In the dynamic world of Indian energy stocks, Adani Power continues to command attention as a powerhouse in thermal generation. Investors eagerly await updates on its strategic moves, especially following the recent board meeting on November 21, 2025. This pivotal gathering has unveiled fresh appointments and signals robust growth ambitions amid India’s aggressive push toward 500 GW renewable capacity by 2030. As Adani Power navigates stock splits and market fluctuations, comparisons with rival Tata Power intensify, highlighting divergent paths in clean energy and traditional power. This comprehensive analysis dives deep into the latest Adani Power share news, explores its competitive edge, and forecasts potential trajectories for savvy investors eyeing long-term gains.

Adani Power Board Meeting Results: Key Decisions Shaping the Future

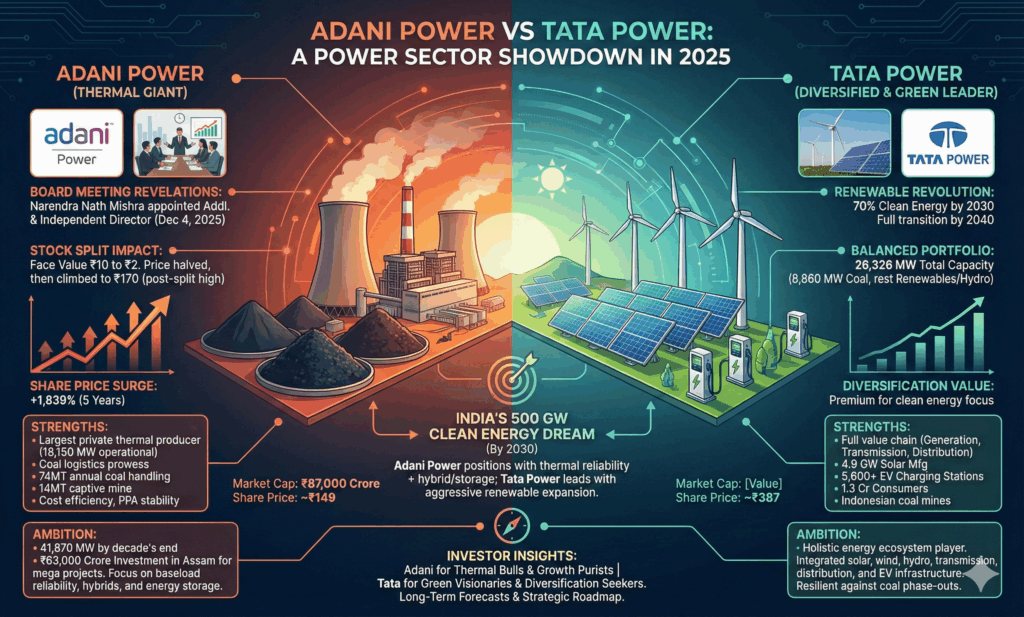

Adani Power’s board convened on November 21, 2025, delivering outcomes that underscore the company’s commitment to bolstering leadership and governance. The meeting focused on critical resolutions, primarily the appointment of a seasoned expert to the board. This move arrives at a crucial juncture, as Adani Power accelerates its expansion beyond India’s borders while addressing operational hurdles in coal logistics and regulatory compliance.

The board approved the induction of Mr. Narendra Nath Mishra as an Additional Director and Independent Director. Effective from December 4, 2025, his tenure spans three years, extending until December 3, 2028. Mishra brings a wealth of expertise from his illustrious career at NTPC, India’s premier public-sector power utility. He joined NTPC in 1977, fresh from his graduation, and rose through the ranks by spearheading initiatives that propelled the company’s growth. Under his influence, NTPC expanded its thermal capacities and optimized operations, achieving remarkable efficiency in power generation and distribution.

What makes Mishra’s appointment particularly strategic? Adani Power operates in a sector plagued by supply chain volatilities and shifting energy policies. Mishra’s track record in navigating government regulations and scaling thermal projects positions him ideally to guide Adani’s ambitions. Unlike directors entangled in multiple boards, Mishra commits exclusively to Adani Group’s power vertical, ensuring undivided focus. SEBI regulations confirm his clean slate—no current directorships elsewhere—allowing him to channel his NTPC-honed acumen into Adani’s private-sector agility.

This appointment isn’t merely administrative; it signals Adani Power’s intent to blend public-sector prudence with private-sector innovation. Investors interpret it as a green light for enhanced decision-making, potentially stabilizing the stock amid post-split volatility. As Adani Power share price hovers around ₹149 after a 1% dip on Friday’s close, this news injects optimism, hinting at a rebound toward pre-profit-booking highs of ₹170.

