Introduction

The stock market is always changing, offering new chances for investors. Updates on big companies like Tata Motors and Vedanta are key. Also, the latest on IPOs is important. Stay updated to make smart investment choices.

Tata Motors: Significant Updates in the Auto Sector

Recent Performance

Tata Motors is a big name in cars. Recently, its stock has seen ups and downs. It went from ₹816 to under ₹750 in five days. Despite the challenges, Tata Motors is still a major player.

₹914 Crore Investment in Tamil Nadu

Tata Motors is investing ₹914 crore in Tamil Nadu. This is for making luxury cars like Jaguar and Land Rover. The goal is to cut costs and increase sales, improving its market standing.

Key Support and Resistance Levels

- Immediate Support: ₹700–₹745

- Resistance Level: ₹750

Investors should watch these levels closely to plan their next moves.

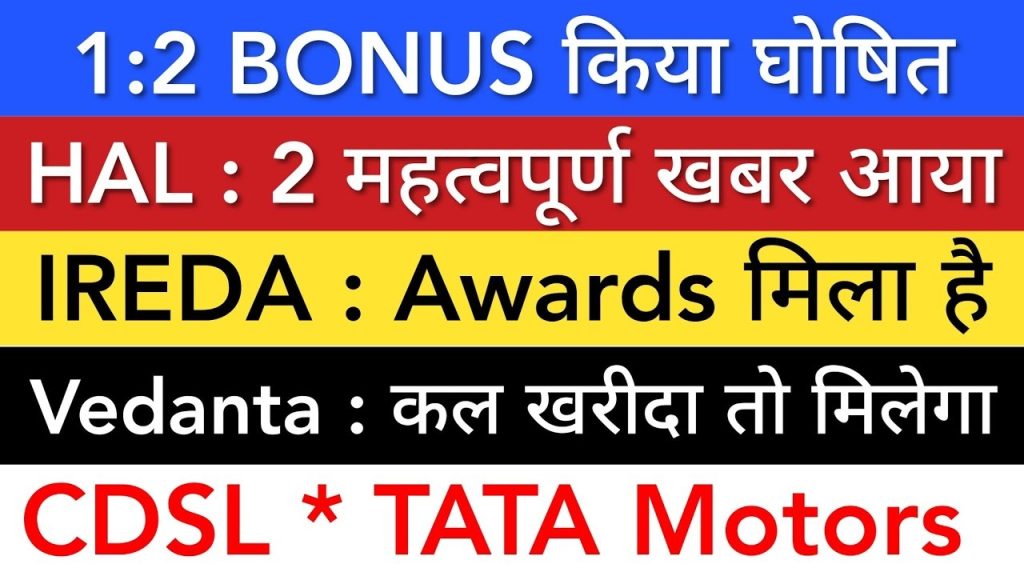

Ayush Wellness: Impressive Returns and Bonus Shares

Ayush Wellness Limited has seen amazing growth. Over a year, its stock rose by 4269%, even with market ups and downs.

Bonus Share Announcement

The company is giving a 1:2 bonus share ratio. This means shareholders get one extra share for every two they have. To get the bonus:

- Purchase shares by December 23 or 24, 2024.

- Hold shares until the record date, December 26, 2024.

Risks and Rewards

While the returns are great, investing in Ayush Wellness is risky. Do your homework before deciding.

Vedanta Limited: Dividend and Strategic Decisions

Vedanta Limited is a big name in mining and resources. It has shared important updates.

Interim Dividend

The company has declared a fourth interim dividend of ₹85 per share for the year. To get it, buy shares by December 24, 2024.

Base Metal Business Retention

Vedanta has chosen not to split its base metal business. This move aims to keep operations smooth and in sync.

Hindustan Aeronautics Limited (HAL): Exciting Progress

HAL is leading in aerospace and defense. It has secured big orders and reached important milestones.

₹2141 Crore Helicopter Order

HAL got a ₹2141 crore order for four Pawan Hans helicopters. This supports India’s goal of boosting local defense production.

AMCA Program Update

The AMCA program is advancing, with the first flight set for 2028. It will help India stand out in the global defense market.

IREDA: Recognized for Excellence

Indian Renewable Energy Development Agency (IREDA) won the PSU Excellence Award. It’s a big win for its work in renewable energy. Its strong start to the year has caught investors’ attention.

Key Levels to Monitor

- Support Level: ₹200

- Resistance Level: ₹215

CDSL: A Key Player in the Depository Space

Central Depository Services Limited (CDSL) is a solid choice for long-term investors.

Performance Overview

CDSL shares are still strong, around ₹2000. They might test the range of ₹1700–₹2000 soon.

IPO Updates: Premiums and Trends

The IPO market is buzzing with new launches:

- Ras Manta Digital Services: Premium at ₹14

- KleenTek IPO: Premium at ₹51

- Sanathan Textiles: Premium at ₹12

Keep an eye on these IPOs for quick wins and future growth.

Conclusion

The stock market is full of chances for those who keep up. Tata Motors’ smart moves, Vedanta’s dividends, and IPO trends are key. Stay tuned to reliable sources to boost your investment path.