2 beats: 18% PAT growth to ₹643 crore, despite the dip. Volumes hit 452 million shares on December 2, signaling institutional accumulation at lows. For housing finance investors, this sale offers a rare chance to buy from promoters at attractive pricing, echoing the transcript’s wisdom: “You’re getting it directly from the promoters.”

BHF Share Price Target 2025: Navigating Oversold Territory for Rebound Potential

BHF share price targets for 2025 hinge on breaking the consolidation yoke. At ₹95-₹98 (as of December 2, 2025), the stock trades at 4.13x book value and 37x trailing earnings—premium but justified by 25% growth. Analysts diverge: ICICI Securities eyes ₹125 (31% upside), citing NIM expansion; TradingView’s consensus hits ₹113.78 (max ₹160, min ₹83). Optimistic forecasts from MoneyMintIdea project ₹280-₹469, banking on 30% AUM CAGR.

Bull case: RBI rate cuts in H2 2025 spur housing demand, lifting disbursals 30% YoY. Stake sale completion enhances free float, attracting FIIs (currently 0.94%). Technicals suggest a base at ₹90; a close above ₹110 triggers upside to ₹140. Risks: Prolonged high rates cap NIMs at 4%, or realty slowdowns hike NPAs.

Short-term target: ₹110 by Q1 2026. Long-term: ₹195 (LDCC Bank). Investors should accumulate on dips, as the stock’s “true water finds its level”—fundamentals eventually prevail.

Long-Term BHF Share Price Forecast: 2030 Vision in Housing Finance Boom

Zooming to 2030, BHF share price targets paint a bullish canvas. TradeMint forecasts ₹725 by 2030, scaling to ₹2,660 by 2040, assuming 25% CAGR in AUM to ₹5 lakh crore. Drivers? India’s housing deficit—20 million units—fuels 15% sector growth. Bajaj Housing Finance’s digital pivot (80% loans sourced online) and LAP expansion (20% of book by 2028) amplify this.

By 2030, expect ROE at 20%, PAT at ₹10,000 crore. Valuation: 5x book yields ₹2,100-₹2,700 (MoneyMintIdea). Bear risks: Regulatory caps on NBFC lending or economic slowdowns. Yet, with Bajaj’s 100+ year legacy, BHF emerges as a multi-bagger in housing finance stocks.

| Year | Min Target (₹) | Max Target (₹) | Key Driver |

|---|---|---|---|

| 2025 | 195 | 469 | Rate cuts, AUM growth |

| 2026 | 342 | N/A | Digital expansion |

| 2030 | 2,100 | 2,700 | Housing boom |

This roadmap underscores patience: Ultra-long-term plays like BHF reward holders, not traders.

Investment Strategy for BHF Shares: Patience Pays in IPO Traps

Drawing from the transcript’s candor, BHF suits patient investors, not short-term punters. The IPO “fiasco” trapped hype-chasers; now, at lows, it offers entry. Strategy: Allocate 5-10% portfolio, buy in tranches below ₹100, hold 3-5 years. Diversify with peers like Aavas Financiers. Monitor Q3 results for disbursement cues.

Risks abound—volatility, funding costs—but rewards eclipse: 50%+ upside by 2026. As one analyst notes, “Real stocks catch their flow.” For Bajaj Housing Finance promoter stake sale watchers, this dip screams opportunity.

Conclusion: Seize the Dip in Bajaj Housing Finance for Enduring Gains

Bajaj Housing Finance’s journey—from IPO fireworks to consolidation calm, now punctuated by a promoter stake sale—tests mettle but reveals strength. With stellar financials, a dominant housing finance footprint, and 2025 targets up to ₹469, BHF beckons long-haul investors. Ignore the noise; embrace the patience. In India’s housing renaissance, Bajaj Housing Finance doesn’t just participate—it leads. Position now, and watch your portfolio flourish.