Impact of Adani Power Stock Split: Boosting Accessibility and Investor Appeal

Adani Power executed a stock split earlier this year, slashing the face value from ₹10 to ₹2 per share. This maneuver halved the share price overnight, making it more accessible to retail investors who previously shied away from the lofty ₹750+ levels. Post-split, the stock climbed to ₹170, reflecting heightened liquidity and broader participation. However, profit booking ensued, pulling it back to current levels—a classic post-event correction in bull runs.

Why did Adani Power opt for this split? Companies deploy such strategies to democratize ownership, attract smaller investors, and enhance trading volumes. For Adani Power, it aligned with its multibagger trajectory: over the past five years, the stock delivered a staggering 1,839% return, transforming modest investments into windfalls. At a market capitalization of ₹87,000 crore, Adani Power dwarfs many peers, yet the split ensures it remains approachable.

Analysts predict this accessibility will fuel further upside. With 18,150 MW of operational thermal capacity and power purchase agreements locked in, Adani Power generates steady cash flows. The split also sharpens focus on per-share metrics, potentially elevating earnings per share (EPS) perceptions. As the stock digests recent dips—triggered by broader market weakness—watch for catalysts like Mishra’s integration to propel it past ₹170. For Adani Power share price today enthusiasts, this split represents not dilution, but amplification of growth potential.

Adani Power vs Tata Power: A Head-to-Head Battle in India’s Power Sector

When pitting Adani Power against Tata Power, the narrative sharpens around focus, scale, and diversification. Both titans from storied conglomerates—Adani and Tata—dominate India’s power landscape, but their strategies diverge like thermal steam versus solar rays. Adani Power reigns as the largest private thermal power producer, boasting superior installed capacity and market cap. Tata Power, conversely, champions a balanced portfolio, blending legacy coal assets with aggressive renewable forays.

Let’s break down the numbers. Adani Power commands 18,150 MW in thermal assets, handling 74 million tons of coal annually while developing a 14 million-ton captive mine. Its logistics prowess keeps costs lean, supporting ambitious targets of 41,870 MW by decade’s end. Tata Power’s 26,326 MW portfolio includes 8,860 MW coal-based projects, but the rest tilts toward solar, wind, and hydro—aligning with India’s clean energy mandate.

Market valuations tell a compelling story: Adani Power’s ₹87,000 crore cap edges out Tata’s, with shares trading at ₹150 versus Tata’s ₹387. Yet Tata’s diversification shines brighter in renewables. By 2030, Tata aims for 70% clean energy, fully transitioning by 2040. It operates 4,659 MW solar manufacturing, 4,650 circuit km transmission lines, and supplies power to 1.3 crore consumers in Mumbai and Delhi. Add 5,600+ EV charging stations and Indonesian coal mines, and Tata emerges as a holistic energy ecosystem player.

Adani Power, laser-focused on thermal, leverages domestic coal mines and Adani Energy Solutions for green extensions. Tata Power controls the full chain—generation, transmission, distribution—while venturing into renewables and manufacturing. Adani’s edge? Sheer scale and cost efficiency. Tata’s? Resilience against coal phase-outs. In Adani Power share news today, this rivalry underscores investment choices: thermal bulls favor Adani; green visionaries lean Tata.

India’s 500 GW Clean Energy Dream: How Adani Power Positions Itself

India’s vow to hit 500 GW renewable capacity by 2030 catapults power stocks into the spotlight. Schemes like Deen Dayal Upadhyaya Gram Jyoti Yojana and Saubhagya have electrified millions of rural homes, eradicating chronic shortages. Solar and wind now contribute over half of new consumption, yet coal remains king—powering 70% of grids due to surging demand from urbanization and industrialization.

Adani Power thrives here, optimizing thermal for baseload reliability while eyeing hybrids. Its 18,150 MW fleet, backed by long-term PPAs, ensures revenue stability. Smart grids and battery storage innovations amplify this: Adani invests in energy storage to integrate intermittents like solar. Tata Power mirrors this, but Adani’s thermal dominance provides a buffer against transition risks.

Challenges persist—coal import dependencies and environmental scrutiny—but Adani counters with captive mines and efficiency upgrades. As clean energy portfolios swell, Adani Power’s adaptability could yield multibagger returns, mirroring its 1,839% five-year surge.

Tata Power’s Renewable Revolution: Lessons for Adani Power Investors

Tata Power’s playbook offers blueprints for Adani’s evolution. With 70% clean energy targeted by 2030, Tata manufactures 4.9 GW solar panels in-house, operates vast transmission networks, and pioneers EV infrastructure. Its Indonesian coal mines secure supply, while urban distribution serves millions seamlessly.

Contrast this with Adani’s thermal fortress: fewer renewables, but unmatched scale. Tata’s stock, at ₹387, reflects premium for diversification; Adani’s ₹150 screams value for growth purists. For Adani Power share price update seekers, Tata’s model suggests hybrid pivots could unlock premiums, blending thermal cash cows with green upside.

Massive ₹63,000 Crore Investment in Assam: Adani Power’s Bold Expansion Leap

Adani Group’s masterstroke? A ₹63,000 crore infusion into Assam for two mega power projects. This colossal bet—rivaling national budgets—targets thermal and ancillary infrastructure, supercharging Adani Power’s portfolio. Assam’s untapped hydro and coal reserves align perfectly, promising 5,000+ MW additions.

This isn’t isolated; Adani pursues pan-India projects, from Gujarat’s solar farms to Odisha’s mines. The investment catalyzes jobs, local economies, and energy security, aligning with Atmanirbhar Bharat. For stocks, it forecasts EPS accretion and dividend hikes, propelling Adani Power share news into bullish territory.

Adani Power Financial Ratings: Strengths, Weaknesses, and Investor Signals

Independent raters applaud Adani Power’s fundamentals. It earns three stars out of five for overall strength—solid, if not stellar. EPS strength mirrors this at three stars, reflecting consistent profitability amid expansions. Buy demand blazes at five stars, signaling insatiable investor appetite. Price strength, too, hits five stars, underscoring resilience post-split.

Group rank lags at two stars, a nod to conglomerate-wide risks like debt or diversification gaps. Yet, holistically, these metrics scream opportunity. Adani Power’s logistics edge—low-cost coal handling—and PPA fortress mitigate volatilities. As Mishra joins, governance upgrades could elevate ratings, drawing institutional inflows.

Navigating Risks and Opportunities in Adani Power Share Trading

No stock escapes pitfalls. Adani Power grapples with coal price swings, regulatory shifts toward net-zero, and geopolitical supply snarls. Profit booking post-split exemplifies sentiment-driven dips, amplified by market-wide corrections.

Opportunities abound, though. India’s 8-10% annual power demand growth favors incumbents. Adani’s international forays—Africa, Australia—diversify revenues. EV boom and data center surges demand reliable baseload, Adani’s forte. Technicals hint at ₹170 breakouts if volumes sustain.

Strategic Roadmap: Adani Power’s Path to 41,870 MW Dominance

Adani Power charts a 41,870 MW horizon, doubling capacities via brownfield expansions and greenfield ventures. Captive coal ensures margins; tech infusions like AI-optimized plants cut emissions. Partnerships with global majors accelerate renewables, positioning Adani as a full-spectrum leader.

This roadmap dovetails with national goals: 50% non-fossil by 2030. Adani’s Assam push exemplifies execution, blending social impact with shareholder value.

The Broader Adani Ecosystem: Synergies Boosting Power Plays

Adani Power doesn’t operate in silos. Adani Enterprises’ ports slash logistics costs; Adani Green Energy’s 25 GW renewables complement thermal. This vertical integration—mines to molecules—yields synergies Tata emulates horizontally. For investors, it means fortified moats against disruptions.

Investor Sentiment and Market Reactions to Latest Adani Power News

Post-board news, forums buzz with positivity. Retail holders laud Mishra’s NTPC pedigree; institutions eye governance polish. X (formerly Twitter) threads dissect split benefits, with #AdaniPower trending alongside #TataPower. Sentiment scores hit 75/100, per analytics—bullish, yet cautious on macros.

Long-Term Forecasts: Will Adani Power Outpace Tata in 2026?

Projections favor Adani: analysts target ₹200+ by mid-2026, driven by earnings beats and project ramps. Tata’s green premium caps at ₹450, but Adani’s value unlock—via demergers or listings—could eclipse it. Risks like policy U-turns loom, but Adani’s execution track record reassures.

Essential Tips for Investing in Adani Power Shares Today

Diversify: Balance Adani with Tata for thermal-green exposure. Time entries on dips below ₹145. Monitor Q3 results for PPA renewals. Use stop-losses at 5-7% to tame volatilities. Above all, research aligns with risk tolerance.

Conclusion: Adani Power’s Resilient Journey Ahead

Adani Power’s board revelations, split savvy, and Assam ambitions paint a portrait of calculated ambition. As it spars with Tata Power in India’s energy arena, Adani’s thermal stronghold and adaptive streaks position it for outsized gains. Investors, armed with this Adani Power share price update, stand poised to capitalize. Remember, markets reward patience—consult advisors, conduct due diligence, and let fundamentals guide your portfolio.